Author: Zz, ChainCatcher

"The most interesting place on the Internet" - three founders born in the 2000s once described their work Pump.fun in this way. Today, this sentence sounds more like a black humor.

In July 2025, this star platform that once subverted the Meme track with the "one-click coin issuance" model is facing an unprecedented crisis of trust and market challenges.

The company is not only facing the commercial pressure of market share being eroded by competitors and key data falling sharply, but also deeply trapped in the legal dilemma of securities fraud and even RICO felony charges in the United States. The story of Pump.fun began with enthusiasm and is also experiencing the test brought by enthusiasm.

The outbreak point of the crisis of trust

In July 2025, a decision changed everything.

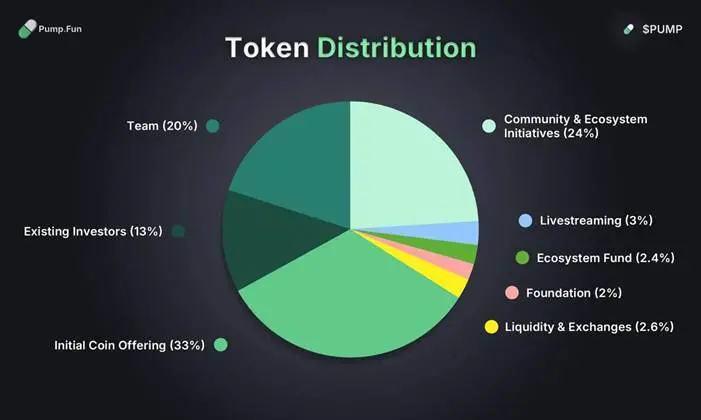

Pump.fun announced the issuance of its own token PUMP, with a fully diluted valuation of up to US$4 billion. This should have been a milestone in the development of the platform, but it became a turning point that shook the trust of the community.

Ironically, the founder of the platform had previously won credibility for the platform with the declaration that "every pre-sale is a scam." Now he has turned around and launched a large-scale pre-sale for PUMP, which is regarded by the community as blatant hypocrisy and betrayal.

Jocy, the founder of the well-known venture capital IOSG Ventures, publicly stated on the X platform that it was a high-risk "Exit Liquidity event", believing that financing at a valuation of $4 billion in the downward cycle of altcoins has seriously overdrawn the future. The market's concerns quickly came true.

According to CoinMarketCap data, the price of the token plummeted by 75% within hours of its launch. As of the publication of this article, PUMP has fallen to 0.0024 USDT, a drop of more than 30% from its public sale price of 0.004 USDT.

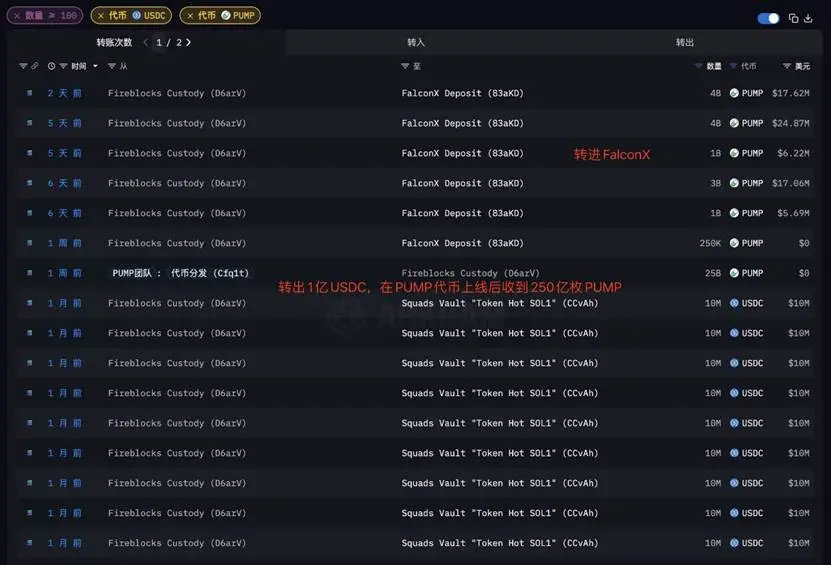

The data behind it is even more shocking: 340 whale wallets coordinated to sell, controlling more than 60% of the pre-sale share. According to the on-chain data of X user EmberCN, only two private placement rounds related wallets sold tokens worth $141 million, making a profit of nearly $40 million.

In social media, the atmosphere suddenly changed from carnival to despair. "We thought this was an opportunity to change our destiny, but it turned out to be fuel for their luxury yacht party. "This feeling of being fooled and harvested spread rapidly, seriously damaging the community foundation on which Pump.fun relies for survival.

Shares collapsed, and the business model faced a test

The loss of trust is directly reflected in the bleak market data.

Competitor LetsBONK.fun is eroding its market position at an alarming rate. According to Dune Analytics data, in just one month, Pump.fun's share of the new coin issuance market fell sharply from 90% to 24%, while LetsBONK.fun soared from 5% to 64%. Behind this is a contest between two completely different philosophies.

Pump.fun's model is centralized pumping, while LetsBONK.fun's success lies in its use of 58% of the platform's revenue to repurchase and destroy ecological tokens, building a powerful value and trust flywheel through real interest sharing.

Faced with difficulties, CoinCentral reported that although the team announced that it would use tens of millions of dollars for large-scale repurchases, it was ridiculed by the market as "using retail investors' money to take over their own orders at high prices." Analysts pointed out that the project party sold it at $0.004 and then repurchased it at $0.0064 with platform revenue, which is essentially a 60% premium for market value management.

Although this move boosted the coin price in the short term, it could not restore the serious damage to its value foundation and market confidence. At the same time, the global regulatory network is tightening.

In December 2024, after receiving a warning from the UK Financial Conduct Authority (FCA), Pump.fun was forced to block British users who accounted for 9% of its traffic.

This is not an isolated incident, but a regulatory scrutiny that its "viral" growth model will inevitably attract. Pump.fun is caught in a serious negative feedback loop: increased competition erodes revenue, reduced revenue weakens the ability to repurchase, and falling coin prices undermine confidence, ultimately leading to accelerated user loss.

RICO is hunting

The more serious challenge comes from the legal level. Initially, multiple class action lawsuits accused all Meme coins on the platform of being unregistered securities. Law firms such as Wolf Popper LLP proposed the "joint issuer" theory, arguing that the platform is deeply involved in the creation, trading and liquidity process of tokens and is not a neutral technical party.

In July 2025, the legal battle escalated sharply. According to the revised documents in the Aguilar case, the plaintiffs have added charges based on the Racketeer Influenced and Corrupt Organizations Act (RICO), which is often used to combat organized crime.

The scope of defendants has also expanded, with the Solana Foundation, Solana Labs, and even its co-founders listed as "architects, beneficiaries, and accomplices" of the fraud. The lethality of this move goes far beyond the project itself, and it directly questions the responsibility boundaries of the entire Solana ecosystem.

As the underlying infrastructure, does Solana have an obligation to review or supervise the star projects within its ecosystem? This lawsuit has made all public chain platforms realize that their relationship with ecological projects may be much more dangerous than they imagined. The basic acts of RICO's allegations include wire and securities fraud, unlicensed fund transmission, and assisting money laundering.

The most explosive allegation is that the North Korean hacker group "Lazarus Group" used Pump.fun to issue Meme coins to launder the funds stolen in the Bybit hack.

Governance flaws make it difficult to prevent internal thieves

However, the most shocking thing may be the betrayal from within.

On May 16, 2024, the platform was attacked and about $1.9 million in funds were stolen. However, the attacker was not an external hacker, but a former employee with a grudge.

The former employee named "Stacc" publicly admitted responsibility on the social platform X, with the motivation pointing directly to personal revenge and contempt for "terrible bosses". Technical analysis shows that the attack originated from the abuse of management rights, not smart contract vulnerabilities.

The employee used his privileged position to illegally obtain withdrawal authorization, and then quickly bought out the supply of multiple tokens through flash loans, ultimately intercepting the initial liquidity that should have entered the DEX. While claiming to solve the risk of Meme coins running away, its internal "backdoor" had long been opened to dissatisfied employees.

This incident is like a mirror, reflecting Pump.fun's astonishing neglect of internal security and corporate governance during its rapid development.

From solving running away to "running away" by oneself

The root of the story began with the "Solana Meme Coin Frenzy" that swept the world in early 2024. Countless developers and speculators have flocked to the Solana ecosystem, eager to create or capture the next 100x coin, but the process of creating tokens and providing them with initial liquidity pools (LPs) is both expensive and complicated, requiring thousands of dollars in costs and expertise, and this threshold has kept countless creative and "grassroots" players out.

The protagonists are three founders born in the 2000s: CEO Noah Tweedale (21 years old), CTO Dylan Kerler (21 years old) and Alon Cohen (23 years old), alias COO. They keenly captured this core pain point, claiming to solve the risk of Meme coins running away, and their vision is to create the most interesting place on the Internet.

Pump.fun was born in January 2024. Its core innovation: "One-click coin issuance" simplifies the originally complicated process to just a few clicks and a few dollars. This disruptive innovation has brought explosive growth.

But this talent soon became a speculative tool. The entire business model is amplifying speculative sentiment. The pre-sale of PUMP tokens with a valuation of $4 billion pushed this speculation to the peak.

The disregard for business rules runs through it all. They once won trust with their anti-pre-sale stance, but turned around and launched a large-scale pre-sale. When faced with FCA supervision, they chose to cut ties with the British operating entity. The CEO denied that Pump.fun was a British company, and the COO argued that the employment relationship did not represent ownership. These all seemed like careful calculations rather than ignorance to the public.

Technical genius, speculator, and rule-agnostic, this complex portrait presents the complete trajectory of Pump.fun's rocket-like rise and rapid fall. The young founders did not expect that this project intended to bring fun would push them into a complex legal and commercial vortex.

Standing at a crossroads

Pump.fun is standing at a crossroads. Pending lawsuits, declining market share, and damaged user trust have put it in trouble.

This seems to be another cruel performance of "DeFi Darwinism": a species prospers rapidly due to its unique adaptability (low threshold, high dissemination), but ultimately faces challenges due to its inability to evolve the ability to cope with a complex environment (regulation, trust, security).

For the entire crypto industry, the dilemma of Pump.fun raises a serious question: When innovation walks on the edge of the law, to what extent should the platform be responsible for the behavior within its ecosystem?

When the regulatory focus shifts from centralized exchanges to more complex DeFi applications, the next Pump.fun may be brewing.

And for every surfer, the ability to distinguish between fun and traps has never been as important as it is today. This story from grassroots to the peak and then from the peak to the fall may be foreshadowing the next chapter of the crypto world.