Author: Frank, PANews

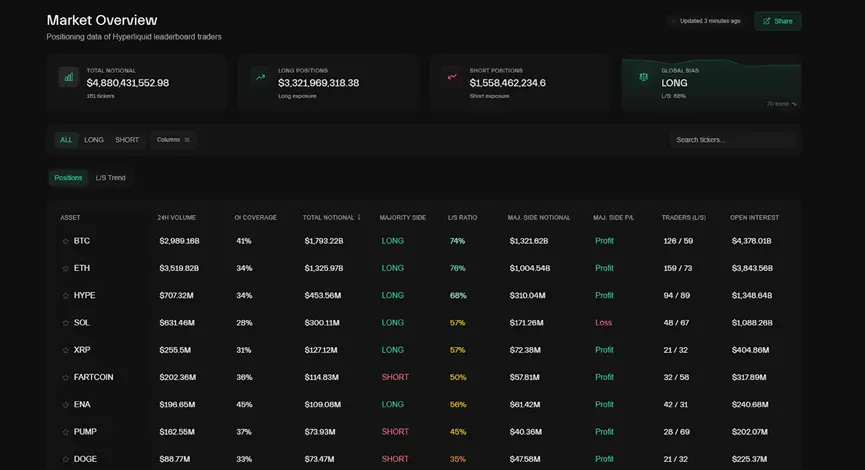

In the volatile cryptocurrency market, the movements of whales have always been a crucial indicator of market trends. To gain insight into the true flow of "smart money," PANews conducted an in-depth analysis of the latest data from the Hyperliquid leaderboard, a decentralized derivatives exchange. As of July 30th, whales on the Hyperliquid leaderboard had opened positions worth a total of $4.6 billion, with long positions dominating at $3 billion. However, beneath this seemingly optimistic overall data lies a stark divergence of strategies: traders are firmly bullish on mainstream assets like BTC and ETH, while simultaneously actively shorting numerous altcoins and MEME coins. What does this significant divergence portend for the market?

Overall Trend: Bulls Remain Dominant, but the fervor appears to be cooling

Macroeconomic data suggests that bulls currently hold the upper hand. As of July 30th, the total open interest of Hyperliquid's top traders was approximately $4.6 billion, consisting of approximately $3 billion in long positions and $1.57 billion in short positions, for an overall long-short ratio of approximately 66%.

However, beneath the optimistic data lie cautionary signals. First, the bullish trend has shown a downward trend, with the long-short ratio falling from a high of 76% on July 27th. Secondly, in terms of profitability, short positions performed even better: among tokens that whales were short, a staggering 79% of their positions were profitable, compared to only 53.5% of their long positions. This suggests that while whales are generally bullish, their short-term bearish decisions are more likely to yield profits.

Furthermore, Coinglass data shows that short positions have become the dominant force among Hyperliquid's top 125 wallet addresses, diverging from smaller wallets. Positions held by smaller addresses indicate a generally bullish outlook.

Whale Big Data: Sticking to Mainstream, Shorting Altcoins

The core strategic divergence among whales is reflected in their token selection, revealing a clear trend of "sticking to mainstream and shorting altcoins."

With respect to mainstream assets, whales demonstrate a resolute bullish stance. For example, BTC and ETH, which hold the largest positions, have long-short ratios exceeding 66%. Specifically for BTC, total long positions reach $1.2 billion, while short positions stand at just $479 million. Interestingly, the average liquidation distance for short positions is a staggering 48.3%, significantly higher than the 14% for long positions. This suggests that many short positions may not be purely bearish, but rather hedging orders used for risk mitigation. Furthermore, tokens such as TON ($19.83 million in positions) and AAVE ($25.18 million in positions) also boast high long-to-short ratios, making them among the few altcoins favored by whales. However, whales exhibit a starkly different attitude towards altcoins and MEME coins. A range of tokens, including FARTCOIN, PUMP, DOGE, SUI, BONK, PEPE, and even BNB, have long-to-short ratios below 50%, indicating a dominant position for shorts. For tokens like MOODENG, SYRUP, S, and JUP, the long-to-short ratio is less than 10%, indicating extreme bearish sentiment. These short positions are generally profitable, further confirming the effectiveness of whales' short-selling strategies.

Overall, while the bullish trend remains dominant across all tokens, it has been declining since July 27th. On July 28th, the long-short ratio dropped from 76% the previous day to 66%. Among the tokens bullish on by whales, 53.5% are generally profitable. Of the 29 tokens with an overall bearish outlook, 79% are profitable. Specifically for BTC, 71.7% of the top traders are long, totaling $1.2 billion in long positions. The average entry price is approximately $114,000, and the average liquidation distance is 14%. The overall profit is currently $27.82 million. Regarding short positions, the total is significantly smaller, at approximately $479 million, with an average entry price of $115,000. However, the average liquidation distance is still 48.3%, indicating that whales' short positions appear to be more heavily weighted towards hedging. In terms of position size, the average long position of BTC whales is $10 million, and the average short position is approximately $7.98 million.

Top Traders: Long-Term Bullish, Short-Term Wait-and-See or Short-Term

Beyond the overall data, the attitudes of top traders also seem to reveal some sentiments about the market.

The most profitable trader on Hyperliquid, 0x8af700ba841f30e0a3fcb0ee4c4a9d223e1efa05, currently has a total profit of approximately $54.86 million. This trader's profit curve has been generally upward since December 2024, demonstrating his relative stability and endurance.

His current positions are relatively evenly balanced in terms of total value, with both long and short positions around $63 million. Regarding the specific tokens he chooses, most are short, while a few are long. His position with the largest unrealized profit is FARTCOIN, which he shorted at $1.44, resulting in a current unrealized profit and loss of $1.12 million. Of his 16 profitable positions, only two are long positions with unrealized profit. AAVE has a floating profit of $976,000. His positions are largely consistent with the data, maintaining long positions on BTC and ETH, but shorting altcoins in the short term. The second-ranked trader, 0x15b325660a1c4a9582a7d834c31119c0cb9e3a42, currently has a profit of approximately $35 million. This trader clearly maintains a long-term bullish outlook, with all his positions held long, and his overall leverage is only 3.6x. From a cyclical perspective, this trader is clearly a long-term investor, with his ETH long positions opened at just $2,812, BTC long positions at $110,000, and SOL at $142, representing almost all long-term positions. However, not all of his long positions have realized profits, with unrealized losses on FARTCOIN, BIGTIME, and STRK at $235,000, $45,000, and $18,000, respectively. All remaining orders were profitable, with his long ETH position alone generating a $7.21 million profit.

The third-ranked trader was 0x2ba553d9f990a3b66b03b2dc0d030dfc1c061036, whose profit reached $40 million (actually, he should be the second-highest-earning trader). 78% of this trader's positions are short. This trader appears to be a short-term trader, holding positions for an average of less than two hours. Currently, his positions are relatively small, suggesting he is adopting a wait-and-see approach to the market. Judging from the positions held by these traders, long-term traders generally remain optimistic about the future, while short-term traders are more likely to be bearish or reduce their positions. In summary, Hyperliquid's whale data paints a picture of a market that favors mainstream and shorts altcoins. While overall positioning favors long positions, this bullish sentiment is primarily concentrated in a few core assets, such as BTC and ETH, whose dominance has been declining. Furthermore, whales hold not only a large number of short positions in altcoins, but also a higher percentage of profitable positions, demonstrating their widespread bearishness on high-risk assets and their effective harvesting. Judging from the personal strategies of top traders, long-term investors remain optimistic and patient, while short-term traders tend to be more cautious about shorting or holding onto their holdings. For ordinary investors, understanding the "two-sided" strategies of whales may be more important than simply following the long and short positions.

Risk Warning: This article is based on public data analysis and is for informational purposes only. It does not constitute investment advice or opinion. The cryptocurrency market is extremely risky and prices fluctuate drastically. Invest with caution. Please exercise independent thinking and assume all risks at your own risk.