TL;DR:

- Funding rates exhibit predictability : they tend to fluctuate within a certain range, influenced by a "structural floor" created by inherent biases in the funding rate formula and a "capital ceiling" imposed by arbitrageurs. Identifying this structure can form the basis of a trading strategy.

- Boros Funding Rate futures allow traders to bet on funding rate fluctuations now and use leverage to amplify returns, or hedge funding rate exposure in their positions.

- Trading on Boros can provide two ways to profit : 1) Funding rate income generated by the difference between the exchange funding rate and the implied rate on Boros, and 2) Spreads generated by trading changes.

- Successful trading depends on three key factors: 1) the contract's expiration time (shorter maturities are good for speculation, longer maturities are good for trend following), 2) the choice of exchange (volatile exchanges may offer opportunities to capture rate spikes, while more stable exchanges may be better suited for generating returns), and 3) the implied rate at the time of entry, which should align with the overall market outlook (whether bullish, bearish, or neutral).

introduction

Our Q3 derivatives report , "Anchors and Caps: Understanding the Structure of Funding Rates," analyzed the structure and logic of funding rates, specifically examining the structural forces at play: the pull of the funding formula on 0.01%/8hr and the vast institutional capital pool capitalizing on high funding rates. This reveals that the funding rate market has clear boundaries and is generally predictable, and it is precisely these inefficiencies that traders perceive as opportunities for consistent profit.

Understanding the underlying mechanisms is crucial, but the real challenge lies in applying them to trading. This article builds directly on our structural findings, providing a practical trading strategy for funding rate futures as a novel trading instrument. It will cover everything from venue selection to executing funding rate futures trades on Boros.

How to view Bitcoin/Ethereum funding rates: lower and upper limits

Our previous report noted that the funding rate formula is crucial for predicting surprising behavior in funding rates under certain market conditions. Our analysis revealed a gravity zone defined by a structural floor and a capital-enforced ceiling.

1. Structural lower limit: positive deviation by design

The funding rate formula itself provides a strong "floor." Recall the formula: F = P + clamp(I - P, -0.05%, 0.05%), where I is 0.01%/8 hours on exchanges like BitMEX, Binance, and Hyperliquid. This formula inherently creates a positive bias. To illustrate, consider a scenario where the perpetual swap is trading below the spot price under bearish sentiment, with a premium (P) of -0.02%.

- The clamp function becomes: clamp(0.01% - (-0.02%), ...) = clamp(0.03%, ...) = 0.03%

- The final funding rate remains: F = -0.02% + 0.03% = +0.01%

Even when perpetual swaps are trading at a discount, funding rates remain positive. This mechanism provides a strong structural floor, explaining why, despite mostly flat price action last quarter, including a >10% drop at one point, BTC funding rates remained positive over 93% of the time. Negative rates require significant and sustained selling pressure to overcome this built-in positive bias.

2. The upper limit from arbitrage institutions : It is difficult to break through the annualized rate of 10.95%

If the funding rate formula provides a floor, then arbitrageurs provide a ceiling. The benchmark funding rate is 10.95% APY. This is roughly 100% higher than what a US dollar money market fund can offer, making it attractive to large players like Ethena. When the premium pushes the rate well above this level, it becomes a clear opportunity for large-scale funding rate arbitrage.

Participants like Ethena, with billions of readily deployable capital, are capturing this delta-neutral yield by shorting perpetual swaps and buying spot assets. This massive capital force acts as a hard cap, actively pushing any fee rate spikes back to the 0.01% anchor.

Together, the lower and upper bounds create a predictable range, and deviations from this area often represent trading opportunities.

Together, the lower and upper bounds create a predictable range, and deviations from this area often represent trading opportunities.

Building a transaction framework

Understanding structural floors and ceilings is the first step. The next step is to apply this knowledge to trading. This requires a deeper understanding of Boros's mechanics and a strategic framework that considers timing, trading venues, and implied fees.

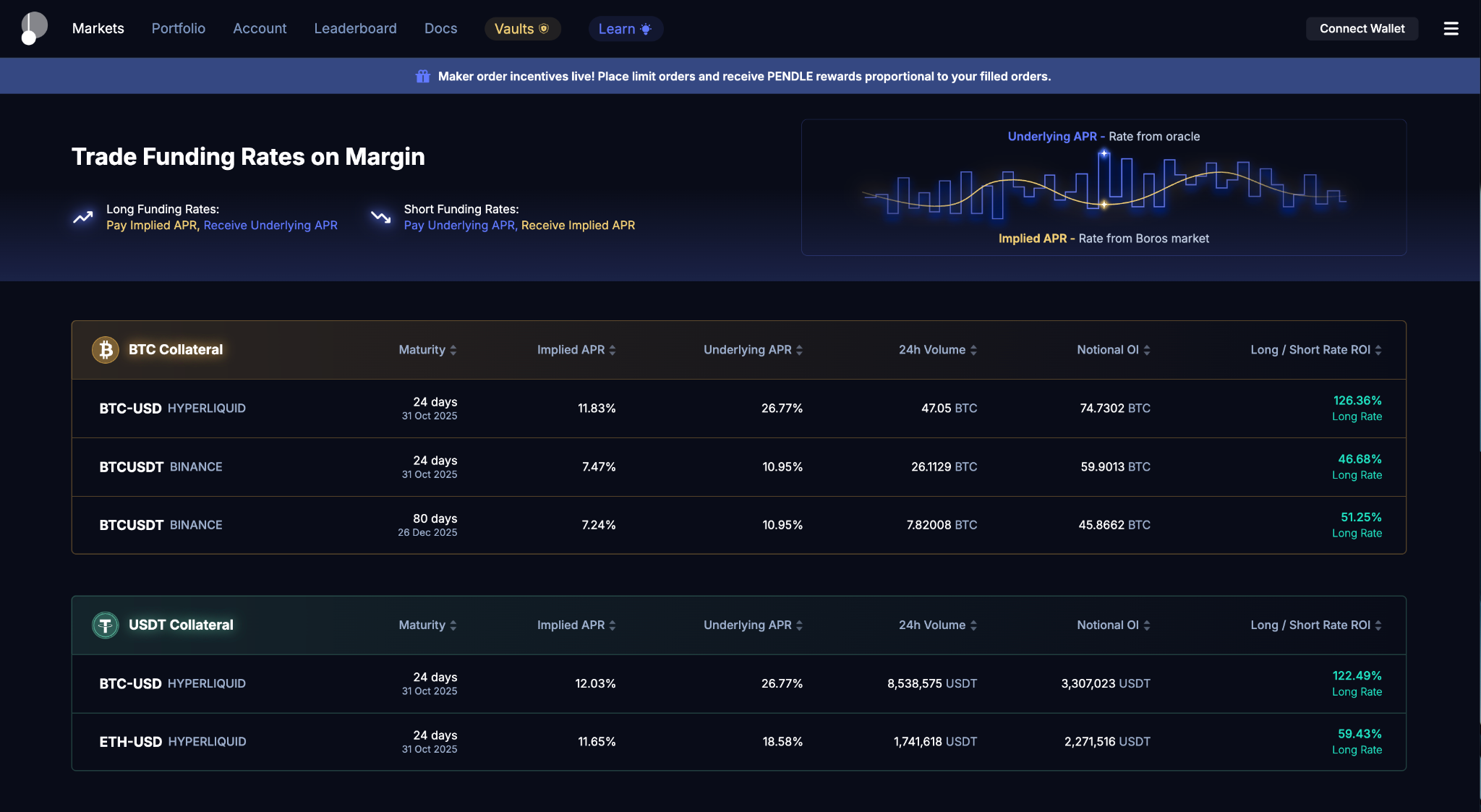

What is Boros?

Boros enables on-chain funding rate trading. Through the Boros Marketplace, traders can hedge their funding rate exposure and speculate on funding rate fluctuations and trends. With over $2.6 billion in trading volume since its launch less than three months ago, Boros is an emerging DeFi protocol with the potential to enter the larger perpetual swap market.

Understanding Boros's Mechanism: Two Sources of Revenue

Trading on Boros is different from simply holding a perpetual contract. A trader’s profits and losses come from two main sources:

- Rate differential : This is the cash flow component. For each funding interval (e.g., 8 hours on BitMEX), you either pay or receive the difference between the exchange's actual funding rate and the implied funding rate of your trade on Boros. If you're long the implied rate and the actual rate ends up being higher, you'll receive a payment, and vice versa.

- Spread : This is the price component. The implied funding rate on Boros is determined by its own order book and fluctuates based on trader expectations. If you go long at an implied rate of 15% APY, and market sentiment pushes it to 20% APY, your position will increase in value, creating the opportunity for capital gains when you sell.

Trading strategies

A robust strategy considers three main variables: time, trading venue, and entry point of the implied rate.

1 – Time (Expiration Dates Matter): Every implied funding rate market on Boros has an expiration date. This is a key factor in how sensitive a position is to short-term rate changes.

- Longer-dated contracts with weeks or months until expiration are less sensitive to individual funding rate payments. They represent the market's expectation of the average funding rate over the entire period. These are better suited for betting on long-term trends or structural shifts.

- Shorter expiration dates: Contracts nearing expiration are highly sensitive to the next few funding rate payments. These are better suited for speculative, short-term bets on immediate rate spikes or drops.

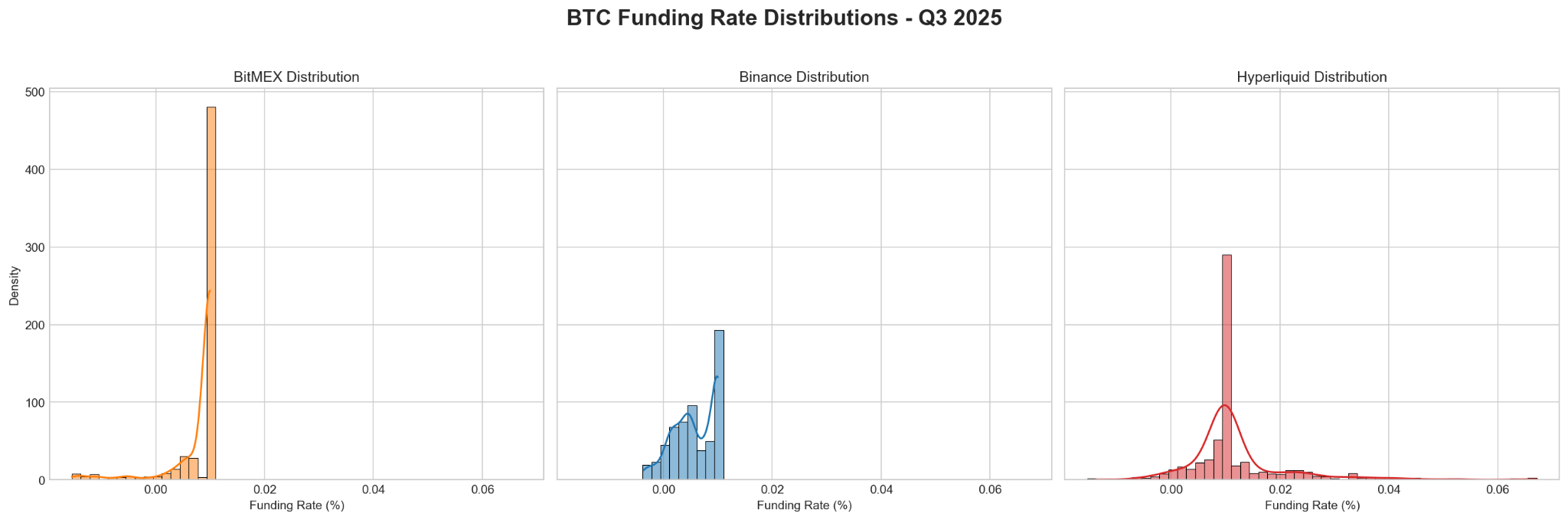

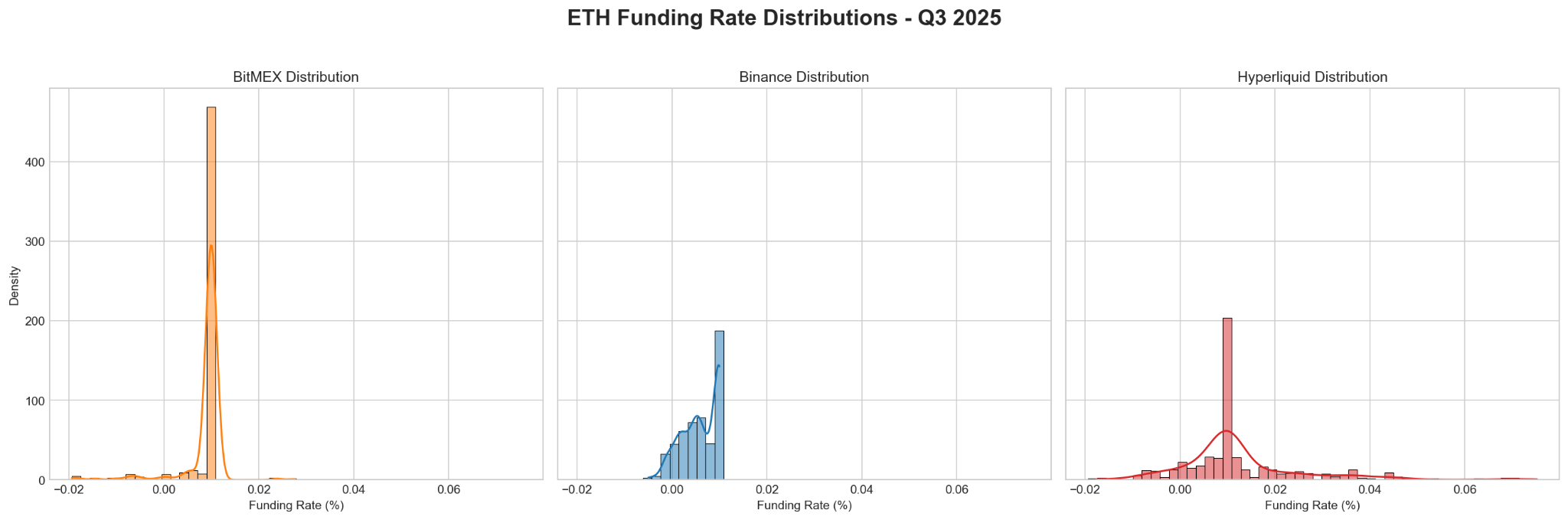

2 – Trading Venues (Choose Your Battles): As highlighted in our previous reports, the underlying venue determines the behavior of the fee rates.

- For stability and returns: Venues like BitMEX, with their 8-hour trading window and deep liquidity, provide a more predictable environment for baseline return strategies.

- For volatility and speculation: Venues like Hyperliquid, which have 1-hour windows, are designed for volatility and provide more frequent opportunities to capture dramatic spikes and dips.

| index | BitMEX (stable) | Hyperliquid (Volatility) | Key Points |

| Average rate | 0.0090% | 0.0150% | Hyperliquid has a higher average premium. |

| Standard deviation | 0.0045% | 0.0250% | Hyperliquid is almost 6 times more volatile, creating more trading opportunities. |

| Minimum/maximum value | -0.0194% / 0.0276% | -0.05% / 0.10% | Hyperliquid's trading range is significantly wider at both ends. |

| Frequency> 0.05%/8 hours | < 1% | ~15% | Spikes offering high yields are more common on Hyperliquid. |

3 – Implied Rates: After choosing the time and place, the final decision is to time your entry based on the market’s implied rates and your expectations.

| scene | trade |

| 1: Prediction Market FOMO | If you anticipate a period of bullish market euphoria, funding rates may rise. Trade: Go long when the implied fee rate falls below 10% APY. Rationale: While the 10.95% anchor creates a strong pull, periods of intense speculation can cause rates to temporarily exceed this ceiling, providing an opportunity to capture capital gains from regular payments and rising implied fees. |

| 2: Forecasting a neutral market | If you believe the market will be relatively balanced, significant deviations from 10.95% can be viewed as opportunities. Trade: Go long if the implied rate falls significantly below this anchor; go short if the implied rate is too high, betting on a return to the structural rate. Rationale: 10.95% APY serves as a structural anchor. Trading away from this anchor can profit as the implied rate reverts to its structural mean. |

| 3: Predicting market panic | If you anticipate bearish sentiment, keep in mind the structural floor. Due to the formula's bias, funding rates may still remain positive. This creates an asymmetric opportunity. Trade: Go short when implied funding rates are relatively high (e.g., above 7% APY). Rationale: The goal isn't to bet on rates turning negative, but rather on their compression from a high positive value to a lower, structurally supported floor (e.g., near 4% APY). |

How to trade funding rates on Boros

The following steps provide a general framework for implementing a strategy based on the concepts discussed.

Step 1: Create a plan

Before entering any trade, develop a clear thesis based on a structural framework. Are you expecting a reversion to the mean, a surge due to market euphoria, or compression to a structural floor?

For example, an argument could be: "Implied fees on Hyperliquid are currently elevated due to short-term FOMO, and I expect it to compress back to its structural anchor."

Step 2: Select your market and expiry date

Depending on your thesis, choose the right trading instrument:

- Venue selection: Determine the underlying market. As shown in this analysis, funding rates can vary significantly between exchanges. If your strategy relies on capturing sharp, short-term fluctuations, a more volatile venue like Hyperliquid may be suitable. If your strategy relies on earning a reliable baseline return, a more stable venue may be preferable.

- Time Horizon: Select a contract expiration that matches your strategy. For short-term speculative bets on immediate rate changes, choose contracts close to expiration. For a long-term view on average rates, choose contracts with weeks or months remaining.

Step 3: Execute the trade on the order book

Navigate to the Boros platform and connect your wallet. Depending on your thesis, you will go long or short on the implied funding rate.

- Go Long (Expecting Rates to Rise): Place a buy order on the Boros order book for the implied funding rate. This position is profitable if the implied funding rate increases (capital gain) or the actual funding rate paid is higher than your entry implied funding rate (regular payment).

- Going short (expecting a rate drop): Place a sell order for the implied funding rate. This position is profitable if the implied funding rate drops (capital gain) or if the actual funding rate payment is lower than your entry implied funding rate (periodic payment).

Step 4: Monitor and manage your positions

After an order is filled, the position is actively managed by monitoring two sources of returns:

- Fee Income/Expense : Tracks the cash flow generated by the difference between the actual funding rate of the underlying exchange and the implied fee rate of your trade.

- Capital Gains/Losses: Monitor the market price of your positions on Boros. The implied rate will fluctuate based on market expectations, creating opportunities to profit or stop losses before expiration.

Step 5: Exit Strategy

You can realize your profit and loss in two main ways:

- Sell your position: Close your position on the Boros order book before the contract expires. This is ideal for capturing capital gains from favorable movements in implied rates.

- Hold to Expiration: Maintain your position until the contract expires. Your final profit or loss will be the sum of all periodic payments you receive or make during the life of the contract.

Conclusion: Structure over emotion

The ability to trade funding rates directly marks a significant evolution in the crypto derivatives space. Our analysis suggests that success in this new space may come more from understanding market structure than predicting market sentiment.

By recognizing the structural floor created by the funding rate formula and the hard cap enforced by arbitrage capital, traders can build a robust framework. Trading strategies become less about guessing market direction and more about identifying when the market deviates from its own structural norms. By systematically closing unsustainable premiums or buying fear-driven dips to the structural floor, traders can begin to master the new, more predictable world of funding rate derivatives.