Author: Frank, PANews

The cryptocurrency investment landscape is undergoing a profound transformation. On the one hand, traditional institutions are entering the market, bringing more capital and new ways to play. On the other hand, native crypto investors are facing stronger competition. Simple "hoarding" strategies, contract trading, DeFi lending, and other methods are becoming increasingly difficult and require a higher level of user knowledge.

The crypto market is becoming increasingly unfriendly to novice users.

When choosing an investment strategy, there's a classic dilemma: the "impossible triangle" of profitability, security, and liquidity. In past cycles, DeFi protocols often forced investors to make difficult trade-offs between these three factors: the pursuit of impressive annualized yields (APYs) often came with significant risks associated with smart contracts and the permanent loss of principal; the pursuit of absolute security meant funds sat dormant in their wallets, missing out on growth opportunities. Therefore, a combination of investment strategies is gaining popularity among investors. As a leading exchange, Binance consistently leads the industry in wealth management product categories and is one of the most popular platforms for crypto investors. However, the sheer variety of wealth management products can often be overwhelming. This article provides a comprehensive review of Binance's high-yield wealth management products, hoping to offer a new investment strategy. Binance's high-yield wealth management products can be broadly categorized into two main categories. One is USD stablecoin-linked products, such as RWUSD and BFUSD, which offer stable income streams, such as RWA tokenized US Treasury bonds or futures funding rates. The other is structured products, which involve discounted coin purchases and dual-currency investments. Products backed by USD stablecoins are relatively conservative, offer low barriers to entry, and offer principal protection and stable returns. Structured products generally carry higher risks while offering potentially high returns, and require strategic investment strategies.

"Buy Coins at a Discount": Bringing Institutional-Grade Options Strategies to Retail with One Click

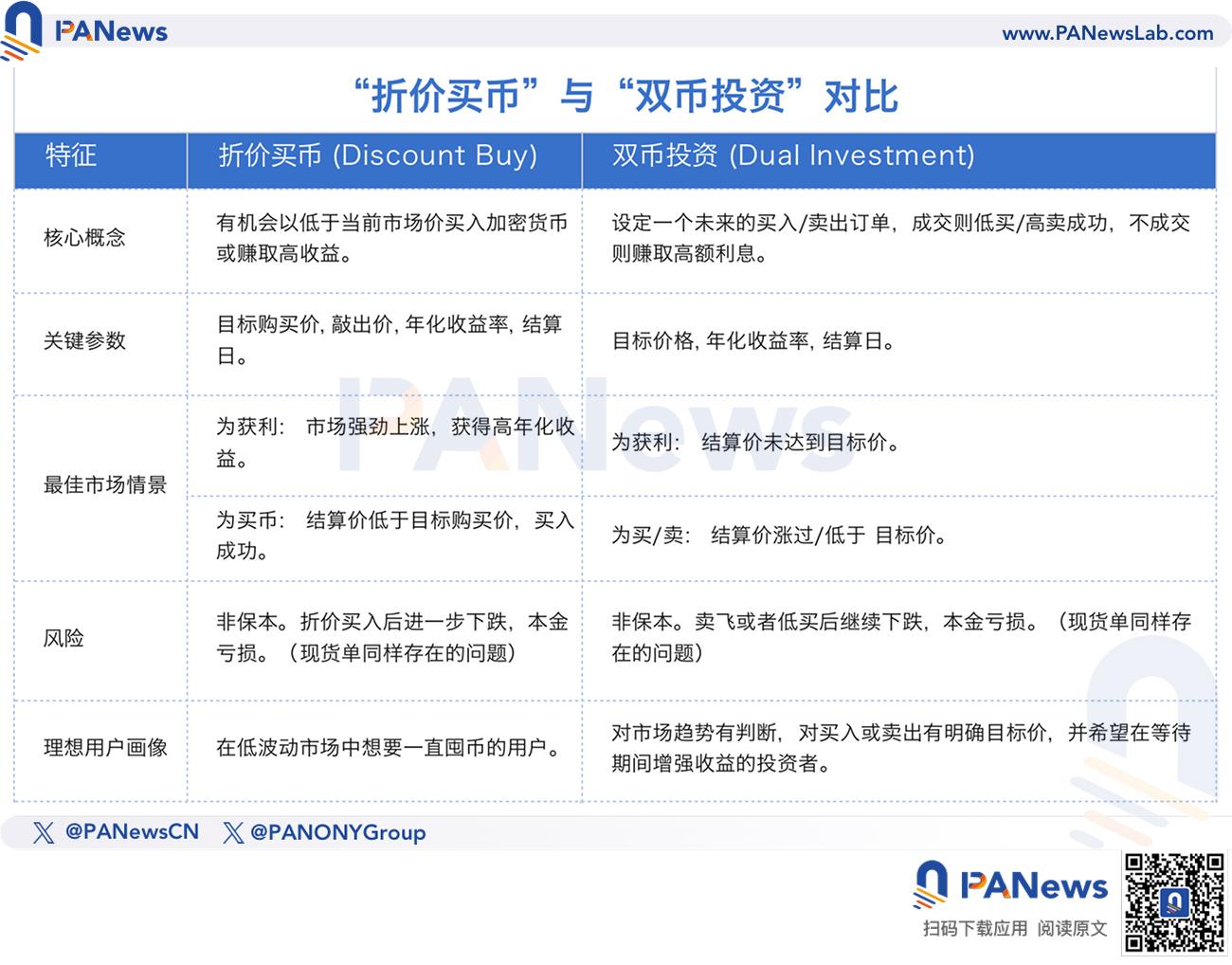

"Buy Coins at a Discount" is Binance's latest structured wealth management product. Like its previously launched "Dual Currency Investment," it also leverages options as its underlying asset. These two are the twin stars of Binance's structured product offerings.

For many investors, the current market presents a dilemma: they want to enter positions at a lower cost during a pullback, but they're also wary of buying the dip halfway through. Binance's newly launched "Buy Coins at a Discount" product is designed to address this pain point.

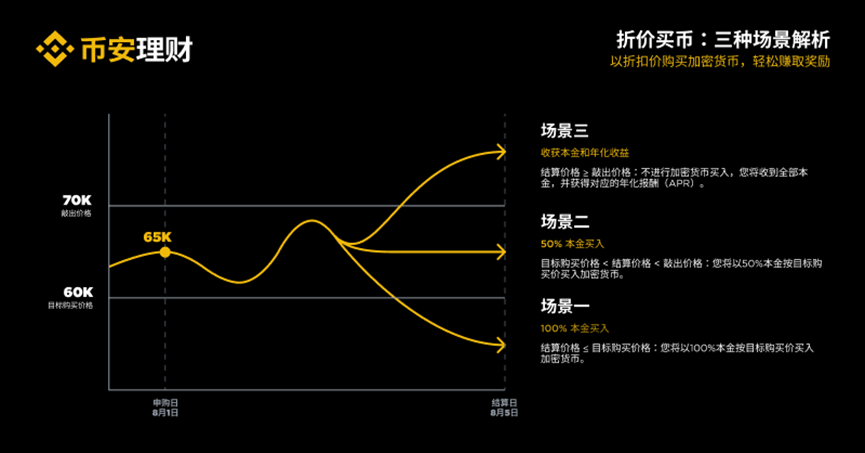

"Buying Coins at a Discount" is essentially a complex "exotic options" model. Its key feature is that users can accumulate coins (such as BTC and ETH) below market price or earn high annualized returns. Traditional strategies of simply accumulating coins or buying the dip at a low price often result in users setting the entry point too low, resulting in a failure to successfully buy the dip. This process not only prevents them from completing their positions, but also wastes funds while waiting, resulting in further opportunity costs. "Discounted Coin Buying" perfectly solves this problem. Users can select a target purchase price, along with a corresponding APR and knock-out price. If the settlement price on the settlement date (the average price in the last half hour of the settlement date) is lower than the target purchase price, the position can be successfully established. If the settlement price is between the knock-out price and the target purchase price, the user will complete half of the position at the target price and receive a full refund of the principal. If the price is higher than the knock-out price, although the coin is not purchased, the principal will be fully refunded along with the agreed-upon APR. This acts as a "missing opportunity protection," paying interest for the opportunity cost of waiting.

The true value of "Buying Coins at a Discount" lies in helping users who wish to open a position at a lower price in the future to automate their position building process. Even if they are unable to establish a position, they can still guarantee a certain investment return (the current APR can reach 30%). Similar to "Buying Coins at a Discount," "Dual Currency Investment" is also based on options. The core logic can be simply understood as: "Place a limit order for your future self. If the order executes, your buy low/sell high purchase is successful. If it doesn't execute, you'll still earn extra interest while waiting." Typical Scenario: Suppose you plan to buy Bitcoin when the price falls back to 60,000. Simply place a spot limit order. If it doesn't execute, your funds will be idle during this period. However, if you use the "Buy Low" option of "Dual Currency Investment" and set a target price of 60,000, your funds will continue to generate high interest even if the order doesn't execute. Dual Currency Investment is more suitable for "planned traders" who have clear future buy or sell points. It converts the time cost of waiting into tangible returns. Users can choose the settlement date and APR based on their investment preferences. Many investors prefer to choose a target price with a long settlement date or a large difference from the current price, not aiming for a transaction but rather for a more stable high return. Other users choose to repeatedly buy low and sell high within a range.

If "dual-currency investment" is a basic "spot limit order + interest," "buying coins at a discount" is more like an "intelligent bottom-fishing robot" with a buffer and multiple outcomes.

RWUSD: A Bridge Connecting Real-World Assets (RWA) and Retail Investors

If structured products are suitable for more professional crypto investors, then products based on US dollar stablecoins are more suitable for users with a lower risk appetite who want to increase asset utilization.

By 2025, RWAs and stablecoins were undoubtedly the hottest stories of this cycle. Boston Consulting Group even predicted that the RWA market would reach $16 trillion by 2030, and the stablecoin market had already exceeded $260 billion. However, when giants like BlackRock rushed into the market, their high barriers to entry for RWA and stablecoin products kept most retail investors out.

Binance's RWUSD and BFUSD appear to be just such a bridge.

RWUSD is essentially a principal-guaranteed financial product backed by the returns of real-world assets such as US Treasury bonds. While the official announcement emphasizes that RWUSD is not a stablecoin or US Treasury bond, its innovative significance lies in combining the native properties of crypto with the principal-guaranteed wealth management of US Treasury RWAs. RWUSD offers the following features: 1. It surpasses the investment threshold for RWAs, with a minimum investment of 0.1 Units and a flexible redemption mechanism (a free and quick redemption limit of 5,000 Units per person per day). 2. It is an investment option suitable for those with a low risk appetite. While its reference annualized yield of approximately 4.2% cannot compare to high-risk DeFi projects, it provides a more reliable and robust option for investors with a lower risk appetite than native crypto returns. 3. Compliant principal protection. Compared to previous principal-guaranteed wealth management products in the crypto space, RWUSD, backed by US Treasury bonds or stablecoins, is the first to achieve true principal protection in its underlying logic. This is likely to attract a large number of institutions that have been on the sidelines regarding the crypto industry.

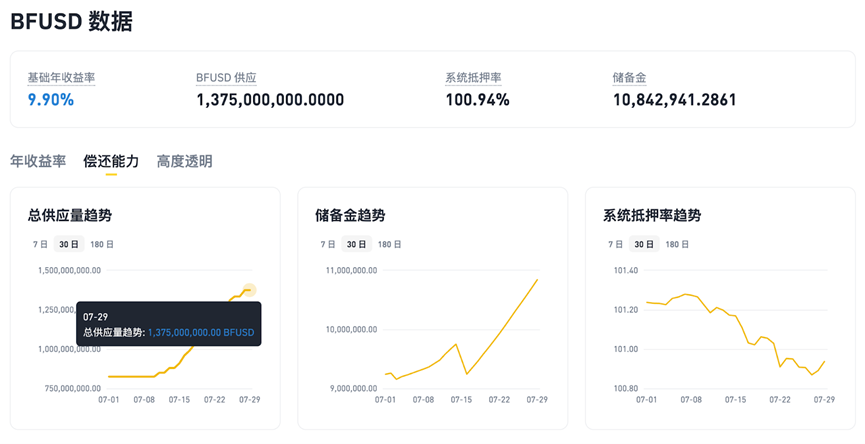

Overall, RWUSD and BFUSD are both principal-guaranteed investment assets. While their annualized returns aren't as high as DeFi, they significantly improve fund utilization and provide greater capital security. For individuals and institutions new to crypto investing, they are undoubtedly a relatively safe choice.

BTC Staking: Activate Idle Capital and Capture Native On-Chain Yield

In addition to the two wealth management products mentioned above, Binance also offers a stable of on-chain investment products. Take BTC staking, for example, for example, "Earn Coins on the Chain."

Unlike public chains like Ethereum that use Proof of Stake (PoS) and earn network security rewards by staking their native tokens, Bitcoin, which uses Proof of Work (PoW), lacks inherent "interest-bearing" capabilities. This results in a vast amount of BTC sitting idle, unable to generate passive income for its holders. To address this issue, the BTCFi ecosystem was born. One of its key innovations is liquidity staking.

Binance, through partnerships with third parties such as Solv Protocol, provides a way to increase the value of BTC, a traditionally "non-interest-bearing" asset. Users can stake BTC in their Binance accounts and earn SOLV token rewards based on their selected lock-up period, with an annualized yield ranging from 0.6% to 1.6%. This product supports various lock-up periods and can be redeemed early at any time (but accrued rewards will be forfeited). Users can stake BTC on the Binance platform with a single click, eliminating the need for complex on-chain operations and capturing the inherent returns of the BTCFi ecosystem. This allows users to capture the inherent returns of on-chain innovation without leaving the familiar and trusted Binance environment.

Binance's BTC staking offers the following advantages:

1. Binance manages and manages the assets, ensuring the security and reliability of funds.

2. No wallet setup or DeFi knowledge is required; simply use your Binance account to participate.

3. Multiple staking periods and ample quotas are available to meet the income and liquidity needs of different users.

Back to the original topic, there's no single perfect product on the market that simultaneously delivers high returns, high security, and high liquidity. However, a sophisticated investor understands how to dynamically balance these three requirements by building a diversified asset allocation portfolio based on market conditions and personal needs.

By productizing and making complex financial strategies one-click, Binance is lowering the barrier to entry for ordinary users to participate in advanced investment. This is not only a tool innovation, but also a profound evolution of investment philosophy. An era that belongs to all crypto investors and focuses more on strategy and allocation has arrived.