Author: Shao Shiwei

Why did "stablecoin" suddenly become popular?

Recently, the concept of "stablecoin" has become a bit too popular. For those who have never paid attention to Web3 and virtual currencies, "stablecoin" may still be a slightly unfamiliar term. But as a lawyer who has been deeply engaged in blockchain legal services for many years, I am exposed to related businesses and cases every day. Now, it seems to have "broken the circle".

But in the past few days, putting the following news events together, it still feels a bit magical.

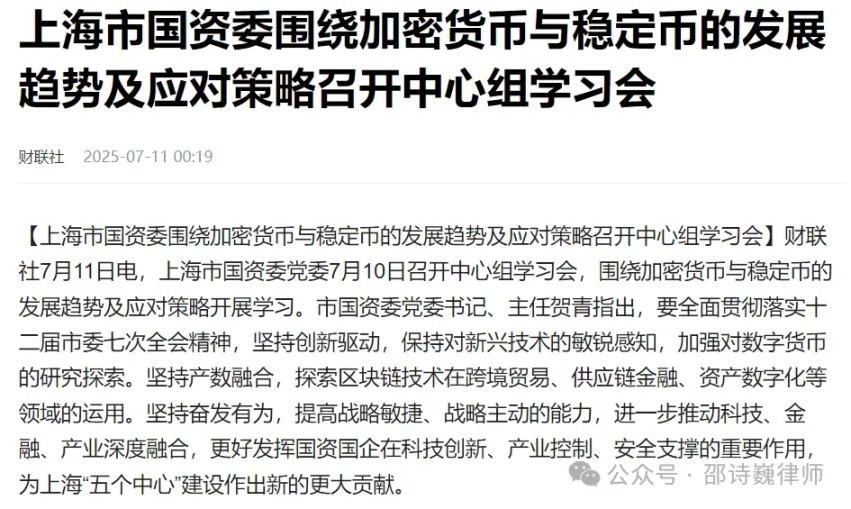

On July 10, 2025, the Party Committee of the Shanghai State-owned Assets Supervision and Administration Commission held a study meeting of the central group to study the development trends and response strategies of cryptocurrencies and stablecoins.

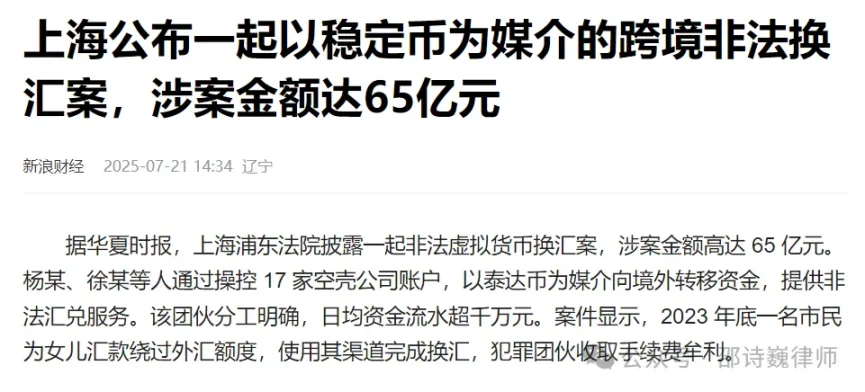

On July 16, 2025, the People's Court of Pudong New Area, Shanghai, announced a major cross-border foreign exchange case using stablecoins as a medium. The case showed that Yang and others operated domestic shell company accounts to provide stablecoins to overseas accounts of unspecified customers, thereby realizing cross-border transfers of funds to obtain profits. Over the past three years, they have participated in illegal foreign exchange transactions amounting to 6.5 billion yuan.

On July 18, 2025, US President Trump officially signed the "Guidance and Establishment of a National Stablecoin Innovation Act" (referred to as the "Genius Act") at the White House, marking the first time that the United States has formally established a regulatory framework for digital stablecoins.

At the same time, Hong Kong will officially implement the Stablecoin Regulation Ordinance on August 1, 2025, becoming the world's first jurisdiction to establish a comprehensive regulatory system specifically for fiat stablecoins.

Putting these things together, on the one hand, major financial centers such as China, the United States, and Hong Kong are promoting the compliance and financialization of stablecoins; on the other hand, some domestic law enforcement agencies still regard stablecoins as a typical scenario of "illegal financial activities."

This misalignment between regulatory rhythm and institutional concepts seems to remind us that it is time to re-examine the real role and institutional position of "stablecoins".

Why do the black and gray industries love stablecoins so much?

The reason why underground banks choose virtual currency (especially stable currency represented by USDT) as the first choice for cross-border exchange is that it technically breaks through the multiple bottlenecks faced by traditional exchange, such as quota restrictions, capital pool pressure, timeliness of arrival, identity concealment and differences in jurisdiction. This also directly leads to the repeated failure of regulatory policies in the face of "virtual currency anonymity risks" and "virtual currency money laundering risks".

The first is the issue of "quota limit". According to my country's annual foreign exchange purchase quota system, each person can only purchase a maximum of US$50,000 per year. Traditional underground banks often circumvent this limit by splitting up people and forging trade documents. But after the emergence of stablecoins, on-chain transfers through encrypted assets such as USDT or BTC can completely bypass this quota limit and achieve a one-time cross-border transfer of millions of dollars.

The second is the "capital pool pressure" problem. In the past, underground banks had to prepare foreign exchange positions in both domestic and foreign places, which was risky and costly. Stablecoins break the logic of bilateral reserves. They only need to collect RMB in China to instantly complete currency-to-currency exchange or currency-to-fiat currency conversion in foreign exchanges. The threshold for starting up has dropped rapidly from tens of millions to hundreds of thousands of yuan.

The third is the issue of "timeliness of arrival". Traditional bank wire transfers usually take T+1 to T+3 working days, and a series of compliance materials must be submitted. In contrast, on-chain transfers can be completed within an average of 10 minutes to 1 hour, operating around the clock without holiday restrictions, which greatly improves the efficiency of capital circulation. This also makes customers generally willing to pay 1% to 3%, or even higher fees in exchange for "quick arrival".

The fourth is the problem of "identity concealment". Traditional cross-border remittances often leave a relatively complete supervision chain through bank statements, customs declaration forms, etc., while in virtual currency transactions, with the help of on-chain address obfuscators, desensitized wallets and overseas exchanges, the connection between the flow of funds and the real identity is severed at multiple levels, the difficulty of investigation by law enforcement agencies has increased significantly, and the case-solving cycle has also been significantly extended.

Finally, there is another regulatory arbitrage point that is frequently used by the gray industry: differences in jurisdictions. Traditional currency exchange requires dealing with both domestic and foreign regulation, but with the help of stablecoins as a cross-border medium, illegal funds often complete the final legal currency landing in jurisdictions with loose regulation. Even if domestic accounts are frozen, foreign funds can still be safely withdrawn, thus achieving free movement in "different regulatory regions."

It can be said that the introduction of stablecoin technology has not only reconstructed the operation mode of illegal foreign exchange, but also greatly magnified the efficiency and concealment of black and gray industries. This low-threshold, decentralized, and strong cross-border tool is becoming a new technical infrastructure for the "gray flow" of cross-border funds.

Why does the country continue to crack down on virtual currency-related crimes with high pressure?

my country's high-pressure crackdown on virtual currency-related crimes is based on the following two core regulatory logics:

First, virtual currency has natural anonymity and cross-border liquidity, which makes it difficult for the traditional financial regulatory system to effectively penetrate it and can easily be used to conceal and transfer illegal income.

In the "Interpretation of the Supreme People's Court and the Supreme People's Procuratorate on Several Issues Concerning the Application of Laws in Handling Criminal Cases of Money Laundering" which came into effect on August 20, 2024, the act of "transacting through virtual assets" has been officially listed as one of the methods of money laundering, which means that the judicial authorities' crackdown on "virtual asset money laundering" has entered a clear and institutionalized stage.

Second, as a country that implements strict foreign exchange controls, the borderless nature of virtual currency can easily become a technical tool for evading regulation and achieving illegal currency exchange.

Such behavior not only disrupts the financial order, but also has a substantial impact on macroeconomic regulation and national economic security, mainly including:

- Statistical distortion: Since the virtual currency transaction chain is not controlled by local regulatory agencies, the actual foreign exchange outflow cannot be accurately included in the official statistical caliber, resulting in a "data black hole" in the balance of payments and foreign exchange reserves;

- Failure of macro-control: The central bank cannot accurately grasp the real situation of foreign exchange supply and demand in the market, and may misjudge the timing of exchange rate and interest rate adjustments, affecting the effectiveness of policies, and even need to use a large amount of real reserves to "fill" the outflow gap;

- Tax and asset loss: Illegal currency exchange through virtual currency to avoid taxes leads to the loss of the country's deposit reserves, cross-border tax sources and anti-money laundering data in the foreign exchange settlement and sales process.

Since the "September 4th Notice" in 2017 first clearly defined virtual currency-related businesses as illegal financial activities, regulatory efforts have continued to increase. The "Card Cutting" special operation that began in 2020, while combating traditional bank card crimes, also prompted underground banks, online gambling gangs, etc. to gradually switch funding channels to digital asset tools such as stablecoins. Even though the "924 Notice" in September 2021 reiterated that virtual currency-related businesses are illegal financial activities, in reality, due to the high liquidity, low threshold, and strong concealment of stablecoins, their use has become more active in the gray industry.

It is also in this context that a group of intermediaries who engage in "buy low and sell high" arbitrage have emerged, commonly known as "U merchants" - they do not directly participate in cryptocurrency projects, nor are they involved in upstream links in the chain such as money laundering and gambling, but are often accused of suspected illegal business operations, assisting information network criminal activities, concealing criminal proceeds and other common crimes for providing matchmaking transactions and earning exchange rate differences. They are also the "high-risk marginal groups" involved in criminal proceedings in current judicial practice.

Can stablecoins really be "eliminated" through continued policy suppression?

From the "September 4th Announcement" in 2017, to the "September 24th Notice" in 2021, to the continuous crackdown on virtual currency transactions and illegal foreign exchange transactions across the country since 2023, the density and intensity of regulatory policies have been significantly enhanced. However, as a lawyer who has handled a large number of criminal cases in the fields of virtual currency, illegal operations, and illegal foreign exchange, and can be said to be a "witness" in the handling of each criminal case, I also constantly think about it in the process of handling each criminal case:

Can this continuous and severe crackdown really achieve the goal of effectively combating crime and punishing illegal and criminal activities?

This question arises because in many of the cases I have come into contact with or handled, there are many situations like this:

Those who were arrested were all "marginal figures":

Whether it is the virtual currency trading platform cases I have handled, or the underground banks, currency exchange companies, and money laundering networks, a very common phenomenon is that those who are arrested are often ordinary employees who work for wages, "drivers" who help move money, middlemen who introduce currency exchange for a small commission, U merchants who make a profit by buying low and selling high, and of course, there are also corrupt officials involved in such cases. But these people are often neither decision makers nor the core of the chain, let alone the real beneficiaries.

The main culprit is on the run and law enforcement is difficult to track down:

Many of the operators and big bosses of the cases have already fled abroad, or even changed their nationality. Transnational law enforcement has costs. Even my client mentioned to the case handler many times that the main criminal was in Hong Kong, China, but the case-handling unit did not take the initiative to arrest him because the mainland police also have no law enforcement power in Hong Kong.

The country’s losses are difficult to recover, and the high-intensity investment of judicial resources has limited returns:

Take the cross-border online gambling case involving 400 billion yuan in cash flow cracked by the Jingmen police in Hubei in 2022 as an example. The case was called the first "virtual currency case" in the country where the currency was confiscated by court order.

It took nearly two years from the filing of the case to the verdict, and a lot of manpower and material resources were invested. Although the court finally made a confiscation judgment on "partial freezing of virtual currency", according to insiders, the actual amount recovered was far lower than expected.

The reason is that a large amount of the assets involved in the case are stored in the form of virtual currency on overseas trading platforms or in overseas company accounts. For example, Tether, the issuer of USDT, is registered in the United States. Chinese law enforcement agencies hope that it will cooperate with judicial seizure, but they also face many practical difficulties.

The reality of fragmented law enforcement is that it only treats the symptoms but not the root cause.

The above problems reveal a reality: for the real main offenders, the cost of breaking the law is often just to let "marginal figures" serve their sentences as scapegoats; and for those who are caught, they are just a link in the entire chain - neither the organizers nor the planners, nor do they have the ability to bear the consequences of the entire chain. Although the crackdown of criminal law has deterrent power, in practice, it makes "introducers", "transporters" and "exchangers" the main targets of punishment, which is a temporary solution but not a fundamental solution.

At the same time, it is worth pondering whether the huge amount of police force and law enforcement resources invested by the state in each case can bring about a systematic governance effect. Let us review the typical cases reported by the authorities in recent years:

- Shanghai Pudong Court announced a major case of illegal cross-border exchange of 6.5 billion yuan in stablecoins. Yang used 17 shell companies to manipulate cross-border "counter-trading" (2025)

- Beijing police cracked a 2 billion yuan virtual currency serial case, using USDT for "cross-border counter-trading" to provide RMB-foreign currency exchange channels for gamblers, cross-border e-commerce, etc. (2024)

- Shandong Qingdao police and the Qingdao branch of the State Administration of Foreign Exchange jointly cracked a major underground money laundering case involving a sum of 15.8 billion yuan (2023)

- Hubei Jingmen police cracked the first virtual currency case in the country. Hubei Jingmen police cracked a cross-border online gambling case involving a turnover of 400 billion yuan (2023)

- The Hangzhou Court in Zhejiang Province sentenced Zhao and others to an illegal business case of circular arbitrage by collecting dirhams in Dubai, purchasing USDT, and selling the RMB in China. The case involved a turnover of more than 43.85 million yuan (2022)

- The Shanghai Baoshan Court sentenced Guo Mouzhao, Fan Mouxun and others to set up websites such as "tw711 platform" and "Huosu platform" for illegal currency exchange, involving a turnover of 220 million (2022)

In practice, there seems to be a sense of loss of control, with "the more we block, the more leaks we get" and "the more we fight, the bigger the problem gets". The country hopes to achieve a warning effect for the whole society through punishment of individual cases, but the actual situation is that everyone is an isolated island, trapped in their own information cocoon. Before the incident, these people may not have paid attention to the relevant news, or even if they saw it, they did not realize the seriousness of the problem and whether it was related to them.

We actively abandoned the dominance of stablecoins

If combating gray industries is "defense", then leading legal alternatives should be "offense". Unfortunately, in this area, we have abandoned our own initiative.

Looking back, China was once the world's largest stablecoin power. Today, the founders of exchanges that are well-known in the global cryptocurrency circle, such as Binance, OKX, Gate.io, Huobi, and Matcha, are almost all Chinese. In the past, the exchange operation team was located in China, and cryptocurrency information platforms developed in large numbers. Most users used RMB or RMB stablecoins to complete virtual currency transaction settlements.

But now, all this has become a thing of the past. If it weren’t for the continuous introduction of policy barriers, which forced project owners, platform operators, and investment teams to shut down or choose to go overseas, China would have had a great chance to dominate the entire stablecoin ecosystem. Now, those who remain in China are often just low-level workers.

In addition to policy blockade, my country is also trying to find another way. Since 2016, the central bank has started the research and development of digital RMB, clearly put forward the goal of publicly issuing digital currency, and appointed Yao Qian as the first director of the Digital Currency Research Institute. Its design goal, to some extent, is to benchmark the US dollar stablecoin, and try to achieve the following intentions through digital RMB:

- Reduce dependence on the US dollar channel, use digital RMB for settlement in cross-border trade, investment, aid and other scenarios, bypass SWIFT and the US dollar clearing system, and reduce the risk of international sanctions;

- Suppress capital flight and illegal currency exchange, and replace the role of USDT and USDC in the underground financial system from a technical level;

- Provide businesses and individuals with an "official", compliant, and fee-free digital cash tool to weaken the gray appeal of stablecoins.

However, due to the lack of a wide range of application scenarios and ecological support for the digital RMB, even though the technical level is basically ready, the market acceptance is still sluggish. This path has not formed a truly effective payment alternative. It is not feasible to force the promotion of the digital RMB by administrative orders if users do not pay.

In addition, there is a bit of black humor. On November 20, 2024, the official report on Yao Qian’s serious violations of discipline and law mentioned that he abused his power during his tenure, provided "close" support to specific technology companies, and was suspected of using virtual currency for power-for-money transactions, becoming a key training target for those "hunters" who should have been regulated.

The failure of the promotion of the digital RMB to achieve policy goals has proven the limitations of the policy path on the one hand, and also highlighted the other side of the "ban" on stablecoins: policy resistance has not eliminated the problem itself, but has only made the gray path more hidden and underground transactions more complex and hidden. For existing supervision, it has brought more troubles.

What are the advantages of stablecoins? What are their use cases?

On July 18, 2025, US President Trump signed the Genius Act, which formally established the regulatory framework for digital stablecoins. In this regard, Sun Lijian, director of the Financial Research Center of Fudan Development Research Institute, publicly commented: "The US dollar stablecoin is essentially a tokenized projection of the US dollar in the blockchain world and a digital extension of the US dollar hegemony. It has magnified the global penetration of the US dollar through technical means, but it has also brought new systemic risks. For countries, stablecoins have also become a new battlefield for monetary sovereignty games."

Looking back, the things that we once regarded as rubbish seem to be regarded as treasures by our opponents. At the same time, they have now become weapons for our opponents to counterattack us?

From a technical perspective, stablecoins are programmable digital assets that are anchored to the value of legal tender and run on blockchain networks. Its core mechanism is to map the book value of legal tender to homogeneous tokens on the chain through the custody of off-chain reserve assets (such as US dollars, RMB, etc.). It can be transferred without relying on bank accounts and is automatically executed by smart contracts. It has the characteristics of high efficiency, decentralization, and low cost.

- For this reason, stablecoins are widely used in the following typical scenarios:

- Cross-border trade settlement: Enterprises can use USDT or USDC and other stablecoins to achieve cross-border payments in seconds, significantly reducing foreign exchange fees and settlement cycles;

- Free Trade Zone and Bonded Warehouse Payment System: In the free trade zone, RMB stablecoin can be used for one-click account splitting, covering a variety of scenarios such as warehousing, customs, and logistics;

- Supply chain finance: Platform companies use stablecoins to discount accounts receivable and automatically complete multi-level split transfers between upstream and downstream;

- Carbon trading and digital asset market: "On-chain credit assets" with stablecoins as the underlying can achieve automatic matching 24/7, improving the liquidity of assets such as carbon credits and digital equity;

- B-end and C-end payment tools: As a seamless intermediary in payment scenarios such as cross-border salary payment, study abroad payment, offshore financial management, and margin management, stablecoins can effectively open up the "last mile" between the traditional financial system and the on-chain economy.

We must see that stablecoins may indeed be used for illegal activities such as money laundering and private currency exchange, but they also have practical positive uses. This is why many places such as the United States, Hong Kong, China, and Singapore are actively trying to explore the design of a "compliance sandbox" for them.

Therefore, when evaluating the regulatory policies for stablecoins, we should not only focus on its risk labels such as "anonymity" and "borderlessness", but also need to deeply understand its value in cross-border payments, financial services, industrial collaboration, etc. Rather than completely excluding it from the system, it is better to face up to its logic and think about how to use it in a controllable way.

Stablecoins are not a tool for crime, the lack of system is the root of the problem

Stablecoins are not natural criminal tools, but carriers of new financial structures. Whether they will be abused depends on whether the system can follow up in time. Simply suppressing them will not hinder the rapid development of technology. At the same time, what we lose is not only the failure of supervision to meet expectations, but also the global competitiveness that we could have mastered. (In fact, it seems that we have never actively strived for and actively built them).

From my experience as a criminal lawyer, I can see that the institutional vacuum brings about substantial law enforcement difficulties.

First, there is an institutional vacuum and the case-handling units are lagging behind in their awareness.

Domestic policies simply suppress and deny the value and significance of virtual currencies, and lack relevant legal basis and case handling guidelines. In fact, from a law enforcement perspective, this is not conducive to the smooth handling of cases and the correct implementation of the law.

We represent Web3-related criminal cases in many places across the country, and frequently deal with judicial authorities at different levels. We can responsibly say that the vast majority of grassroots case handlers still lack basic knowledge of the technical principles and operating mechanisms of blockchain. This requires our lawyers to popularize the basic concepts to case handlers, and then the second step is to start arguments about legal disputes.

For example, in a recent Web3 case we represented, the local judicial authorities hoped that our client would voluntarily hand over hundreds of millions of virtual currencies as "illegal gains", but the presiding judge of the case asked us during the communication before the trial: What do these strings of letters and numbers (addresses, transaction hashes) mean? The case handler who decided the fate of the client knew nothing about this field, which is the norm for us to handle a large number of criminal cases involving virtual currencies, Web3 projects, and exchanges.

Second, the crackdown strategy is fragmented and law enforcement actions are tantamount to "whack-a-mole".

At present, my country's regulatory path for stablecoins and virtual currencies has not formed a systematic compliance guide. From the perspective of the prosecution, cases involving virtual currencies and Web3 often lack clear boundaries in terms of characterization, which can easily lead to uncertainty in the application of the law and make law enforcement officers exhausted and stuck in a "whack-a-mole dilemma."

Judicial organs have long relied on "plugging loopholes and catching criminals in the act" to maintain the bottom line, which is destined to be a high-cost, low-output approach. As long as there is real demand in the market, as long as there is still room for cross-border payments and on-chain transactions, there will always be "alternative solutions" to be developed. At this time, arresting "marginal people" and closing "downstream outlets" is just a continuation of the traditional logic of combating crime. It is destined to treat the symptoms but not the root cause, and it is difficult to form a truly sustainable governance system.

Truly effective institutional construction is neither "purely relying on crackdowns" nor "working behind closed doors", but rather building a system that achieves a dynamic balance between security and efficiency. This is the direction that financial governance should take in the future.

Conclusion

The real way out is not to block technical tools such as "stablecoins", but to build a compliant ecosystem that can guide, replace and regulate, so that virtual currency regulatory policies can play a precise and effective role. Let those who should be attacked have nowhere to hide, and let those who should be used be used for our own benefit.