1. The concept of "TACO transaction"

The "TACO" concept, originally coined by Financial Times columnist Robert Armstrong in May of this year, stands for "Trump Always Chickens Out." This concept stems from US President Trump's typical policy style. On issues like trade and tariffs, he often uses tough rhetoric or aggressive measures to create bargaining chips, thereby building political pressure and public opinion. However, when market volatility intensifies or the economy comes under pressure, he quickly softens his stance to avoid a substantial impact on economic fundamentals. This pattern of applying pressure first and then making concessions has gradually formed a policy cycle that is predictable by the market and has become a key clue to understanding the rhythm of Trump's policies and their market impact.

Based on this logic, "TACO trading" is defined as a speculative strategy centered around policy changes. Its core is identifying the short-term alignment between political signals and market prices. "TACO trading" typically follows a complete cycle: policy signal triggering, market reaction amplification, and sentiment recovery and convergence. The process often begins with the release of strong policy signals on political issues, such as the announcement of tariffs, export controls, or sanctions, which rapidly push up market risk premiums and trigger uncertainty. Subsequently, the market quickly reprices, with leveraged and derivative positions passively liquidated, leading to a sharp drop in asset prices. When the policy tone shifts to pragmatism or signs of compromise emerge, market confidence gradually recovers, risk appetite rebounds, and capital flows re-enter, completing the cycle from emotional selling to rational recovery. Notably, "TACO trading" often exhibits distinct timing and rhythmic patterns. Strong signals are often released on weekends or overnight, exploiting liquidity gaps to create price gaps and emotional shocks, while dovish statements typically occur during the weekdays to stabilize expectations and restore market sentiment.

Source: tradosaure

2. Cryptocurrency linkage triggered by “TACO transaction”

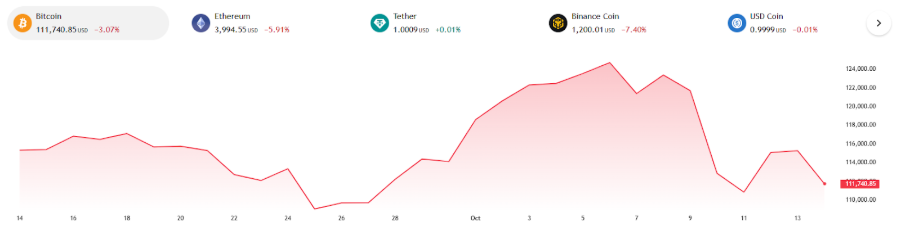

As the "TACO trading" logic continues to reappear in the market, its impact has expanded beyond traditional assets, becoming particularly pronounced in the crypto market . For example, on October 10th, US President Trump announced plans to impose an additional 100% tariff on Chinese exports and directed the Ministry of Commerce to implement export controls on key Chinese software and rare earth-related products by November 1st. This sudden statement was viewed by the market as the most significant shift in US-China trade policy since 2020, triggering a re-pricing of the risk of global supply chain disruptions. Consequently, US stock futures quickly plummeted, with the Dow Jones Industrial Average closing down 1.9% and the Nasdaq down 3.6%. However, just two days later, the White House's tone shifted significantly. On October 12th, Trump emphasized in his speech his desire to resolve differences through cooperation, and US Vice President Vance stated that the tariff proposal was still under review. On October 13th, the Dow Jones Industrial Average rebounded 1.3% and the Nasdaq 1.6%, signaling a rapid recovery in market risk appetite. The rhythm from tough pressure to softening and repairing once again confirms the characteristics of "TACO trading", which creates short-term panic with political signals and then releases trading rebound through correction.

Compared to traditional assets, the cryptocurrency market demonstrated greater sensitivity and amplification during this "TACO trading" cycle. Due to their highly leveraged structures, continuous trading mechanisms, and liquidity-driven characteristics, crypto assets became the first to react to policy uncertainty. On October 11th, the price of Bitcoin plummeted from a high of $114,500 to $104,800, a single-day drop of over 8%. Ethereum briefly fell below $4,000. The "October 11th crash" also became the largest liquidation event in cryptocurrency history, with forced liquidations totaling $19 billion across the market. Major exchanges triggered automatic deleveraging mechanisms, and funding rates fell to their lowest level since the end of the 2022 bear market. With the easing of policy tone on October 12th and the recovery of risk sentiment, Bitcoin was the first to rebound above $115,000, and Ethereum also returned to $4,100. This demonstrates that the crypto market is becoming the most emotionally resilient market in the "TACO trading" chain. Its price fluctuations not only align with the adjustment of risk premiums in traditional markets, but also deepen the impact of policy signals on the market through emotional feedback.

Source: tradingview

3. The Gray Line of "TACO Trading"

Following the dramatic volatility triggered by the "TACO trade," the market began to focus on the underlying risks. Was this plunge a natural reaction to policy expectations, or a liquidity trap orchestrated by a specific capital group? On-chain analyst Eye noted significant anomalies in the short-selling activity preceding the crash. Subsequent exposure of on-chain transaction records and associated wallets further corroborated this analysis. Between October 8th and 9th, a whale account named Garrett Jin sold approximately 35,000 Bitcoins on the Hyperliquid platform over two consecutive days, simultaneously establishing a $735 million perpetual short position in BTC. From the evening of October 10th to the early morning of October 11th, quantitative strategies on major platforms like Hyperliquid and Binance collectively triggered risk control thresholds, sending the total network liquidation amount soaring to $9 billion within an hour, directly triggering the "October 11th crash." On-chain tracking further revealed that funds associated with these large-scale short-selling transactions were deliberately split before the operation and repeatedly transferred through multiple layers of addresses. A few hours later, some of the funds were re-transferred to multiple Binance deposit accounts. Among these transfers, one was confirmed to have flowed to an address on the Ethereum domain ereignis.eth. The activity timeline for this address closely overlapped with the aforementioned accounts, indicating that these funds were likely manipulated by the same party.

The latest developments further reveal the complexities of the gray area surrounding "TACO trading." Eye claims Garrett Jin may have been acting as an agent; the leaker likely didn't provide him with the information directly, but rather passed it along through intermediaries. This crucial information originated from insiders with access to the US presidential staff. Analysis suggests that the core traders are suspected to be Zach Witkoff and Chase Herro (both co-founders of World Liberty Financial, the Trump family's crypto project). They are believed to have exploited this information in advance, organizing internal trading groups to establish advantageous positions before policy announcements, thereby amplifying market volatility. Eye even hinted at the possible involvement of Trump's eldest son. On October 14th, Eye announced that further disclosure would be halted for personal safety reasons. However, this demonstrates that as policy expectations become tradable signals, the boundaries between the crypto market and information about power are quietly being eroded.

Source: @eyeonchains

4. The Double-Edged Nature of the “TACO Transaction”

The rise of "TACO trading" is essentially an adaptive pricing mechanism formed in an environment where policy dominates and fundamentals take a back seat. Investors increasingly base their decisions on policy signals, with policy gradually replacing economic data as the primary variable influencing asset prices. Whether it's interest rate expectations, regulatory stances, or geopolitical pronouncements, they are quickly translated into trading action. The crypto market, with its continuous trading hours, high liquidity, and responsiveness, serves as a real-time radar for policy expectations. This has indeed improved market responsiveness, but it has also created structural problems. The correlation between prices and real economic activity has weakened, and trading has become more like betting on policy shifts rather than the fundamental value of the protocol.

A deeper risk lies in the implicit premise of "TACO trading" that policies will eventually return to stability. However, when the market generally bets on a return to stability, trading behavior itself can reversely influence policymakers' judgment through price signals, thereby amplifying volatility and uncertainty. For the crypto market, with its high leverage and sensitive liquidation mechanisms, this feedback loop is particularly dangerous and could even evolve into systemic liquidity risk. In this sense, "TACO trading" is both a strategic framework and a mirror reflecting market behavior. In such an environment, investors may need to pay greater attention to liquidity security and the resilience of their risk exposure, while recognizing that true competitiveness lies not in predicting the speed of policy shifts, but in the ability to maintain stability and adaptability amid policy uncertainty.