Trump has done his best to support the crypto industry.

Just last week, Trump unleashed another powerful force, signing an executive order allowing 401(k) retirement savings plans to invest in a wider range of assets, including private equity, real estate, and, for the first time, crypto assets. This means that as much as $8.7 trillion in retirement funds could potentially be exposed to crypto assets. This event has far-reaching implications for both the crypto sector and pensions themselves.

Interestingly, this type of positive news, which used to drive up prices within minutes, is less evident in today's crypto market. On the day the information was released, BTC remained remarkably stable, but in contrast, ETH experienced a rare rapid rise.

To discuss the impact of the executive order on the crypto market, we must first discuss the US pension system. The US pension system consists of three main components: a government-managed national plan funded through social security taxes; a voluntary individual retirement plan similar to my country's existing individual pension plan; and, the focus of this article, the 401(k) plan, managed primarily by companies. Under these three pillars, the US has essentially formed a multi-tiered pension system, with social security taxes as its foundation, 401(k)s as its core, and individual pensions as a supplement.

To explain 401(k) specifically, it refers to a private enterprise retirement benefit plan established under Section 401K of the Internal Revenue Code of 1978. Contributions are jointly paid by employers and employees. Employees can independently choose their investment portfolios and enjoy tax-deferral benefits, and flexibly withdraw account funds after retirement.

Judging from the terms themselves, 401(k) is similar to my country's enterprise annuity system, and is jointly paid by both the company and the employees. However, it is worth mentioning that unlike my country's model of unified management, companies usually have fixed cooperative fund companies, and employees can control their personal accounts themselves and choose to invest their pensions in various products in designated funds, but they are responsible for their own profits and losses.

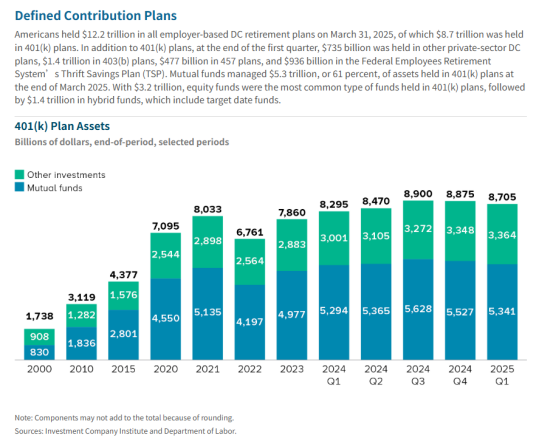

While 401(k) plans aren't universal and clearly can't cover all retirement funding needs, given that nearly 60% of American households have them, they've become a core part of the American retirement system. Naturally, this funding is substantial. According to public data, as of March 31, 2025, total assets in all employer-led defined contribution (DC) retirement plans reached $12.2 trillion. Of this, $8.7 trillion was held in 401(k) plans.

The question is, where will the 8.7 trillion US dollars flow?

Looking at current fund flows, stock funds are the most common type of fund within 401(k)s. A total of $5.3 trillion is managed by mutual funds, of which $3.2 trillion is held by stock funds and $1.4 trillion by hybrid funds. The inclusion of stocks demonstrates that fund investments are not limited to traditional, conservative investments.

In reality, given the unique nature of pensions, the investment targets of pension systems have undergone numerous shifts, from strictly conservative to return-oriented. Before the Great Depression, pensions were restricted to low-risk assets such as government bonds, high-quality corporate bonds, and municipal bonds. Following the devastating impact of the Great Depression, pension systems were devastated, and returns declined. Some private trusts introduced the "prudent investor rule," allowing for the pursuit of higher returns through asset diversification. This influence spread to states, leading to the rise of stock investment. Ultimately, the Employee Retirement Income Security Act of 1974 applied the prudent investor standard to public pension funds, officially relaxing restrictions on pension fund investment in the equity market.

In 2025, this restriction was further lifted. On August 7th, local time, Trump signed an executive order allowing Americans' 401(k) plans to invest in private equity funds, cryptocurrencies like Bitcoin, and other so-called alternative assets. Trump also asked Labor Secretary Lori Chavez-DeRemer to work with counterparts at the Treasury Department, the Securities and Exchange Commission (SEC), and other federal regulatory agencies to determine whether rules should be amended to facilitate this effort. He also instructed the SEC to facilitate the inclusion of alternative assets in pension plans where participants invest their own money.

From a policy perspective alone, this directive will have far-reaching implications for both pension funds and the crypto market. From a pension perspective, this move will include alternative assets such as cryptocurrencies and private equity within the investment scope. While broadening pension fund investment channels, it also introduces greater risk and volatility. This represents a further shift in the pension investment system from a relatively conservative one to a highly open one, encompassing products with illiquidity and complex structures. This represents a radical reform of the pension system.

For the crypto market, the significance is even more significant. This marks a leap forward in the mainstreaming of crypto assets. With pension funds now accepting them, crypto assets undoubtedly receive a higher level of national endorsement. From a product perspective, a surge in crypto asset products packaged as ETFs is foreseeable. More noteworthy is the shift in the demographics of crypto asset holders. Given that pension funds typically have low turnover and long holding periods, a Vanguard report indicates that the average 401(k) transaction frequency in 2024 will be 0.5 times per month. This means that when this capital enters the crypto market, the underlying price support for these assets will be further consolidated. In other words, if this capital flows heavily into ETFs primarily based on BTC and ETH, the volatility of major cryptocurrencies will actually decrease significantly, shifting the nature of these assets from risky assets to safe-haven assets. In the medium to long term, this executive order will boost the market size. After all, with $9 trillion in capital, even just 5% would still amount to a staggering $0.45 trillion.

However, the greater the impact, the louder the market's voices. Traditional financial participants have stated that the high fees and illiquidity of alternative assets present significant opportunities for asset management companies, increasing their incentive to include them in their portfolios. These assets also come with lower disclosure requirements. However, for individual investors who are detached from the market, it may be difficult to fully understand the asset attributes and risks before investing. This information asymmetry is likely to significantly harm investor interests and increase a range of legal risks. Furthermore, it's worth noting that while the executive order has been issued, its implementation will take time. For asset management companies responsible for product development, it typically takes several years for new products to become widely available.

Perhaps for these reasons, the market didn't react as expected to this significant executive order, instead experiencing a certain lag effect. BTC rose only 2% in the 24-hour period, but judging by capital inflows, neither spot trading volume nor BTC ETFs saw a significant increase within 24 hours following the announcement. However, after August 11th, BTC actually surged past $122,000.

Interestingly, Ethereum experienced a starkly opposite trend. Within 24 hours of the pension information release, ETH spot trading volume increased significantly, accompanied by a rapid price increase, soaring from $3,600 to over $4,000 on August 8th. Currently, ETH has reached $4,299, surpassing BTC in this round of growth. ETFs also saw an increase in holdings, with net inflows into ETH ETFs increasing by $680 million over the two-day period.

It can be seen that while both saw simultaneous increases, ETH's rise was more sensitive and rapid. This has led to market speculation that funds are flowing from Bitcoin into Ethereum. A similar trend is also evident in the derivatives market. The annualized premium of Ethereum futures on the Chicago Mercantile Exchange (CME) relative to spot prices has exceeded 10%, exceeding Bitcoin's level, prompting some traders to shift positions from Bitcoin to Ethereum.

Looking solely at the ETH/BTC trading pair, despite recent increases, trading volume has yet to significantly surpass average levels, making the theory of a vampire exchange difficult to substantiate. As for why ETH is more responsive, there are likely multiple reasons.

First, the growth is driven by institutional accumulators. Crypto treasuries focused on ETH have already accumulated approximately $13 billion worth of ETH. Compared to ETH, which is relatively cheaper, this influx of funds has led to a more significant increase. Second, there is support from large ETF institutions. ETH ETFs have attracted over $6.7 billion in net inflows this year, with the strong backing of asset management giant BlackRock. The core of this market manipulation is the SEC's blueprint for "all financial markets on-chain." As the leading public blockchain, Ethereum is a direct beneficiary of this policy. Third, there are the calls for buying from the off-market. A prime example is the passionate calls from Bitmine Chairman Tom Lee last week. In a podcast, he discussed the future of Ethereum and predicted that ETH could reach $15,000. This 180,000-view video appears to have been a strong success in attracting retail investors.

Compared to the booming BTC and ETH, the altcoin market remains bleak. In terms of market capitalization, ETH has broken through the long-awaited $4,000 mark, and altcoins have followed suit, with their market capitalization increasing by over 15% compared to last week. However, a closer look reveals that, aside from a few blue-chip altcoins that have seen gains, over 70% or even 80% of altcoins remain deeply depressed.

The reason is obvious: ETH's gains stem from institutional investment, not from the crypto market's own funds. Given the current liquidity crunch, institutional investors are choosing more conservative investments, preferring currencies with manageable risk. This, in turn, hinders capital from spilling over into the altcoin market. In other words, the capital-driven Ethereum rally is having a difficult time transmitting to altcoins. In fact, there's a sense in the market that "ETH is now what BTC was last year," and there's some truth to this. While a full-scale altcoin boom may be difficult to replicate, a structural altcoin bull market remains a possibility, relying on investor instinct.

Fortunately, another exciting event is just around the corner. The U.S. Department of Labor's July nonfarm payroll figures showed significantly lower-than-expected growth, and the unemployment rate rose slightly, significantly increasing the likelihood of an interest rate cut. On August 9th, local time, Federal Reserve Vice Chair for Supervision Michelle Bowman delivered two key messages in her latest speech: she supports three rate cuts this year and will host a community bank conference on October 9th.

CME's "Federal Reserve Watch" data revealed that the probability of the Federal Reserve keeping interest rates unchanged in September is 11.6%, and the probability of a 25 basis point rate cut is 88.4%.