By Wilbur Fernandes

Compiled by Shaw Golden Finance

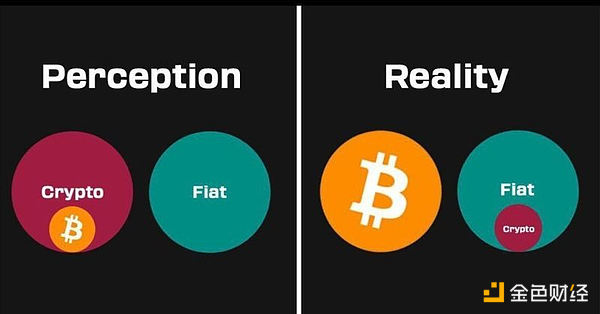

Take a look at the image above. What it reveals has completely changed my perspective on money, investing, and the future. For a long time, I thought Bitcoin was just another "cryptocurrency"—like the thousands you see on apps like Coinbase or Binance. Boy, was I wrong.

When you're first starting out, no one tells you this: Bitcoin and "cryptocurrency" are not the same thing. In fact, they're completely opposite. It took me way too long to figure this out, and I wish someone had explained it to me sooner. So let me explain it in simple, understandable terms.

The biggest lie in finance today

When most people hear the word "cryptocurrency," they tend to lump it all together. Bitcoin, Ethereum, Dogecoin, Shiba Inucoin—they all seem like different variations of the same digital currency, right? And that's exactly what the cryptocurrency industry wants you to think.

But here’s the thing: Bitcoin is trying to replace our existing, flawed monetary system. Everything else? They’re just companies trying to profit from our existing, flawed system.

Think of it this way. Imagine our existing financial system is a leaky boat. Most cryptocurrency projects are like selling you a better bucket for scooping water, a fancier pump, or more expensive boat decorations. But Bitcoin? Bitcoin is building you a brand new, leak-proof boat.

Why Almost Everything Called "Cryptocurrency" Is Really Just a Wolf in Sheep's Clothing

Let me tell you something that shocked me when I first learned about it. With the exception of Bitcoin, almost all major cryptocurrencies operate exactly like regular companies. They have CEOs, marketing teams, headquarters, and boards of directors that decide where your investment goes.

Take Ethereum, for example. It's run by the Ethereum Foundation, whose founder, Vitalik Buterin, regularly announces the direction of Ethereum's development. When they switched from one system to another (from "proof-of-work" to "proof-of-stake"), it wasn't because users voted to do so—it was because Ethereum's leadership decided it was best for business.

The same is true for Cardano, which is led by founder Charles Hoskinson. Solana is run by the Solana Foundation. These aren’t decentralized networks, but rather tech companies that issue tokens rather than stock certificates.

This is why so many people lose money in cryptocurrency scams. When you buy these tokens, you're essentially buying a stake in a company that has no legal obligation to do anything for you. The founders can make decisions that benefit them, adjust the direction of the business, or simply abandon the project altogether.

Remember when Facebook changed its name to Meta? Imagine if Mark Zuckerberg decided to completely pivot to something else, and your Facebook stock became worthless. This situation is actually very common in cryptocurrency projects.

What “decentralization” really means (and most cryptocurrencies aren’t)

Here’s another question that has puzzled me for a long time. Every cryptocurrency project claims to be “decentralized,” but what does that actually mean?

Most cryptocurrency companies think that decentralization means storing copies of the database on partners’ computers, rather than just on their own. It’s like a group of friends putting copies of the club rules at each other’s houses and calling it “decentralized” because no one has the only copy.

But this isn’t true decentralization; it’s just a company with a good backup system.

True decentralization means anyone in the world can participate, without anyone's permission. With Bitcoin, you can download the software and start participating in the network instantly, and no one can stop you. You don't need the foundation's approval, meet any wealth requirements, or require anyone's permission.

Like most other cryptocurrencies? Good luck. To validate transactions on Ethereum, you need around $50,000 to $100,000 worth of ETH. This directly excludes 99% of the world's population. Those who can participate are mostly institutions and wealthy individuals—the same people who control our current financial system.

Bitcoin: A truly meaningful rebel

Bitcoin is different. Very different. When someone using the name Satoshi Nakamoto created Bitcoin, they weren't trying to start a company or get rich. They were trying to solve a millennia-old problem: How do you create a currency that can't be controlled or manipulated by governments and banks?

Here are some things that make Bitcoin special:

Fixed Supply: There will always be only 21 million Bitcoins. No company can print more Bitcoins to maintain operations. No government can issue more Bitcoins to pay its bills. No CEO can dilute your Bitcoin by issuing more. It's mathematically impossible.

Anyone can participate: You can secure the Bitcoin network with hardware cheaper than a smartphone. You can send Bitcoin to anyone in the world without permission from any bank or government. You can store Bitcoin without trusting any company.

No one controls Bitcoin: Bitcoin has no CEO, corporate headquarters, or board of directors. Its founder vanished more than a decade ago, leaving Bitcoin to operate independently. Making changes to Bitcoin requires the consent of its users worldwide—a process so difficult that it has remained remarkably stable for over 14 years.

It's actually quite secure: Bitcoin uses a mechanism called "proof of work," which means the network's security is guaranteed by computers solving mathematical problems that consume actual electricity. This isn't just clever programming; it's a matter of physics. To attack Bitcoin, you'd need to consume more electricity than you'd gain from the attack.

Why Bitcoin Uses So Much Energy (and Why It's Actually Good)

You may have heard that Bitcoin “wastes” a lot of energy. I used to think so too, until someone explained to me what that energy actually does.

Bitcoin doesn't consume energy to speed up payment processing. Instead, it uses energy to create absolute truth in the digital world. Every 10 minutes, computers around the world compete to write the next page in Bitcoin's history. The winner must prove they completed a massive computational effort, and once they win, that page of history becomes permanent and unchangeable.

This is a revolution. For the first time in human history, we have a way to create digital records that cannot be altered, deleted, or manipulated by any authority. When you receive Bitcoin, you can be 100% sure that these coins are real and that the transaction can never be reversed.

Compare this to other cryptocurrencies, where a small group of wealthy validators could potentially coordinate to alter transaction records. Or compare it to your bank account, where the bank can freeze your funds, reverse transactions, or even close your account entirely.

Bitcoin's energy consumption is not a waste, but the cost of building the most secure and trustworthy monetary system in human history.

Scaling Issues: Why Steady Progress Leads to Success

Another criticism you’ll hear about Bitcoin is that it’s “slow.” Bitcoin processes about 7 transactions per second, while newer cryptocurrencies claim to be able to process thousands per second.

But here's the thing—Bitcoin's base layer is designed like the foundation of a house. It needs to be strong, not fast. Every Bitcoin transaction is final, like moving gold bars between bank vaults. It's supposed to be secure and permanent, not fast and convenient.

For everyday transactions, Bitcoin has solutions like the Lightning Network, which enables instant Bitcoin payments. It’s like having a solid foundation (the Bitcoin mainnet) with a fast and convenient room (the Lightning Network) built on top.

Other cryptocurrencies have tried to make their infrastructure faster, but this always comes with trade-offs. Solana can process thousands of transactions per second, but its network has crashed multiple times—something Bitcoin has never experienced. Would you rather have a rock-solid infrastructure that requires you to build extra layers for convenience, or a faster infrastructure that could completely collapse?

Why governments treat Bitcoin differently

Here's an interesting phenomenon that helps me understand the difference between Bitcoin and cryptocurrencies: how governments around the world regulate them.

Most crypto projects are regulated like corporations because they are corporations. The U.S. Securities and Exchange Commission (SEC) can take action against the Ethereum Foundation, subpoena Cardano executives, or shut down Solana's development team. These projects have offices, employees, and decision-makers who can be held accountable.

Bitcoin? There's no Bitcoin company to regulate. No CEO to arrest. No headquarters to shut down. Bitcoin is simply software running on computers around the world, just like email or the internet itself.

That's why even regulators skeptical of Bitcoin acknowledge its uniqueness. They call it "digital gold" or a "commodity," not a security issued by a company. Some countries have even designated Bitcoin as legal tender, something they would never do with a cryptocurrency company's token.

The Problem Bitcoin Really Solves (and Why It Matters)

The more I learned about Bitcoin, the more I realized it wasn't trying to be a better payment app or a faster way to transfer money. Bitcoin was trying to solve a problem with money itself.

Think about it—when we step back and examine our current monetary system, it's pretty bizarre. Governments can print money without limit, which devalues your savings over time. Banks can freeze your account, reverse your transactions, or prevent you from sending money to certain people or places. Financial institutions can exclude entire groups from the banking system.

For most of human history, people used currencies that were not controlled by authorities—such as gold, silver, or other scarce commodities. But these physical currencies had limitations. They were difficult to transport, indivisible, and easily stolen.

Bitcoin combines the best qualities of traditional currencies (scarcity and independence from authority) with the advantages of digital technology (instant global transfers and perfect divisibility). It’s like owning digital gold that you can send instantly to anyone in the world.

Network Effects: Why Bitcoin Keeps Winning

As I delved deeper into this space, one thing became clear to me. While thousands of alternative cryptocurrencies are created every year, Bitcoin continues to thrive. It has the most users, the strongest security, the widest acceptance, and the most real-world applications.

Historically, this makes sense. People tend to choose the best form of money at the time. Gold reigned supreme for thousands of years not because governments forced people to use it, but because it simply outperformed other currencies.

In the digital world, Bitcoin follows the same pattern: despite new cryptocurrency projects claiming to be faster, cheaper, or more advanced, people continue to choose Bitcoin for long-term savings and real monetary purposes.

When large institutions, governments, and corporations get involved in the cryptocurrency space, their focus is ultimately on Bitcoin. They may trade other tokens for speculation, but when they need to store significant wealth in digital form, they choose Bitcoin.

Make the right choice for your future

Learning all this completely changed my perspective. I no longer viewed cryptocurrencies as a get-rich-quick scheme or a way to trade the latest hot token. I began to understand that Bitcoin might be the most important monetary innovation in hundreds of years.

The cryptocurrency industry spends billions on marketing, partnerships, and hype, trying to convince people that their tokens represent the future. But the future of money lies not in complexity, fancy features, or the latest technological innovations, but in returning to the sound money principles that have proven effective for thousands of years, improved upon with the help of modern technology.

Every penny you spend chasing the latest cryptocurrency trend is a penny that could be used to acquire what is arguably the best form of money in the world. Every hour you spend researching which altcoin to buy next is an hour that could be spent understanding the monetary revolution taking place.

I'm not trying to preach or convince you, but I'm sharing my thoughts because I wish someone had explained these concepts to me when I first started. Understanding the difference between Bitcoin and cryptocurrencies has completely changed my financial strategy and given me more confidence in my decisions.

The image at the top of this article represents a choice we all have to make. We can accept the notion that everything digital and monetized is essentially the same, or we can take the time to understand what is actually happening in the world of money and technology.

Whatever you decide, make sure you're making an informed choice, not just following the crowd or believing marketing hype. Your financial future could depend on it.