Author | Wu Shuo Blockchain

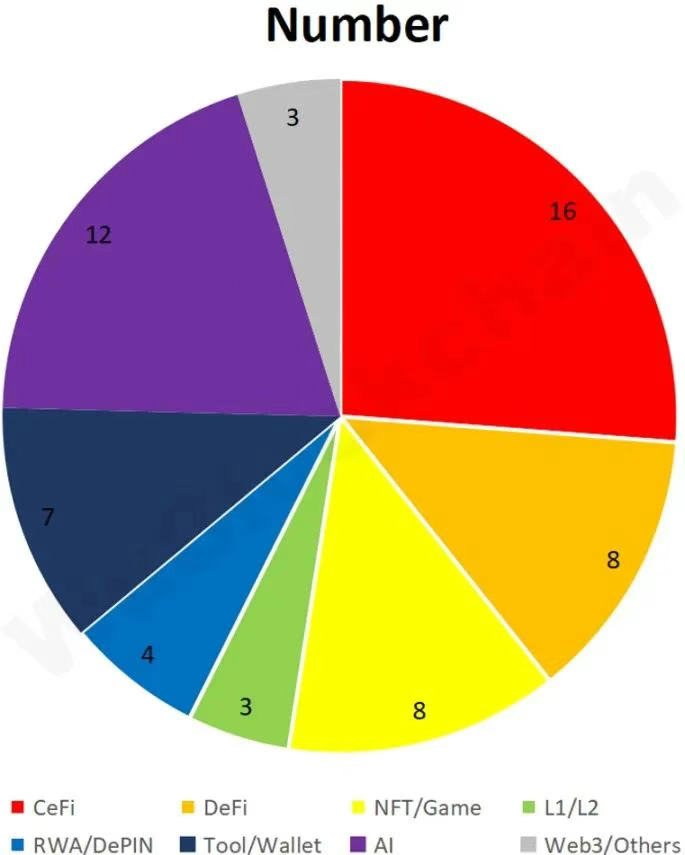

According to RootData, there were 61 publicly disclosed venture capital projects in the Crypto VC sector in July 2025, a 7.6% decrease from the previous month (66 projects in June 2025) and a 46.5% decrease from the previous year (114 projects in July 2024). The number of small financings continues to decline. Note: Since not all financings are announced in the same month, the above statistics may increase in the future. The number of projects in each sector is as follows:

Among them, CeFi accounts for about 26.2%, DeFi accounts for about 13.1%, NFT/GameFi accounts for about 13.1%, L1/L2 accounts for about 4.9%, RWA/DePIN accounts for about 6.6%, Tool/Wallet accounts for about 11.5%, and AI accounts for about 19.7%.

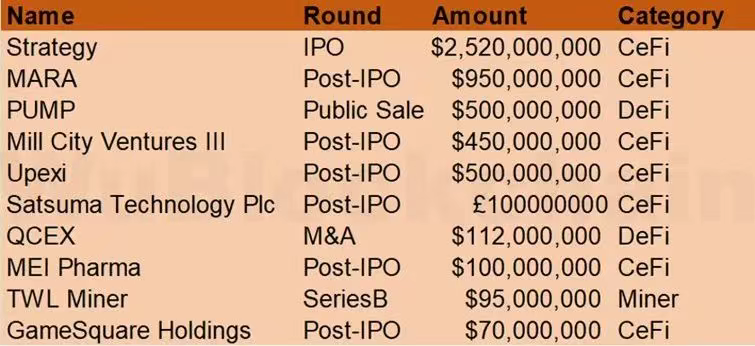

In July 2025, the total amount of funding reached $5.361 billion, a record high, up 88.4% from the previous month (a total of $2.846 billion in June 2025) and up 426.6% from the previous year (a total of $1.018 billion in July 2024). The top 10 rounds by amount are as follows:

Strategy (MSTR) raised $2.521 billion through its fourth preferred stock offering, Stretch (STRC), generating approximately $2.474 billion in net proceeds after deducting issuance fees. The proceeds were used to purchase 21,021 BTC at an average price of $117,256 per coin. Following the transaction, Strategy's BTC holdings increased to 628,791, with a market capitalization of approximately $74 billion. On August 1st, Strategy co-founder Michael Saylor announced plans to issue an additional $4.2 billion in preferred stock to purchase BTC.

MARA Holdings has completed an offering of $950 million in 0.00% convertible bonds maturing in 2032. The bonds were privately offered to institutional investors and included an over-allotment option of up to $200 million. The company expects to use the remaining proceeds to acquire additional Bitcoin and for general corporate purposes, including acquisitions and asset expansion. The proceeds will also be used to repurchase a portion of the convertible bonds due in 2026.

Pump.fun issued 125 billion PUMPs, representing 12.5% of the total supply, which sold out in less than 12 minutes. The sale raised $500 million, with funds distributed between on-chain exchanges and major exchanges such as Kraken, KuCoin, and Bybit.

Mill City Ventures III has completed $450 million in private equity funding and has initiated its SUI asset reserve strategy. Through over-the-counter agreements with the Sui Foundation and in-kind investments, it has accumulated 76,271,187 SUI tokens at an average cost of $3.6389. Participants in this round include Big Brain Holdings, Galaxy Digital, Pantera Capital, Electric Capital, GSR, and other institutions.

Upexi (NASDAQ: UPXI) has reached an agreement with AGP for up to $500 million in equity financing to accelerate its Solana treasury strategy. The financing terms include zero commitment fees, with Upexi determining the issuance cadence at its discretion. The proceeds will be used for general corporate purposes and to expand its Solana holdings. Upexi recently increased its treasury holdings to 1.9 million Sol.

Satsuma Technology PLC (Tao Alpha PLC), a publicly listed company, has completed its second round of private placement of convertible bonds, significantly exceeding the original minimum of £100 million. Satsuma stated that the funds will be used to expand its business and strengthen its Bitcoin adoption and decentralized AI strategies. Upon conversion of the convertible bonds, Satsuma will apply for listing on the London Main Market.

MEI Pharma (NASDAQ: MEIP) has completed a $100 million financing round, which it plans to use to purchase Litecoin (LTC) as a reserve asset. This move reportedly makes MEI the first company listed on a national exchange to hold Litecoin (LTC). Litecoin founder Charlie Lee has joined MEI's board of directors, and digital asset firm GSR has been hired as financial advisor. The financing, which included approximately 29.24 million shares at $3.42 per share, involved participation from the Litecoin Foundation and several institutional investors.

British cloud mining platform TWL Miner successfully completed its Series B financing, receiving US$95 million, which will be used to support the integration of artificial intelligence technology and cloud mining business.

Gamesquare Holdings, Inc. (NASDAQ: GAME) has completed an underwritten $70 million public offering, selling 46.7 million shares at $1.50 per share. According to the announcement, the proceeds are intended to support the company's ETH accumulation strategy, developed in partnership with crypto-native asset manager Dialectic, with a significant portion of the proceeds going toward increasing its ETH holdings.