Author: CoinW Research Institute

Key Takeaways

- The global cryptocurrency market capitalization is $3.96 trillion, down 5.95% from $4.21 trillion last week. As of press time, US Bitcoin spot ETFs have seen a net inflow of approximately $56.81 billion, with a net outflow of $902.5 million. US Ethereum spot ETFs have seen a net inflow of approximately $13.12 billion, with a net outflow of $796 million.

- The total market value of stablecoins is US$301 billion, of which USDT has a market value of US$174.4 billion, accounting for 57.94% of the total market value of stablecoins; followed by USDC with a market value of US$73.69 billion, accounting for 24.47% of the total market value of stablecoins; and DAI with a market value of US$5.36 billion, accounting for 1.78% of the total market value of stablecoins.

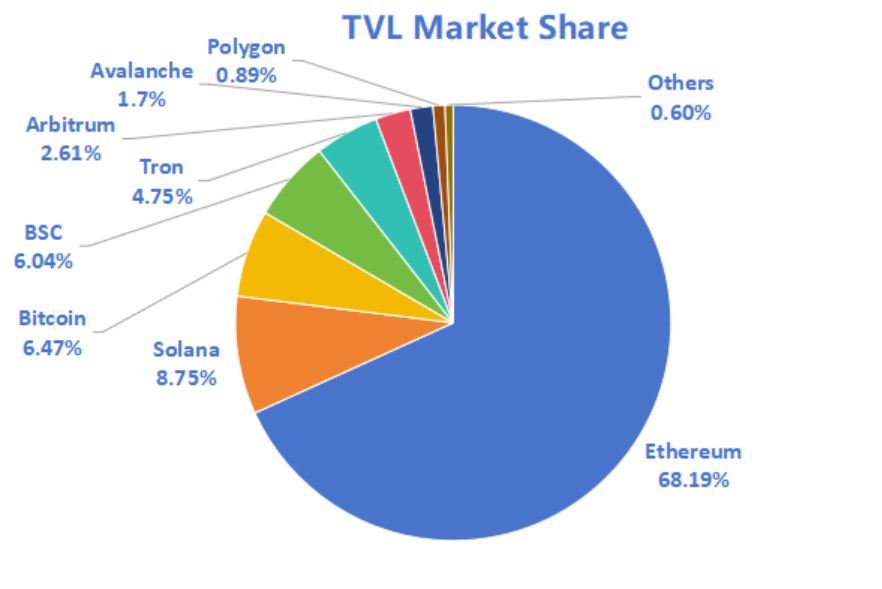

- According to DeFiLlama, the total DeFi TVL reached $155.5 billion this week, down 3.36% from $160.9 billion last week. Breaking down the TVL by public chain, the three chains with the highest TVL were Ethereum (68.19%), Solana (8.75%), and Bitcoin (6.47%).

- On-chain data shows significant fluctuations in daily transaction volume across various public chains this week, with Sui up 50.5%, Ethereum up 49.38%, Solana down 35.39%, and BNBChain down 33.7%. Other chains saw minor fluctuations. Regarding transaction fees, Ethereum saw a 100% increase, Solana down 60%, and Aptos down 20%, while other chains showed little change. Looking at daily active addresses, with the exception of BNBChain, which saw a 2.46% increase, all other chains saw a downward trend. Sui fell 23.92%, Aptos fell 18.7%, Toncoin fell 13.5%, Ethereum fell 6.36%, and Solana fell 5.62%. Looking at TVL, with the exception of Sui, which saw a 0.97% increase, all other chains saw a downward trend. Among them, BNBChain fell 14.41%, Solana fell 9.34%, Ethereum fell 7.4%, Toncoin fell 6.47%, and Aptos fell 6.33%.

- Innovative projects to watch: Fuseon is a centralized liquidity hub based on Plasma, dedicated to providing efficient fund aggregation and trading support for the DeFi ecosystem; BULK focuses on building a high-performance on-chain perpetual contract trading platform, aiming to narrow the gap between CEX and DeFi in high-frequency order matching and performance; Future.fun is a decentralized prediction market platform designed to provide users with blockchain-based prediction and trading mechanisms.

Table of contents

Key Takeaways

1. Market Overview

1. Total cryptocurrency market capitalization/Bitcoin market capitalization ratio

2. Panic Index

3.ETF inflow and outflow data

4. ETH/BTC and ETH/USD exchange rates

5. Decentralized Finance (DeFi)

6. On-chain data

7. Stablecoin Market Cap and Issuance

2. Hot money trends this week

1. This week's top five VC and Meme coins

2. New Project Insights

3. New Industry Trends

1. Major industry events this week

2. Big events coming up next week

3. Important investment and financing last week

Reference Links

1. Market Overview

1. Total cryptocurrency market capitalization/Bitcoin market capitalization ratio

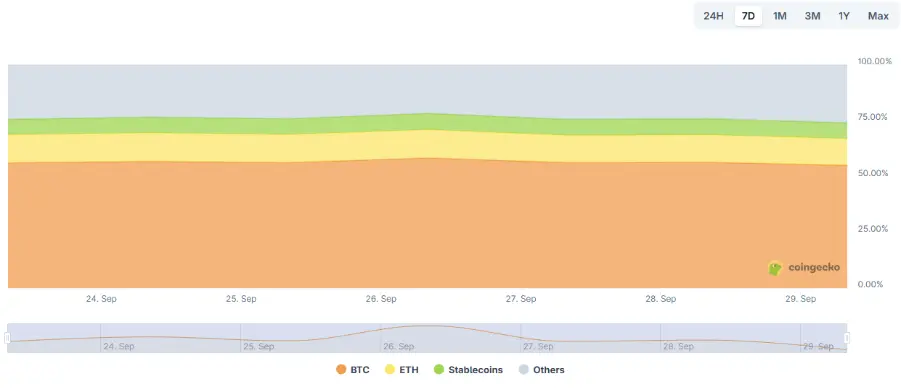

The total market value of global cryptocurrencies is US$3.96 trillion, down 5.95% from US$4.21 trillion last week.

Data source: CryptoRank

Data as of September 28, 2025

As of press time, Bitcoin’s market capitalization is $2.24 trillion, accounting for 56.52% of the total cryptocurrency market capitalization. Meanwhile, stablecoins’ market capitalization is $301 billion, accounting for 7.6% of the total cryptocurrency market capitalization.

Data source: coingeck

Data as of September 28, 2025

2. Panic Index

The cryptocurrency fear index is at 49, indicating neutrality.

Data source: coinglass

Data as of September 28, 2025

3.ETF inflow and outflow data

As of press time, the U.S. Bitcoin spot ETF has accumulated a total net inflow of approximately US$56.81 billion, with a net outflow of US$902.5 million this week; the U.S. Ethereum spot ETF has accumulated a total net inflow of approximately US$13.12 billion, with a net outflow of US$796 million this week.

Data source: sosovalue

Data as of September 28, 2025

4. ETH/BTC and ETH/USD exchange rates

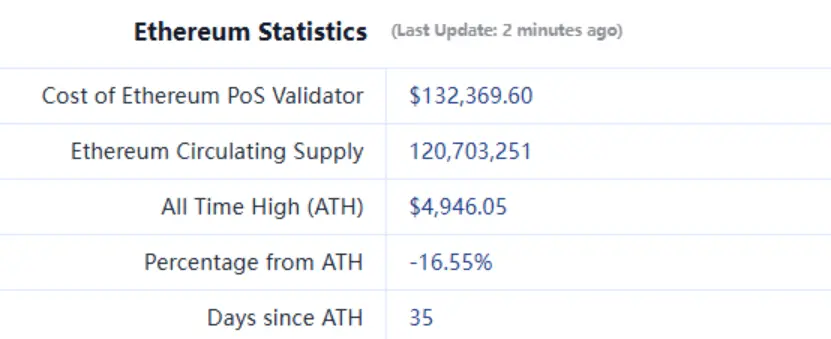

ETHUSD: Current price is $4,133, historical high is $4,946, down about 16.55% from the high.

ETHBTC: Currently at 0.036823, the historical high is 0.1238.

Data source: ratiogang

Data as of September 28, 2025

5. Decentralized Finance (DeFi)

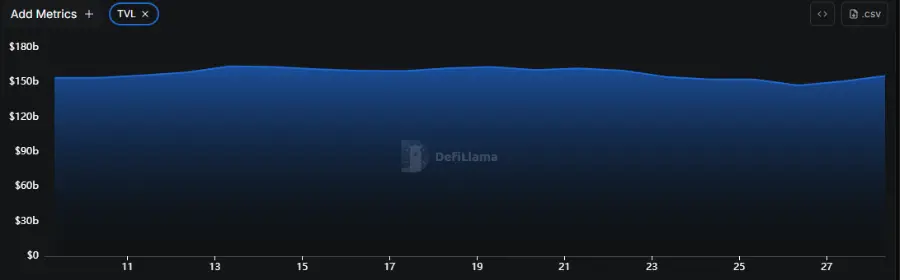

According to data from DeFiLlama, the total TVL of DeFi this week was US$155.5 billion, down 3.36% from US$160.9 billion last week.

Data source: defillama

Data as of September 28, 2025

Divided by public chain, the three public chains with the highest TVL are Ethereum chain accounting for 68.19%; Solana chain accounting for 8.75%; and Bitcoin chain accounting for 6.47%.

Data source: CoinW Research Institute, defillama

Data as of September 28, 2025

6. On-chain data

Layer 1 related data

The main analysis is based on daily transaction volume, daily active addresses, and transaction fees. The current Layer 1 data includes ETH, SOL, BNB, TON, SUI, and APT.

Data source: CoinW Research Institute, defillama, Nansen

Data as of September 28, 2025

● Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. This week, daily trading volumes across various public chains showed significant fluctuations, with Sui seeing a 50.5% increase, Ethereum a 49.38% increase, Solana a 35.39% decrease, and BNBChain a 33.7% decrease. The remaining public chains saw minor fluctuations. Regarding transaction fees, with the exception of Ethereum (up 100%), Solana (down 60%), and Aptos (down 20%), the remaining public chains showed little change.

● Daily Active Addresses and TVL: Daily active addresses reflect the level of participation and user stickiness in a public chain's ecosystem, while TVL reflects user trust in the platform. Looking at daily active addresses, with the exception of BNBChain, which saw a 2.46% increase, all other public chains saw a downward trend this week. Sui fell 23.92%, Aptos 18.7%, Toncoin 13.5%, Ethereum 6.36%, and Solana 5.62%. Looking at TVL, with the exception of Sui, which saw a 0.97% increase, all other public chains saw a downward trend. BNBChain fell 14.41%, Solana 9.34%, Ethereum 7.4%, Toncoin 6.47%, and Aptos 6.33%.

Layer 2 related data

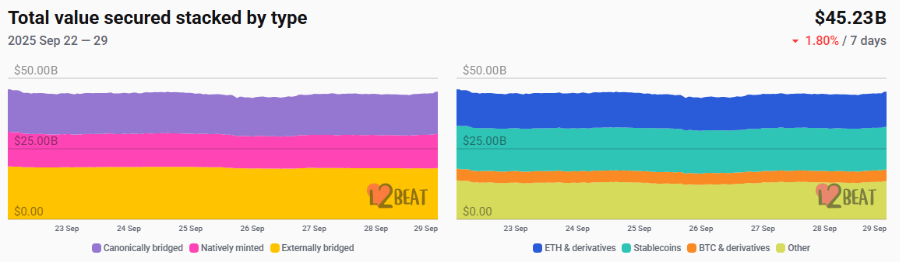

● According to L2Beat data, the total TVL of Ethereum Layer2 is US$45.23 billion, a decrease of 1.76% from US$46.04 billion last week.

Data source: L2Beat

Data as of September 28, 2025

- Base and Arbitrum occupy the top position with 38.26% and 35% market share respectively. This week, Base still ranks first in the TVL of Ethereum Layer2.

Data source: footprint

Data as of September 28, 2025

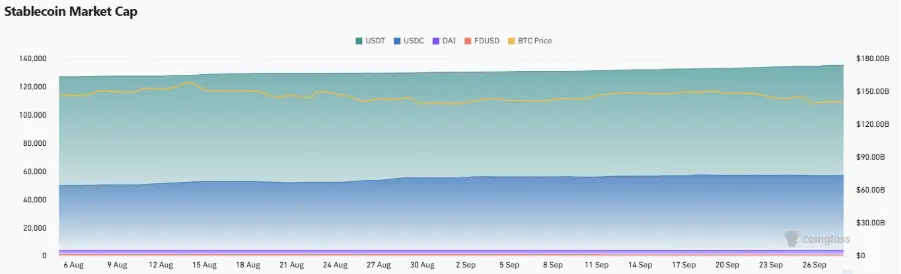

7. Stablecoin Market Cap and Issuance

According to Coinglass data, the total stablecoin market capitalization is $301 billion. USDT's market capitalization is $174.4 billion, accounting for 57.94% of the total stablecoin market capitalization. USDC is second at $73.69 billion, accounting for 24.47% of the total stablecoin market capitalization. DAI's market capitalization is $5.36 billion, accounting for 1.78% of the total stablecoin market capitalization.

Data source: CoinW Research Institute, Coinglass

Data as of September 28, 2025

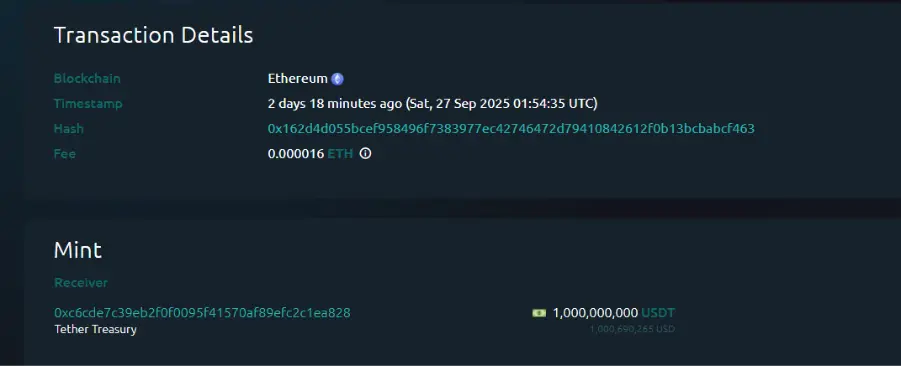

According to Whale Alert data, USDC Treasury issued a total of 2.78 billion USDC this week, and Tether Treasury issued a total of 3 billion USDT. The total amount of stablecoins issued this week was 5.78 billion, an increase of about 1.23% from the total amount of stablecoins issued last week, which was 5.71 billion.

Data source: Whale Alert

Data as of September 28, 2025

2. Hot money trends this week

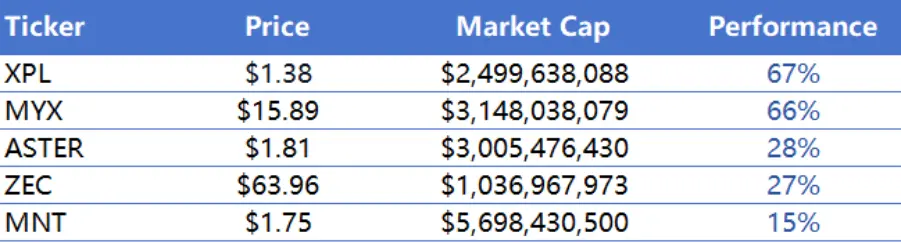

1. This week’s top five VC and Meme coins with the highest growth

Top five VC coins with the highest growth in the past week

Data source: CoinW Research Institute, coinmarketcap

Data as of September 28, 2025

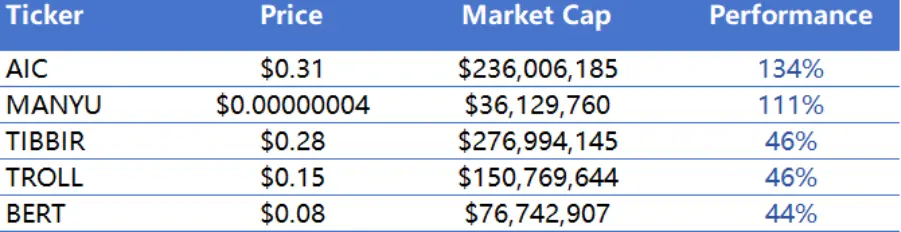

Top 5 Meme Coins with the Most Gains in the Past Week

Data source: CoinW Research Institute, coinmarketcap

Data as of September 28, 2025

2. New Project Insights

- Fuseon is a centralized liquidity hub built on Plasma, dedicated to providing efficient fund aggregation and trading support for the DeFi ecosystem. The project improves capital efficiency through centralized liquidity management, while also being compatible with DEXs and other DeFi use cases, aiming to become the core liquidity gateway on the Plasma network.

- BULK is a decentralized exchange that focuses on building a high-performance on-chain perpetual contract trading platform. It adopts the CLOB model and aims to narrow the gap between CEX and DeFi in high-frequency order matching and performance. BULK completed an $8 million seed round of financing in September 2025.

- Future.fun is a decentralized prediction market platform founded in 2025 that aims to provide users with a blockchain-based prediction and trading mechanism.

3. New Industry Trends

1. Major industry events this week

- River has announced that its RIVER token airdrop is now open for claiming. This airdrop utilizes a dynamic airdrop conversion mechanism, whereby the amount of RIVER a user can claim increases over time. The longer the wait, the more tokens a user will receive. The maximum waiting period is 180 days. If a user claims on the 180th day, they will receive 270 times the amount of tokens they received on the first day.

- The Base ecosystem prediction market, Limitless, has launched its Season 2 Points Program. The program runs from September 22, 2025, to January 26, 2026. Users can earn points through trading and providing liquidity. Its TGE will take place during the Season 2 Points Program, and further details regarding the distribution and token announcement will be announced soon.

- Blockchain gaming platform CUCKOO and ODIN have partnered for the first time globally, launching a dual-platform exploration tour event. Participants will receive 10 iPhone 17 Pro Max units and various ecosystem rewards. The event is open to users worldwide and runs until October 22nd. Participants simply need to complete designated tasks for a chance to win rewards.

- On September 20th, the Flipflop Foundation launched the Footprint Ambassador Program, simultaneously launching the Launch and Mint competitions, with a total prize pool of $700,000. The Footprint Ambassador Program is open to global community members, rewarding them for spreading the word and participating in building the platform ecosystem. The Launch competition encourages builders to launch projects on the Flipflop platform and receive funding and community resources. The Mint competition encourages users to participate in building and strengthening the ecosystem.

- Morph announced that its BGB Unity Drop eligibility check is now live. Users can connect to their wallet to check their airdrop eligibility, with official redemption starting September 25th. Morph stated that the Unity Airdrop is available to active users across the Morph ecosystem: Morph Creators and Ambassadors; Morph Zoo Points holders; Zootosis event participants; the top 500 Morph Hub XP users; and Morph Hub Invitation Points holders.

2. Big events coming up next week

- Meteora is a liquidity infrastructure project in the Solana ecosystem, focusing on dynamic liquidity management and sustainable returns. The market expects the TGE to take place in the first week of October.

- Sahara AI has released its latest roadmap, with the first vertical agent, DeFi Copilot, expected to launch in the fourth quarter of this year. This product will focus on simplifying on-chain interactions and asset management, lowering the barrier to entry for users in DeFi. Furthermore, the Sahara platform will upgrade its enterprise-level data services, providing more comprehensive management and control tools and collaboration systems to support the implementation of large-scale AI applications.

- Huma Finance announced that the HUMA token Season 1 airdrop part 2 is now live, and the claim window will end on October 26.

- Decentralized trading platform Aster announced that Phase 2 of its Genesis trading points program will conclude on October 6th, with 4% of the total ASTER supply allocated to Phase 2 rewards. Additionally, Phase 3 of the trading points program is about to begin, which will include spot trading points and more.

3. Important investment and financing last week

- Fnality has completed a $136 million Series C funding round, with participation from Temasek, WisdomTree, Citi, Tradeweb Markets, and other institutions. Fnality is committed to providing a digital cash instrument with final settlement for tokenized transactions using distributed ledger technology. (September 23, 2025)

- Zero Hash has completed a $104 million Series D funding round from leading investors including Morgan Stanley, Apollo Global Management, and Interactive Brokers. As a B2B2C embedded infrastructure platform that provides digital asset-as-a-service, Zero Hash enables emerging banks, brokerages, and payment groups to quickly integrate crypto trading, custody, staking rewards, and crypto cashback. (September 23, 2025)

- Bastion has secured $14.6 million in funding from investors including Coinbase Ventures, Andreessen Horowitz, Hashed, and Sony Financial Ventures. Bastion provides a compliant white-label platform and API technology, enabling businesses to quickly integrate managed wallets, intelligent transaction routing, and data analytics. (September 24, 2025)

Reference Links

1.Fuseon, https://x.com/fuseon_finance

2.BULK, https://x.com/_bulktrade

3. Future.fun, https://x.com/futuredotfun

4.Fnality, https://x.com/fnality

5.Zero Hash, https://x.com/ZeroHashX

6.Bastion, https://x.com/bastionplatform