Author: Weilin, PANews

The long-silent Solana ecosystem wallet Phantom finally broke the silence. On July 9, Phantom announced the launch of a perpetual contract trading function, supported by Hyperliquid's API.

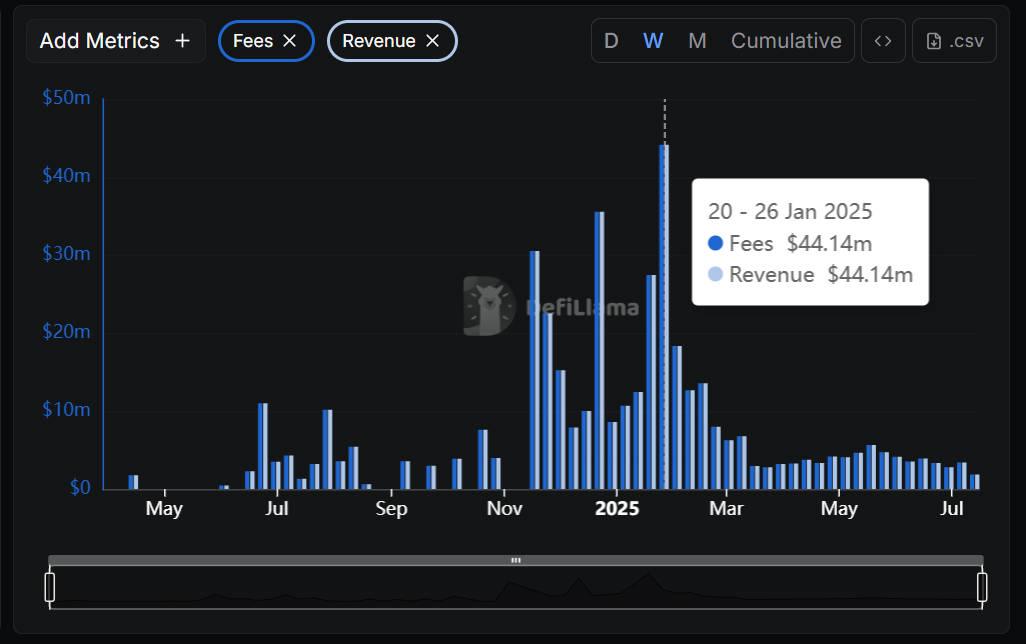

More than half a year ago, Phantom took advantage of the Solana ecosystem and completed three acquisitions in the nine months from May 2024 to February 2025. The acquisition targets were SimpleHash, a token and NFT data platform, Blowfish, a security company that protects users from fraud, and Bitski, an embedded wallet operator. In January of this year, Phantom also announced that it had successfully raised an additional $150 million in Series C financing, led by Sequoia Capital and Paradigm. Judging from DefiLlama's revenue data, the peak transaction volume of Phantom wallet was in January of this year, with monthly revenue (expenses) reaching $110 million.

However, affected by the overall market in recent months, coupled with the fact that Binance and OKX have been vigorously promoting wallets with their platforms, Phantom has been facing revenue declines and market growth pressure. The company previously stated that it currently has no plans to issue coins. Can it break through in the fiercely competitive wallet war?

Integrating Hyperliquid perpetual contract trading: Phantom’s new layout

On July 9, Phantom is launching support for perpetual contract trading, first for users in the EU and powered by Hyperliquid. The product accesses the market through a permissionless integration with Hyperliquid's API, enabling eligible users to trade perpetual contracts directly within this popular Web3 wallet while maintaining non-custodial control over their positions.

Phantom offers a mobile-first experience that feels like an intuitive extension of the core Phantom interface, supporting up to 40x leverage, stop loss, take profit, and real-time alerts.

At the same time, although perpetual contract trading has brought new functional highlights, it has also raised questions about the transparency of fees among some users. Some users questioned whether Phantom Wallet might make profits by charging higher fees, but after clarification, the exchange between USDC and SOL occurred on Hyperliquid, not on Phantom.

First, crypto user @aadvark89 mentioned, “Phantom may make a lot of money with this integration with Hyperliquid. There is a small detail that most people won’t notice, about the fees: ‘Convert to USDC: standard Phantom exchange fees apply.’ ‘Standard’ exchange fees are 0.85% for normal exchange and 1.5% for gasless exchange.” The user said that he spent $50 to exchange $4,000 of tokens and learned a painful lesson from it. The 0.85% applies to everyone, not just mobile apps.

Crypto user @blankxbt further noted, “This is terrible for SOL price action isn’t it? Forcing users to deposit SOL balances, dumping them to USDC, charging conversion fees, and creating huge selling pressure, all to bring liquidity to the on-chain economy.”

But then, user @pana067 pointed out that the exchange took place on Hyperliquid, not Phantom. Their basis was that the crypto project Unit posted a post stating how Phantom could inject funds into the user's Hyperliquid perp account with one click:

The process of Phantom using SOL to fund the Hyperliquid perp account is simplified to a single user-signed transaction. The main steps are as follows:

Depositing SOL to Hyperliquid via Unit: The user signs a Solana transaction, sending SOL via Unit. This is a standard wallet signature and the only on-chain interaction required on Solana.

Convert SOL to USDC on Hyperliquid Spot: Once the funds arrive on Hyperliquid, Phantom converts SOL to USDC using the spot order book. The swap is performed by a proxy wallet controlled by Phantom, which means no explicit user signature is required. Use Hyperliquid's public API to estimate slippage and expected output in advance.

Transferring USDC from Spot to Perps: This step requires the user's EIP-712 signature. Phantom can pre-generate signatures via the API (using the user's wallet), allowing funds to be transferred from the user's spot balance to their perpetual balance.

Three acquisitions: Phantom's rapid expansion

Phantom started as a Web3 wallet focused on the Solana ecosystem in 2021, and successfully attracted a large number of users by taking advantage of the blockchain bull market at the time. According to The Block, its multi-chain strategy began in April 2023, expanding support for Ethereum and Polygon blockchains. In December 2023, Phantom followed up with support for Bitcoin. Recently, Phantom launched support for Base and supported Sui, a Layer 1 network based on Move. At the same time, Phantom also plans to provide support for the Monad blockchain when it is released, which is currently in the testnet stage.

The rapidly growing Phantom has also started an acquisition mode. In the nine-month period between May 2024 and February 2025, Phantom completed three acquisitions, demonstrating its rapid expansion. In May 2024, Phantom acquired the a16z-backed wallet platform Bitski, an embedded wallet operator. The specific acquisition amount was not disclosed. Bitski had raised at least $25.5 million in funds.

In November 2024, Phantom acquired Blowfish, a security company that provides advanced fraud protection. Blowfish is backed by Paradigm and has raised at least $11.8 million in funding.

On February 26 this year, Phantom acquired the token and blockchain data platform SimpleHash. SimpleHash is currently capable of processing thousands of requests per second from 80 different blockchains. Founded in 2022, SimpleHash has raised $500,000 in investment, with participants including Y Combinator and Coinbase Ventures. SimpleHash's LinkedIn page shows that the company is small in size, with between 2 and 10 employees. Phantom claims that the SimpleHash team's expertise will play a key role in real-time market data, automatic metadata updates, and enhanced spam protection, helping users make smarter asset decisions.

Through these acquisitions, Phantom hopes to simplify the crypto experience, making it easier for new users to enter the blockchain and keep their funds safe.

C round of financing of US$150 million, facing pressure in the "battle" for the wallet market

In January 2025, Phantom announced that it had raised $150 million in Series C funding, led by Sequoia Capital and Paradigm. This round of financing brought Phantom's total financing to $268 million, with a valuation of $3 billion. It also released user data, and as of January 16, Phantom had 15 million monthly active users.

Data shows that Phantom's main source of income is transaction fees. With the rise of the Solana network in the Trump Meme coin craze that began in November, Phantom "woke up" from the low transaction fees and got rid of the dilemma of less than $100 in weekly revenue in the previous few months. Affected by Trump's coin issuance, its revenue in the week of November 11, 2024 soared from $7,510 to $30.51 million. During the peak period of Solana transactions this year, Phantom's weekly transaction revenue could reach more than $44 million.

As Binance Wallet joins the "war", in terms of market share, the Dune panel shows that as of July 9, Phantom's weekly Swap active traders accounted for only 4% of the market share, at 21,478 people, but higher than its competitor Metamask's 2.4%. In terms of weekly Swap transaction volume, Binance accounts for 94.5% of the share, and Phantom only accounts for 0.3%, but higher than its competitor Metamask's 0.1%.

In general, Phantom's performance in the market demonstrates its innovation and market adaptability. Its non-custodial perpetual contract trading function, cross-chain wallet support, and enhanced security and data capabilities through acquisitions have enabled it to gain a foothold in the crypto wallet field.

Currently, Phantom is also facing market pressure, but its core strategy of focusing on user experience and technological innovation may provide potential growth momentum in the highly competitive encryption market. As Phantom matures further, whether it can stand out from these challenges is a suspense worth paying attention to.