Original Article: Dennis Liu , General Partner, Momentum 6

Compiled by Yuliya, PANews

With the upcoming launch of $WLFI, the Trump family's crypto project, market interest is growing. Momentum 6 General Partner Dennis Liu delved into $WLFI's investment value in this article. He not only detailed the token's stablecoin mechanism, pegged to US Treasuries, and its strong institutional backing, but also disclosed his seven-figure investment position and $1 price target. The author believes that $WLFI, with its blend of political, financial, and highly speculative attributes, is one of the most noteworthy events of this cycle. The following is the original article, which has been translated by PANews.

What is $WLFI and why is it important?

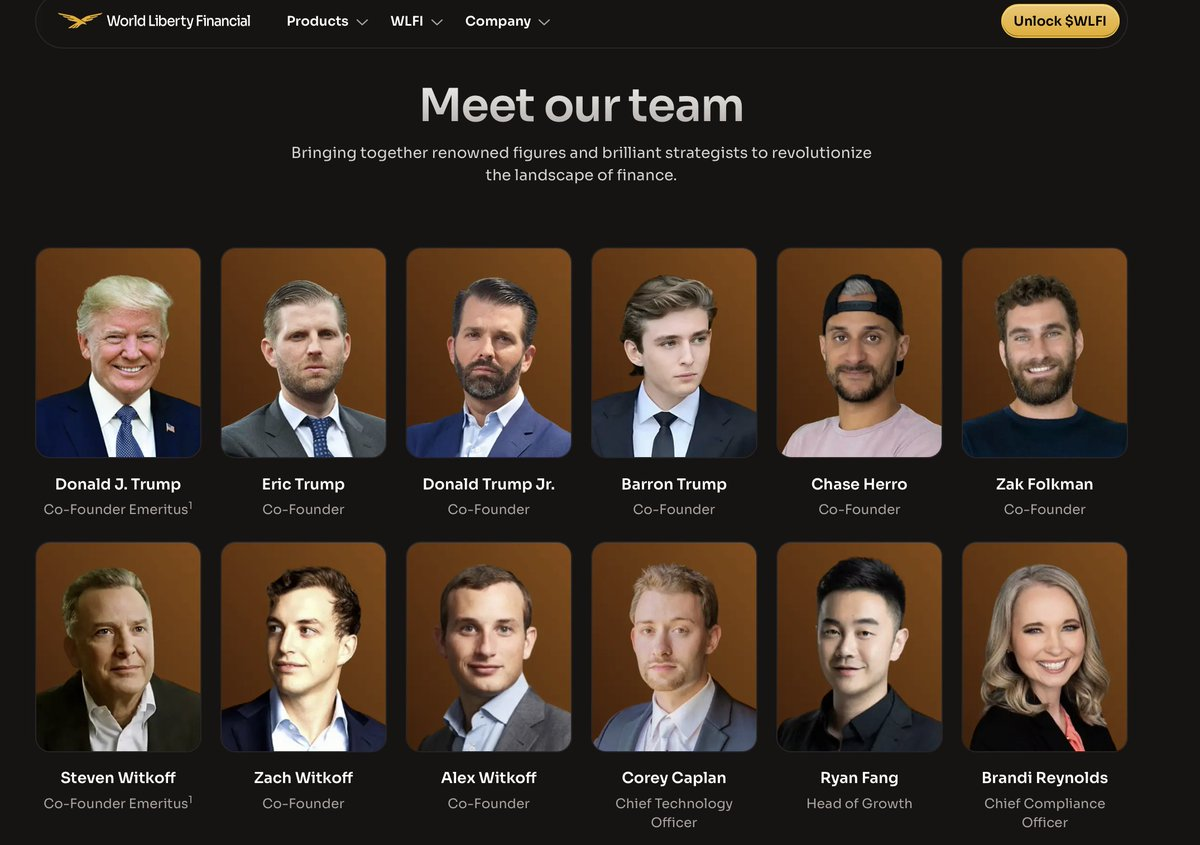

$WLFI is the official Trump token, co-founded by Eric Trump, Donald Trump Jr., and Barron Trump. Trump himself was included in the team before he took office. This project is not a simple memecoin, but is closely linked to the regulated stablecoin USD1. USD1 is backed by U.S. Treasury bonds, making $WLFI both a political tool and a financial tool.

On September 1st, $WLFI will be available on all major exchanges, including Binance, and futures contracts will also be launched. As part of the pre-sale, 20% of the tokens will be immediately released for circulation, while the remaining 80% will enter a lock-up mechanism. For most traders, this will be their first opportunity to gain exposure to $WLFI.

Positions and Strategies

I've been buying $WLFI through the pre-market futures market, first at $0.40, then adding to my position at $0.30, and continuing to buy more between $0.22 and $0.24. My average entry cost is $0.28, and the current price is $0.25. Yes, you can get in even cheaper than I did right now.

The key to my strategy is using only 1x leverage—no leverage at all. Pre-market prices fluctuate drastically, and even 1.5x leverage can result in liquidation. Using 1x leverage is essentially the same as spot trading, with no liquidation risk and no funding fees. This is precisely why I'm able to comfortably hold a seven-figure USD long position in $WLFI.

Price targets and institutional layout

My price target is $WLFI reaching $1 (corresponding to a fully diluted valuation of $100 billion).

For reference, a memecoin previously launched by Trump lacked practicality and saw little adoption, yet still reached a peak FDV of $73 billion. In contrast, $WLFI not only enjoys official recognition, is pegged to US Treasury bonds, and was launched during Trump's presidency, significantly increasing its credibility and potential cap.

Institutional investors have also made early arrangements:

- DWF Labs invested $25 million at $0.10;

- Aqua One Fund invested $100 million at $0.125;

- Nasdaq-listed ALT5 Sigma invested $1.5 billion at $0.20.

Relative to the current price of $0.25, it is only 25% higher than the investment price of Nasdaq-listed companies.

Diversified investment strategies

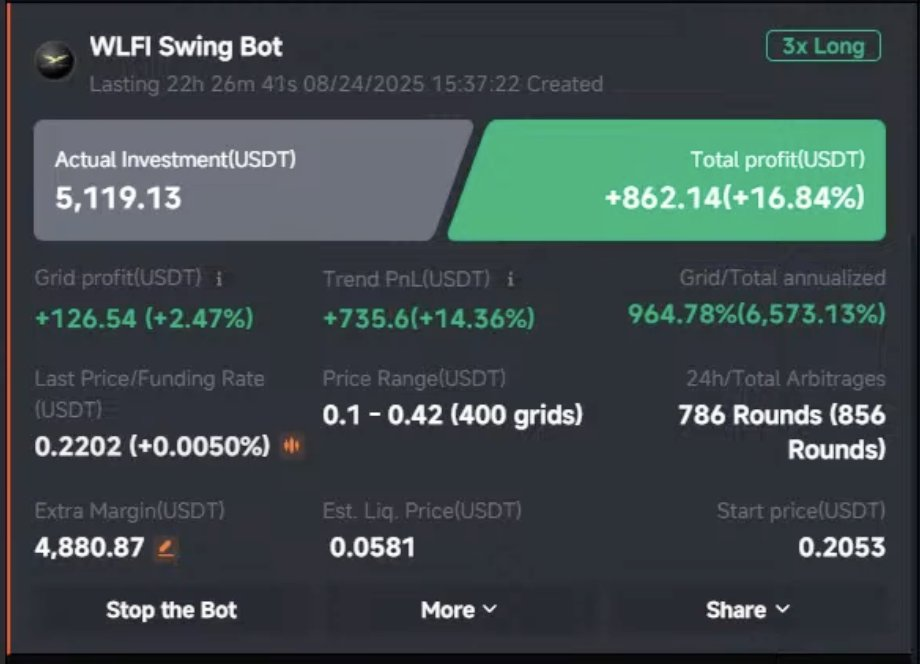

In addition to holding directly, I also run a $WLFI trading bot on Pionex. The grid interval is set between $0.10 and $0.42. In just 22 hours, it has already generated a 2.5% profit (an annualized return of 960%). For investors unwilling to hold long-term, volatility alone can yield substantial returns.

Additionally, there are two higher-risk ecosystem projects worth watching:

- One is $BLOCK ( Blockstreet ), founded by the CIO of $WLFI and the launch platform for USD1;

- Another is $DOLO ( Dolomite ), led by the CTO of $WLFI and a DeFi service provider for USD1.

These projects have smaller market capitalizations, meaning greater potential upside, but also higher risk.

If $WLFI doubles in price, these two tokens could potentially rise 3-4x in value, but if $WLFI falls, they could fall even more. Therefore, achieving balance in your portfolio is crucial.

Overall, $WLFI is undoubtedly one of the most significant token events of this cycle. Its identity is more than just a narrative; it combines political influence, financial attributes, and speculative value. Its status as the official Trump token, institutional endorsement, and stablecoin pegged to US Treasury bonds have made it a focus of intense market attention.