Author: Mario @IOSG

TL;DR:

The Internet Capital Market (ICM) is a crypto-native alternative to the Traditional Capital Market (TCM), which allows entrepreneurs to raise funds directly from the online community through tokenization, bypassing cumbersome procedures such as venture capital and initial public offerings (IPOs). Platforms represented by Believe App (formerly Clout) have taken the lead in promoting this change on the Solana chain. Users can easily issue and invest in projects by simply @ing the platform on X (formerly Twitter).

Despite many criticisms, such as lack of regulation, low entry barriers, and the easy release of misleading tokens, ICM still has strong potential for mass adoption, especially in promoting Web3 to Web2 users through simple user experience, fiat payment gateways, and viral narratives. In order to achieve long-term development, platforms like Believe need to jump out of short-term hype, promote founder accountability mechanisms, optimize token economic models, build DAO governance, and achieve real utility, so as to truly transform ICM from a meme craze to a new capital formation paradigm.

Background of traditional capital markets

In the traditional capital market (TCM), entrepreneurs often rely on expensive and time-consuming financing methods such as initial public offerings (IPOs) or venture capital, which itself presents many challenges.

From the perspective of financing, entrepreneurs need to deal with lengthy application processes, complex legal procedures, and constantly cater to investors' preferences, which often prevents them from focusing on product development or community building.

From the perspective of investors, early investment opportunities are basically monopolized by large institutions, such as hedge funds, mutual funds, etc. Ordinary investors can hardly get a share and often have to wait until the project valuation soars before they can enter the market.

This model is not only inefficient and lacks openness, but also leads to a serious misalignment of incentives between creators and supporters. These structural problems reflect the market’s urgent need for a more open, direct, and participatory financing method, which is exactly the core problem that the Internet Capital Market (ICM) wants to solve.

Figure 1: Cost comparison of direct listings

Direct listing is a more cost-effective way to raise funds, which skips the expensive and time-consuming intermediary process in the traditional financing process and provides entrepreneurs with a new option. Internet Capital Markets (ICM) is similar to direct listing in many ways, but in theory has more advantages because entrepreneurs raise funds directly through the blockchain.

What is ICM

ICM is a new narrative in the crypto industry. It allows entrepreneurs to raise funds for their products directly through the Internet, without having to go through the cumbersome processes in the traditional capital market. They only need to tokenize their ideas to get immediate support from investors.

Unlike the traditional market, where investors’ shares are usually held in custody by banks or securities firms, in the ICM model, investors directly hold their own funds (token assets) through self-custody wallets, fully controlling the ownership and liquidity of assets. This approach not only significantly lowers the threshold for ordinary people to participate in investment, but also allows project parties to obtain start-up funds more efficiently.

ICM Ecosystem Status

It is worth noting that the concept of ICM is not just an experimental attempt at a product narrative, it is highly consistent with Solana’s own strategic direction. According to a market memorandum issued by the Solana Foundation on November 27, 2024[19], the Foundation proposed the vision of building an “Internet-native version of Nasdaq” - anyone with a wallet and an Internet connection can participate in the capital market.

The memorandum paints a picture of the future: financial assets such as stocks, real estate, and cultural tokens can be freely accessed and traded by anyone at any time through a globally shared blockchain ledger, thus eliminating many barriers and restrictions in traditional finance.

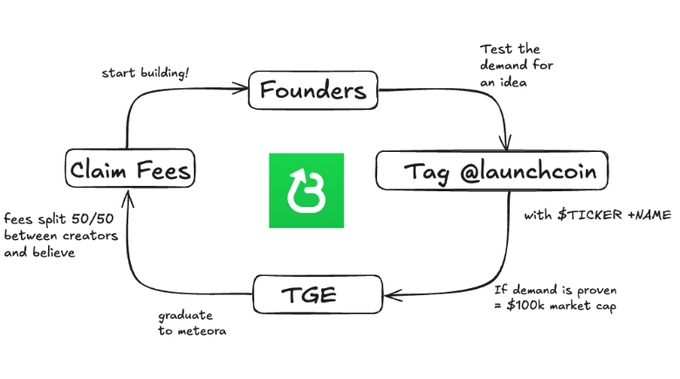

The current leader of the ICM ecosystem is Believe App (formerly Clout) on Solana. This platform allows founders to directly issue their own tokens by @ing an account on X (formerly Twitter). It attempts to subvert the traditional venture capital model and provide a decentralized, community-driven alternative that allows creators and entrepreneurs to take the initiative.

Figure 2: LaunchCoin token economic model flow chart

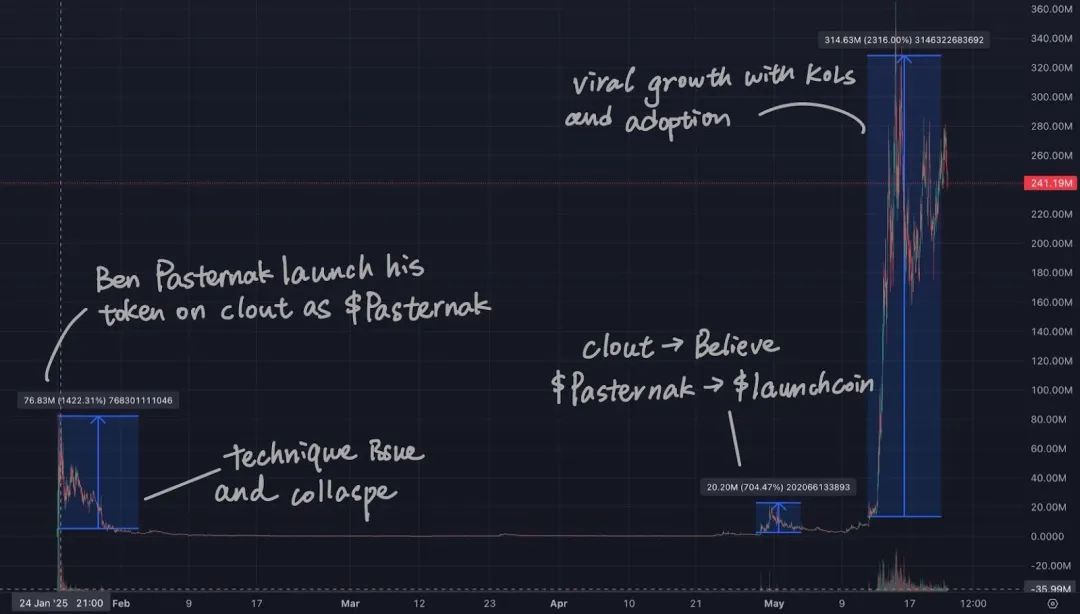

Figure 3: LaunchCoin price timeline (with author’s notes),

Screenshot source: Dexscreener [3]

It all started with Ben Pasternak, a Web2 entrepreneur and Forbes “30 Under 30”. In January this year, he launched his own token $Pasternak through the Clout platform [14]. Its market value once soared to about $77 million, but due to technical problems - even if the conditions were met, the token could not “graduate” - the project eventually collapsed. [15]

In late April, the platform was officially renamed from Clout to Believe, and the core focus shifted from "individuals" to "creativity and projects", truly moving towards the direction of ICM. $Pasternak was gradually phased out, and the platform also launched a new core token $launchcoin. The development of the platform quickly gained attention after being forwarded by well-known founders such as Nikita Bier and Solana co-founder Toly. Subsequently, tokens of multiple projects, such as $GOON and $NOODLE, were successful on Believe and achieved high market capitalizations. This viral spread and user growth pushed the platform's overall market capitalization to US$314 million. [16]

Clanker vs. Believe: Why Believe is more successful

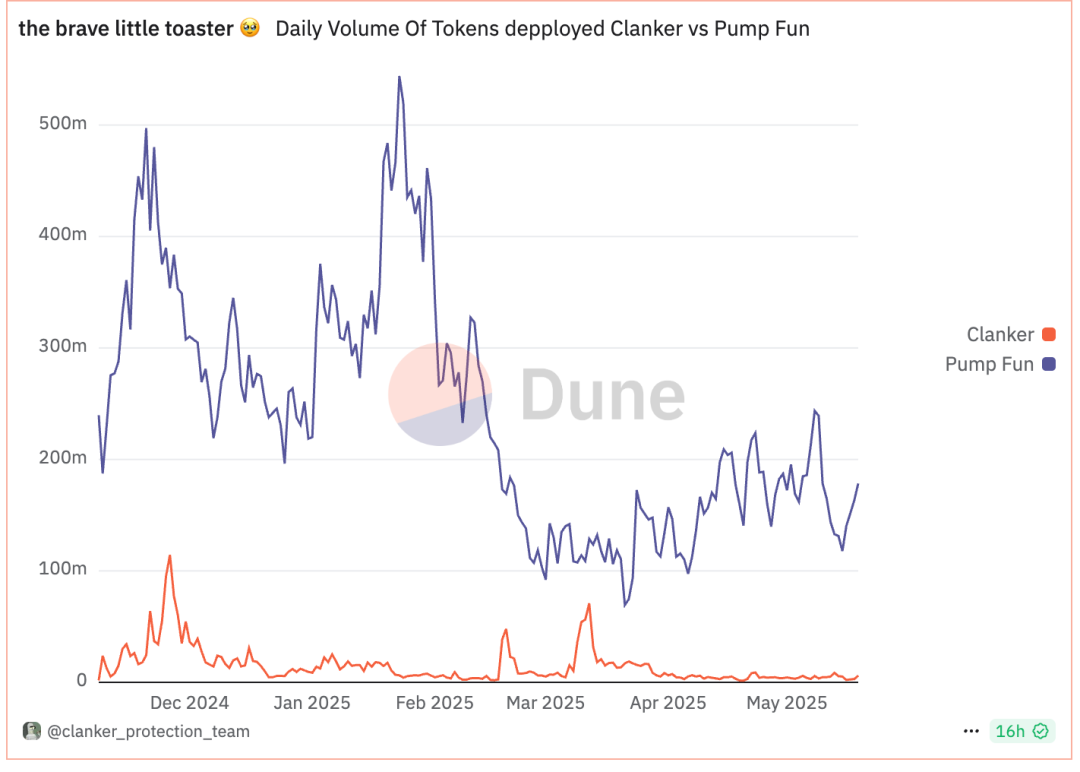

Clanker is another token issuance platform that also allows users to create their own tokens through social media interactions, mainly by tweeting or using Farcaster (a Web3 Twitter). Although Clanker and Believe seem similar in terms of "issuance method", Believe has several obvious advantages in terms of user experience, narrative structure and growth potential, making it stand out from the crowd.

Ecological impact

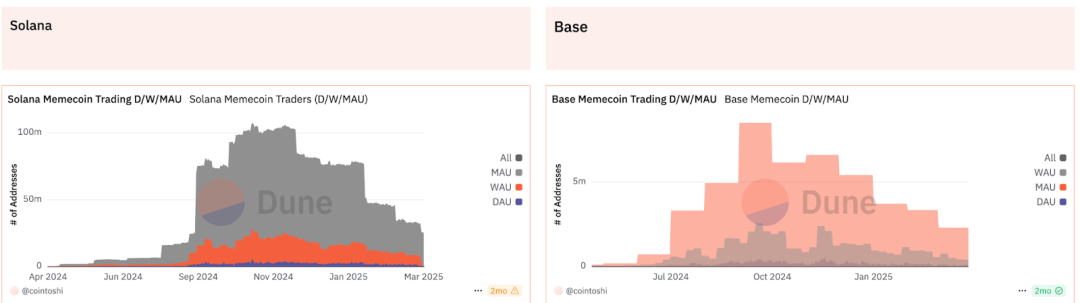

As can be seen from the chart below, Solana chain far exceeds Base chain in terms of both transaction volume and number of active traders, which provides greater momentum for Believe's expansion. In addition, the support of Alliance DAO and the forwarding of Nikita Bier and Toly have further accelerated its growth.

Figure 4: Meme coin transaction indicators on Solana chain

(Source: Cointoshi, Dune Analytics) [4]

Figure 5: Comparison of daily issued tokens: Clanker and Pump Fun

User Experience

Figure 6: User Rifqi Saputra (@denyosapone) publishes token issuance information on X via Clanker (2025)

Figure 7: A showcase post by user Pata van Goon (@basedalexandoor) via Believe (2025)

We can see that issuing on Believe is much simpler - users only need to fill in a token abbreviation and @Believe on X; while on Clanker, additional information is required, such as name, icon, etc.

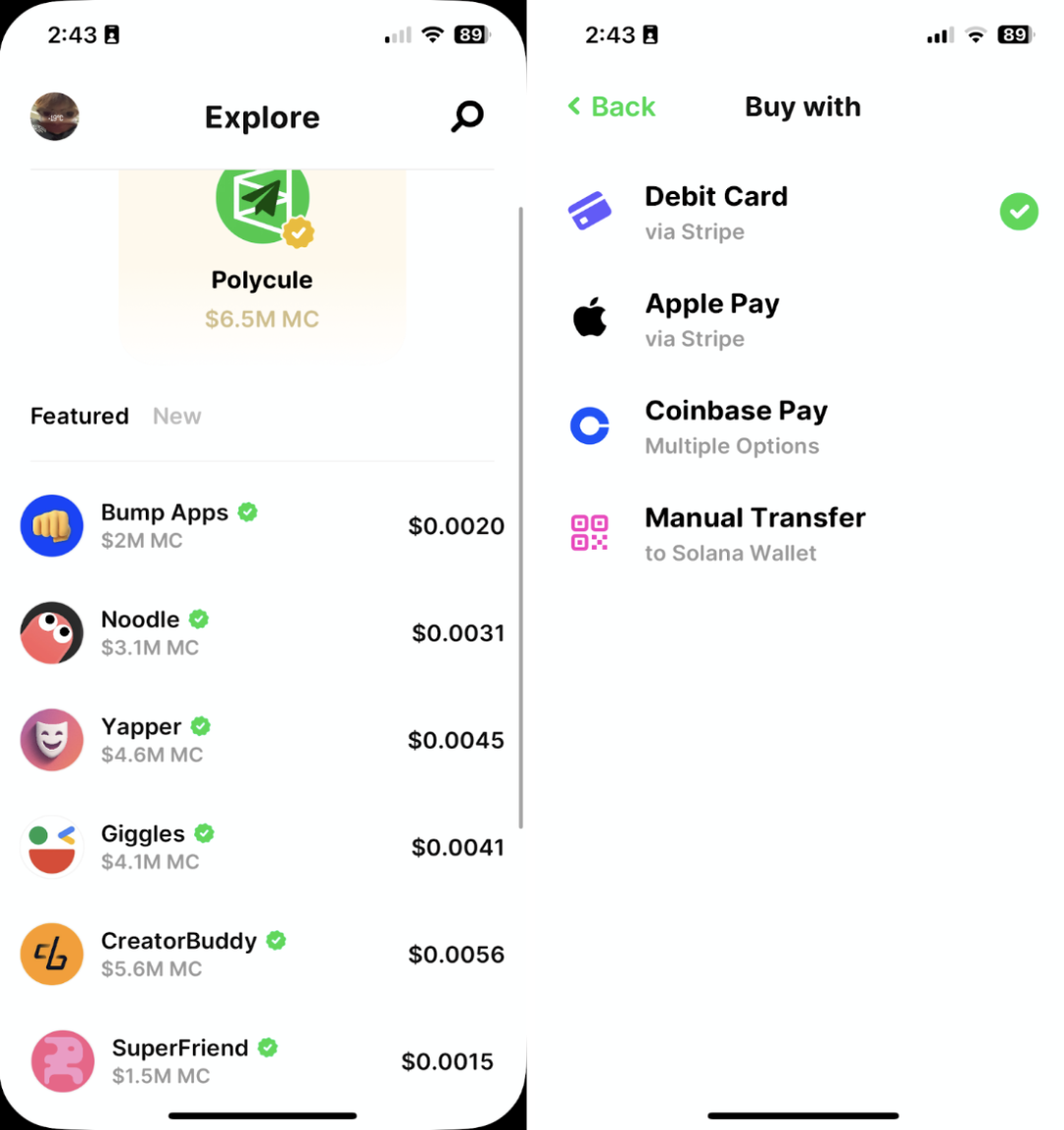

In addition, Believe's user interface is more intuitive and concise. They have also developed a mobile app and launched it on the App Store, where users can directly purchase token assets through wallets or credit cards. Clanker currently only has a web version and can only be purchased using a wallet, similar to traditional Web3 launch platforms.

Figure 8: Believe app interface showing token list and payment methods (2025) [8]

Although Clanker simplifies the “selling” part of the token issuance process, users still need certain Web3 knowledge when purchasing, such as how to connect to a wallet and how to add it to the Base blockchain.

Believe is completely different. It allows users to issue and purchase tokens without any Web3 knowledge. You can issue directly through Twitter and purchase with a credit card or Apple Pay. This greatly lowers the barrier to participation and attracts a large number of Web2 users to the Web3 world.

For example, Web2 entrepreneur Alex Leiman (who developed the slither.io-like Web3 game noodle.gg) chose to launch his new token $noodle on Believe [9].

Narrative and Vision: The Difference Between ICM and Meme Platforms

Believe is one of the earliest projects to propose the "Internet Capital Market (ICM)" narrative, which emphasizes the issuance of real ideas and projects to support their development, rather than just hyping memes with no actual value. This higher-level vision is more likely to resonate with the community and attract users who want to participate in meaningful construction and pursue long-term value.

In contrast, Clanker is more like a meme distribution platform focused on short-term speculation and trading. It lacks a clear narrative direction and a long-term development vision, so its appeal is limited to "short-term players" and it is difficult to establish lasting user stickiness and ecological construction.

Why ICM may just be another meme hype

The idea behind ICM is indeed very attractive. However, there is always a trade-off between efficiency and security. When you save time and threshold, you inevitably sacrifice some protection mechanisms.

Founders do not need to commit to any responsibility

Unlike traditional capital markets, where traditional projects usually need to go through rigorous roadshows, due diligence, and regulatory approval before an IPO, in ICM, founders only need to @Believe on the official Twitter to easily release their own tokens.

But the problem is: the founders have no delivery commitments or legal obligations, and there is no guarantee mechanism to ensure that they deliver on their original goals. This lack of accountability is worrying, especially in reality, there have even been some "presidential-level" accounts that forwarded the contract address of a token, but later deleted the post or distanced themselves from the matter on the grounds that the account was hacked. This also reveals the huge risks of the ICM model in an open but unregulated state.

Figure 9: Clout’s official guidelines emphasize that tokens must be used for non-securities scenarios (2025) [10]

According to LaunchCoin’s official guidelines, in order to prevent the tokens themselves from being classified as securities or investment products, the platform has set very strict legal compliance requirements. For example: tokens cannot represent equity, nor can they imply any form of return on income. They are designed to be more like digital souvenirs that allow supporters to express their support for the project, rather than a security that can generate income, dividends or profit sharing.

This also reveals a key problem: there is a huge disconnect between the token itself and the underlying project. According to the guidelines, the token is essentially very similar to a meme coin - it has no practical use, and its significance is more as a symbol of "supporting a founder".

Although this method can indeed help project parties raise funds and promote project progress, many investors may mistakenly believe that they are participating in a high-quality early-stage investment opportunity. Many people think that they are playing the role of angel investors to help entrepreneurs who are struggling, but the fact is: these tokens do not promise any returns and there is no guarantee mechanism.

The abused narrative

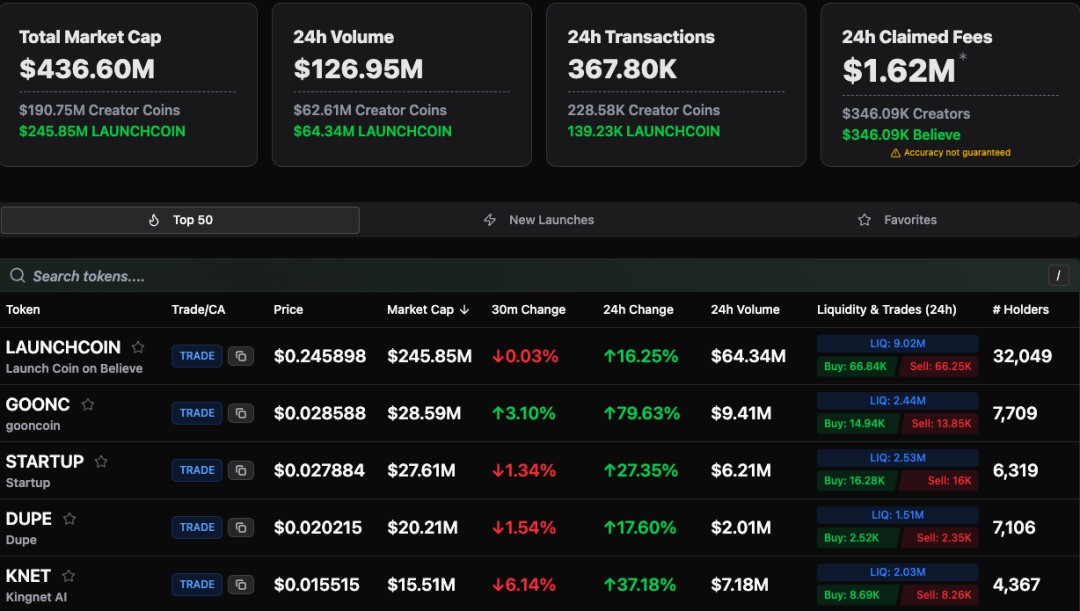

Figure 10: Market statistics for the Believe ecosystem, including tokens ranked by market capitalization, trading volume, and 24-hour price changes (2025) [11]

Judging from the current market data, ICM’s original vision was to support founders and their projects, but it is now being clearly abused. Among the top three project tokens on the platform by market value, two are essentially meme coins.

ICM was originally intended to empower truly creative builders, but the current situation is ironic: many people are just using the narrative of “supporting projects” to create waves of meme crazes. These tokens, which have no constructive significance, are more popular and more famous than projects that really need financial support.[17]

What’s next for ICM

Currently, issuing tokens on Believe is free for founders, but its market performance is highly dependent on the continued advancement of the project itself. In order to motivate founders to continuously update projects and maintain community attention on projects, Believe should consider optimizing the existing economic model (tokenomics).

For example, a penalty mechanism can be set up through smart contracts: if the founder does not update the project for a long time or is in a "disconnected" state, they will not be able to receive transaction fee income. In addition, it is also very necessary to establish a DAO mechanism to give the community voting rights and project feedback rights, thereby improving transparency and the sense of responsibility of the founding team.

Fundamentally, I think ICM is not just a short-term meme hype. It does have greater potential, but the premise is that it needs clearer rules and a more mature ecological environment to support its development. The concept of ICM reminds me of TON's promotion path - TON successfully brought a large number of Web2 users into the Web3 world with the help of the Telegram platform.

Currently, all crypto assets combined only account for approximately 0.56% of the world’s total currency [18]. If Web3 is to become truly popular, it must provide a simpler and more intuitive way of use. The real value of ICM is that it can attract and convert a large number of Web2 users without requiring users to have in-depth Web3 knowledge.

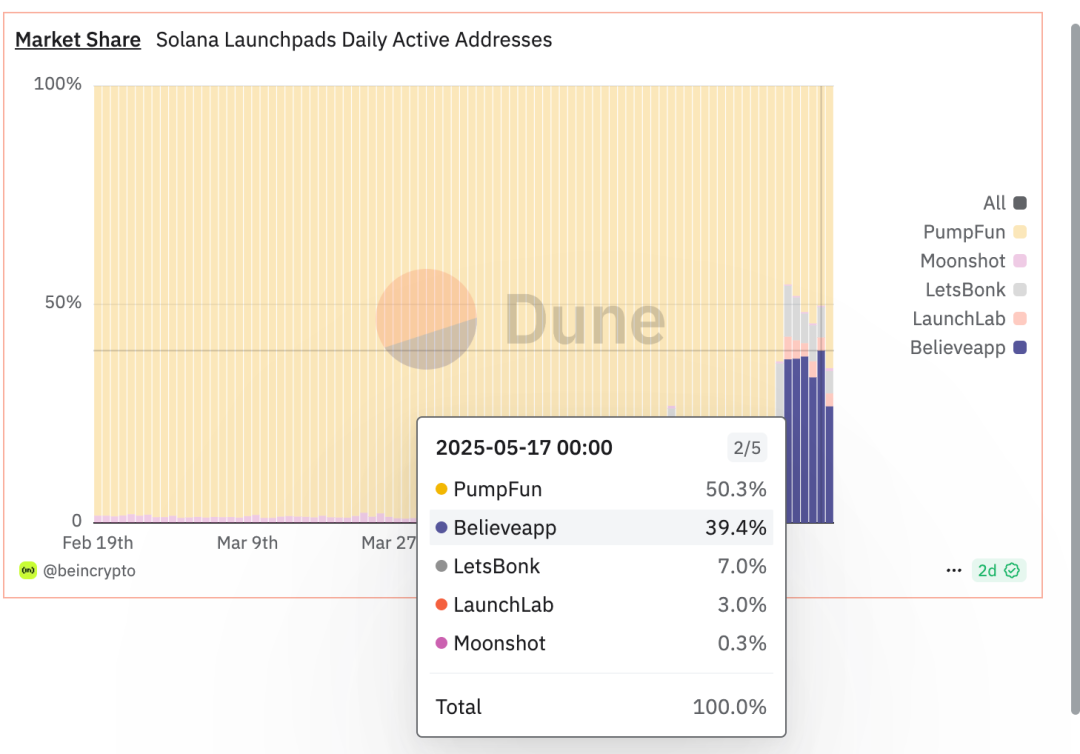

Although some people currently view Believe as another meme-style issuance platform, it is developing rapidly and has seized market share on the Solana chain that was originally dominated by old platforms such as Pump Fun. By diluting Pump Fun’s monopoly, the selling pressure faced by Solana has also been alleviated.

In the past, Pump Fun was almost in a monopoly position as a token issuance platform, and users were free to use $SOL for transactions, and were forced to use it as their main choice. Now, the rise of Believe has broken this situation, bringing more competitive options to retail investors and reducing the liquidity risks caused by centralized platforms[17].

Figure 11: Daily active address market share of Solana’s major token issuance platforms, comparing BelieveApp with competitors such as PumpFun and LetsBonk (2025) [12]

In the short term, if Believe can continue to maintain its advantage in competition with other traditional token issuance platforms, the ICM narrative is likely to exist for a long time, because achieving mass adoption of Web3 is always the ultimate goal of the entire ecosystem.

However, if Believe wants to gain a firm foothold and not become a short-lived hype platform like Clanker, it must further strengthen and expand its unique positioning: not only a distribution tool, but also a platform to promote project incubation and real value creation.

Figure 12: Let’sBonk ($BONK) price chart, showing its initial surge and subsequent trend (2025) based solely on “narrative” [13]

This means that ICM must build deeper practical value around the concept of "Internet capital market". Specifically, it can start from the following directions:

- Promote truly meaningful community governance mechanism (DAO)

- Establishing a system for founders to be held accountable on an ongoing basis

- Integrate projects with real-world application scenarios to attract a wider range of mainstream users.

If Believe does not evolve in this direction, it is possible that the market will see it as just another meme platform and eventually lose the momentum to achieve long-term growth. To truly have a lasting impact, Believe must be more than just a launch platform for meme coins, but also an innovative platform that inspires creativity, drives projects, connects the public, and helps popularize Web3.

appendix

[1] Lily Liu. 2025. Building Internet Capital Markets on Solana - TOKEN2049 Dubai 2025. Retrieved fromhttps://www.youtube.com/watch?v=QXAshrNDBVY

[2] Manoppo, Marco (@ManoppoMarco). 2025. LaunchCoin tokenomics workflow. Retrieved fromhttps://x.com/ManoppoMarco/status/1922713575594000892/photo/4

[3] Dexscreener. 2025. LaunchCoin price chart. Retrieved fromhttps://dexscreener.com/solana/yrrustgpugdp8bbfosqdefssen6sa75zs1qjvgnhtmy

(Annotations by author)

[4] Cointoshi. 2025. Solana Memecoin Trading Metrics. Dune Analytics. Retrieved fromhttps://dune.com/cointoshi/solmemes

[5] Clanker Protection Team. 2025. Daily Volume of Tokens Deployed: Clanker vs. Pump Fun. Dune Analytics. Retrieved fromhttps://dune.com/clanker_protection_team/clanker-vs-others

[6] Saputra, Rifqi (@denyosapone). 2025. Token deployment post for FISH AI.

[7] van Goon, Pata (@basedalexandoor). 2025. Token deployment post for $GOONC.

[8] Believe. 2025. Believe app interface screenshot. Retrieved from the Believe mobile application, May 20, 2025.

[9] Believe (@believeapp). 2025. $NOODLE just launched on Believe. Built by @alex_leiman.

[10] Clout. 2025. Legal guidelines for creators. Clout Playbook. Retrieved fromhttps://www.clout.me/playbook

[11] Believe Screener. 2025. Market data dashboard of the Believe ecosystem. Retrieved from https://www.believescreener.com/

[12] BeinCrypto. 2025. Solana Launchpads Daily Active Addresses. Dune Analytics. Retrieved fromhttps://dune.com/beincrypto/solana-launchpads

[13] GMGN.ai. 2025. Let'sBonk token ($BONK) price chart. Retrieved fromhttps://gmgn.ai/sol/token/CDBdbNqmrLu1PcgjrFG52yxg71QnFhBZcUE6PSFdbonk

[14] Wikipedia contributors. 2025. Ben Pasternak. Wikipedia. Retrieved May 22, 2025, fromhttps://en.wikipedia.org/wiki/Ben_Pasternak

[15] Finet.hk. 2024. The rise of the one-click launch platform Believe has set off a wave of token issuance among Hong Kong people. Retrieved from https://www.finet.hk/newscenter/news_content/68246ac8800d456e80466411

[16] Crypto Chris. 2024. Believe is online! One-click launch platform, the strongest Launchpad on the entire network? Retrieved from https://www.youtube.com/watch?v=lrGD3oo7gh8

[17] Coinsider. 2024. Solana 2024: Pump.fun, Rug AI, Believe, Clout, Launch Labs… Retrieved fromhttps://www.youtube.com/watch?v=oQje6i_7LQs

[18] Frankenfield, J. 2023. How Much of the World's Money Is in Bitcoin? Investopedia. Retrieved fromhttps://www.investopedia.com/tech/how-much-worlds-money-bitcoin/

[19] BlockBeats. 2024. Revealing the Solana Foundation Marketing Memo: The Perfect Victory of Internet Capital and the FAT Principle. Published November 27, 2024. Retrieved fromhttps://en.theblockbeats.news/news/55923