Author: 0xBrooker

BTC daily trend

BTC opened at $117,488.59 this week and closed at $113,478.00, with a low of $110,635.00 and a high of $117,633.80, a drop of 3.41% and an amplitude of 5.95%. The trading volume increased compared with last week.

This week, BTC's trend was volatile due to the influence of multiple factors, including the sudden change in market sentiment before and after Powell's dovish speech, cyclical long-term selling, and changes in risk preferences within the crypto market.

Before the Jackson Hole Global Central Bank Annual Meeting, risky assets including BTC and US stocks continued to decline. However, at the annual meeting, the Federal Reserve Chairman unexpectedly released obvious "dovish" remarks, which triggered a sharp rebound in the stock market and crypto assets.

The market is cautiously returning to expectations of a September rate cut. However, the pace and magnitude of this year's rate cuts remain constrained by economic and employment data. This raises questions about the continued rise of risk assets, which have seen sharp price rebounds and high valuations. The market needs more data to reassure traders and strengthen their bullish sentiment. August inflation data remains pending before the September rate cut, and if inflation rises too quickly, the market may revise downward.

Policy, macro-financial and economic data

Last week's PPI data dealt a heavy blow to the U.S. stock market, which was already highly valued. The market was worried that the increase in producer prices would inevitably be passed on to consumers, thereby pushing up inflation and reducing the probability or magnitude of interest rate cuts.

US stocks, already at high valuations, have been in a correction for most of this week, but sector rotation has also occurred, with highly valued technology stocks continuing to fall, while industrial and cyclical stocks have rebounded. This suggests that the market is only pricing in the frequency and magnitude of interest rate cuts downward, and has not yet priced in a delayed rate cut in September.

On Friday, Powell unexpectedly released "dovish" remarks, focusing more on the mission of "maintaining employment" rather than "controlling inflation."

It emphasizes that U.S. economic growth has significantly weakened. GDP growth is projected to be 1.2% in the first half of 2025, a significant decline from 2024. The unemployment rate remains stable at 4.2%, but job growth has slowed significantly. The labor market faces downside risks. Declining immigration has left the labor supply fragile, and declining demand could rapidly worsen the employment situation.

He also noted that the core PCE inflation rate of 2.9% has not yet returned to the Fed's 2% target. Recent tariff policies have pushed up prices of some commodities, which will have a one-off impact on CPI in the short term, but long-term inflation expectations remain stable.

In addition to placing greater emphasis on the serious employment situation, the "policy framework adjustment" mentioned in Powell's speech is also seen as an important positive - abandoning the "average inflation targeting system" (FAIT) since 2020 and returning to the "flexible inflation targeting system", emphasizing flexible adjustment of policies based on economic data, and giving priority to responding to employment market risks.

During Friday's speech, U.S. stocks and BTC prices rose rapidly, while the U.S. dollar index fell, indicating that the market quickly priced in an upward probability of a September rate cut.

Currently, FedWatch shows that the probability of a rate cut in September is 87.2%, which is an increase from the pessimistic expectations earlier this week, but still lower than the previous probability pricing of more than 90%.

Ahead of the September rate cut, non-farm payrolls and August inflation data remain highly anticipated. These figures will not only determine whether a September rate cut will take place, but also the frequency and magnitude of rate cuts this year. The latter is still undervalued by the market and will become a key trading point in the future.

Crypto Market: Funds Flow from BTC to ETH

From the perspective of technical indicators, driven by the decline in risk appetite, BTC once again fell back to the "Trump bottom" and the 90-day moving average this week. After Powell's speech at the Jackson Hole Annual Meeting on Friday, it was boosted and rose sharply to return to the 5-day moving average, but fell back over the weekend and found support from the 60-day moving average.

Since last week, with the breakthrough of BTC prices and changes in market risk appetite, long-term selling pressure has increased. The scale of selling this week is close to that of last week, which has put short-term pressure on BTC's short-term price trend.

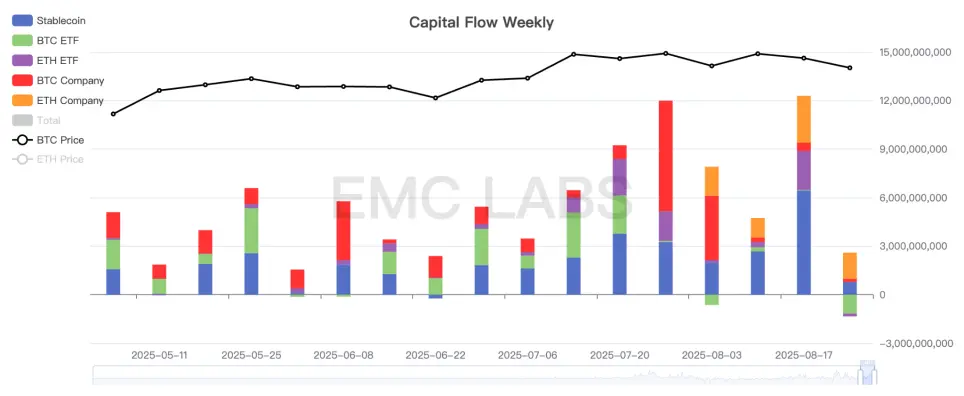

A lack of sufficient capital is the fundamental reason why BTC prices are struggling to break free from selling pressure. This week, the crypto market saw a total inflow of $1.255 billion, a significant drop from last week's $12.29 billion. Of this total, the BTC Spot ETF saw a significant outflow of $1.165 billion.

Crypto Market Capital Inflow and Outflow Statistics (Weekly)

With the resumption of the interest rate cut cycle and increased investor risk appetite, a rotation is also occurring within the crypto market. According to eMerge Engine, funds are flowing from BTC to ETH both on and off the exchange, pushing BTC down 2.41% this week and ETH up 6.88%.

The eMerge Engine Altseason Signal indicates it has reached 100%. If this continues, BTC prices may fluctuate or rise slightly in the future, while BTC's market share will continue to decline.

Cycle indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is 0.625 and is in an upward phase.

EMC Labs was founded in April 2023 by cryptoasset investors and data scientists. Focusing on blockchain industry research and secondary crypto market investments, and leveraging industry foresight, insight, and data mining as core competencies, EMC Labs is committed to participating in the booming blockchain industry through research and investment, and promoting the benefits of blockchain and crypto assets for humanity.

For more information, please visit: https://www.emc.fund