Written by Deng Tong, Golden Finance

On October 21, 2025, Coinbase acquired Echo, a leading on-chain financing platform, for approximately $375 million. The Echo platform makes it easier for community members to raise funds and invest, whether through private placements on Echo or public sales using Sonar.

What is Echo? Who founded it? Why is Coinbase so interested in it? Will ICOs make a comeback?

1. What is the Echo platform? Who is its founder?

In 2023, Echo, founded by crypto OG Cobie (Jordan Fish) and former fund manager Lexie, is an on-chain fundraising platform that allows blockchain projects to conduct private or public token issuances to the community or investors through platform tools. The platform aims to help "join the professional investment community in private financing rounds for new startups or token projects." Its focus is on "enabling projects to raise funds directly from the community," "enabling investors to participate earlier," and "making the process more transparent." In May 2025, Echo launched its Sonar product and tweeted on X: "We're making on-chain fundraising accessible to everyone. Introducing Sonar."

Its founder, Cobie, is a well-known figure in the crypto space. Cobie entered the crypto space in 2013, initially for speculation and interest, purchasing assets such as BTC, ETH, and DOGE early on. In 2020, he founded the crypto podcast "UpOnly," co-hosting it with Chris Dixon. The podcast has featured guests such as Elon Musk, Vitalik Buterin, CZ, and SBF, making it one of the most popular podcasts in the industry.

Cobie is also a top investor. During the bull market, he participated in the angel rounds of many early-stage projects, including Lido, Arbitrum, ENS, dYdX, and Friend.tech. This also laid the foundation for his subsequent creation of the on-chain fundraising platform Echo.

In response to Coinbase’s recent acquisition of Cobie, Cobie stated at X: “Echo will remain a standalone platform under its existing brand for now, but we will integrate Sonar’s public sale product into Coinbase and potentially introduce new ways for founders to reach investors and provide investors with access to Coinbase.”

Coinbase said it plans to expand Echo’s infrastructure beyond cryptocurrencies, eventually supporting tokenized securities and real-world assets.

The acquisition complements Coinbase’s previous purchase of token management platform LiquiFi. Coinbase also invested $25 million to relaunch Cobie’s UpOnly podcast.

2. Echo's Star Product

In early 2024, Echo launched Private Group Investing, supporting private group fundraising with on-chain USDC settlement and multi-round distribution mechanisms. Mid-year, the Investor Dashboard launched, providing investors with investment history, project tracking, and return display capabilities. By the end of the year, the Founder Portal was launched, serving as a fundraising backend system for project owners, supporting token allocation, whitelisting, and smart contract deployment. In May 2025, Sonar, a self-hosted public offering tool, was launched.

Private Group Investing and Sonar are two of Echo's star products. Private Group Investing allows projects to initiate private placements through a "group leader + community member" structure, while Echo provides on-chain tools, smart contracts, USDC circulation, and standardized processes. Sonar allows projects to conduct their own "self-hosted" public token sales. Developers can use the Sonar tool to raise funds directly from the community, rather than being limited to traditional private placements.

Echo's most notable success story is Plasma. On May 27, 2025, Plasma officially announced its public sale using Echo's new token sale infrastructure, Sonar. Sonar handled Know Your Customer (KYC) verification, jurisdiction screening, and other checks on Plasma's behalf, while Plasma was responsible for the sale execution, including the transfer of all funds and tokens.

The case of MegaLabs also attracted attention. In December 2024, MegaLabs raised $10 million in less than three minutes using the Echo platform. MegaLabs co-founder Shuyao Kong revealed that the company's initial goal was to raise $4.2 million, which it achieved in just 56 seconds after launching its crowdfunding campaign. Due to overwhelming investor demand, the project raised an additional $5.8 million, fully funded within 70 seconds.

In addition, according to Cobie, Ethena, which caused a stir in the market when USDe was first launched in 2024, was also an important early fundraising project of Echo and one of the first projects that Echo helped to complete fundraising.

3. Why is Coinbase so fond of Echo?

Coinbase answered this question in a blog post: Creating a more complete capital market and building a full-stack solution from launch to financing to secondary markets.

The "why" is simple. We want to create more accessible, efficient, and transparent capital markets. But today, founders often struggle to raise capital, and individual investors lack access to private token sales.

Echo solves this problem by allowing projects to raise funds directly from the community, either through private offerings or by launching their own public token sales using Sonar. Integrating Echo's tools will help us achieve more direct community engagement, connecting projects with capital entirely on-chain. While we will initially conduct crypto token sales through Sonar, we plan to leverage Echo's infrastructure to gradually expand support to tokenized securities and real-world assets.

Echo has made significant progress in opening up private markets, helping approximately 300 projects raise over $200 million since its launch. Its new, self-operated public token sale product, Sonar, has also seen initial success, powering Plasma's XPL token sale.

With this acquisition, we are building a full-stack solution for crypto projects and investors, covering everything from launch to fundraising to secondary trading.

- For builders: easier access to capital and community-aligned fundraising tools, such as Echo for private investment groups and Sonar for self-hosted public token sales;

- For investors: New and differentiated opportunities that were previously unavailable are available through trusted platforms like Echo or directly through Sonar;

- For the on-chain economy: Create a more efficient, transparent, and globally accessible capital market to drive innovation and growth.

Echo complements our recent acquisition of Liquifi, which simplifies token creation and cap table management for early-stage teams. Liquifi strengthens our ability to provide early-stage support to entrepreneurs, while Echo extends that support to fundraising. Combined with our existing strengths in exchange listing, custody, staking, trading, and fundraising, we are now able to provide full lifecycle support for token issuers and investors, from issuance to fundraising and subsequent market access.

4. Will the Initial Coin Offering (ICO) boom make a comeback?

The significance of Coinbase’s acquisition goes beyond mere corporate expansion. Coinbase may be fueling a wave of regulated, community-driven token sales, which could have profound implications for future investment models in the cryptocurrency space.

According to Tiger Research, platforms such as Sonar, Buidlpad, Legion and Kaito are leading a new wave of compliant startup platforms whose KYC and transparency measures combine accessibility with investor protection.

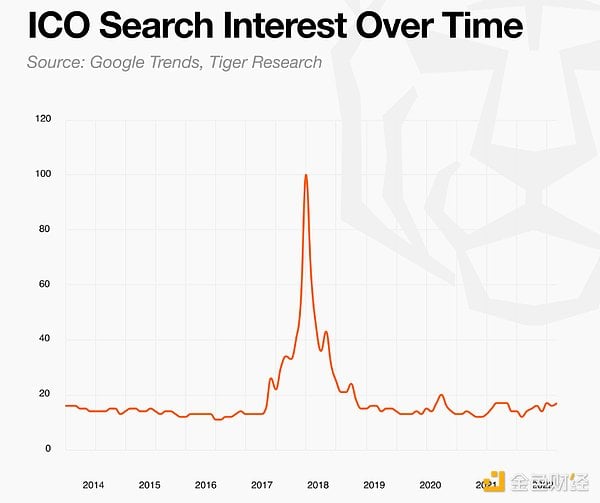

In 2017, numerous blockchain projects emerged through initial coin offerings (ICOs), such as Ethereum, Chainlink, and Filecoin. However, the ICO craze quickly cooled due to regulatory concerns. The SEC classified many ICOs as unregistered securities offerings.

But Sonar offers a different model for ICOs—one conducted transparently through self-custody. Echo’s Sonar product perfectly aligns with this trend: it allows founders to conduct their own public token sales directly on blockchains like Base, Solana, Cardano, and Hyperliquid.

For Coinbase, integrating Sonar could transform its exchange from a trading hub into a global funding portal, giving verified users access to early-stage investment opportunities previously only available to venture capital firms.

While consolidating its position as a leading exchange in the industry, Coinbase also provides a new possibility for the crypto-financial market - the "ICO 2.0 era" may be coming in a compliant and transparent manner.