Author: Techub selected compilation

At 18:05 Hong Kong time on May 7, 2025, Ethereum has reached the scheduled Epoch 364032 of the Pectra mainnet upgrade, and the Pectra upgrade has been completed.

Original title: The Bullish Case for Ethereum

Written by: Ignas, DeFi Research

Compiled by: J1N, Techub News

What is Pectra Upgrade?

The Pectra upgrade is an important milestone in Ethereum's upgrade roadmap, merging updates to Prague (execution layer) and Electra (consensus layer).

In the past, all major upgrades of Ethereum have attracted much attention, but this time the Pectra upgrade seems to have received little attention from the market.

I understand why. Ethereum has undergone major changes before: the migration from PoW to PoS, the launch of Ethereum destruction, and EIP-4884. Although the scale of the Pectra upgrade is not as large as the previous ones, there are also some interesting updates.

1. Account abstraction: Ultimately improving user experience

One of the biggest changes with the Pectra upgrade is how accounts are handled.

Currently, managing a wallet requires many cumbersome steps, from signing transactions to managing transaction fees across different networks. Through account abstraction, the Pectra upgrade simplifies the entire process.

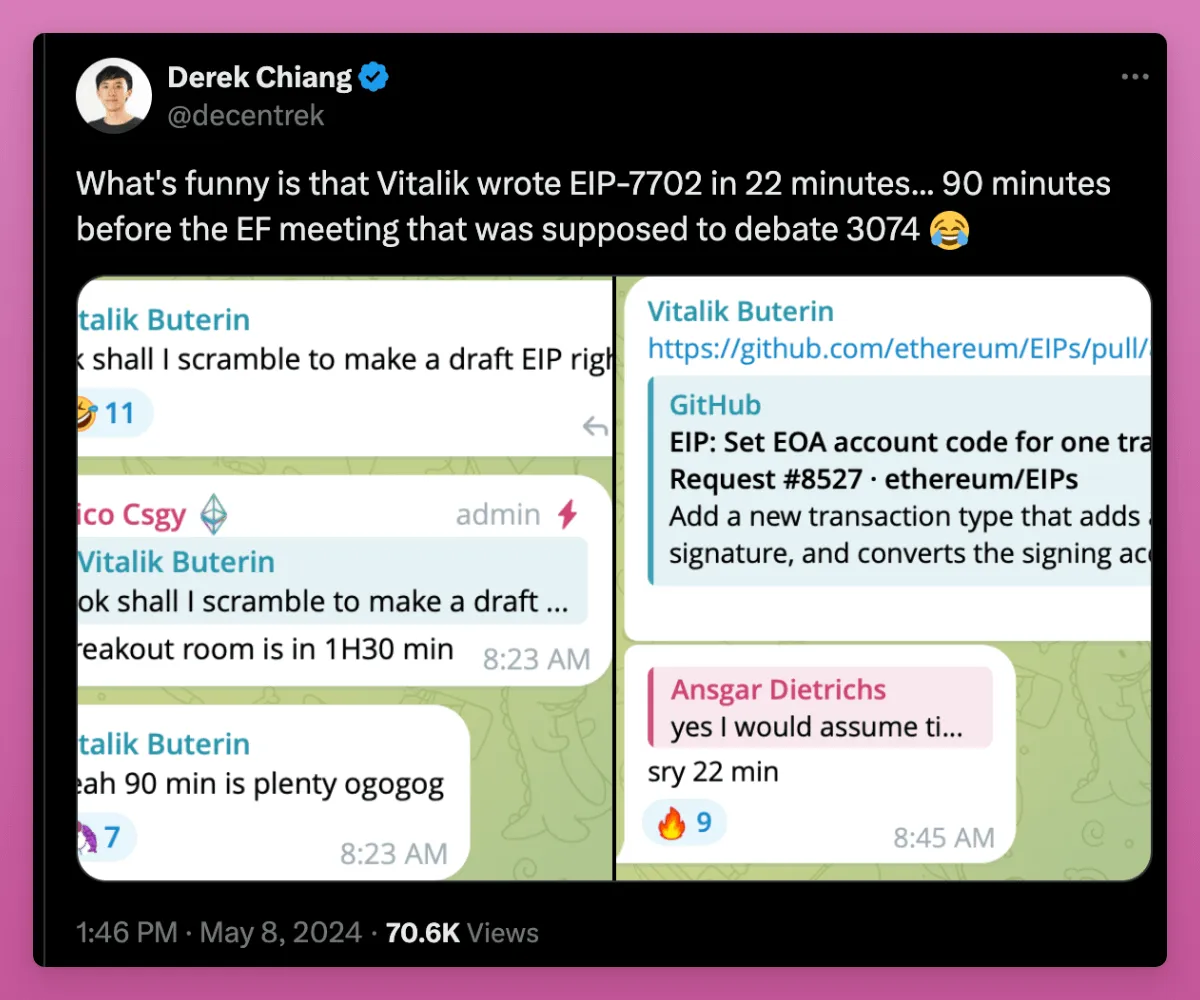

EIP-3074 and EIP-7702 are two proposed improvements. EIP-3074 allows traditional wallets (external owned accounts or EOAs) to interact with smart contracts, for example enabling batch transactions and sponsored transactions.

EIP-7702 goes a step further and allows EOAs to temporarily act as smart contract wallets during transactions. Temporary means that your EOA wallet only becomes a smart contract wallet during transactions. It works by adding smart contract code to the EOA address. Let's take a look at what this would look like in an ideal scenario:

With just one interaction, you can directly exchange USDC for UNI, without approval.

DApp can pay Gas fees for users

Pre-approve the DApps that users want to use with their wallet and set spending limits

EIP-7702 written by Vitalik seems to have taken precedence over EIP-3074, and EIP-7702 is also compatible with AA's implementation.

The idea of "EOA temporarily becoming a smart contract" is cool, because current DApps are generally incompatible with smart account wallets (try using Safe or Avocado multi-signature with DApp). I hope AA will get more attention after the upgrade.

2. Equity pledge optimization

The Pectra upgrade brings some significant changes for those running validators.

EIP-7251 increases the maximum stake amount for a validator from 32 ETH to 2048 ETH. It allows large stake providers to consolidate their stakes, reducing the number of validators and alleviating network load.

This is also a benefit for smaller stakers because it provides more flexible staking options (you can stake 40 Ethereum or compound rewards). In addition, the Ethereum staking queue will be shortened from hours to minutes.

One of the big highlights that I'm excited about is related to MEV mitigation, but it doesn't look like it will be implemented in the Pectra upgrade.

3. Scalability improvements

Pectra introduced Peer Data Availability Sampling (PeerDAS) through EIP-7594.

Like Proto-Danksharding in the previous Dencun upgrade, PeerDAS will bring lower gas fees on L2. But I can't find data on how much cheaper it is (I think PeerDAS will be particularly useful during high usage). 0xBreadguy mentioned that the Pectra upgrade will increase blob capacity by 2-3 times.

There are also several technical upgrades, such as BLS12-381, which can shorten BLS signatures (reduce gas costs), and EIP-2935, which can verify transactions without the need for blockchain history.

These EIPs, together with the Verkle Trees Transition (EIP-6800), which will eventually replace the existing Merkle Tree structure, can make lightweight clients more secure and make it easier for nodes to participate in the network, thereby increasing decentralization.

One of the major changes is the change of EVM. Through 11 EIP standards, it will be easier to write and deploy smart contracts, reduce costs and improve efficiency. In other words, development on Ethereum will become smoother.

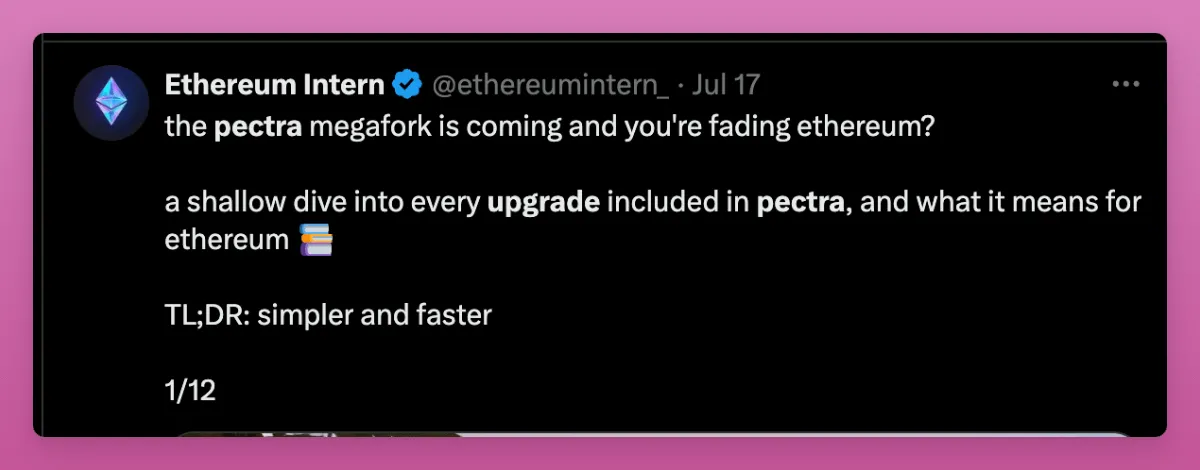

This tweet from Ethereum Intern simply explains the impact of the technology upgrade.

I'm glad that single slot (SSF) is finally coming with the Pectra upgrade, but it's not yet included in the upcoming Osaka upgrade.

Vitalik shared in December 2023 that SSF is the simplest way to solve most of the flaws in Ethereum PoS design.

Currently, Ethereum’s proof-of-stake consensus mechanism takes about 15 minutes to complete the final confirmation of a block, which means that the block cannot be changed or deleted without substantial economic penalties. SSF attempts to shorten this time to a single slot, about 12 seconds, ensuring that the block is finalized almost immediately after creation.

In practice, this means faster and more secure bridges, as well as faster deposits to CEXs. Disappointingly, this has not yet been implemented. Not including this in the upgrade is disappointing, as it shows that Ethereum developers still have not made level 1 scaling a priority.

Regardless, the Pectra upgrade is a technology upgrade, but I think the market is underestimating its significance.

Now, let's talk about the price of Ethereum.

VanEck predicts that by 2030, the price of Ethereum will reach $11,800.

Honestly, $11,800 is pretty conservative (I expect Ethereum to be much higher), but keep in mind that VanEck predicts Solana will only be priced at $335 by 2030.

So, based on the base case, Ethereum has a potential of 4.4x, while SOL only has 2.2x. Note that both of these predictions were made a year ago, before the Ethereum ETF launched, so I was curious to see their latest predictions.

By the way, if you need more bullish perspective, Ark Invest CEO Cathie Wood expects Ethereum to reach $166,000 and Bitcoin to reach $1.3 million by 2030.

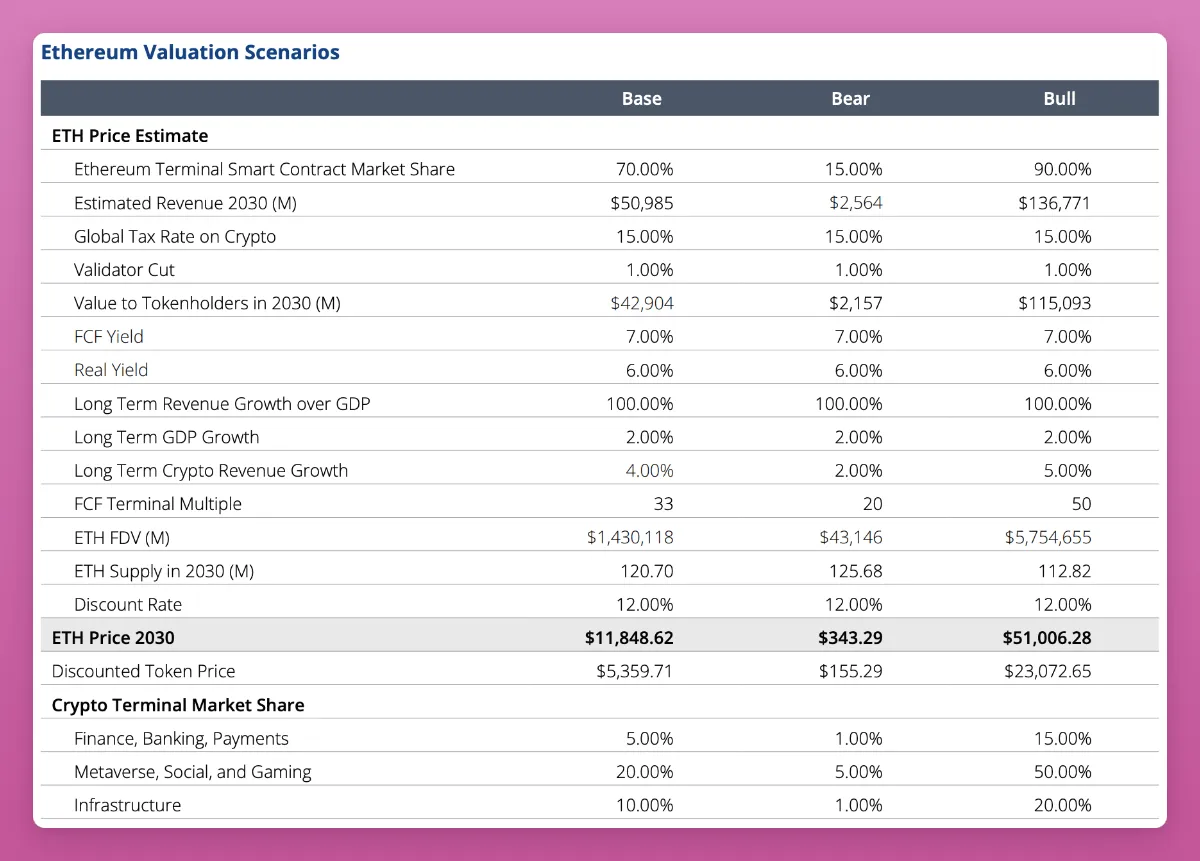

However, I am realistic about VanEck’s bullish view of Ethereum reaching $51,000. VanEck’s Ethereum price prediction is based on:

VanEck predicts that by 2030, Ethereum will have a 70% market share in smart contract platforms thanks to its first-mover advantage as the global blockchain settlement network.

Ethereum revenue is expected to grow from $2.6 billion per year to $51 billion by 2030. This growth is attributed to transaction fees, increases in MEV, and the launch of "security as a service" (SaaS), which uses Ethereum staking to protect other protocols (restaking).

Ethereum is expected to capture more economic activities in areas such as finance, banking, payments, metaverse, social, gaming, and infrastructure.

Ethereum’s potential as a store of value asset has been recognized, and its usability has been enhanced by smart contract programmability and cross-chain messaging technology.

Below is a summary of the base, bear, and bull scenarios.

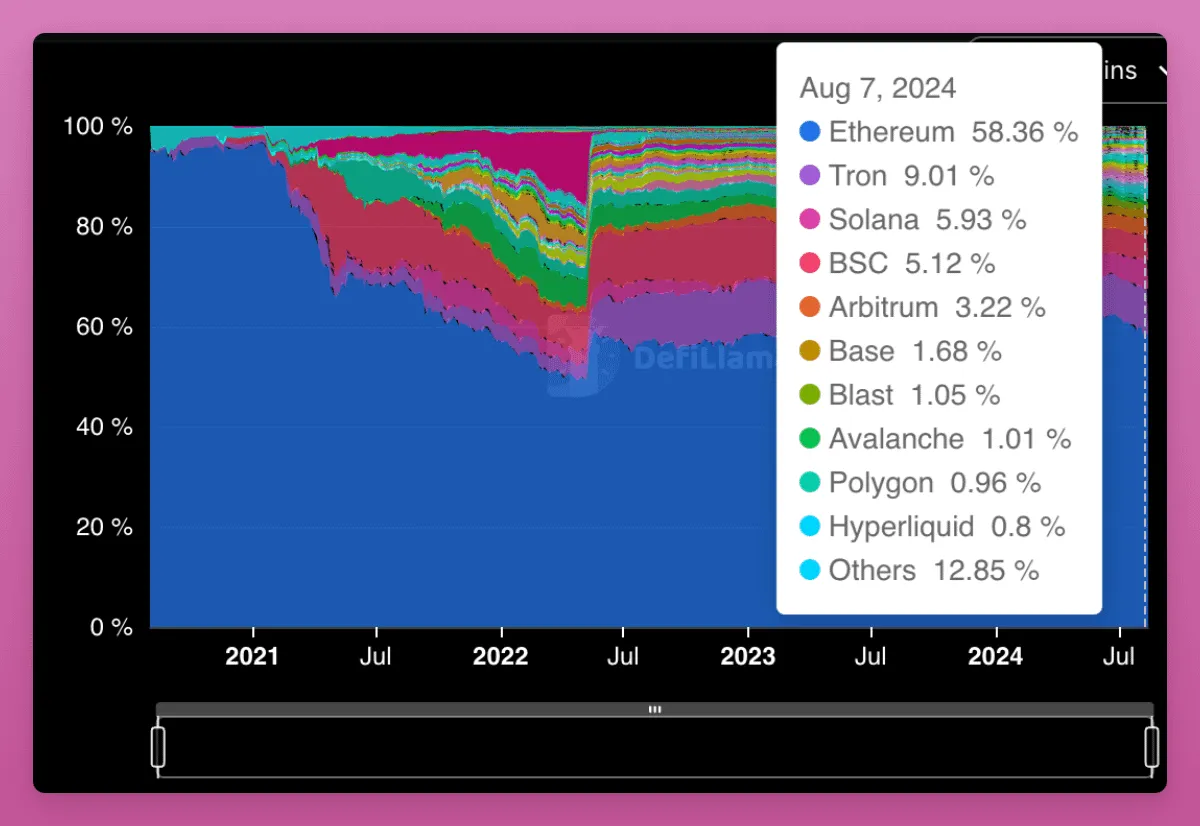

Ethereum's 70% smart contract platform position seems pretty reasonable to me, even though Ethereum's dominance is only 58% right now, but with all the secondary markets, it's about 65%. Even with SOL's crazy rise, Ethereum's dominance has remained the same since the beginning of 2022.

The TVL ratio will be a key indicator as institutions are more concerned about it.