Trump finally took action against the Federal Reserve.

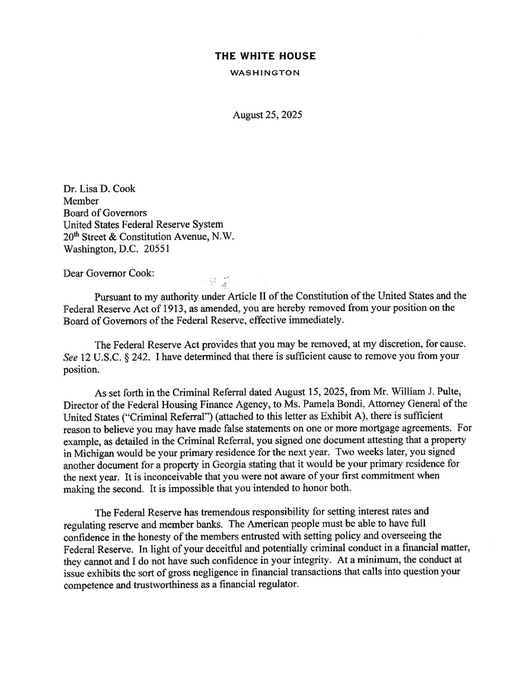

The interest rate cut has caused widespread panic, and Trump, unable to hold back, has finally swung his cudgel at the Federal Reserve. On the evening of August 25th, Trump announced that he had fired Federal Reserve Governor Lisa Cook due to allegations of "mortgage fraud." This marks the first time in the Fed's 111-year history that a president has removed a governor. Cook has vigorously contested the accusation and has stated that she will sue the Federal Reserve. A major battle between the president and the Federal Reserve is imminent.

Faced with this once-in-a-century melee, the crypto market suffered. Just yesterday, BTC briefly plummeted below $109,000, reaching a low of $108,600, a 12.7% drop from its recent high. Ethereum even hit a new high of $4,954 before crashing to $4,311. According to Coinglass data, as of noon yesterday, over $935 million in liquidated positions were liquidated across the entire network in the 24-hour period. Long positions were the primary target, with over $821 million liquidated, affecting 168,320 individuals worldwide.

Can Trump remove Cook? Can he truly control the Federal Reserve? Ultimately, the market will pay the price for Trump's dramatic performance.

Let's first review the major crypto events of recent days. Just last week, Federal Reserve Chairman Powell, speaking at the annual economic symposium in Jackson Hole, Wyoming, hinted that despite the current upward inflation risks in the United States, the Fed may still cut interest rates in the coming months. He stated, "In the short term, US inflation risks are tilted upward, while US employment risks are increasing. Based on changes in the economic outlook and the balance of risks, the Fed's monetary policy stance may need to be adjusted."

Taken together, this is a clear signal of a softening policy stance, and a September rate cut is essentially a foregone conclusion. The market reaction was immediate. On the same day, all three major US stock indices closed higher: the Dow Jones Industrial Average rose 1.89%, the S&P 500 rose 1.52%, and the Nasdaq Composite rose 1.88%. Even the often-maligned A-shares surged over 3,800 points, signaling a bull market rally. The ripple effect was also evident in the crypto market, with BTC rebounding to $117,000. Ethereum (ETH) performed even more impressively, breaking through $4,800 that day and reaching a new all-time high of $4,956 on August 25th.

But good times never last. Along with the interest rate cut came fears of a recession. On August 25th, Moody's Chief Economist, Zandi, warned that downside risks to the US economy were intensifying. States accounting for nearly one-third of US GDP were already in recession or highly likely to do so, another one-third were experiencing economic stagnation, and the remaining one-third were still expanding. Subsequently, the renowned international investment bank Barclays issued a new forecast, stating that there was a 50% chance of a US recession during US President Trump's administration. As the market recovered from the euphoria of the rate cut, US stocks began to pull back, with BTC and US stocks clearly following suit. Only ETH continued to rise, supported by institutional buying.

Coincidentally, on the morning of August 26th, Beijing time, another bombshell news caught the market's attention. Trump suddenly announced that he had signed documents to remove Federal Reserve Board Governor Lisa Cook for alleged mortgage fraud. At the same time, Trump also published an open letter to Cook on social media, stating that he had sufficient grounds to remove her, and the language was quite vehement: "Given your deceptive and potentially criminal conduct in financial affairs... I have no confidence in your integrity."

As to whether this claim is true, we need to go back to last week. Also on social media, Bill Pulte, director of the Federal Housing Finance Agency, accused Cook of claiming two properties as primary residences to obtain preferential interest rates, and stated that he had submitted this allegation to the Department of Justice. A seemingly minor issue involving property interest rates, thanks to Trump's relentless efforts, has stirred up a murky waters. Following this incident, Trump immediately retweeted the report and bluntly stated, "Cook should resign immediately." Cook subsequently responded on social media, stating that he would never resign due to bullying.

Breaking down the language, it's ridiculous that a Federal Reserve governor, simply seeking to lower his mortgage payments, was labeled dishonest and even fired. Regardless of whether this is true or not, it's truly hilarious. After a fruitless social media backlash, the situation escalated, culminating in Trump signing the aforementioned removal order on the 25th. This marks the first time in the Fed's 111-year history that a president has removed a Federal Reserve governor by executive order.

Cook herself has a very tough attitude. Not only did she state in public that Trump had no right to fire her, she also hired the well-known lawyer Abbe Lowell to sue Trump. It can be foreseen that this will be a protracted legal battle.

This naturally raises the question: Why Cook? Does Trump actually have the power to fire her? Legislative considerations suggest that while presidential removal is difficult to achieve due to the Federal Reserve's independence, the power does exist. The Federal Reserve Act stipulates that Federal Reserve Board members serve fixed terms and can only be removed by the president for "good cause." While this justification is relatively vague, as no one has attempted such an action in years, serious misconduct or ethical issues could be reasonable grounds.

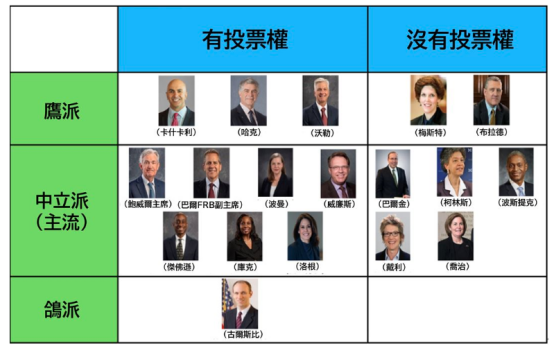

As for why Cook was chosen, the signal is even clearer: in the clash with the Federal Reserve, Trump's trump card is truly insufficient. From a decision-making perspective, the seven members of the Federal Reserve Board and the five presidents of the regional Federal Reserve Banks form the Federal Open Market Committee (FOMC), which determines the federal funds rate. Therefore, the Federal Reserve Board is the central decision-making body of the Federal Reserve. Each of the seven seats on the Board is nominated by the President of the United States and confirmed by the Senate. With the exception of the four-year terms of the Chairman and Vice Chairman of the Board, each round of nominees can theoretically serve for up to 14 years, spanning up to four presidents. This term system is designed to mitigate the impact of presidential rotation, help maintain the stability of the Federal Reserve, and lay the foundation for its independence.

Current members of the Federal Reserve Board. Source: Oanda

Looking at the current composition of the Fed's board of governors, aside from Chairman Powell, only two of the six remaining members were nominated and appointed by Trump during his first term. The remaining four were all nominated and appointed by former President Biden. Cook, who was impeached, was the first Black woman to serve on the Federal Reserve Board. She took office in May 2022, with a term until 2038. Previously, she was an economics professor at Michigan State University and served on the Council of Economic Advisers during the Democratic presidency of Barack Obama. Cook has previously stated that the current president's trade policies could suppress American productivity.

This clearly demonstrates the Federal Reserve's remarkably stable internal structure, but this stability also has inherent weaknesses: a lack of flexibility and adaptability, with everything being driven by data. This long-standing characteristic of the Fed has deeply displeased Trump. However, the long tenure of the Fed has hindered swift intervention, leaving it struggling to balance policy initiatives with inflation. Trump has previously criticized Powell for his delay in cutting interest rates. After trying various approaches without success, he naturally turned his attention to the board members. Cook, already a member of his own party and facing accusations of corruption, became the preferred political tactic, with the goal of using his case to intimidate the board. Mortgage fraud is, in fact, not new; several members of the Democratic Party have been investigated by the Trump administration.

At its core, under legal protection, the independence of the Federal Reserve will not be at risk of being weakened in the short term. Trump's move is more of a demonstration, exerting pressure to force the Federal Reserve to follow his personal opinions, and further attempting to achieve a major shake-up of the Board of Governors to enhance his influence on the Federal Reserve. Earlier this month, Trump nominated his confidant Stephen Milan to replace Kugler, a resigning board member whose term expires in January next year. If Cook's dismissal is successful, he will successfully install more of his own people in the Federal Reserve. According to people familiar with the matter, Trump intends to let either Milan or former World Bank President David Malpass replace Cook. Just yesterday, Trump said on social media, "We will soon have a majority at the Federal Reserve, and we may transfer Milan to another longer-term position at the Federal Reserve. Interest rates must be lowered to ease housing cost pressures."

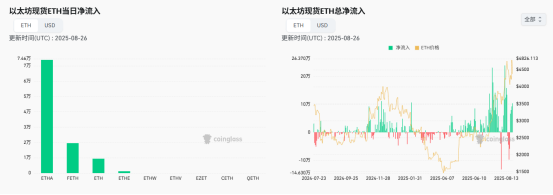

It was precisely amidst the complex tussle between interest rate cuts, recession, and the Trump-Federal Reserve that the market experienced a flash crash yesterday. BTC fell below the $112,000 support level, hitting a low of $108,000. ETH also plummeted to $4,311, a 12.97% decline from its peak. Panic is evident. After falling below $112,000, BTC's turnover surged, with even small holders showing signs of exiting the market. Overall, however, despite the decline to $108,000, the support level remains intact, and ETH has actually performed better. Regarding ETFs, Ethereum spot ETFs saw a net inflow of $455 million on August 26th, marking the fourth consecutive day of net inflows and over five times the daily inflow of BTC.

In terms of capital flows, it appears that more funds are flowing from BTC into ETH. On the day of the flash crash, approximately $2 billion in Bitcoin funds were reallocated to Ethereum, indicating a more positive outlook for ETH. Institutional holdings are also continuing to increase. BitMine, the leading ETH cryptocurrency and stock, received 131,736 ETH from three institutional platforms: BitGo, Galaxy Digital, and FalconX, in the past 12 hours.

Currently, the performance of the US stock market suggests that widespread systemic risks have not yet emerged, and market panic has eased. BTC has returned to above $111,000, while ETH has returned to above $4,600. Sol rose to $202 on the back of the treasury news, and Binance Coin (BNB) also returned to $859.

On the other hand, in addition to his continued influence on a macro level, Trump is also developing another major crypto event. On August 23, the Trump family's crypto project, World Liberty Financial (WLFI), announced that it would open initial applications and trading for WLFI tokens on September 1, marking the official launch of the WLFI token.

Regarding unlocking, to maintain price stability, only 20% will be unlocked for early backers, with the remaining 80% to be determined by the community through a governance vote. Notably, tokens held by the founding team, advisors, and partners will not be unlocked at launch. Based on current pre-market contracts, WIFI has fallen to $0.26 after peaking at $0.55. While this still offers significant upside compared to the early purchase prices of $0.015 and $0.05, WIFI's fully diluted valuation is currently only $26 billion, which is only considered acceptable. While the founding team will not unlock tokens upon launch, the early realization of value through contract hedging is not uncommon.

It's foreseeable that Trump will continue to promote his cryptocurrencies and market sentiment on September 1st. However, whether this move will drain liquidity like Trump's or simply pump and dump the market to benefit the public remains to be seen. More likely, Trump will release new positive news on September 1st to capitalize on the crypto backyard where users can withdraw funds at any time.

Looking solely at crypto, the independent performance of the crypto market has been fading, driven by external pressures from the US stock market and internal policy support. However, both internal and external factors appear to be closely tied to Trump. Ultimately, it must be acknowledged that with the increasing politicization of the crypto market, Trump and the cryptocurrency community have long been on the same page.