Article | Coindesk

By Bryan Courchesne

Compiled by Portal Labs

When talking about compliance in the Web3 world, taxation is often the most overlooked yet the most difficult part to deal with.

Although mainland China has not yet opened up to cryptocurrency transactions and the relevant tax system is still blank, crypto assets have gradually been incorporated into the mainstream tax regulatory framework globally, especially in the United States, where reporting requirements are becoming more detailed and mandatory.

From the transparency of on-chain behavior, to the tax reporting problems of CEX and DEX, to the cost benchmark tracking obligations of personal wallets, the Web3 world is being covered by a more sophisticated and stricter tax framework. More importantly: once the compliance path is opened, taxation is the first entry threshold.

For high-net-worth investors with global asset allocation needs, understanding the evolution of these systems is not a distant proposition, but an important reference for judging future compliance trends and optimizing cross-border structural layout. Therefore, Portal Labs has compiled and compiled this tax observation content for everyone to understand the core points and professional suggestions of crypto asset tax treatment in the current mainstream jurisdictions.

The following is the main text.

As financial and tax consultants who have been deeply involved in the crypto space, we are well aware of the tax treatment scenarios unique to such assets. For example:

- Cryptocurrencies are not subject to the “wash sale rule”, allowing for more efficient tax loss harvesting strategies

- Supports direct asset exchange (such as BTC-ETH or ETH-SOL) without converting to fiat currency first

These characteristics make crypto assets distinct from traditional investments.

But what investors need to be most wary of is that the huge amount of data brought about by multi-platform operations often causes tracking difficulties during tax filing season.

Crypto tax management is not a year-end sprint, but a year-round battle - especially when you are active on multiple centralized exchanges (CEX) and decentralized platforms (DEX). Every transaction, exchange, airdrop, staking income or cross-chain transfer may trigger tax obligations at any time.

Tax pain points of centralized exchange transactions

When investors use centralized exchanges (CEX) such as Coinbase, Binance or Kraken, the year-end tax summaries provided by the platforms often have two major flaws: incomplete cross-platform data and broken cost benchmarks. This is in stark contrast to the traditional securities market.

In traditional stock trading, if you buy Amazon stock through your Fidelity account and then transfer it to your Charles Schwab account:

- Automatic synchronization of original cost base transfer

- Update position data in real time for each transaction

- Charles Schwab directly generates accurate 1099 tax reports (complete presentation of annual profit and loss)

However, in the crypto world, when you transfer assets from Kraken to Coinbase:

- Cost basis reset to zero (original purchase information does not transfer with assets)

- Cross-platform flows create data black holes (each transaction needs to be manually recorded)

- Facing a data reconstruction nightmare during tax season (missing records will lead to tax filing bias)

This structural defect forces crypto investors to establish a transaction ledger system throughout the year. Especially when assets flow between multiple CEXs and decentralized platforms (DEX), every exchange, airdrop or even cross-chain transfer may become a trigger for a taxable event.

Decentralized exchange transactions

When using a DEX, the complexity is even greater. When you connect to decentralized exchanges such as Uniswap and Jupiter through wallets such as Coinbase Wallet (note: not Coinbase exchange) or Phantom, these DEXs neither provide tax reports nor track your cost basis, so the responsibility of recording and verifying each transaction falls entirely on your shoulders.

If you miss a token exchange or forget to record the fair value of a liquidity pool withdrawal, your tax return may be distorted. This may trigger an IRS audit or even lead to loss of tax deduction eligibility. Although some applications can calculate the profit and loss of a single wallet address, these tools often fail when assets are transferred between addresses - which greatly reduces the practical value for active users.

What’s even more tricky is that if you trade frequently on DEX, you are likely to be in a loss. But even if you are losing money, you must declare it accurately to qualify for the deduction. Otherwise, you may not only lose the right to deduction, but even worse, you may face a tax audit.

Unless you are a professional crypto trader, the time and effort required to track each trade is not only a source of stress, but also a real financial drain.

Q: How to ensure tax compliance?

There are several ways to properly prepare for crypto taxes:

- Tax software is available right from the start, but manual verification of transaction logic and timely calibration of data are still required

- Hire a crypto tax expert, or choose a financial and tax consultant who is proficient in the cryptocurrency ecosystem.

- Export all transaction logs and hand them over to a certified public accountant to build a cost baseline and calculate actual profits and losses.

As adoption increases, tax reporting will inevitably evolve, and in the meantime, continuing to track transaction activity is critical to preparing for tax season.

More information - Saim Akif

Q: Why are advisors paying close attention to cryptocurrencies?

A: Institutional crypto inflows have soared to $35 billion. Although cryptocurrencies are more volatile than traditional assets, mainstream cryptocurrencies such as Bitcoin have long outperformed traditional asset classes since 2012.

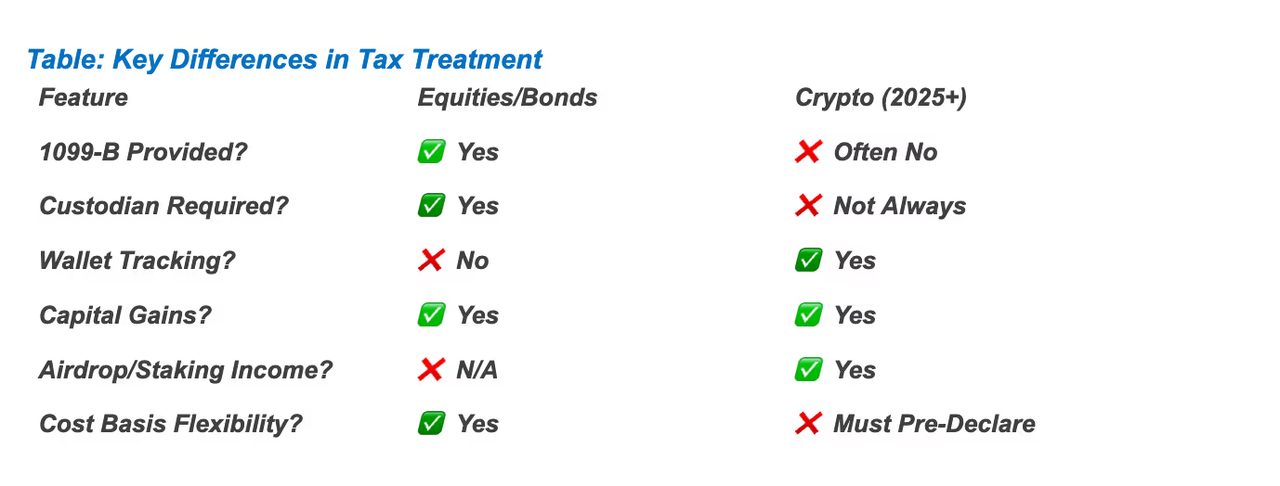

Q: What are the differences in tax treatment between crypto assets and stocks/bonds?

A: Crypto assets are fundamentally different from stock and bond products in terms of taxation.

- Wallet cost tracking. Advisors must independently calculate the cost benchmark for each wallet (mandatory from January 2025)

- Tax reporting vacuum. Exchanges rarely provide traditional 1099 tax reporting, especially for self-custodial assets.

Q: What professional advice do you have for CPAs and tax advisors?

A: Compliance has become a legally mandatory requirement. For the 2025 tax year declaration:

- Wallet-level cost benchmark reporting is mandatory (per IRS Notice 2024-21)

- IRS Form 1099-DA will be effective for tax year 2026 (Section 80603 of the Infrastructure Investment and Jobs Act)

- Exchanges that hold digital assets generally lack reporting support (SEC 2023 Compliance Guidance Item III.C.2)

Forward-looking tax agencies are integrating the following three core capabilities into high-end service products:

- Crypto asset tax declaration

- Tax audit response

- Decentralized Finance (DeFi) Accounting