In recent months, stablecoins have become an absolute hot commodity in the financial and cryptocurrency worlds! With the United States and Hong Kong successively passing legislation supporting stablecoins, internet giants and established financial institutions have jumped in, either hoarding them or applying for licenses. It's as if a spring breeze has suddenly arrived, bringing thousands of pear trees into bloom. Meanwhile, mainland China's policies remain largely unchanged, giving the impression of sitting on the saddle. News of the widespread use of stablecoins in Yiwu has been widely circulated online, citing two primary sources: a Huatai Securities research report showing that stablecoins have become a key tool for cross-border payments in Yiwu, and blockchain analysis firm Chainalysis estimating that on-chain stablecoin flows in Yiwu will exceed $10 billion by 2023.

Interestingly, when reporters conducted on-site research, most merchants said they had never heard of stablecoins and were unfamiliar with them. A few expressed doubts about their compliance and costs, and only a handful explicitly stated they had used them for payment. The situation felt a bit like the old man downstairs answering Charlotte, "Ma what Mei," "Ma Dong what," and "what Dong Mei." What's the real story? Let's delve into two sources of this information.

Huatai Securities Research Report

Based on publicly available information, I haven't been able to find any media outlets citing the specific name and source of this Huatai Securities research report. However, with the help of a colleague, I was able to find a 31-page report titled "How Will Stablecoins Impact the Global Monetary System?" published by Huatai Securities on June 25th. In eight chapters, Huatai Securities systematically expounds on the global development prospects and risks of stablecoins. On page 8, the report contains the following statement regarding the use cases of stablecoins:

"Beyond being used directly in cryptoasset transactions, stablecoins are rapidly growing in terms of their share in global goods and services transactions, their use as a store of value, and their penetration among residents. Specifically, in Yiwu, China, the world's small commodity center, stablecoins have become a crucial tool for cross-border payments. Blockchain analysis firm Chainalysis estimates that on-chain stablecoin flows in the Yiwu market will exceed $10 billion by 2023."

However, unlike other viewpoints in the report that are supported by data charts, this viewpoint is not accompanied by data support.

Overall, the report is very readable. The following are some of the author's selected points:

1. The stablecoin market is huge in countries with large monetary aggregates and strong legislative support, such as the United States (dollar hegemony), the European Union (single market), and China (potential market). The penetration rate of stablecoins will be high in countries with developed digital and virtual economies, such as South Korea, and in countries with a high degree of openness and strong external dependence, such as Singapore. The penetration rate of stablecoins will also be high in emerging market economies such as Turkey, Argentina, and Nigeria, which have low currency stability, underdeveloped banking systems, a large underground economy, restricted capital flows, or even sanctions.

2. Faced with the challenges posed by the development of stablecoins, major economies have typically adopted two approaches: issuing digital currencies or strengthening stablecoin regulation. Mainland China began research on digital currencies as early as 2014, with pilot programs launched in 2019. The rapid development of stablecoins, particularly Hong Kong's upcoming stablecoin bill, which will take effect in August of this year, may signal a shift in China's development strategy towards a "two-track approach." The head of the People's Bank of China, speaking at the Lujiazui Forum on June 18th, also explicitly stated that emerging technologies such as blockchain and distributed ledgers are driving the rapid development of central bank digital technologies and stablecoins, demonstrating the People's Bank of China's increased focus on stablecoins.

3. Hong Kong's stablecoin legislation is expected to accelerate the development of the Hong Kong dollar, offshore RMB, and even RMB-backed stablecoins, providing further impetus for RMB appreciation. Expanding the Hong Kong dollar and offshore RMB "funding pool," diversifying their investment in highly liquid assets such as interest-bearing bonds, vigorously developing cross-border business, the digital economy, and the virtual economy, and expanding the use cases for stablecoins are key to the success of Hong Kong's stablecoin and will further revitalize the RMB's internationalization.

4. Stablecoins pose challenges to cross-border financial regulation and carry a degree of redemption risk. Fiat stablecoins can also devalue when the value of their reserve assets fluctuates, the creditworthiness of their issuers is challenged, or even when their issuers go bankrupt. As stablecoins expand in scale and their impact on the traditional financial system deepens, achieving true stability may ultimately require stricter regulation, or even partial nationalization.

Chainalysis' data analysis

Unfortunately, the author searched the domestic and foreign networks and consulted the 2023 and 2024 "Cryptocurrency Geography Reports" released by Chainalysis, but did not find any relevant statements or data support about Yiwu merchants using stablecoins.

The author also excerpted some data and opinions on mainland China and Hong Kong from two Chainalysis reports:

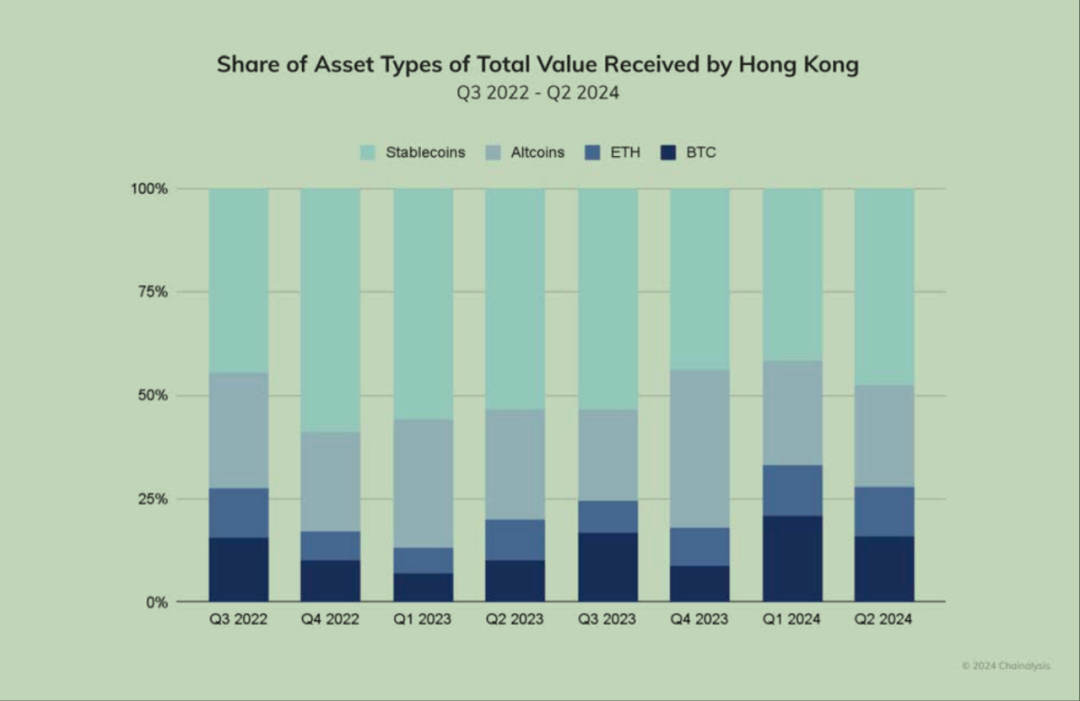

1. For a long time, stablecoins have accounted for more than 40% of the value of crypto assets collected by Hong Kong users. With Hong Kong's stablecoin legislation set to officially take effect in August this year, this proportion is expected to rise further.

Figure 1: Stablecoins account for a high proportion of crypto assets collected in Hong Kong - Chainalysis

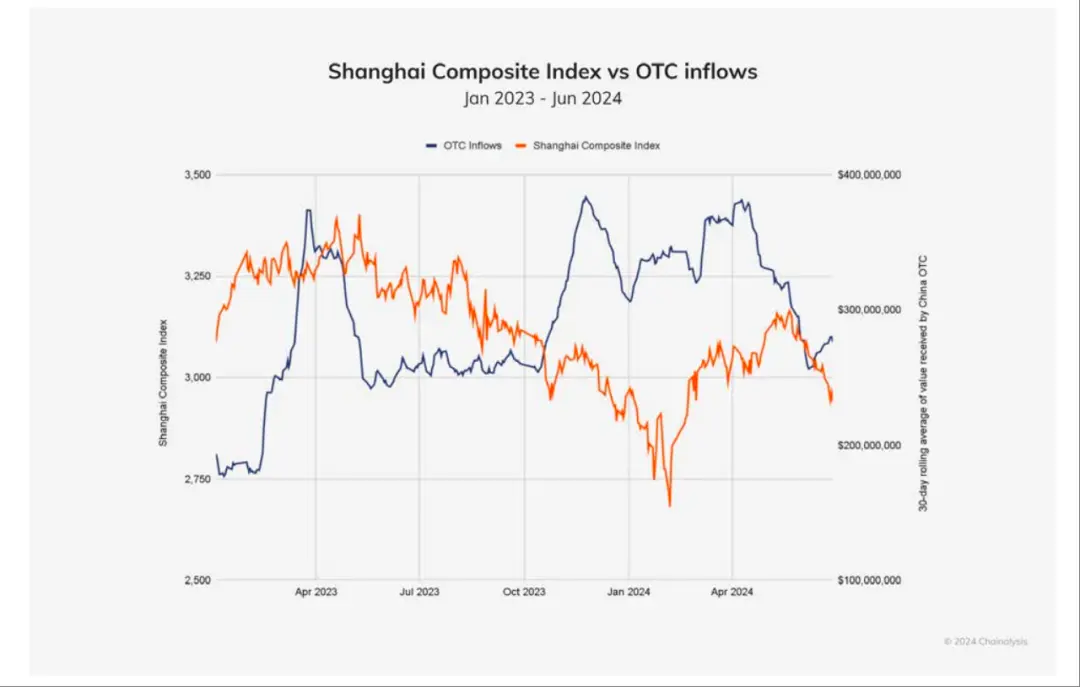

2. Data shows that Chinese users use crypto assets to preserve and increase the value of their wealth.

Figure 2: Comparison of Shanghai Composite Index and OTC Inflows from January 2023 to June 2024 - Chainalysis

In my opinion, there may be a lack of accurate data to verify whether stablecoins are used on a large scale in Yiwu, but the combination of foreign trade and stablecoins does have natural advantages. The characteristics of stablecoin payments such as instant arrival, stable value, and low fees have solved many business pain points for small and medium-sized foreign trade merchants.

On the other hand, considering mainland China's regulatory policies on crypto assets such as stablecoins, mainland foreign trade merchants will face serious compliance issues and even criminal risks if they directly use stablecoins during transactions.

Furthermore, considering that my country's current export tax rebate policy often requires a bank's foreign exchange settlement receipt, using stablecoins means being unable to provide this document, and consequently, being unable to enjoy the export tax rebate, which is devastating for merchants' profits. Furthermore, exhibition qualifications at trade shows like the Canton Fair often rely heavily on exporters' bank statements, and commercial banks also prioritize bank statements when reviewing loans. These factors, for now, mean that stablecoins will be limited in scale among Yiwu's export merchants.

So, how can mainland foreign trade merchants legally utilize stablecoins to reduce costs and increase efficiency? Currently, a relatively compliant approach is to connect traditional foreign trade with crypto payments through the collaboration of Hong Kong and mainland companies, leveraging Hong Kong's foreign trade convenience and open policies toward crypto assets.

Hong Kong dollar stablecoin and feasible foreign trade model using compliant stablecoins

On August 1, Hong Kong's "Stablecoin Ordinance" will officially come into effect, and the Hong Kong government will begin accepting applications for licenses to issue stablecoins in Hong Kong. This means that stablecoins officially recognized by Hong Kong will be officially launched, and Hong Kong dollar stablecoins will be regarded as a legal means of payment. The exchange between Hong Kong dollar stablecoins and fiat currencies will also be more convenient and compliant.

1. The rigid requirement of 100% redemption of Hong Kong dollar stablecoins

The Hong Kong Stablecoin Ordinance stipulates that the issuer of a stablecoin must ensure that the stablecoins it issues are supported by sufficient reserve assets and that the market value of the reserve assets is not lower than the face value of the issued and circulating stablecoins.

Stablecoin issuers should ensure that stablecoin holders have the right to redeem, shall not hinder or restrict the redemption of stablecoins, and shall not charge any fees other than reasonable handling fees when redeeming stablecoins.

2. The Hong Kong dollar stablecoin meets compliance requirements such as anti-money laundering and counter-terrorist financing.

Hong Kong's Stablecoin Ordinance stipulates that issuers of Hong Kong dollar stablecoins must comply with strict anti-money laundering and anti-terrorist financing requirements.

In a consultation paper released on May 26, the Hong Kong Monetary Authority (HKMA) outlined the relevant AML/CFT requirements. The core requirements include:

Customer due diligence. All purchases or redemptions exceeding HKD 8,000 are subject to due diligence, including verification of wallet ownership.

Strict supervision of non-custodial wallets. Strict monitoring and transaction limits are implemented on non-custodial wallet transactions to reduce the risk of wallets being exploited by criminals.

Continuous monitoring. Use blockchain analytics to track transaction history and detect illegal activity, and report suspicious transactions.

Conduct due diligence on custodial wallet providers;

Blacklist illegal wallet addresses.

3. Key points for mainland foreign trade merchants to legally use Hong Kong dollar stablecoins

Considering the current policy differences between mainland China and Hong Kong regarding stablecoins, the author believes that mainland foreign trade merchants can avoid most compliance risks by grasping the following three key points when using Hong Kong dollar stablecoins:

Using Hong Kong or other overseas corporate entities to collect and pay stablecoins;

The compliant exchange of stablecoins and fiat currencies is completed in Hong Kong;

Legal currency is converted back to the mainland parent company in compliance with regulations;