I. Macro Liquidity

Monetary liquidity has improved. Federal Reserve officials have expressed renewed concerns about the latest signs of weakness in the US labor market, reinforcing market expectations of an interest rate cut as early as September. While US stocks continued to rise in August, retail buying, a key supportive force within the market, is showing signs of weakening, and risks are quietly gathering for September. The crypto market has also weakened, following the US stock market's decline.

2. Overall market conditions

Top 300 companies by market capitalization:

This week, BTC fell, altcoins fell across the board, and market manipulation stocks were rampant. The main trend of the market revolved around the ETH system.

Top 5 gainers | Increase | Top 5 decliners | decline |

MYX | 1600% | FRAX | 20% |

M | 60% | PI | 20% |

REKT | 30% | WEMIX | 20% |

PUMP | 20% | SUPER | 20% |

TOSHI | 20% | MOG | 20% |

- ETH: The ETH/BTC exchange rate strengthened. US-listed BMNR holds $3 billion in ETH, making it the largest treasury.

- PROVE: It is a cloud computing platform for ZK zero-knowledge proof, and its stock price has soared on the Korean Stock Exchange.

- MYX: It is an on-chain contract exchange, operated by a Chinese team, and the short squeeze has caused the price to rise dozens of times.

3. On-chain Data

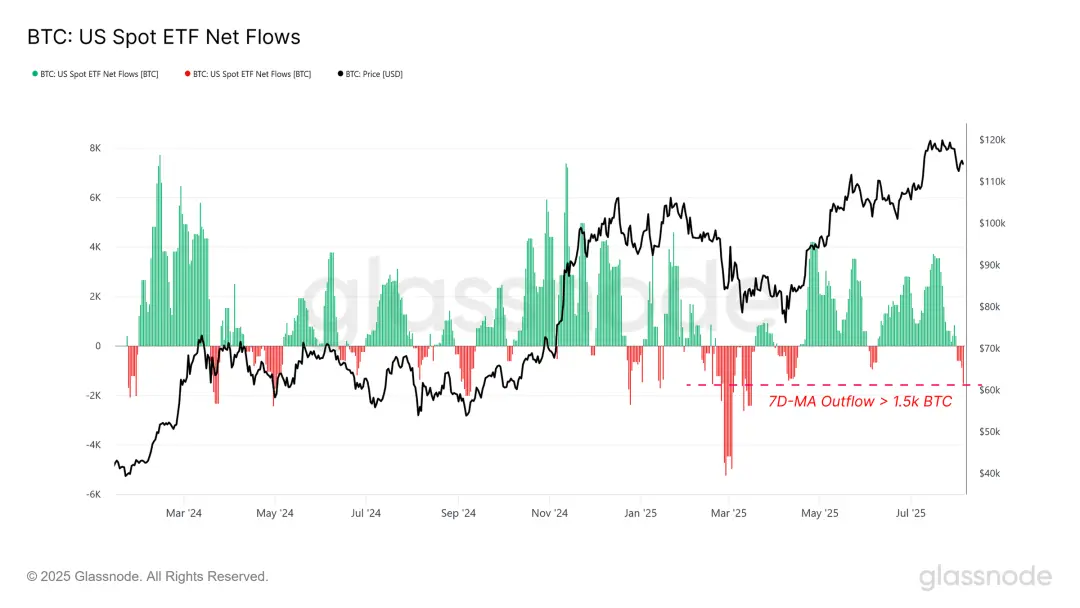

BTC is hesitant after reaching a new high. Profitability for short-term holders has declined, and ETF flows have turned negative, the largest outflow since April 25. Market funding rates have fallen, suggesting a weakening of confidence in a short-term upward trend.

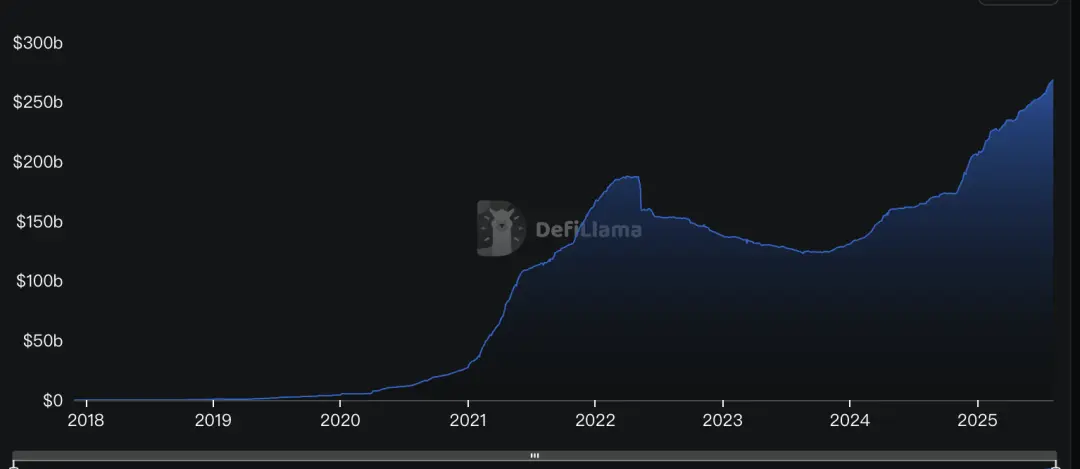

The supply of stablecoins continued to grow by 1%.

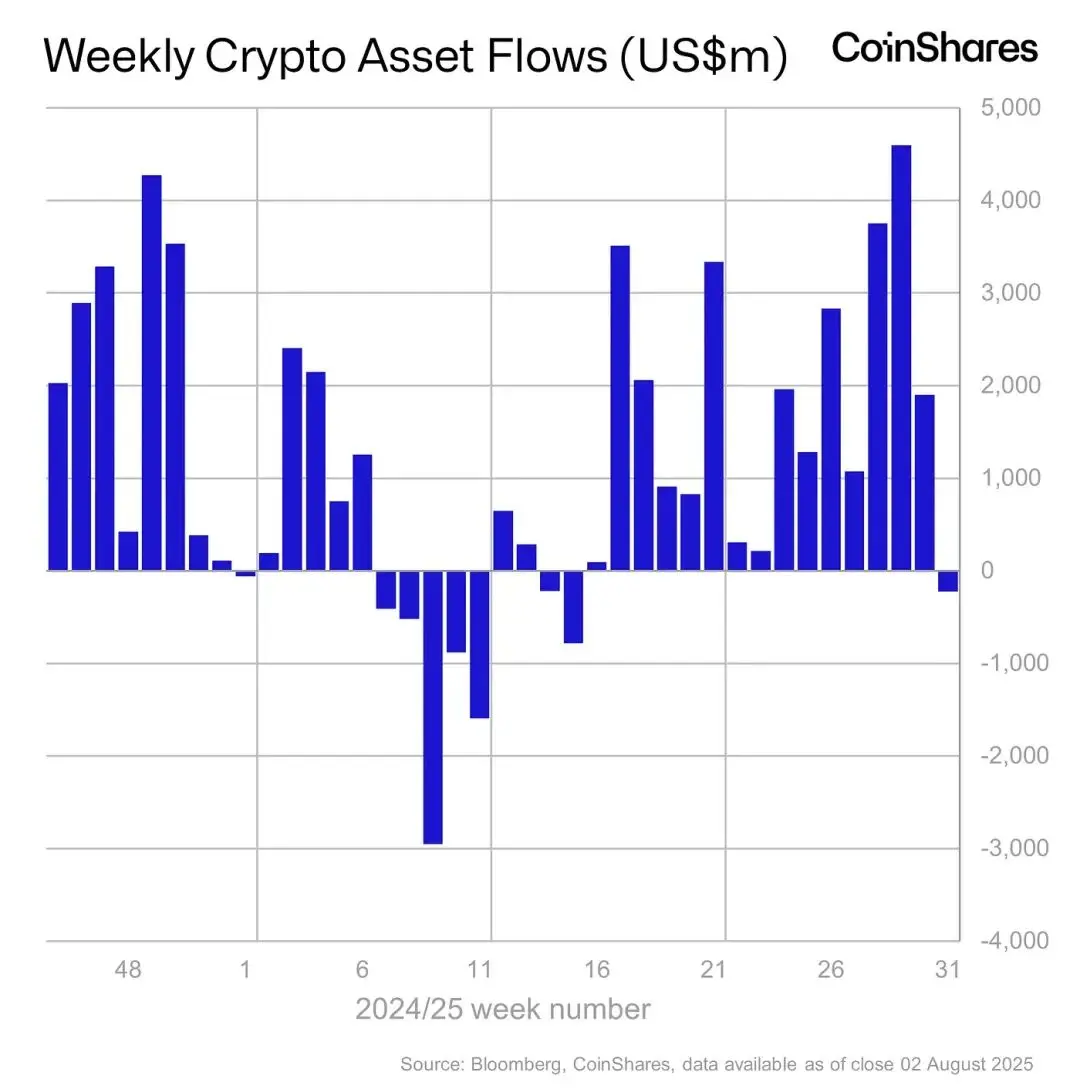

Institutional funds saw net outflows for the first time in 15 weeks, while ETH continued to see inflows.

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is the top range; when the indicator is less than 2, it is the bottom range.

IV. Futures Market

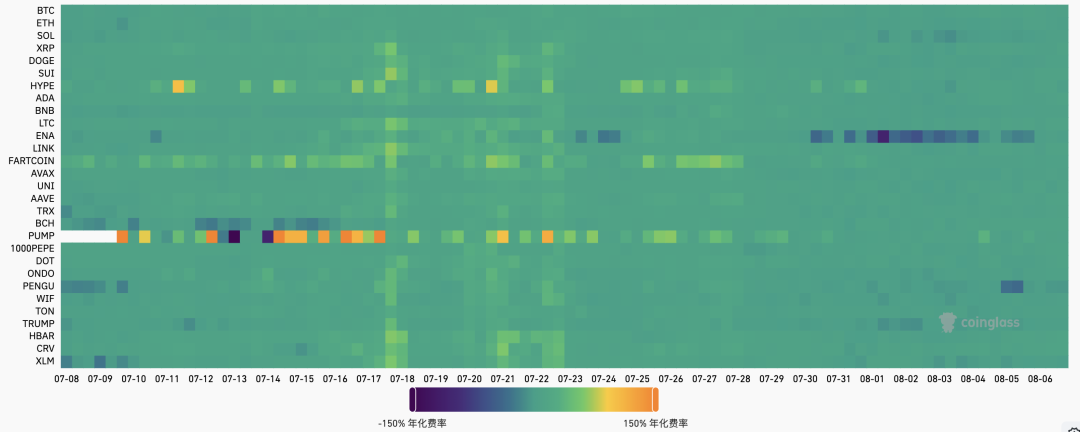

Futures Funding Rate: This week's rate is 0.01%, which is normal. Rates between 0.05-0.1% indicate high leverage in long positions, signaling a short-term market top; rates between -0.1-0% indicate high leverage in short positions, signaling a short-term market bottom.

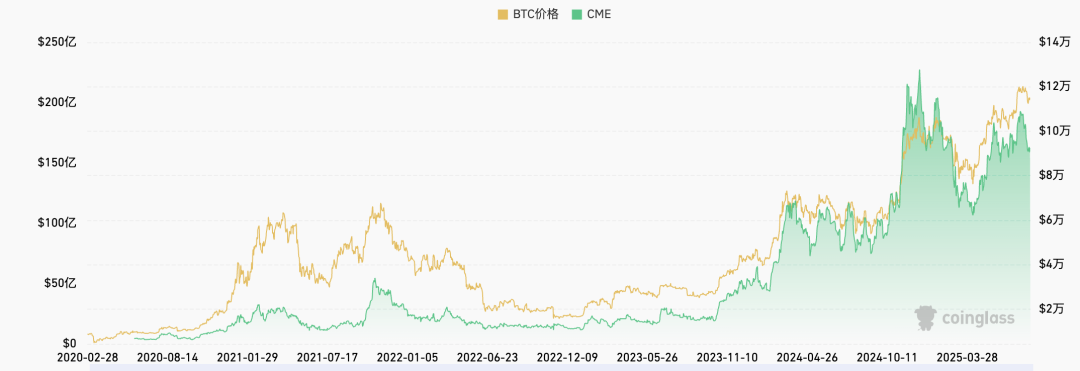

Futures Open Interest: BTC open interest began to decline this week, with major market funds withdrawing.

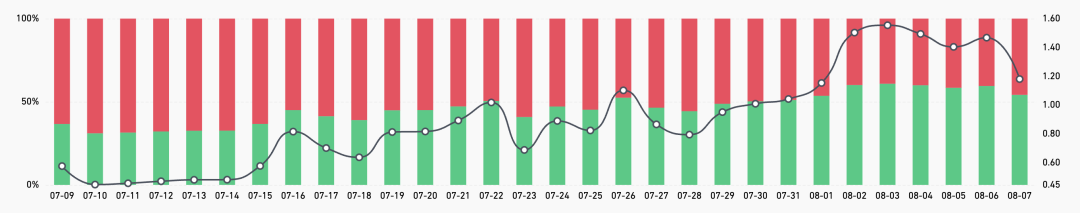

Futures long-short ratio: 1.1, indicating neutral market sentiment. Retail investor sentiment is often a contrarian indicator, with readings below 0.7 indicating fear and above 2.0 indicating greed. The long-short ratio fluctuates widely, making it less useful as a reference.

5. Spot Market

BTC saw weak fluctuations this week, with its dominance rate falling 5% to 61%. Looking back at July, the overall cryptocurrency market capitalization rose 13%, driven by growing institutional demand. Altcoins, led by ETH, performed strongly, with ETH spot ETFs recording record net inflows for 20 consecutive days. The US House of Representatives passed the Genius Act, a bill aimed at regulating stablecoins, and President Trump signed it into law.