Author: Biteye core contributor @lviswang

Editor: Biteye core contributor Denise

01. Market Overview: dTAO upgrade triggers ecological explosion

On February 13, 2025, the Bittensor network ushered in a historic Dynamic TAO (dTAO) upgrade, which shifted the network from a centralized governance model to a market-driven decentralized resource allocation. After the upgrade, each subnet has an independent alpha token, and TAO holders can freely choose investment targets, truly realizing a market-based value discovery mechanism.

Data shows that the dTAO upgrade has unleashed tremendous innovative vitality. In just a few months, Bittensor has grown from 32 subnets to 118 active subnets, an increase of 269%. These subnets cover all segments of the AI industry, from basic text reasoning and image generation to cutting-edge protein folding and quantitative trading, forming the most complete decentralized AI ecosystem.

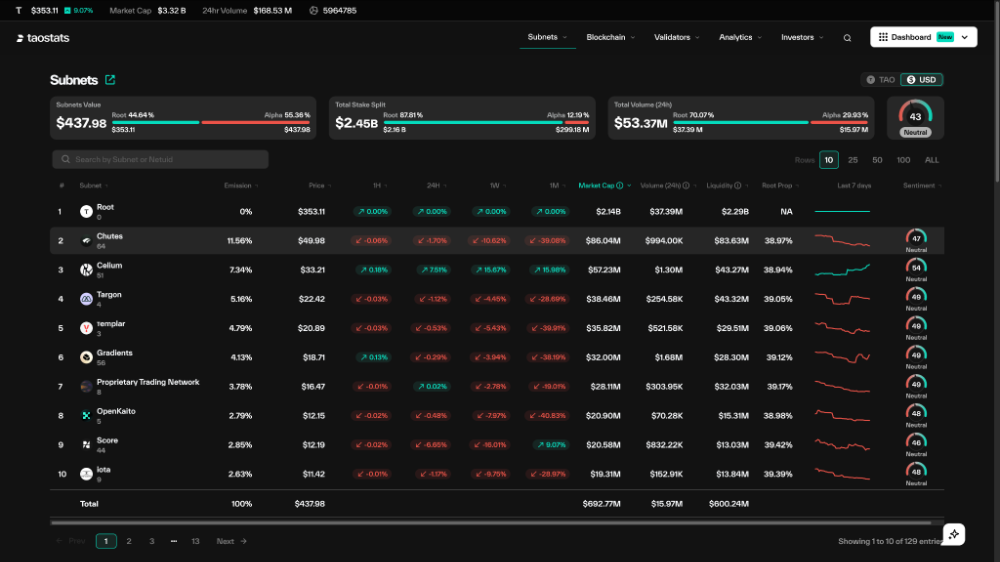

The market performance is also impressive. The total market value of the top subnets has increased from $4 million before the upgrade to $690 million, and the annualized return on staking has stabilized at 16-19%. Each subnet distributes network incentives according to the market-based TAO staking rate. The top 10 subnets account for 51.76% of the network emissions, reflecting the market mechanism of survival of the fittest.

https://taostats.io/subnets

02. Core network analysis (top 10 emissions)

1. @chutes_ai, Chutes (SN64) - Serverless AI Computing

Core value: Innovate the AI model deployment experience and significantly reduce computing costs

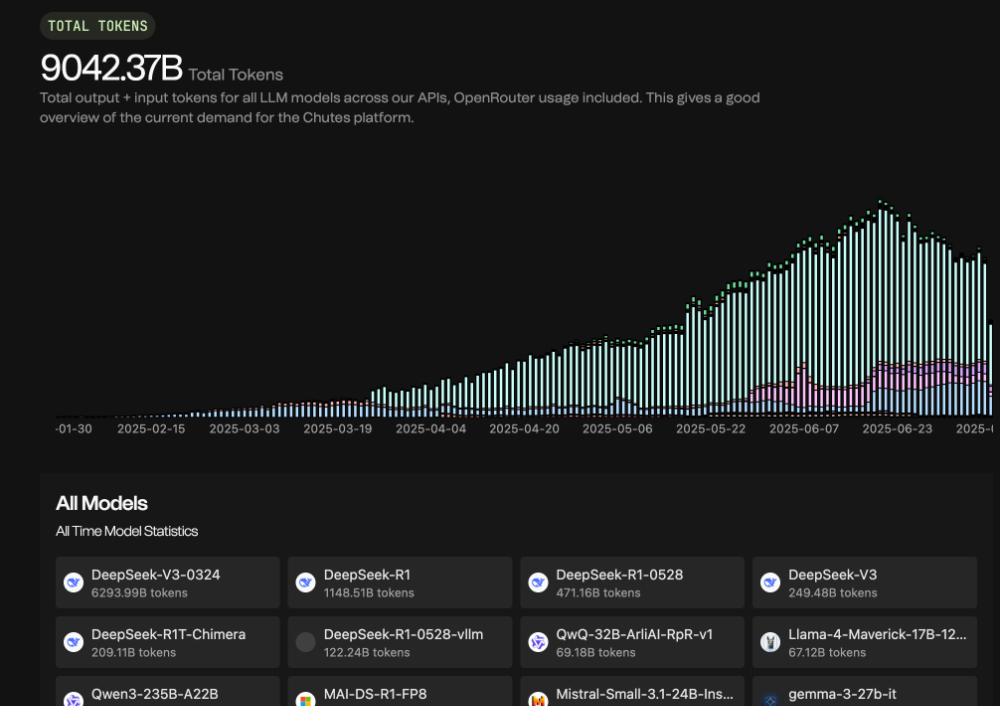

Chutes uses an "instant start" architecture to compress the startup time of AI models to 200 milliseconds, which is 10 times more efficient than traditional cloud services. With more than 8,000 GPU nodes worldwide, it supports mainstream models from DeepSeek R1 to GPT-4, processes more than 5 million requests per day, and keeps the response delay within 50 milliseconds.

The business model is mature, and it adopts a free value-added strategy to attract users. Through the integration of the OpenRouter platform, Chutes provides computing power support for popular models such as DeepSeek V3, and generates revenue from each API call. The cost advantage is significant, 85% lower than AWS Lambda. The total token usage currently exceeds 9042.37B, serving more than 3,000 corporate customers.

dTAO reached a market value of $100 million 9 weeks after its launch, and its current market value is 79M. It has a deep technical moat, is progressing smoothly in commercialization, and has high market recognition. It is currently the leader of the subnet.

https://chutes.ai/app/research

2. @celiumcompute, Celium (SN51) - Hardware Compute Optimization

Core value: Optimize underlying hardware to improve AI computing efficiency

Developed by Datura AI, it focuses on hardware-level computing optimization. Through four major technical modules, GPU scheduling, hardware abstraction, performance optimization, and energy efficiency management, it maximizes hardware utilization efficiency. It supports a full range of hardware such as NVIDIA A100/H100, AMD MI200, Intel Xe, etc. The price is 90% lower than similar products, and the computing efficiency is increased by 45%.

https://celiumcompute.ai/

Currently, Celium is the second largest subnet on Bittensor, accounting for 7.28% of network emissions. Hardware optimization is the core link of AI infrastructure, with technical barriers and a strong price increase trend, and the current market value is 56M.

3. @TargonCompute, Targon (SN4) - Decentralized AI Inference Platform

Core value: confidential computing technology to ensure data privacy and security

The core of Targon is TVM (Targon Virtual Machine), a secure confidential computing platform that supports the training, reasoning, and verification of AI models. TVM uses confidential computing technologies such as Intel TDX and NVIDIA confidential computing to ensure the security and privacy protection of the entire AI workflow. The system supports end-to-end encryption from hardware to application layer, allowing users to use powerful AI services without leaking data.

Targon has high technical barriers, a clear business model, and a stable source of income. Currently, the revenue repurchase mechanism has been opened, and all revenue is used for token repurchase, with the latest repurchase of 18,000 US dollars.

4. @tplr_ai, τemplar (SN3) - AI research and distributed training

Core value: large-scale AI model collaborative training to lower the training threshold

Templar is a pioneer subnet on the Bittensor network that specializes in large-scale distributed training of AI models. Its mission is to become the "world's best model training platform." Through collaborative training with GPU resources contributed by global participants, it focuses on collaborative training and innovation of cutting-edge models, and emphasizes anti-cheating and efficient collaboration.

In terms of technical achievements, Templar has successfully completed the training of a 1.2B parameter model, which has undergone more than 20,000 training cycles and involved about 200 GPUs in the entire process. In 2024, the commit-reveal mechanism will be upgraded to improve the decentralization and security of verification; in 2025, large model training will continue to be promoted, with a parameter scale of 70B+, and the performance in standard AI benchmarks is comparable to industry standards, which has been personally recommended by Const, the founder of Bittensor.

Templar has a prominent technological advantage, with a current market value of 35M, accounting for 4.79% of emissions.

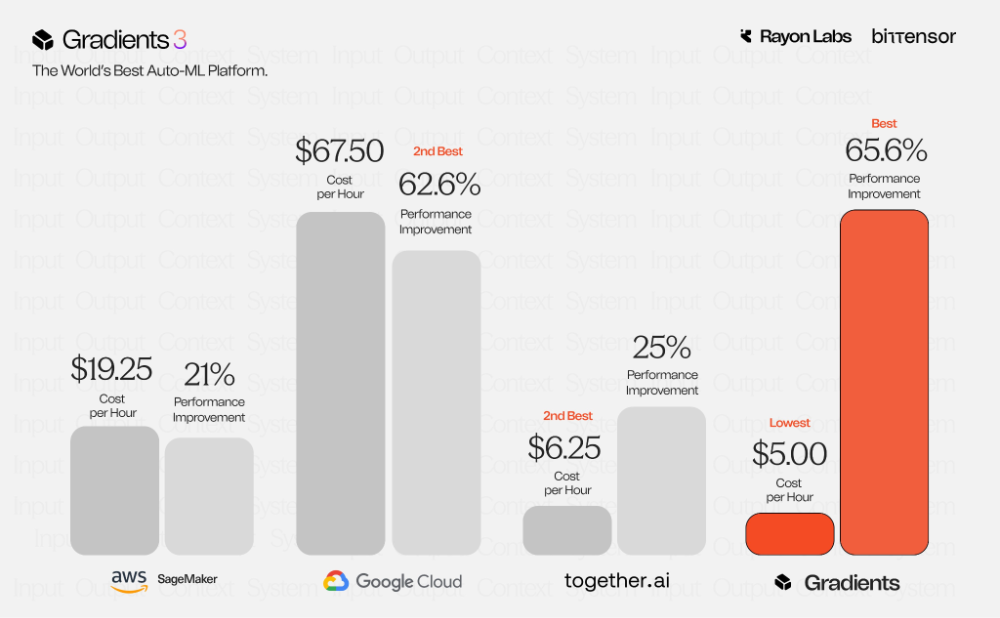

5. @gradients_ai, Gradients (SN56) - Decentralized AI training

Core value: Popularizing AI training and significantly reducing the cost threshold

Also developed by Rayon Labs, it solves the pain point of AI training cost through distributed training. The intelligent scheduling system is based on gradient synchronization and efficiently distributes tasks to thousands of GPUs. It has completed the training of 118 trillion parameter models at a cost of only $5 per hour, which is 70% cheaper than traditional cloud services and 40% faster than centralized solutions. The one-click interface reduces the threshold for use, and more than 500 projects have been used for model fine-tuning, covering medical, financial, education and other fields.

With a current market value of 30M, huge market demand, and clear technical advantages, it is one of the subnets worthy of long-term attention.

https://x.com/rayon_labs/status/1911932682004496800

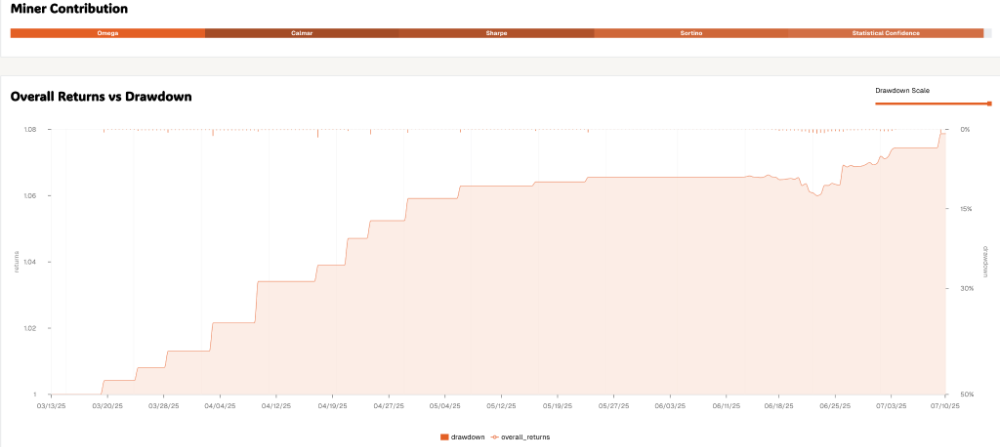

6. @taoshiio, Proprietary Trading (SN8) - Financial quantitative trading

Core Value: AI-driven multi-asset trading signals and financial forecasting

SN8 is a decentralized quantitative trading and financial forecasting platform with AI-driven multi-asset trading signals. The proprietary trading network applies machine learning technology to financial market forecasting and builds a multi-level forecasting model architecture. Its time series forecasting model combines LSTM and Transformer technology to process complex time series data. The market sentiment analysis module provides sentiment indicators as auxiliary signals for forecasting by analyzing social media and news content.

On the website, you can see the returns and backtests of strategies provided by different miners. SN8 combines AI and blockchain to provide innovative financial market trading methods, with a current market value of 27M.

https://dashboard.taoshi.io/miner/5Fhhc5Uex4XFiY7V3yndpjsPnfKp9F4EhrzWJg7cY6sWhYGS

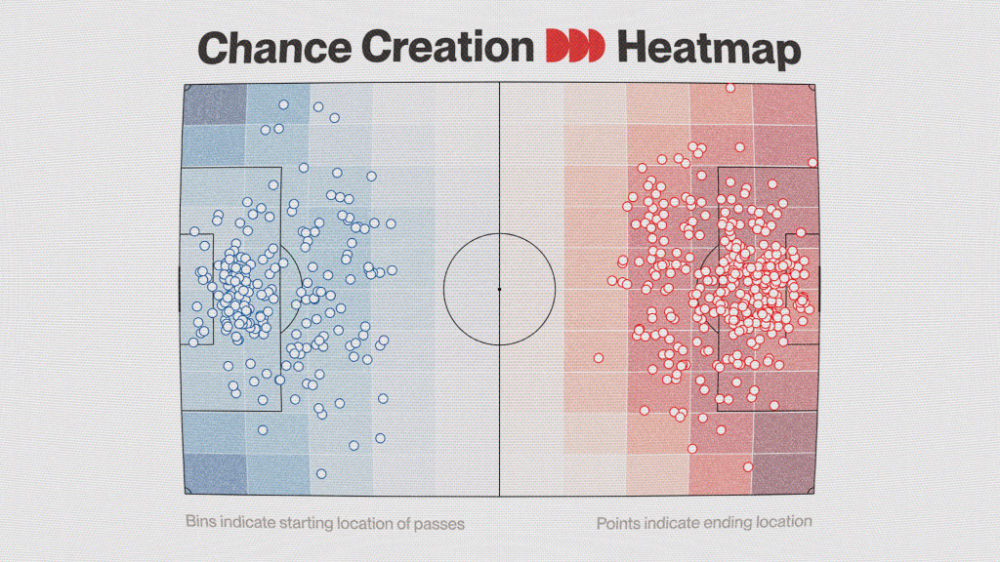

7. @_scorevision, Score (SN44) – Sports analysis and evaluation

Core value: Sports video analysis, targeting the $600 billion football industry

A computer vision framework focused on sports video analysis, it reduces the cost of complex video analysis through lightweight verification technology. It uses two-step verification: court detection and CLIP-based object inspection, reducing the traditional annotation cost of thousands of dollars per game to 1/10 to 1/100. In cooperation with Data Universe, DKING AI agents have an average prediction accuracy of 70%, and have achieved 100% single-day accuracy.

https://x.com/webuildscore/status/1942893100516401598

The sports industry is huge in scale, with significant technological innovation and broad market prospects. Score is a subnet with a clear application direction and is worthy of attention.

8. @openkaito, OpenKaito (SN5) - Open source text reasoning

Core value: text embedding model development, information retrieval optimization

OpenKaito focuses on the development of text embedding models and is supported by Kaito, an important player in the InfoFi field. As a community-driven open source project, OpenKaito is committed to building high-quality text understanding and reasoning capabilities, especially in information retrieval and semantic search.

The subnet is still in the early stages of construction, mainly building an ecosystem around text embedding models. It is worth noting the upcoming Yaps integration, which may significantly expand its application scenarios and user base.

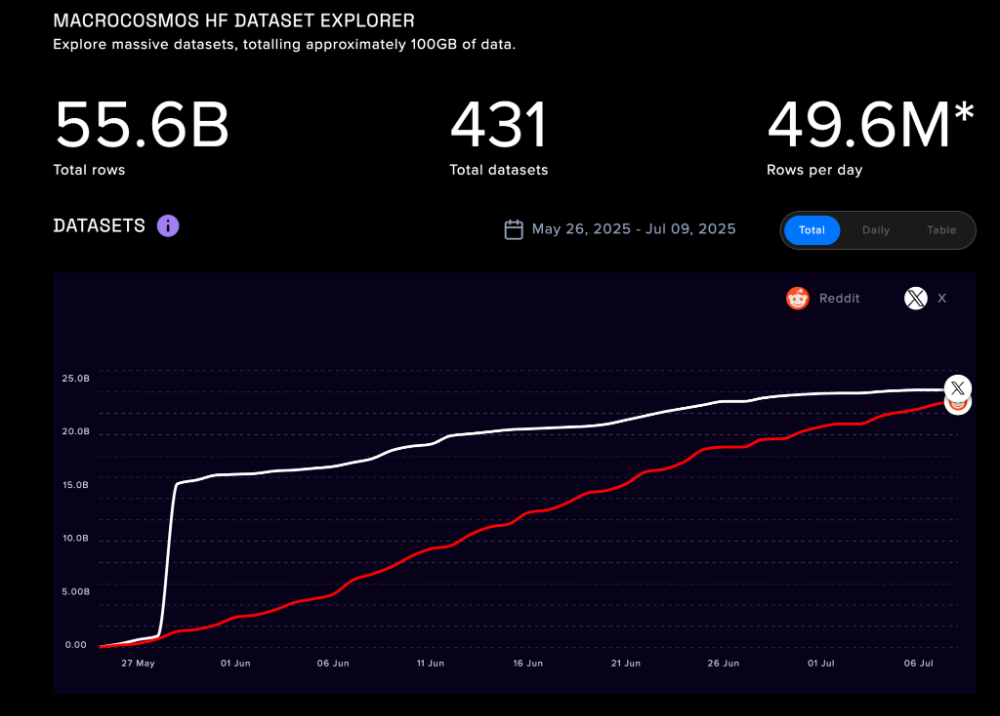

9. @MacrocosmosAI, Data Universe (SN13) – AI data infrastructure

Core value: large-scale data processing, AI training data supply

It processes 500 million rows of data per day, with a total of more than 55.6 billion rows, and supports 100GB of storage. The DataEntity architecture provides core functions such as data standardization, index optimization, and distributed storage. The innovative "gravity" voting mechanism enables dynamic weight adjustment.

https://www.macrocosmos.ai/sn13/dashboard

Data is the oil of AI, the value of infrastructure is stable, and the ecological niche is important. As a data supplier for multiple subnets, we have in-depth cooperation with projects such as Score, which reflects the value of infrastructure.

10. @taohash, TAOHash (SN14) - PoW mining

Core value: connecting traditional mining and AI computing, integrating computing resources

TAOHash allows Bitcoin miners to redirect their computing power to the Bittensor network and obtain alpha tokens through mining for staking or trading. This model combines traditional PoW mining with AI computing, providing miners with a new source of income.

In just a few weeks, it attracted more than 6EH/s of computing power (about 0.7% of the global computing power), proving the market's recognition of this hybrid model. Miners can choose between traditional Bitcoin mining and obtaining TAOHash tokens, optimizing their earnings according to market conditions.

11. @CreatorBid, Creator.Bid - Launchpad for the AI Agent Ecosystem

Although not a subnet, Creator.Bid plays an important coordination role in the Bittensor ecosystem. The Creator.Bid ecosystem is built on three pillars. The Launchpad module provides fair and transparent AI agent launch services, providing a safe and transparent starting point for new AI agents through anti-sniping fair launch smart contracts and curated launch mechanisms. The Tokenomics module unifies the entire ecosystem through BID tokens and provides agents with a sustainable revenue model. The Hub module provides powerful API-driven services, including content automation, social media APIs, and fine-tuned image models.

The core innovation of the platform lies in the concept of Agent Keys. These digital membership tokens allow creators to build communities around AI agents and achieve shared ownership. Each AI agent has a unique identity through the Agent Name Service (ANS), which is implemented as an NFT to ensure that each agent has a non-repeatable identifier. Users can enter personality traits through simple prompts and generate fully functional AI agents without programming knowledge.

Although Creator.Bid itself is built on the Base network, it has established a deep collaborative relationship with the Bittensor ecosystem. By operating the TAO Council, Creator.Bid brings together top subnets such as BitMind (SN34) and Dippy (SN11 & SN58), becoming the "coordination layer for TAO-aligned agents, subnets, and builders to converge."

The value of this collaborative relationship lies in integrating the strengths of different networks. Bittensor provides powerful AI reasoning and training capabilities, while Creator.Bid provides a user-friendly agent creation and launch platform. The combination of the two ecosystems allows developers to create agents using Bittensor's AI capabilities, and then tokenize and socialize them through Creator.Bid's Launchpad.

The collaboration with Masa’s AI Agent Arena (SN59) further demonstrates this synergy. Creator.Bid provides agent creation tools for the arena, allowing users to quickly deploy AI agents to participate in competitions. This cross-ecosystem collaboration model is becoming an important trend in the decentralized AI field.

03. Ecosystem Analysis

Core advantages of technical architecture

Bittensor's technological innovation has built a unique decentralized AI ecosystem. Its Yuma consensus algorithm ensures network quality through decentralized verification, while the market-based resource allocation mechanism introduced by the dTAO upgrade significantly improves efficiency. Each subnet is equipped with an AMM mechanism to achieve price discovery between TAO and alpha tokens. This design allows market forces to directly participate in the configuration of AI resources.

The collaboration protocol between subnets supports the distributed processing of complex AI tasks, forming a strong network effect. The dual incentive structure (TAO emission plus alpha token appreciation) ensures long-term participation motivation, and subnet creators, miners, validators and stakers can all receive corresponding returns, forming a sustainable economic closed loop.

Competitive advantages and challenges

Compared with traditional centralized AI service providers, Bittensor provides a truly decentralized alternative and excels in cost efficiency. Multiple subnets show significant cost advantages. For example, Chutes is 85% cheaper than AWS. This cost advantage comes from the efficiency improvement of decentralized architecture. The open ecosystem promotes rapid innovation, and the number and quality of subnets continue to improve, with the speed of innovation far exceeding the internal R&D of traditional enterprises.

However, the ecosystem also faces practical challenges. The technical threshold is still high. Although the tools are constantly improving, it still requires considerable technical knowledge to participate in mining and validation. The uncertainty of the regulatory environment is another risk factor. Decentralized AI networks may face different regulatory policies in different countries. Traditional cloud service providers such as AWS and Google Cloud will not sit idly by and are expected to launch competitive products. As the network scale grows, how to maintain a balance between performance and decentralization has also become an important test.

The explosive growth of the AI industry has provided Bittensor with huge market opportunities. Goldman Sachs predicts that global AI investment will be close to $200 billion in 2025, providing strong support for infrastructure demand. The global AI market is expected to grow from $294 billion in 2025 to $1.77 trillion in 2032, with a compound annual growth rate of 29%, which has created broad development space for decentralized AI infrastructure.

The supportive policies of various countries for the development of AI have created an opportunity window for decentralized AI infrastructure. At the same time, the focus on data privacy and AI security has increased the demand for technologies such as confidential computing, which is the core advantage of subnets such as Targon. Institutional investors' interest in AI infrastructure continues to heat up, and the participation of well-known institutions such as DCG and Polychain has provided financial and resource support for the ecosystem.

04. Investment strategy framework

Investing in the Bittensor subnet requires the establishment of a systematic evaluation framework. The technical level needs to examine the degree of innovation and the depth of the moat, the technical strength and execution capabilities of the team, and the synergy with other projects in the ecosystem. The market level needs to analyze the target market size and growth potential, the competitive landscape and differentiated advantages, user adoption and network effects, as well as the regulatory environment and policy risks. The financial level needs to focus on the current valuation level and historical performance, the proportion and growth trend of TAO emissions, the rationality of the token economics design, and liquidity and trading depth.

In terms of specific risk management, decentralized investment is the basic strategy. It is recommended to allocate funds among different types of subnets, including infrastructure (such as Chutes, Celium), application (such as Score, BitMind) and protocol (such as Targon, Templar). At the same time, the investment strategy should be adjusted according to the development stage of the subnet. Early projects have high risks but high potential returns, while mature projects are relatively stable but have limited growth space. Considering that the liquidity of alpha tokens may not be as good as TAO, it is necessary to reasonably arrange the proportion of capital allocation and maintain the necessary liquidity buffer.

The first halving event in November 2025 will become an important market catalyst. The reduction in emissions will increase the scarcity of existing subnets and may eliminate underperforming projects, which will reshape the economic landscape of the entire network. Investors can deploy high-quality subnets in advance and seize the configuration window before the halving.

In the medium term, the number of subnets is expected to exceed 500, covering all segments of the AI industry. The increase in enterprise-level applications will promote the development of confidential computing and data privacy-related subnets, and cross-subnet collaboration will become more frequent, forming a complex AI service supply chain. The gradual clarification of the regulatory framework will give compliant subnets a clear advantage.

In the long run, Bittensor is expected to become an important part of the global AI infrastructure. Traditional AI companies may adopt a hybrid model and migrate part of their business to decentralized networks. New business models and application scenarios will continue to emerge, and interoperability with other blockchain networks will be enhanced, eventually forming a larger decentralized ecosystem. This development path is similar to the evolution of early Internet infrastructure, and investors who can seize key nodes will reap rich rewards.

05. Conclusion

The Bittensor ecosystem represents a new paradigm for the development of AI infrastructure. Through market-based resource allocation and decentralized governance mechanisms, it provides new soil for AI innovation, and its innovative vitality and growth potential are remarkable. Against the backdrop of the rapid development of the AI industry, Bittensor and its subnet ecosystem deserve continued attention and in-depth research.