Author: Lucida

Preface

Riding the wave of wealth in the crypto world, we're always searching for the perfect platform that promises easy wins. In our previous article, we analyzed the profit potential of major exchanges. However, high returns often come with higher risks. A truly excellent exchange shouldn't just be a flash-in-the-pan "wealth-making" phenomenon; it should be a solid and reliable guardian of your assets.

So, who can remain calm in a frenzied market and accurately clear minefields for you? Who possesses the nose of a hound, always one step ahead of others and seize the opportunity of the next explosive track?

To answer these questions, LUCIDA's evaluation deepens its perspective, conducting a comprehensive, data-driven physical examination of major exchanges across two core dimensions: risk control capabilities and coin listing capabilities. We move beyond sentimental reputations and instead use quantitative metrics like "odds," "break-even rates," and "half-cut rates" to penetrate the fog and clearly identify those who are protecting you and those who could put you in danger.

We've also tracked the launches of several star cryptocurrencies in popular sectors, uncovering the rhythm of different exchanges: which ones consistently give you the first crack at the market, and which ones consistently arrive late. This brings us to the second installment of our CEX comparison: Risk Control and Coin Listing.

1. Risk Control Capabilities

High returns often hide the fangs of high risk. A good exchange is not only a "wealth-making factory" but also the first line of defense for your assets. We should not only consider the potential gains, but also its ability to help you "clear minefields" and protect your principal.

We quantitatively assess exchanges' risk management capabilities across three dimensions: odds, IPO break-even rates, and the percentage of cryptocurrencies that have halved in value. By penetrating the data, we can clearly see who's swimming naked and who's protecting the market.

1. Odds: How many traps do you have to take to capture the dark horse?

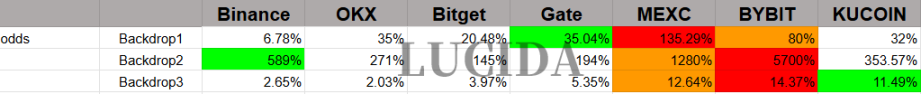

The formula for calculating odds is as follows:

Press enter or click to view image in full size

Where nCEX,i represents the number of cryptocurrencies whose price increases exceed 500% on the i-th backdrop, a certain CEX; mCEX,i represents the number of cryptocurrencies whose price decreases exceed 50% on the i-th backdrop, a certain CEX.

This metric probabilistically measures the risk-reward ratio of "how many significant drawdowns are needed to achieve a significant increase in a particular currency?" Simply put, it measures how many significant declines are needed to achieve a significant increase. The specific calculation results are shown in the table below:

Press enter or click to view image in full size

The data clearly shows that over the three observation periods, MEXC and Bybit consistently maintained top-tier odds performance. In other words, here, you have a better chance of catching those skyrocketing stocks with less trial and error.

2. Break-even rate: IPOs are no longer just blind boxes

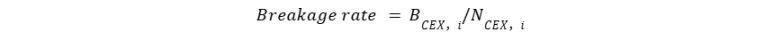

Breaking the issue price is the deepest fear of every IPO enthusiast. We use this to measure the exchange's ability to control the valuation of new coins. The calculation formula is as follows:

Press enter or click to view image in full size

BCEX,i represents the number of broken-issue coins on a CEX in the i-th backdrop; NCEX,i represents the total number of newly listed coins on a CEX in the i-th backdrop.

The break-even rate represents the percentage of newly listed coins in this backdrop that break even. To better reflect the actual cost, we use the next day's opening price as the benchmark. The calculation results are shown in the table below:

The results show that Binance demonstrates its robustness in controlling the IPO price drop, typically keeping it at the lowest level. Bitget and Bybit also performed reliably. Gate, however, failed to make the top three in any of the three rankings, prompting caution when investing in new IPOs.

3. The proportion of coins that have been halved: How many times can your account withstand a halving?

A halving is a nightmare scenario for shrinking assets. A coin's value plummeting by half from its peak is a devastating blow to investor confidence. We've compiled a statistical analysis of the percentage of halved coins across various exchanges, providing a direct indicator of the overall health of their coin pools.

The calculation formula of this indicator is as follows:

Press enter or click to view image in full size

mCEX,i represents the number of cryptocurrencies whose price drops by more than 50% on the i-th backdrop, a certain CEX; MCEX,i represents the total number of cryptocurrencies listed on the i-th backdrop, a certain CEX.

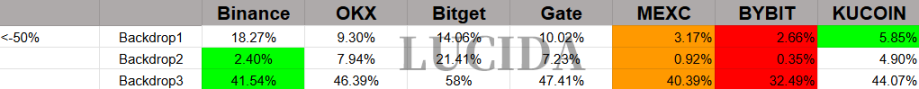

The calculation results are shown in the figure below:

The results show that Bybit and MEXC have once again demonstrated their strong risk management capabilities, with their halving rates remaining at minimal levels, significantly reducing the probability of a significant asset loss. Binance's performance has also become increasingly strong in the latter stages, demonstrating its strong latecomer advantage.

Summary of risk control capabilities:

Bybit and MEXC are top performers in comprehensive risk management. They lead in both odds and halving rates, making them the perfect choice for investors seeking a balance between security and returns.

Safe haven for new IPOs: If you are keen on new coins, Binance, Bybit and Bitget provide you with a safer "new IPO paradise" with lower break-even rates.

2. High-potential Coin Listing Capabilities: Who is Always One Step Ahead?

In the cryptocurrency world, time is money. An exchange's ability to discern hot spots and list promising coins first directly determines whether you can "get on board" before the market takes off. To investigate this question, we tracked the listing cadence of several representative coins in this sector, including PEPE, POPCAT, FARTCOIN, GOAT, INJ, and AXS, to reveal which exchange has the sharpest nose.

1. GAMEFi Track

AGLD

Gate, MEXC, and OKX were the first to go online, followed closely by Binance. Bybit, however, arrived late and missed the main upward trend.

AXS

Binance and KuCoin users reaped almost all of the gains. The market hadn't yet exploded when OKX and Bitget launched, leaving them with opportunities. Gate and MEXC users, on the other hand, faced the risk of a pullback from high levels, as the market had already ended by the time Bybit launched.

2.RWA

INJ

It was first listed on Binance and Gate. After a significant pullback, it was listed on Bybit, Bitget, and MEXC, precisely timing the second wave of gains. The OKX listing was nearing the end of the market.

ONDO

MEXC started to rise after KuCoin, Gate, and Bybit launched first. However, when it was listed on OKX and Binance, the price had already entered a correction phase.

3. AI

FET

Initially launched on MEXC and Binance, they experienced a long bull run after a decline. Gate launched at a peak, Bitget launched at a low point and then saw a surge, KuCoin experienced a pullback immediately after its launch, while Bybit and OKX precisely positioned themselves before the next wave of market activity.

GOAT

MEXC was first launched, and during its rise, it was subsequently listed on Gate, Bitget, Binance, and KuCoin. By the time Bybit and OKX were listed, the party was almost over.

NMR

NMR has been listed on MEXC, Binance, OKX, Gate, KUCOIN, Bitget, and Bybit.

4. meme

PEPE

Gate and MEXC were the biggest winners, allowing users to fully capture the massive gains from the initial period. OKX, while late to the game, still had the potential for a major uptrend. Meanwhile, Binance and KuCoin were already trading at peak sentiment when they launched, making it easy for investors to chase highs and wait for a move.

POPCAT

The story repeats itself, with Gate and MEXC once again taking the lead. Bitget, OKX, and others, which launched later, missed out on the surge in Bybit’s stock price after its listing.

FARTCOIN

MEXC led the way, experiencing an immediate surge upon its initial launch. Bitget followed closely behind. Gate and KuCoin, among others, had already seen significant price fluctuations upon their launch, significantly increasing risk.

MOODENG

This once again proves MEXC's acumen in capturing early popular coins.

summary

Taking the above four cases into account, OKX and Binance tend to be more cautious in listing high-potential cryptocurrencies. This may cause you to miss out on some early opportunities to get rich quick, but it also filters out some junk projects. MEXC and Gate, on the other hand, are known for their speed, offering investors more opportunities to earn high returns.

It's important to note that speed isn't always a good thing. Considering the aforementioned data on IPO break-even rates, Gate's rapid launches also resulted in a significantly higher IPO break-even rate, making it a prime example of a "high-risk, high-return" strategy. Therefore, this capability must be considered alongside risk management capabilities.

In the cryptocurrency world, the pace of project growth and listing logic vary significantly across different industries. Combining the latest market data, we've found that an exchange's industry acumen is crucial for investors' ability to seize opportunities.

Meme sector: Speed is everything, early dividends are the most generous

Meme coins, such as PEPE, POPCAT, and FARTCOIN, have extremely short lifespans, with their speed to market directly determining their returns. MEXC and Gate continue to serve as the "meme launch sites," dominating the launch of nearly all of the early star meme coins. Although OKX and Binance launched later, their massive user bases have still been able to drive the price of their coins into a second wave of significant growth.

Investment Implications: Meme traders should focus 80% of their energy on MEXC and Gate, quickly enter the market on their first day of listing, and consider taking profits in batches when they are listed on Binance and OKX.

AI and Infra (Infrastructure): Gradual Token Listing for More Sustained Value Discovery

AI and infrastructure projects have high technical barriers to entry and long cycles of value release, leading to a clear trend of "gradient listing" across exchanges. Binance is the preferred launch platform for AI projects (such as FET), with its Alpha platform and IDO channels showing a clear preference for AI projects. Bitget and Bybit excel at listing projects during periods of low trading volume after initial adjustments, providing investors who missed out on the initial offering with a second chance to get on board.

Investment Implications: The AI sector is well-suited for a "left-side layout, building positions in batches." You can establish an observation position during the Binance initial offering, and increase investment after secondary listings on second-tier platforms like Bitget and price corrections.

GAMEFi and RWA: Dark Horses Emerge Frequently, and Dark Horse Exchanges Quietly Rise. KUCOIN and Gate have demonstrated remarkable foresight in the GAMEFi space (e.g., AGLD), repeatedly preempting Binance in listing promising projects. Bybit and Bitget have demonstrated keen insight into the RWA (Real World Asset) space (e.g., ONDO), with precise listing timing and multiple opportunities to capture significant gains.

Investment inspiration: In the fields of GAMEFi and RWA, two dark horse markets, in addition to keeping a close eye on the leading exchanges, be sure to set price alerts on KUCOIN, Bybit, and Bitget.

Final conclusion: There is no best, only the most suitable

Through the multi-dimensional data comparison above, we can clearly see that no single exchange leads across all dimensions. Each platform presents unique risk-return characteristics due to its listing strategy, review standards, and user positioning.

Investment advice for you:

If you're a conservative investor: Binance and OKX are your safe havens. You might miss out on the wildest "dog stocks," but you can expect more stable returns, a lower risk of IPO losses, and a more secure trading environment.

If you're an aggressive investor, MEXC and KuCoin are your "adventure playgrounds." With rapid new listings, a high concentration of dark horse stocks, and attractive payouts, they're perfect for those with in-depth research and a willingness to take risks.

If you're looking for the ultimate risk-reward ratio, Bybit is a rare "hexagonal warrior." It strikes a perfect balance between risk control and profitability, making it a top choice for aggressive fund managers.

If you are a veteran coin hunter: Gate offers the widest selection with its vast coin pool and lightning speed. However, this is also where the “law of the jungle” is most prominent, requiring you to possess top-level independent research and judgment capabilities.

Ultimately, choosing an exchange, like choosing an investment strategy, is a highly personalized decision. Understand your risk appetite and investment goals, and then choose the platform that best helps you achieve them. It is your current "best money-printing machine."