In the complex chess game of DeFi, some pieces fall silently, while others are destined to fall with thunder. The debut of Spark (SPK) is undoubtedly the latter.

Almost overnight, it broke into everyone's vision in a very impactful way - it made a high-profile debut under the simultaneous escort of the world's top exchanges Binance and OKX, and was even labeled by Binance as a "seed label" representing unlimited potential and unknown risks. However, if you think this is just an ordinary new coin issuance carnival, you are looking at the wrong chess game. Behind this grand debut stands the oldest and most respected name in the DeFi world: MakerDAO. More precisely, it is the first key chess piece in its grand "Endgame".

This immediately brings up a sharp question: Is Spark, the "chosen one" born with a golden key, a "new infrastructure" to solve the liquidity dilemma of DeFi, or an "Aave terminator" dressed in an innovative coat to regain the hegemony of stablecoins for its parent MakerDAO? This article will unravel the mystery of this disruptor that may rewrite the DeFi lending landscape, from its bloodline, bones and ambitions.

Spark's Genesis: A SubDAO Ambition on Aave Code

The birth of Spark is rooted in the profound transformation of MakerDAO into the Sky ecosystem. In order to cope with the increasingly complex DeFi environment, MakerDAO founder Rune Christensen proposed an ambitious "end game plan", one of the core ideas of which is to reshape the original single and huge DAO structure into a galaxy composed of multiple more agile and focused "sub-DAOs", with Sky as the mother of this galaxy. Spark is the first and most important flagship SubDAO born under this plan, and is developed by the Phoenix Labs team, which has a close relationship with the Sky ecosystem.

Interestingly, for such a project that carries huge expectations, its technical foundation is not built from scratch. Spark's development team made an extremely important strategic decision: to fork the open source code base of Aave V3, its main competitor and the leader in the lending market. This choice is not a simple copy, but to directly inherit Aave V3's proven security, mature functions and user experience familiar to the market, thereby greatly shortening the development cycle, reducing technical risks, and allowing the team to focus on building its own unique value proposition.

However, forking does not mean imitation. Through the audit report, we can clearly see the well-thought-out modifications made on the basis of Aave V3, which reveal Spark's strategic intentions. First, Spark introduced a customized interest rate strategy contract that does not exist in Aave, which laid the foundation for the "transparent interest rate" model determined by governance, which will be detailed later. Secondly, Spark set the Flash Loan fee to zero in the early stage, which is undoubtedly a powerful move to attract developers and arbitrageurs. Furthermore, it adopts different treasury management contracts and a dual treasury system (one for DAI and one for other tokens), showing its different ideas on protocol revenue management. Most importantly, the privileged roles of the protocol, especially the emergency suspension authority, are directly granted to MakerDAO's governance contract, which firmly embeds Spark into Sky's governance system at the code level.

This strategy of "standing on the shoulders of giants" is backed by strong pedigree and capital support. Although market information has mentioned the investment of a16z and Paradigm, in-depth research shows that the funds of these top venture capital firms mainly flowed to its parent ecosystem Sky/MakerDAO, rather than directly targeting Spark's seed round of financing. But this gives Spark a stronger advantage than obtaining a round of direct investment - it can indirectly use the huge resources, top talent pool and unparalleled industry reputation of its well-funded parent company.

From a deeper perspective, this fork is not only a technical shortcut, but also a precise "offensive" market strategy. Before the birth of Spark, the tension between MakerDAO and Aave over the role of DAI in the Aave market had gradually emerged. As one of the most important application scenarios of DAI, any adjustment of Aave's DAI collateral parameters may pose a systemic risk to MakerDAO. By forking Aave, the Sky ecosystem has created a "native" lending platform that is fully controlled by itself. It can not only provide more favorable lending conditions for its own stablecoin USDS, but also directly inject massive liquidity from its own reserves through the D3M module. Therefore, the essence of this fork is to use the open source nature of Aave to transform its R&D results into a competitive weapon for itself, achieving a clever vertical integration, aiming to reduce dependence on competitors and build an absolutely advantageous moat for its core products.

Three pillars: Deconstructing Spark's financial ecosystem

Spark's grand vision is realized through its three core product pillars, which are interconnected and together form a fully functional and highly synergistic financial machine.

Pillar 1: SparkLend - A controlled lending engine

SparkLend is the core lending market of the protocol, a decentralized, non-custodial liquidity protocol where users can deposit and borrow Ethereum (ETH), liquid staking derivatives (such as wstETH), and various stablecoins.

Its most notable differentiating feature is its unique interest rate model. Unlike protocols such as Aave and Compound, which mainly use variable interest rates based on floating capital pool utilization, SparkLend introduces "Transparent Rates" for core assets such as USDS and USDC. These interest rates are not determined in real time by market supply and demand, but are directly set by Sky's community governance through on-chain voting. This model provides a high degree of certainty and predictability for large-scale borrowers and institutional users, greatly reducing the complexity of their capital cost management.

Another killer feature of SparkLend is its unparalleled source of liquidity. It is directly connected to the Sky Protocol's huge balance sheet through the Direct Deposit DAI Module (D3M). This means that Spark can obtain billions of dollars of initial liquidity from Sky's reserves without having to rely entirely on the slow accumulation of early user deposits. This ability to "bring its own water source" ensures that SparkLend can continue to provide extremely competitive low borrowing rates.

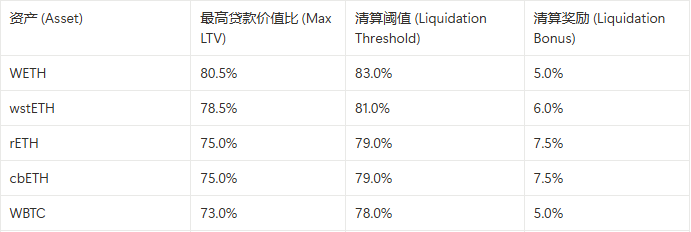

In terms of risk management, SparkLend inherits and optimizes the mature over-collateralization model. All loans must be collateralized by assets of higher value. The protocol uses a "Health Factor" (HF) to monitor the risk status of each loan in real time. Once the HF value is lower than 1, the liquidation mechanism will be triggered, and anyone can repay part of the debt and obtain collateral at a discount, thereby ensuring the solvency of the protocol. The following table lists in detail some of the mainstream collateral assets supported by SparkLend on the Ethereum mainnet and their key risk parameters.

Note: The above data is based on a comprehensive analysis of mainstream protocol parameters and MakerDAO governance proposals and is for reference only. All risk parameters are dynamically adjusted by Sky Governance. Please refer to the Spark official app for the latest data. For example, Sky Governance once initiated a proposal to remove WBTC as collateral due to risk considerations, which fully reflects the dynamic nature of its risk management.

Pillar 2: Diversification benefits

The core of Spark's ecosystem is its savings product, which revolves around the newly upgraded stablecoin USDS. USDS is positioned as an enhanced version of DAI, the native stablecoin of the Sky ecosystem, and can be seamlessly exchanged with DAI at a 1:1 ratio, ensuring a smooth transition for users.

The core user value of this product is that users deposit stablecoins such as USDS or USDC to obtain the corresponding interest-bearing tokens sUSDS or sUSDC. Unlike the "rebasing" model that distributes interest daily, the income of sUSDS is accumulated through the continuous growth of its own value relative to USDS, which means that the number of sUSDS held by users remains unchanged, but the number of USDS they can redeem will increase over time.

The source of this income, the Sky Savings Rate (SSR), is key to Spark’s success. SSR income does not come solely from SparkLend’s lending spread, but is supported by a diversified, actively managed income portfolio across the Sky ecosystem:

- Crypto-collateralized loan fees: Stable fees generated from the lending of various assets on SparkLend.

- Real World Asset (RWA) Investment: The Sky ecosystem invests part of its reserves in low-risk traditional financial assets such as U.S. Treasury Bills (T-Bills), which generate stable real-world returns.

- Deployment of returns outside the liquidity layer: This is the most innovative part. The Spark Liquidity Layer (SLL) will deploy the funds it manages to other DeFi protocols to obtain returns. A typical example is that Spark once planned to allocate up to $1.1 billion in funds to the synthetic USD USDe/sUSDe of the Ethena protocol to capture the high yields it provides.

Pillar 3: Spark Liquidity Layer (SLL) - “Infra-Fi” Infrastructure Finance Engine

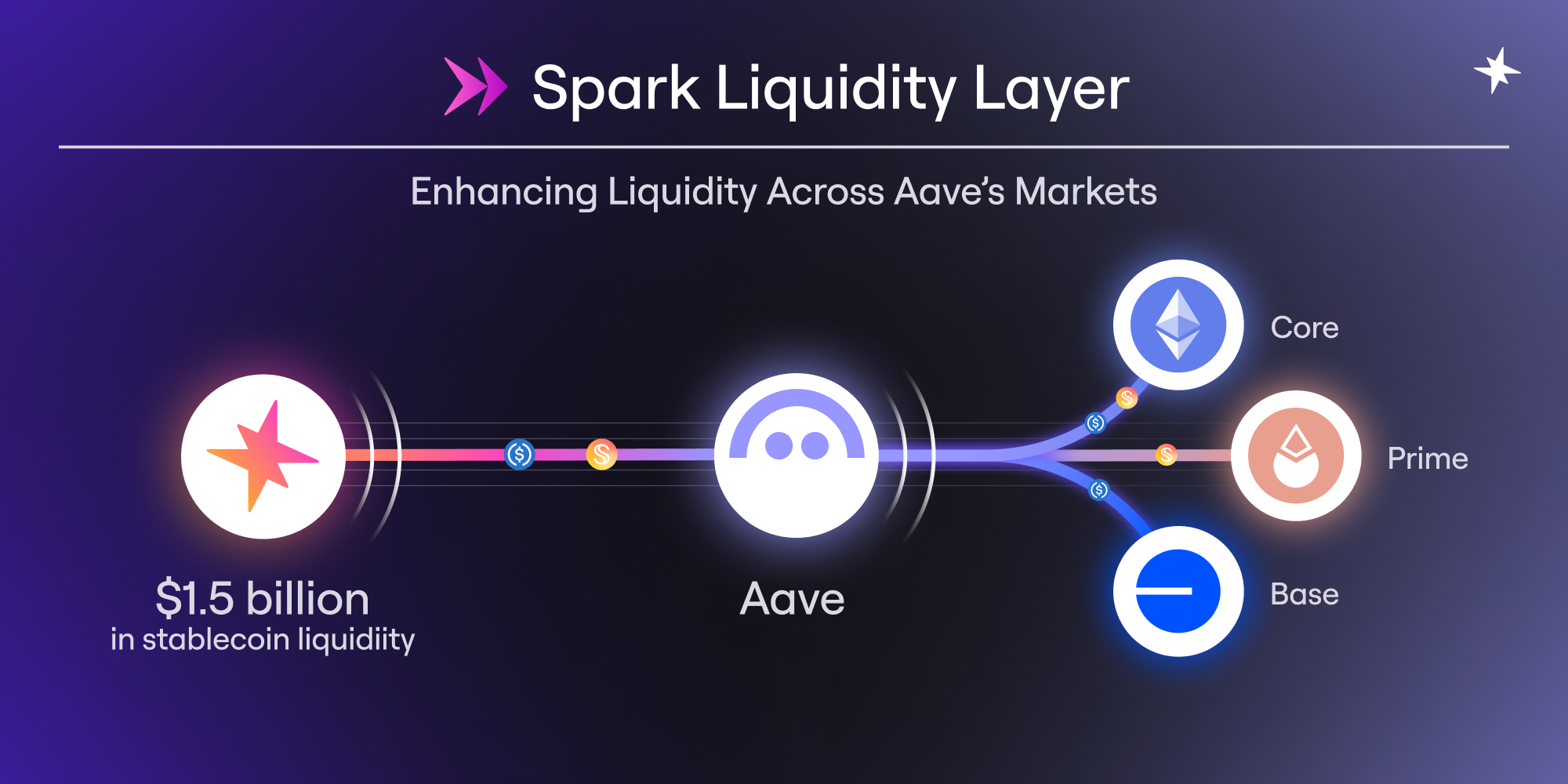

If SparkLend is the engine and savings are the fuel, then Spark Liquidity Layer (SLL) is the intelligent transmission and distribution system of the entire system, and is the most ambitious and forward-looking part of Spark. Its mission is to solve the long-standing problems of liquidity islands and yield fluctuations in the DeFi field and become a cross-chain and cross-protocol "capital allocation master".

SLL mints USDS through Sky's allocation system, and uses cross-chain tools such as SkyLink and Circle's CCTP to accurately deploy these liquidity to multiple blockchain networks and DeFi protocols such as Ethereum, Base, and Arbitrum. Currently, SLL explicitly supports injecting liquidity into mainstream protocols such as SparkLend itself, Aave, Morpho, and Curve.

The "intelligence" of SLL lies in its automated management mechanism. It is not a set of static capital pools, but is dynamically and actively managed by a set of off-chain monitoring software. The software tracks the liquidity level, capital demand and profit opportunities of each protocol in real time, and automatically submits transactions to rebalance capital deployment when necessary. For example, when the demand for USDS on the Base chain increases, SLL will automatically bridge more USDS from the main network. This design enables SLL to efficiently optimize the capital efficiency of the entire ecosystem.

In summary, the combination of these three pillars makes Spark's positioning beyond a simple lending protocol. It is more like a hybrid of a "central bank" and a "multi-strategy hedge fund" in a decentralized world. On the one hand, through its deep binding with Sky, it can "issue" the base currency (USDS) and set the benchmark interest rate (SSR and transparent borrowing rate) through governance, playing a similar role as a central bank in regulating money supply and interest rates. On the other hand, its liquidity layer SLL plays the role of an "investment department", actively allocating huge protocol reserves to diversified assets such as DeFi lending, RWA treasury bonds, and high-yield synthetic dollars in pursuit of risk-adjusted maximum returns. The income obtained by sUSDS holders is essentially the "dividends" generated by this large, diversified and actively managed investment portfolio, which makes its income model more resilient and sustainable than protocols that rely solely on lending spreads.

A moat built on pedigree and liquidity

In the fiercely competitive DeFi lending track, Spark has built a competitive advantage that is difficult to replicate with its unique architecture and background.

In a direct confrontation with Aave, Spark's advantages are obvious. As a fork of Aave V3, it enjoys similar functionality and security, but can obtain cheaper and deeper liquidity through D3M, and provide more stable and predictable interest rates, which is very attractive to institutions and large traders. Aave's advantage lies in its wider multi-chain deployment and richer list of long-tail assets. Considering the historical tension between the two, the birth of Spark can be seen as an inevitable move taken by the Maker ecosystem to ensure its own strategic security.

Compared with Compound, the competitive landscape is different. Compound V3 shifted to a more stringent, isolated market model centered on a single underlying asset (such as USDC). Spark retains the flexible model of Aave V3 where "everything can be borrowed and everything can be mortgaged", while injecting its own unique liquidity and interest rate advantages. This makes Spark a more direct and threatening challenger to Aave's core business model.

Ultimately, Spark’s strongest moat is not a single technical feature, but its **“pedigree and integration”**. It is a protocol born to serve the USDS stablecoin, backed by the financial strength and brand reputation of the entire Sky/MakerDAO ecosystem. This deep binding with a multi-billion dollar, natively integrated liquidity source is an inherent advantage that no other independent protocol can replicate.

Deconstructing the SPK Token: Governance, Revenue, and Value Accumulation

The SPK token is the core of the Spark Protocol, and its economic model (Tokenomics) is carefully designed to balance short-term incentives with long-term sustainability.

The core functions of the token are mainly reflected in two aspects. The first is governance: SPK is the governance token of the Spark protocol. In the future, holders will be able to vote on protocol upgrades, risk parameter adjustments, and development directions. In the early stage, it will be used for testing signals and community sentiment through the Snapshot platform. As the token distribution is decentralized, its governance power will gradually increase. The second is staking and security: The official roadmap shows that in the future, users can stake SPK tokens to help protect various products and services in the Spark ecosystem and get rewards from them. This provides SPK tokens with a potential value capture mechanism beyond simple voting rights.

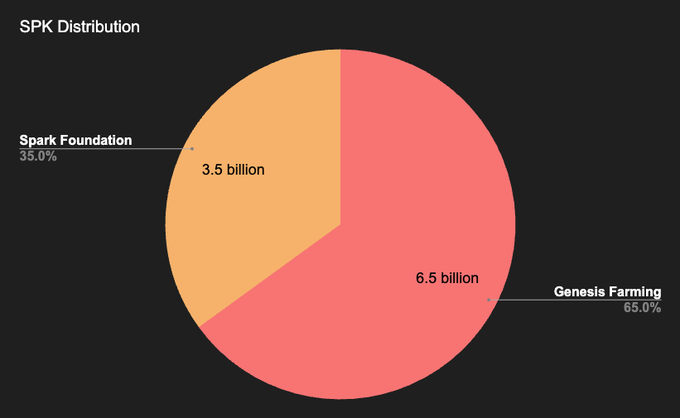

The distribution of tokens is also highly strategic with market dynamics. The total supply of SPK was minted at Genesis at 10 billion. According to Binance's listing announcement, the initial circulating supply is 1.7 billion, accounting for 17% of the total. In order to guide the market and build a community, Spark has adopted a multi-pronged airdrop strategy, including a "pre-farming" season for early users of the protocol, and Binance's "HODLer Airdrop" event for the broader market.

However, the most thoughtful aspect of its token economics is the design of long-term incentives. The largest portion of tokens (65%, or 6.5 billion) are allocated to "Sky Farming", which is planned to be gradually distributed to users over a period of 10 years by staking core assets such as USDS. This design is very different from the practice of many projects that attract "mining, selling and withdrawing" users through short-term high APY (annualized yield). By extending the incentives for most users to a ten-year period, Spark aims to cultivate a community that is deeply bound to the USDS stablecoin, loyal and long-termist. This is not only a smart move for the Spark protocol itself, but also for the entire Sky financial ecosystem to lock in core users and liquidity.

Conclusion: Final Verdict on Spark

After layers of analysis, we can conclude that Spark Protocol is far from a simple, well-funded "echo" of Aave. Although the core code of its lending mechanism is derived from Aave V3, which is a successful "evolution" rather than a "revolution", its real innovation lies in the depth of its business model and strategic integration.

Spark represents a new paradigm for building DeFi protocols:

- Deep vertical integration: It is closely connected with the parent company's stablecoin issuer (Sky/MakerDAO), creating a closed-loop financial system from liquidity supply, interest rate setting to demand guidance.

- Breadth and horizontal expansion: Through its liquidity layer (SLL), it plays the role of "lender of last resort" to provide liquidity to the entire DeFi market, cleverly turning potential competitors (such as Aave, Curve) into "customers" of its capital deployment.

Therefore, the birth of Spark marks the emergence of a new type of decentralized financial institution - it combines the functions of a central bank (money creation and interest rate regulation), a commercial bank (lending business) and a hedge fund (multi-strategy capital allocation). Its success or failure will not only determine the fate of a protocol, but is also likely to provide a reference blueprint for the next generation of a more resilient and systematic DeFi ecosystem. The simultaneous listing on top exchanges such as Binance and OKX is not the end of the story, but the first shot fired by MakerDAO for its grand "end game plan". The market will continue to focus on this rising star to see how it leaves its own mark in the magnificent history of DeFi.