Compiled by: Tim, PANews

PANews Editor's Note: PANews November 3rd News Flash – HumidiFi's 30-day trading volume surpasses Meteora and Raydium, leading the Solana DEX market . Most people in the market know very little about HumidiFi, and the project's official Twitter account only has 12,000 followers. For this "hidden champion," PANews has compiled and translated relevant content from authors TATO and azsui, including an introduction to the HumidiFi project and information about its upcoming ICO event.

text:

What is Prop AMM? What is HumidiFi?

Traditional Automated Market Makers (AMMs):

• Allow any user to inject liquidity → Earn transaction fee revenue

• Adopt a passive pricing mechanism (x*y=k constant product formula)

• TVL is needed to achieve deep liquidity

• Liquidity providers (LPs) face the risk of impermanent loss.

Professional Market Maker Automated Market Maker (Prop AMM):

• All liquidity is provided by professional market makers.

• Pricing strategies are continuously updated and are independent of user transaction behavior.

Algorithms proactively manage inventory like centralized exchange market makers.

• No publicly disclosed liquidity providers (LPs) = Retail investors are not liable for impermanent loss.

HumidiFi's core features:

• Instant price updates, with multiple repricings per second.

• Private order flow mechanism reduces volatility and front-running risk

• Achieve efficient capital utilization by precisely focusing liquidity on areas with the highest demand.

• Runs entirely through on-chain algorithms

• Accessible only via Jupiter routing

It can be understood as an on-chain version of Citadel Securities, a market maker solution that is entirely based on blockchain technology and requires no permission.

HumidiFi's Achievements

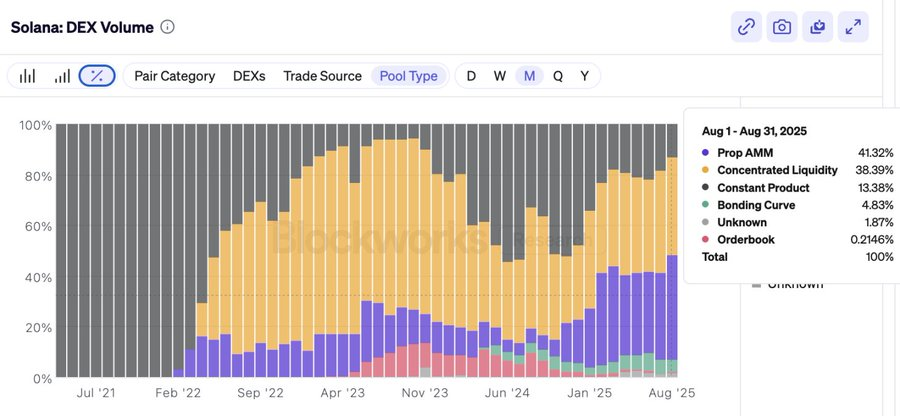

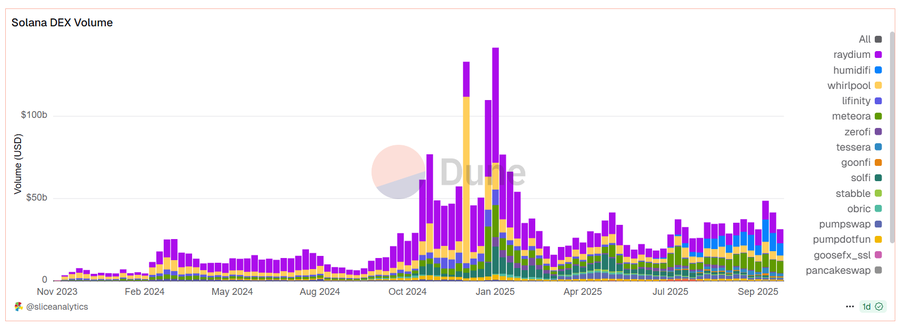

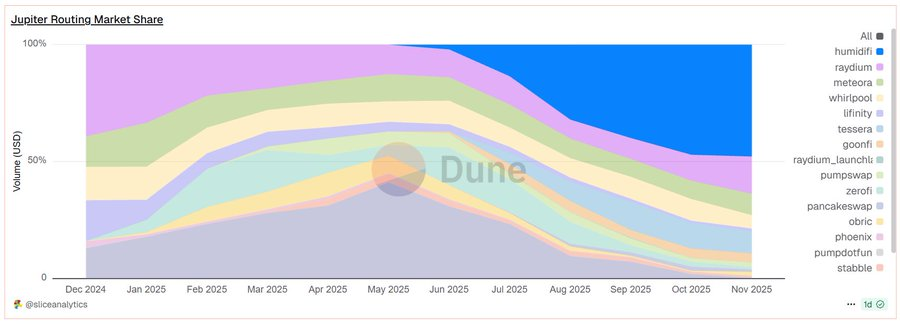

Trading volume dominates

• Achieve a total transaction volume of approximately $100 billion within 5 months

• Accounts for 35% of the total trading volume of the Solana Chain DEX

• Daily trading volume remains stable at $10-190 billion

• Trading volume reached $34 billion last month (more than Raydium and Meteora combined).

Execution quality

• SOL/USDC spread is narrower than Binance's.

• More compact pricing → lower slippage, price impact minimized

• 99.7% success rate (nearly zero transaction failures)

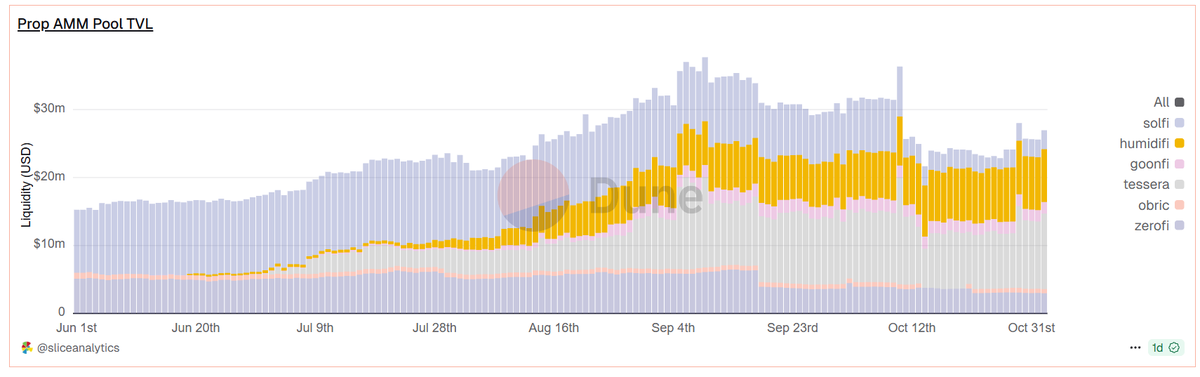

The miracle of capital efficiency

• Handling $819 million in daily trading volume with only $5.3 million in TVL.

• Achieve 154 times the capital efficiency (compared to approximately 1 time for traditional AMMs).

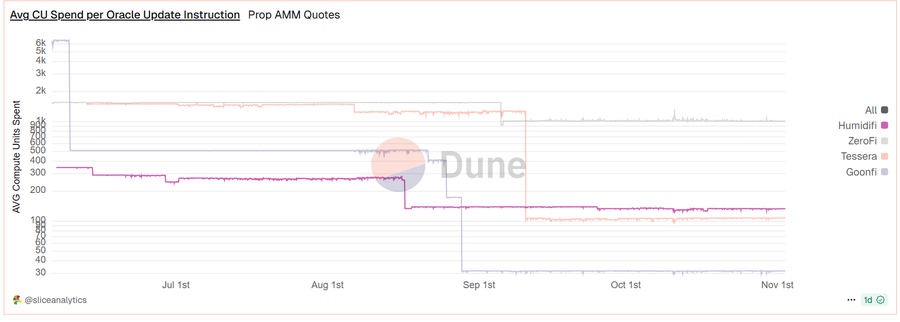

• Oracle updates require only 143 computation units (approximately 1000 times less than regular exchanges).

The result? Users get better prices, without even knowing that HumidiFi is behind it.

Why choose HumidiFi?

Technological advantages

• Ultralight oracle updates require only 143 computation units

• Price refreshes in sub-second increments (competitors take 15-30 seconds).

• Liquidity tightly concentrated around oracle prices = ultimate capital efficiency

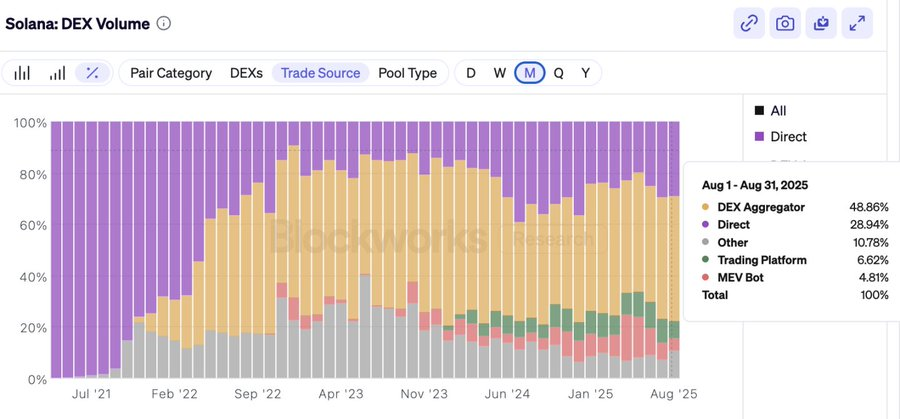

Jupiter's Ecosystem Integration Advantages

Jupiter handles over 80% of Solana's redemption traffic.

HumidiFi holds a 54.6% market share in Jupiter's professional market maker routers.

• Better prices → More routing options → Higher trading volume → Enhanced price advantage (flywheel effect)

Hidden advantages

• No front-end interface

• Private order flow reduces the risk of MEV attacks

• Anonymous operation = reduced regulatory target risk

First-mover advantage

While competitors were aiming for millions, HumidiFi directly broke through to the billion mark. In the DeFi market, liquidity attracts liquidity, and they have already seized the initiative.

The future is here: HumidiFi will lead the development of Solana DeFi.

In short, it always offers you the best price. This is precisely our core need for users.

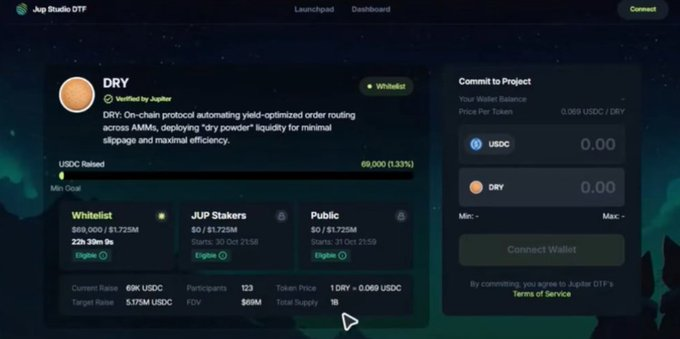

HumidiFi will launch its governance and utility token, $WET, on Jupiter’s newly launched DTF Launchpad in November (specific date to be determined).

This sale will be conducted at a fixed price and in three phases.

- Whitelist phase

- $JUP Staker Phase

- Public sale phase

The key point is that the $WET token has never received investment from any venture capital firm.

This means that if venture capital firms are interested in purchasing the tokens, they must participate in the subscription during the ICO period or purchase them from the secondary market after the tokens are publicly listed.

After the sale concludes, $WET will be immediately available for trading in the liquidity pools of the Meteora platform.

Conclusion

- HumidiFi is a professional AMM protocol that accounts for more than 50% of all DEX trading volume.

- $WET will be the first ICO project on the Jupiter DTF Launchpad platform.

- $JUP stakers will be able to participate in this ICO subscription.