With the continuous evolution of blockchain technology and the rapid growth of the cryptocurrency market, market participants are constantly seeking to attract more capital into the cryptoasset market. At the same time, some users, in addition to using traditional centralized exchanges, also seek to convert fiat to cryptocurrencies directly on-chain. However, existing methods for purchasing cryptocurrencies often involve off-chain payments, cumbersome identity verification, and complex cross-chain operations, which still pose limitations in terms of user experience, transaction efficiency, and compliance risks. To address this pain point, Chainlink, Mastercard, ZeroHash, Swapper Finance, Shift4 Payments, XSwap, and Uniswap have collaborated to build a closed-loop solution from fiat payment to on-chain asset delivery, aiming to create a more secure, transparent, and convenient on-chain native cryptocurrency purchasing channel.

Roles and division of labor

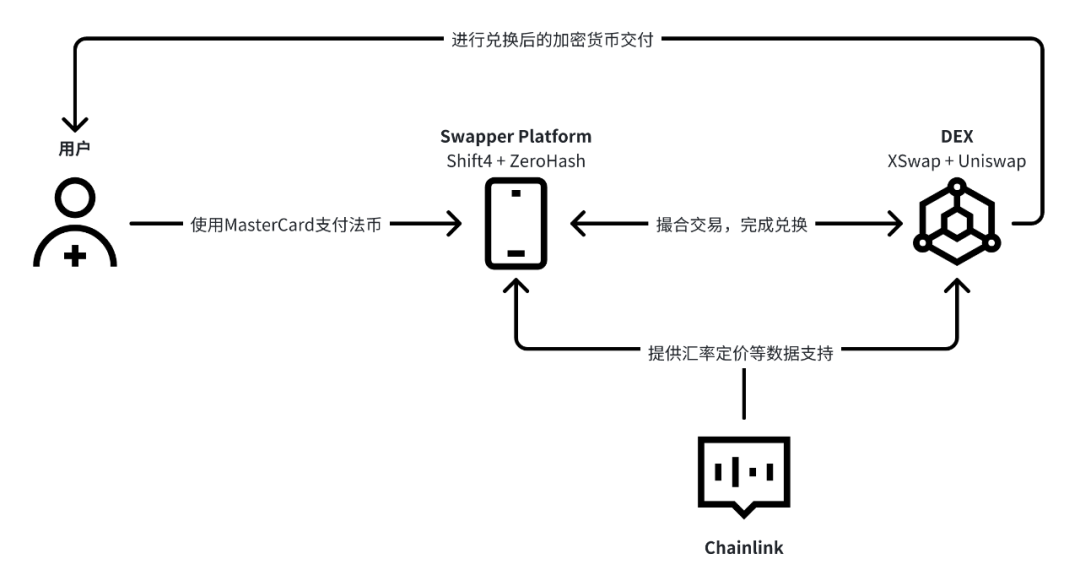

In this new on-chain coin purchase mechanism, each participant has a clear division of labor and assumes different but highly complementary responsibilities. Together, they build a technical and compliance closed loop from fiat currency payment to on-chain asset delivery, jointly ensuring the efficiency, security, and compliance of the fiat-to-cryptocurrency conversion process:

1. MasterCard: As a leading global payment network provider, Mastercard offers a fiat currency payment gateway that supports credit and debit card payments. In addition to fiat currency acquiring, its broad user base and mature payment system enable users of traditional financial channels to directly participate in the digital asset market through familiar scenarios.

2. Shift4 Payments: As a leading global payment processor, Shift4 will primarily handle bank card payments for users in this partnership. Through its established payment network, Shift4 supports bank card payments in multiple fiat currencies (such as the US dollar and euro), ensuring regulatory compliance and providing users with a stable and compliant gateway.

3. ZeroHash: As a regulated digital asset clearinghouse, ZeroHash handles the exchange and settlement of fiat-to-crypto assets. It converts fiat funds received by Shift4 into the equivalent cryptocurrency and performs necessary regulatory compliance measures, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, to ensure compliance during the asset conversion process.

4. Chainlink: As a decentralized oracle network, Chainlink provides real-time exchange rate data between fiat and cryptocurrencies. By aggregating multiple reliable price sources, Chainlink ensures price transparency and accurate data during the exchange process, preventing malicious manipulation or price distortion.

5. Swapper Finance: As a cross-chain liquidity protocol, Swapper Finance bridges crypto assets provided by ZeroHash between different blockchains. For example, if a user needs assets on non-Ethereum chains like Bitcoin or Solana, Swapper Finance can transfer and map these assets using its efficient cross-chain technology.

6. XSwap: XSwap is a decentralized exchange platform that provides liquidity and facilitates trades. In this collaboration, XSwap provides a trading market for newly imported crypto assets, allowing users to instantly exchange them, provide liquidity, and participate in other DeFi activities.

7. Uniswap: As a top-tier decentralized exchange, Uniswap provides ultimate liquidity. Through its deep liquidity pool, Uniswap ensures seamless global trading of users' crypto assets, providing a reliable trading market for the entire ecosystem.

On-chain native coin purchase closed-loop model

From the user's perspective, the entire process of purchasing native tokens on the chain can be divided into the following steps:

Users pay fiat currency through Shift4 → ZeroHash performs asset exchange and on-chain injection → Chainlink provides exchange rate pricing → Swapper Finance performs cross-chain transfers → XSwap matches initial liquidity → Uniswap completes market access and free trading → The exchanged cryptocurrency is paid to the user's wallet.

1. Fiat Payment: Users first make a payment using a MasterCard credit or debit card through the Swapper platform's front-end interface. This process is straightforward; users simply enter their card number and other information to initiate the payment. MasterCard and Shift4 Payments are responsible for receiving and processing the user's fiat payment, ensuring compliance with relevant laws and payment network regulations.

2. Payment Information Transmission and Processing: After a user submits their payment information, the Swapper platform's front-end passes it to Shift4 Payments for processing. Shift4 performs the necessary payment verification and collaborates with ZeroHash to implement anti-money laundering compliance procedures, including Know Your Customer (KYC), to ensure the legality of the transaction. ZeroHash also provides necessary support for subsequent cryptocurrency exchanges and asset liquidations.

3. On-chain exchange rate data: Chainlink provides critical real-time exchange rate data. As a decentralized oracle, Chainlink draws on market data from multiple sources to ensure accurate and transparent exchange rates, free from manipulation by a single market. This ensures that users can be assured that their fiat payments will be converted into cryptocurrency at a reasonable price.

4. Asset Exchange and Liquidation: After payment is confirmed, ZeroHash converts the fiat currency into cryptocurrency and performs the corresponding liquidation operations. ZeroHash is a regulated institution that ensures that all transactions comply with legal requirements and that there are no errors in the fiat-to-cryptocurrency conversion process.

5. Transaction Execution and Asset Delivery: Finally, the user's selected token is exchanged through a decentralized exchange (DEX) to ensure liquidity. DEXs like Uniswap provide the necessary liquidity pools, enabling users to quickly complete transactions and ultimately receive the target tokens in their wallets.

Through this complete, closed-loop process, users not only experience the convenience of fiat-to-cryptocurrency conversions, but also ensure transaction security and compliance. The entire process, based on decentralization and smart contracts, enables users to purchase cross-chain crypto assets quickly, transparently, and cost-effectively.

Key considerations under the legal and regulatory framework

1. Payment Compliance: Shift4 and ZeroHash must comply with payment licensing regulations in various jurisdictions. In particular, when processing fiat currencies such as the US dollar and euro, they should implement payment compliance frameworks based on the region, such as FinCEN, MSB registration requirements, or PSD2 compliance.

2. Identity Verification and Anti-Money Laundering: Users are required to complete the Know Your Customer (KYC) process during the payment process. ZeroHash leverages its regulatory license to connect with KYC providers and conduct AML reviews. This mechanism completes verification off-chain and logs the results on-chain, ensuring a balanced approach to privacy protection and compliance disclosure.

3. Tax Compliance and Disclosure: In jurisdictions such as the US and the EU, digital asset transactions may be subject to capital gains tax. ZeroHash and Swapper should collaborate to generate transaction reports for review by users and tax authorities. Chainlink's exchange rate data can also serve as a standard source for assessing the tax base.

4. Cross-chain and asset security: When performing cross-chain asset transfers, Swapper Finance must implement strict auditing, signature mechanisms, and risk control models to prevent contract vulnerabilities and asset losses. Furthermore, it should integrate with insurance agreements or on-chain guarantee mechanisms to enhance user confidence.

5. Data transparency and user protection: In addition to Chainlink providing data support as an oracle, platforms like XSwap and Uniswap all employ on-chain transparency mechanisms. Chainlink and users can verify transaction records, pricing information, and asset flows through block explorers, minimizing information asymmetry.

Industry significance and prospects

This collaboration, a collaboration involving multiple industry giants, ultimately aims to interconnect traditional payment systems with the decentralized financial ecosystem. The on-chain token purchase channel provided by Chainlink and Mastercard represents not only a technological breakthrough but also, more importantly, an innovative business model. This closed-loop system not only improves transaction efficiency but also has far-reaching implications for the entire industry.

1. Integration of traditional finance and blockchain ecosystem

This collaboration represents a deep fusion of the traditional financial system and blockchain technology, particularly at the intersection of digital payments and crypto assets. Mastercard's extensive user base and mature payment systems enable the rapid expansion of crypto assets to traditional users. This cross-border collaboration provides a convenient access point for traditional financial users, allowing them to purchase digital assets using their bank cards without relying on traditional exchanges or wallets, thus expanding access to the crypto market.

2. User experience optimization

This closed-loop, on-chain native coin purchase process eliminates the complexities of crypto wallet operations and centralized exchange procedures. By integrating with existing financial infrastructure, users can use familiar credit and debit cards to complete payments, enjoying the fast and low-cost asset transfer experience brought by blockchain technology.

3. A two-pronged approach: technology and compliance

In the process of cross-border payments and fiat currency exchange, ZeroHash provides users with regulatory-compliant clearing and custody services through a compliant architecture, ensuring that this process complies with regulatory requirements and that crypto assets are not hindered by regulatory issues at the exchange level.

This is particularly important for traditional financial users, who often have concerns about compliance and transparency in the crypto market. ZeroHash's involvement not only provides regulatory compliance for this collaboration, but also provides a suitable, controlled framework for regulators around the world. This framework can help financial institutions guide more traditional users into the crypto asset market while complying with local laws.

4. User privacy protection and data transparency

Privacy protection and data transparency are two crucial aspects of financial transactions. Although traditional financial systems have strict regulations on privacy protection, in cryptocurrency transactions, users' data transparency and privacy rights are often in a state of balance.

XSwap, a leading decentralized platform, collaborates with decentralized exchanges like Uniswap to bring its robust market liquidity and trading depth to the on-chain coin purchase process. Unlike traditional centralized exchanges, decentralized exchanges do not rely on a central entity, but instead automate transactions through smart contracts. This decentralized nature significantly improves transaction transparency, security, and censorship resistance.

As a decentralized oracle platform, Chainlink uses its decentralized data transmission network in this collaboration to avoid the manipulation risks that may come from a single data source, ensure the fairness of exchange rate and transaction data, and provide regulators with effective data tracking and auditing capabilities.

5. Cross-chain liquidity innovation

The integration of XSwap and Uniswap ensures that users can instantly trade crypto assets through decentralized markets after completing fiat payments. During periods of significant market volatility, decentralized exchanges can also help users obtain more competitive prices and a smoother trading experience through optimized algorithms and liquidity pools. As the decentralized finance (DeFi) ecosystem continues to mature, these platforms are also continuously optimizing their trading mechanisms to enhance the overall user experience and fund security.

6. Market competitiveness and industry prospects

Currently, numerous blockchain projects and payment platforms around the world are attempting to build similar closed-loop ecosystems, and Chainlink's collaboration with Mastercard will provide significant competitive pressure. With its strong compliance guarantees and innovative technical support, this model not only provides users with a convenient channel for asset purchases but also lays the foundation for the mainstream adoption of the entire digital currency market. As the global regulatory framework for cryptocurrencies continues to improve, the promotion of this model will be smoother and its application prospects will be broad.

This collaboration between Chainlink and Mastercard offers a new approach to the entry of fiat currencies into the cryptocurrency market, creating a complete closed loop for future DeFi applications, from fiat payments to on-chain asset usage. Furthermore, by integrating emerging mechanisms such as decentralized identity (DID) and on-chain reputation systems, user experience and trust will continue to improve throughout the entire process. This collaboration also presents significant opportunities for emerging markets. The limitations of the traditional financial system are particularly evident in many developing and underdeveloped countries, such as high cross-border payment fees, insufficient banking services, and financial exclusion. By introducing decentralized financial systems, users in these regions can more easily access the crypto market and enjoy low-cost, efficient payment and asset trading services.