introduction

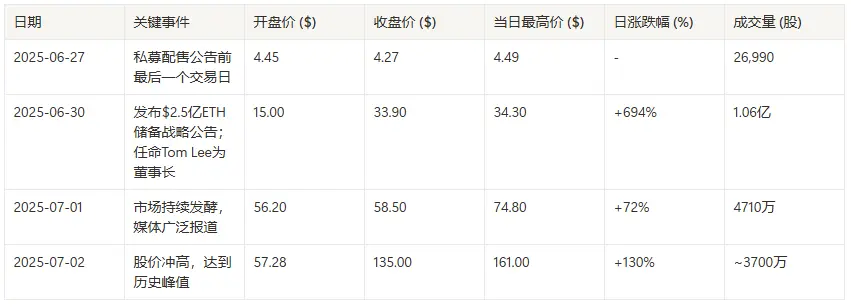

There are always jaw-dropping stories in the capital market, but few stories are as crazy as Bitmine Immersion Technologies (NYSE: BMNR) in such a short period of time. In June 2025, the stock price of this previously unknown company soared like a rocket after announcing its Ethereum (ETH) reserve strategy. On the day before the strategy was announced, its closing price was only $4.26, and in the following trading days, the stock price once soared to $161, with a peak increase of nearly 37 times.

The trigger for this dramatic event was an announcement on June 30, 2025: Bitmine will raise $250 million at $4.50 per share through private placement, and the core purpose of this fund is only one - to acquire Ethereum and use it as the company's main reserve asset. This move not only makes its stock price out of gravity, but more importantly, it reveals a profound change that is quietly emerging and accelerating in the corporate world.

The first draft of the script for this transformation was written by MicroStrategy in 2020, which pioneered the transformation of a public company into an investment vehicle for crypto assets. However, the case of Bitmine marks the entry of this script into version 2.0 - a new stage that is more radical and more narratively impactful. It is no longer just copying MicroStrategy's Bitcoin path, but by choosing Ethereum, a different underlying asset, and cleverly pushing Tom Lee, a well-known Wall Street analyst, to the chairman's throne, it has created an unprecedented combination of market catalysts.

Is this a new paradigm of sustainable value creation that cleverly uses financial engineering and deep insights into the future of digital assets? Or is it a dangerous bubble driven by speculative sentiment, with company stock prices completely decoupled from fundamentals? This article will analyze this phenomenon in depth, from the "Bitcoin Standard" of the founder MicroStrategy, to the different fates of its followers around the world, to the market mechanism behind the Bitmine surge, trying to reveal the truth of this alchemy in the digital age.

Chapter 1: Genesis - MicroStrategy and the Forging of the "Bitcoin Standard"

The current wave began with MicroStrategy (NASDAQ:MSTR) and its visionary (or reckless) CEO, Michael Saylor, who in 2020 made a big bet that would radically change the company's fortunes as its core software business struggled to grow.

In the summer of 2020, the world was shrouded in unprecedented monetary easing policies caused by the COVID-19 pandemic. Saylor was keenly aware that the company's $500 million cash reserves were facing severe inflation erosion. He vividly compared the cash to a "melting ice cube" whose purchasing power was disappearing at a rate of 10% to 20% per year. In this context, finding a means of storing value that can fight currency depreciation has become a top priority for the company. So, on August 11, 2020, MicroStrategy officially dropped a bombshell on the market: the company has spent $250 million to purchase 21,454 bitcoins as its main corporate reserve assets. The day before the announcement (August 10), its stock price closed at $12.36. This decision is not only a bold innovation in the financial management of listed companies, but also a landmark event, which has drawn a blueprint for reference for later generations.

MicroStrategy's strategy quickly evolved from using its existing cash to a more aggressive model: using the capital markets as a "cash machine" for its Bitcoin. The company raised billions of dollars through the issuance of convertible bonds and "at-the-market" (ATM) stocks, almost all of which were used to continue to increase its holdings of Bitcoin. This model forms a unique flywheel: using high stock prices to obtain low-cost funds, and then investing funds in Bitcoin, and the rise in Bitcoin prices further pushes up stock prices. However, this road is not smooth sailing. The cold winter of the crypto market in 2022 brought a severe stress test to MicroStrategy's leveraged model. As the price of Bitcoin plummeted, its stock price was also hit hard, and the market focus was once focused on the company's $205 million Bitcoin mortgage default risk.

Despite the severe test, MicroStrategy's model finally survived. As of mid-2025, through this unremitting accumulation, its Bitcoin holdings have exceeded an astonishing 590,000, and the company's market value has jumped from a small company with less than $1 billion to a giant with a market value of more than $100 billion. Its real innovation is not just buying Bitcoin, but reshaping the entire company's structure from a software company to a "Bitcoin Development Company." It provides investors with a unique, tax-advantaged and institution-friendly Bitcoin exposure through the public market. Saylor himself even compared it to a "leveraged Bitcoin spot ETF." It does not simply hold Bitcoin, but turns itself into the most important Bitcoin acquisition and holding machine on the public market, creating a new category of listed companies-a proxy tool for crypto assets.

Chapter 2: Global Disciples - Comparative Analysis of Transnational Cases

MicroStrategy's success ignited the imagination of the global business community. From Tokyo to Hong Kong, and to other corners of North America, a group of "disciples" began to emerge, either completely copying or cleverly adapting it, staging a series of exciting capital stories with different endings.

Note: Stock prices and holdings are approximate, calculated based on available data, and peak increases are rough estimates.

Japanese investment company Metaplanet (3350.T) is hailed by the market as the "Japanese version of MicroStrategy". Since launching its Bitcoin strategy in April 2024, its stock price has performed amazingly, rising more than 20 times. Metaplanet's success has a unique local factor: Japan's tax law makes it more advantageous for local investors to invest in Bitcoin indirectly by holding its stocks than to hold cryptocurrencies directly.

The case of Meitu Inc. (1357.HK) is a crucial warning. In March 2021, the company, famous for its photo editing software, announced the purchase of cryptocurrencies, but this attempt did not bring the expected stock price surge. Instead, it was mired in financial reporting due to old accounting standards. The company's CEO Wu Xinhong later reflected that this investment distracted the company's attention and caused a negative correlation between the stock price and the crypto market - "When Bitcoin plummeted, our stock fell immediately, but when Bitcoin rose, our stock did not rise much."

In the U.S., two very different imitators have emerged. Medical technology company Semler Scientific (SMLR) is a representative of radical transformation. It almost completely copied MicroStrategy's playbook in May 2024, and its stock price jumped accordingly. In contrast, Block (SQ), a financial technology giant led by Twitter founder Jack Dorsey, took an earlier and more gentle integration route, and its stock price performance is more tied to the health of its core financial technology business.

Japanese gaming giant Nexon (3659.T) provides a perfect contrast. In April 2021, Nexon announced the purchase of $100 million worth of Bitcoin, but clearly defined the move as a conservative financial diversification operation, using less than 2% of its cash reserves. Therefore, the market reaction was also extremely flat. Nexon's example strongly proves that it is not the act of "buying coins" itself that detonates stock prices, but the narrative of "all in" - that is, the company's radical attitude of deeply binding its own destiny with crypto assets.

Chapter 3: Catalyst - Deconstructing Bitmine's Skyrocketing Storm

Now, let's go back to the center of the storm, Bitmine (BMNR), and analyze its unprecedented stock price surge. Bitmine's success is not accidental, but the result of a carefully formulated "alchemical formula".

Anatomy of a surge – BMNR share price performance (June-July 2025)

First is the differentiated narrative of Ethereum. In the context that the story of Bitcoin as a corporate reserve asset is no longer new, Bitmine has taken a different approach and chosen Ethereum, providing the market with a new story that is more futuristic and has more application prospects. Secondly, the power of the "Tom Lee Effect". The appointment of Tom Lee, the founder of Fundstrat, as chairman is the most powerful catalyst in the entire incident. His joining instantly injected huge credibility and speculative appeal into this small-cap company. Finally, there is the endorsement of top institutions. The private placement was led by MOZAYYX, and the list of participants included a number of top crypto venture capital and institutions such as Founders Fund, Pantera, and Galaxy Digital, which greatly encouraged the confidence of retail investors.

This series of operations shows that the market for this type of crypto proxy stock has become highly "reflexive", and its value driver is no longer just the assets held, but also the "quality" and "viral potential" of the stories it tells. The real driving force is this perfect narrative cocktail composed of "novel assets + celebrity effect + institutional consensus".

Chapter 4: The Invisible Engine Room: Accounting, Regulation and Market Mechanisms

The formation of this wave is inseparable from some invisible but crucial structural pillars at its bottom. The most important structural catalyst behind this new wave of corporate coin purchases in 2025 is a new rule issued by the US Financial Accounting Standards Board (FASB): ASU 2023-08. This standard, which officially came into effect in 2025, completely changed the accounting treatment of crypto assets by listed companies. According to the new regulations, companies must measure their crypto assets at fair value, and changes in value are directly recorded in the income statement every quarter. This replaces the old rule that gave CFOs a headache in the past, clearing a huge obstacle for companies to adopt crypto asset strategies.

On this basis, the core of the operation of these crypto proxy stocks lies in a subtle mechanism pointed out by institutional analysts such as Franklin Templeton - the "Premium-to-NAV Flywheel". The stock prices of these companies are usually traded at prices far higher than the net value (NAV) of the crypto assets they hold. This premium gives them a powerful "magic": companies can issue additional shares at high prices and use the cash obtained to buy more crypto assets. Since the issuance price is higher than the net asset value, this operation is "value-added" for existing shareholders, thus forming a positive feedback loop.

Finally, the approval and success of Bitcoin spot ETFs led by BlackRock in 2024 fundamentally changed the landscape of crypto investing. This has a complex dual impact on corporate reserve strategies. On the one hand, ETFs are a direct competitive threat, theoretically eroding the premium of proxy stocks. But on the other hand, ETFs are powerful allies, bringing unprecedented institutional money and legitimacy to Bitcoin, which in turn makes corporate inclusion on their balance sheets seem less radical and unorthodox.

summary

Through the analysis of this series of cases, we can see that the corporate crypto reserve strategy has evolved from a niche means of hedging inflation to a radical new paradigm of capital allocation that reshapes corporate value. It blurs the boundaries between operating companies and investment funds, and turns the public equity market into a super lever for large-scale accumulation of digital assets.

This strategy shows its amazing duality. On the one hand, pioneers like MicroStrategy and Metaplanet have created a huge wealth effect in a short period of time by skillfully riding the "net asset value premium" flywheel. But on the other hand, the success of this model is inseparable from the violent volatility of crypto assets and the speculative sentiment of the market, and its inherent risks are equally huge. The lessons learned from Meitu and the leverage crisis faced by MicroStrategy in the 2022 crypto winter clearly warn us that this is a high-risk game.

Looking ahead, with the full implementation of FASB's new accounting standards and the success of the new "Ethereum + opinion leader" script demonstrated by Bitmine, we have reason to believe that the next wave of corporate adoption may be brewing. In the future, we may see more companies turn their attention to more diverse digital assets and use more mature narrative techniques to attract capital. This grand experiment on corporate balance sheets will undoubtedly continue to profoundly reshape the intersection of corporate finance and the digital economy.