xTAO Technologies Inc., a key project company in the Bittensor ecosystem, recently received final approval to list its common shares on the Toronto Venture Exchange (TSX Venture Exchange) in Canada on July 23, 2025, under the ticker symbol $XTAO.U.

Against the backdrop of a series of Web3 projects recently launching IPO plans, xTAO's listing has sparked market attention: Is this project just another marketing stunt or an infrastructure innovation built on the underlying logic of a "decentralized AI network"? This report will briefly review the mechanisms and positioning of the Bittensor Network and its core token, TAO, based on its technical architecture and network positioning, and attempt to understand the rationale behind xTAO's listing.

1. What is Bittensor?

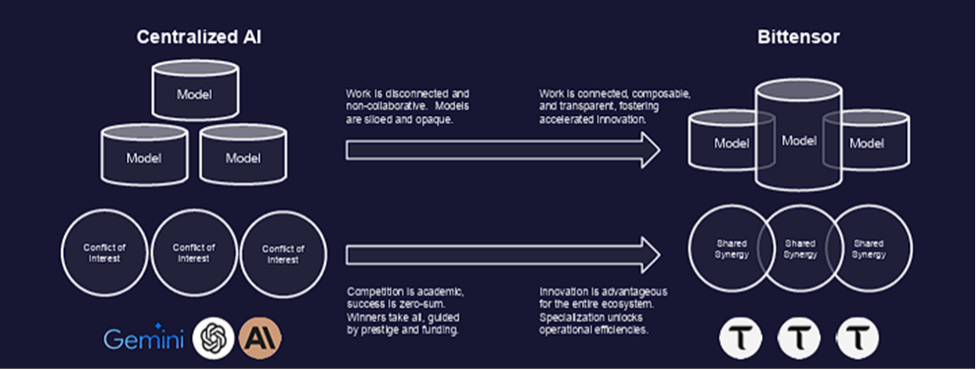

Bittensor is a complete Layer 1 blockchain network dedicated to building a decentralized AI service network. In short, it's not a specific AI application like ChatGPT or Midjourney, but rather a lower-level system platform, akin to an "operating system," dedicated to serving the entire AI ecosystem.

To use an analogy: If the goal isn't to provide a road just for a particular supercar, but to ensure smooth passage for all vehicles, then a fully functional highway is first necessary. Bittensor is building such a "highway system" for all AI tasks and developers—a decentralized platform where anyone in the world can upload models, obtain tasks, receive rewards, and freely assemble AI services.

In this system, the Bittensor network itself acts as the "builder and maintainer" of the highway: it sets operating rules, establishes routes, designs entrances and exits, and implements economic incentive systems to ensure orderly passage for all participants, ultimately forming an efficient and collaborative "AI transportation system."

II. Participant Roles in the Bittensor Network

On this "AI Highway," various participants jointly build a decentralized collaborative network:

1. Miners act like drivers or truckers: They steer their AI models on the road, handling tasks assigned by the system and earning praise from validators and TAO rewards through high-quality output.

2. Validators act like traffic police or quality inspectors: They rate the model's service quality (0-1), ensuring the stability and credibility of the "AI services" circulating in the network and determining the distribution of rewards for miners.

3. Subnet Owners are like "highway contractors" or "road planners": they design the rules for a specific AI service scenario, guide the aggregation of model resources, and build independent economic and governance systems.

4. Delegators can be likened to "investors who contribute to road construction": they support the operation of certain nodes by staking TAO tokens and receive rewards. Although they do not directly participate in model operation, they play a role in sharing risks and benefits within the network's incentive mechanism.

5. End Users are like "passengers" or "shippers" on the highway: they consume AI services (such as text generation and image recognition) provided by models in the network and pay for them.

6. Fuel Cards and Tickets (TAO Token): Used to pay drivers and traffic police, fund new routes, and provide voting and governance rights.

III. Review of Interesting and Novel Technologies within Bittensor

1. Decentralized Mixture of Experts (MOE) Mechanism

Bittensor does not rely on the traditional "centralized training + single model serving" architecture. Instead, it employs a decentralized Mixture of Experts (MOE) mechanism: it connects existing, trained AI models from around the world to the network, dynamically calls upon the most appropriate model combination based on task requirements, and jointly outputs high-quality content, thereby rapidly responding to various intelligent needs.

This mechanism can be understood as transforming AI services from "centralized training" to "global dispatch." Models no longer need to be centrally trained by a single institution. Instead, multiple "expert models" can be collaboratively organized through network routing to generate more accurate and adaptable answers.

For example, when you visit a hospital, you no longer need to randomly make an appointment with an unfamiliar specialist. Instead, you can instantly receive a joint consultation from a team of experts worldwide that best suits your needs. You don't need to train these experts or own them; you simply find and access them when you need them, obtaining answers tailored to your needs.

Furthermore, as these model "experts" continuously learn from new examples and feedback as they tackle new tasks, improving their performance and ultimately forming a self-reinforcing, positive-loop network.

2.Yuma Consensus (POI: Proof of Intelligence)

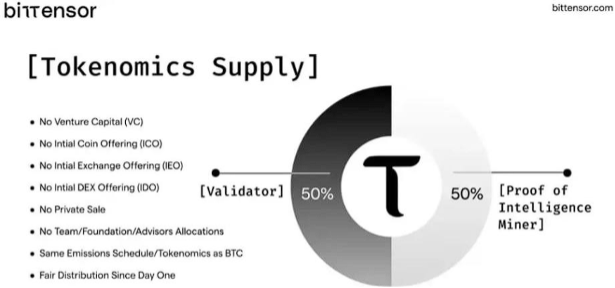

Bittensor uses a consensus mechanism called Yuma Consensus. Its core concept can be summarized as "Proof of Intelligence (POI)." It's a hybrid design that combines PoW (Proof of Work) and PoS (Proof of Stake) mechanisms, aiming to decentralized quality assessment and incentive distribution for AI model performance.

The mechanism consists of four core dimensions: stake + weight + trust + clipping. The specific operating logic is as follows:

(1) PoW idea continuation: miners still need computing power support, but the core competition is not in the performance of the graphics card, but in the model performance and strategy tuning

That is, whether the model is stable, whether the response is accurate, and whether the call is fast will directly affect its score and reward distribution.

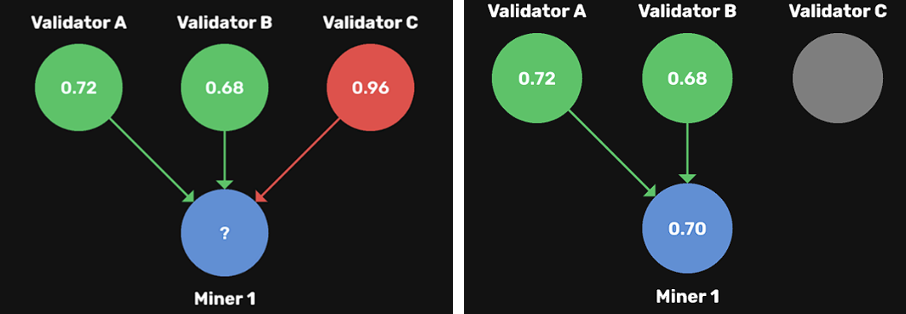

(2) Weights (scoring weight):The validator needs to score the output of each miner's model from 0 to 1

The score represents the validator's evaluation of the quality of the model output and is one of the core reference dimensions of the system's distribution incentives.

(3) Stake (equity weighting):The validator's score weight will be dynamically adjusted according to the amount of TAO staked

In other words, the more TAO a validator holds, the greater the impact of its score. This mechanism ensures that network governance and reward distribution are more decentralized and resistant to manipulation.

(4) Clipping: Validator scores that deviate significantly from the majority score will be automatically clipped by the system and will not be counted in the final consensus.

This mechanism aims to prevent malicious scoring or manipulation, and improve the robustness and objectivity of the entire scoring system.

(5) Trust (Trust mechanism): If the long-term scoring behavior of the validator is relatively consistent with the evaluation results of other validators, its trust score (Trust Score) will gradually increase. The higher the trust score, the stronger the validator's scoring influence in the network, and the easier it is to obtain the recommendation rewards distributed by the system, thereby incentivizing it to continue to perform fair and reasonable scoring behavior.

Finally, the system will complete the distribution of TAO rewards in each block cycle based on the mixed calculation results of the miner score and the validator score weight. This process ensures a strong correlation between reward distribution and actual performance, encouraging various nodes in the ecosystem to continuously optimize their models and evaluation behaviors.

3.Digital Hivemind

Bittensor's "Digital Hivemind" refers to building a decentralized brain system through the collaboration of thousands of AI models worldwide. Unlike traditional approaches that rely on a single, strong model, Bittensor achieves dynamic evolution and intelligent aggregation through competition and scoring between models.

Many people confuse this mechanism with the Mix of Experts (MoE) model, but the two are fundamentally different. While the MoE is more like a collaborative consultation among a group of experts arranged within a hospital, coordinated by a central system, the digital hive mind is more like a global, automated joint consultation involving all top hospitals. Who will see patients and how the work will be divided aren't determined by a central authority; instead, validator scores and Yuma consensus dynamically select the most suitable "experts."

Under this mechanism, models don't require centralized training; the network assigns tasks and rewards based on actual performance, gradually forming a self-optimizing, decentralized intelligent ecosystem.

IV. The Relationship between xTAO and TAO

xTAO is the world's first company dedicated to commercializing the Bittensor network. Founded by Karia Samaroo, a former WonderFi executive, the team's background blends Web2 IPO experience (WonderFi), financial resources (CapitalG, Arche), and chain-native technology (Ala Shaabana), resulting in strong cross-industry integration capabilities.

According to Private Capital, xTAO's IPO coincided with the completion of a $22.78 million subscription round. Investors included leading Web3 institutions such as Animoca Brands, Arca, Arche Capital, Borderless Capital, DCG, FalconX, Hypersphere Ventures, Off the Chain Capital, Republic, and Stratos.

Its core business includes operating a validator node on the Bittensor network, responsible for scoring miner models and providing model access services to enterprise clients. It also assists third-party miner node deployment, acting as the interface between Bittensor and external users.

In short, TAO is the "fuel" of the network, while xTAO is a company specializing in gas stations. Through node operation and service output, it converts the value of on-chain computing power into an off-chain commercial revenue model.

V. What does xTAO's IPO mean?

xTAO's listing echoes the current trend of numerous crypto companies pursuing IPOs. Its core purpose is to connect to the real-world asset market through public offerings and attract traditional capital. For ordinary investors, xTAO provides a channel to indirectly participate in the TAO ecosystem through secondary market investment. For institutional investors, while TAO is a crypto asset and faces regulatory barriers to holding, xTAO stock (XTAO.U), as a regulatory-compliant financial product, provides a "shadow asset" for Web2 investors to access Bittensor.

At the same time, xTAO is expected to become a key interface for traditional enterprises to connect with Bittensor's model services, serving as a bridge in the future commercialization of AI services. If the company regularly discloses financial data in the future, it will also provide the market with a set of indirect indicators of TAO's commercial value, providing auxiliary information for professional investors to assess the ecosystem's growth potential.

Despite its narrative logic and capital background, xTAO's first-day trading performance was relatively reasonable. On the opening day, the stock price fluctuated between CAD 1.45 and CAD 1.80, ultimately closing essentially flat, with no significant fluctuations. This trend was viewed by some as a "healthy opening," preventing irrational speculation. However, others argued that the market lacked enthusiasm, reflecting investors' continued wait-and-see attitude toward the new Web3 AI infrastructure, necessitating further observation regarding its performance and ecosystem rollout. The subsequent day's downward price trend further underscored its weakness.

VI. Summary (Note: This article does not constitute investment advice)

Overall, the Bittensor network and its native token, TAO, demonstrate a relatively complete technical design framework, cutting-edge consensus mechanism, and decentralized model architecture, possessing long-term technical potential and ecosystem scalability. They demonstrate innovation in model scheduling, reward mechanisms, and system governance, and have established a clear path for application implementation.

As a key player in Bittensor's commercialization journey, xTAO has demonstrated strong execution and resource integration capabilities, whether in narrative construction, capital lineup, or team background. However, at its current stage of development, its IPO strategy remains difficult to fully escape the prevailing crypto project strategy of "leveraging the IPO narrative window to capitalize on the current dividends." While its business positioning possesses some substance, it will take time to verify whether it can consistently deliver technological value and commercial revenue in actual operations.

Under this premise, xTAO's IPO represents more of a first step for the TAO ecosystem toward the capital market. Its long-term value depends on the continued breadth and depth of the Bittensor network's AI infrastructure expansion, as well as TAO's ability to truly assume a cross-model, cross-service value-added role within the on-chain economic system.