Author: David, Deep Tide TechFlow

When it rains, it pours; hackers always seem to be looking for a downturn.

Amid the recent downturn in the crypto market, established DeFi protocols have suffered another major blow.

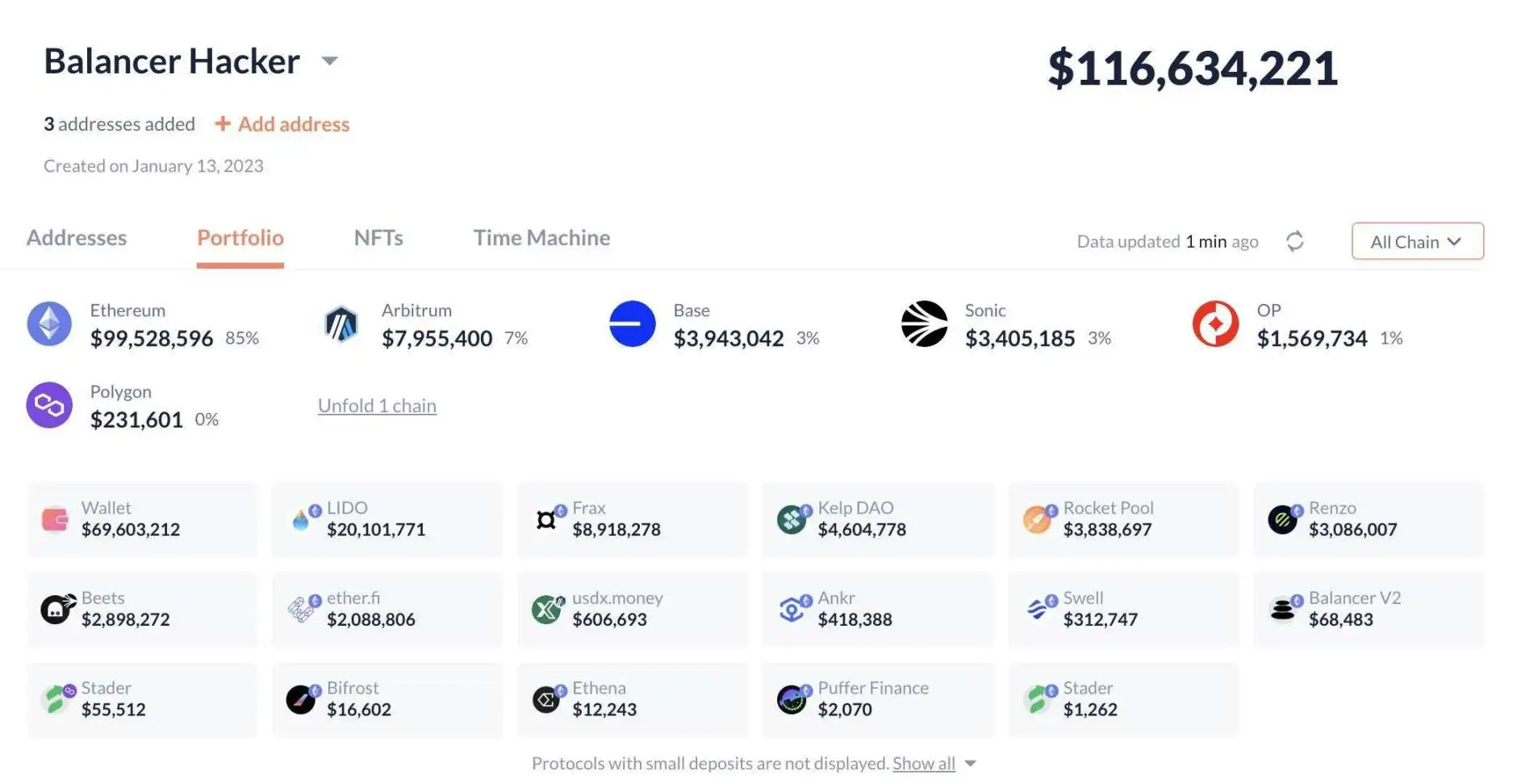

On November 3, on-chain data showed that the Balancer protocol was suspected of being hacked. Approximately $70.9 million in assets were transferred to a new wallet, including 6,850 osETH, 6,590 WETH, and 4,260 wstETH.

According to Lookonchain's monitoring of related wallet addresses, the total losses from the attack on the protocol have risen to $116.6 million.

The Balancer team stated the following after the incident:

"A vulnerability attack that may affect the Balancer v2 pool has been discovered. Its engineering and security teams are investigating this incident as a high priority and will share verified updates and follow-up actions as more information becomes available."

In addition, the official statement also indicated that they were willing to pay 20% of the stolen assets as a white-hat reward to help recover the assets, valid for 48 hours.

The response was timely, but also very official.

However, if you are a veteran DeFi player, you will not be surprised by the title "Balancer hacked," but rather have a strange sense of déjà vu.

As a long-established DeFi protocol founded in 2020, Balancer has experienced six security incidents in the past five years, with an average of one hacker attack per year. This incident was just the one with the largest amount of money stolen.

Looking back at history, when market conditions make trading extremely difficult, even arbitrage opportunities in DeFi may not be safe.

June 2020: Deflationary token vulnerability, resulting in a loss of approximately $520,000.

In March 2020, Balancer entered the DeFi world with its innovative concept of a "flexible automated market maker." However, just three months later, this ambitious protocol encountered its first nightmare.

Attackers exploited a vulnerability in the protocol's mishandling of deflationary tokens, resulting in a loss of approximately $520,000.

The basic principle was that a token called STA would automatically burn 1% as a transaction fee for each transfer.

The attacker borrowed 104,000 ETH from dYdX flash loan and then traded between STA and ETH 24 times. Because Balancer did not correctly calculate the actual balance after each transaction, the STA in the pool was eventually depleted to only 1 wei. The attacker then took advantage of the severe price imbalance to exchange a small amount of STA for a large amount of ETH, WBTC, LINK, and SNX.

March 2023: The Euler incident was caught in the crossfire, resulting in losses of approximately $11.9 million.

Balancer was an indirect victim this time.

Euler Finance suffered a $197 million flash loan attack, and Balancer's bb-e-USD pool was affected because it held Euler's eTokens.

When Euler was attacked, approximately $11.9 million was transferred from Balancer's bb-e-USD pool to Euler, representing 65% of the pool's TVL. Although Balancer immediately suspended the relevant pool, the damage was irreversible.

August 2023: Balancer V2 pool precision vulnerability, resulting in a loss of approximately $2.1 million.

This attack was actually foreshadowed. On August 22nd of that year, Balancer proactively disclosed the vulnerability and warned users to withdraw their funds, but the attack still occurred five days later.

The vulnerability involves a rounding error in the V2 Boosted Pool. Attackers manipulated the pool to skew the supply of BPT (Balancer Pool Token), allowing them to withdraw assets at an unfair exchange rate. The attack was carried out through multiple flash loan transactions, with different security firms estimating losses ranging from $979,000 to $2.1 million.

September 2023: DNS hijacking attack, resulting in approximately $240,000 in losses.

This was a social engineering attack, targeting traditional internet infrastructure rather than smart contracts.

Hackers used social engineering to breach the domain registrar EuroDNS and hijack the balancer.fi domain. Users were redirected to a phishing website that used the Angel Drainer malicious contract to trick users into authorizing transfers of funds.

The attackers then laundered the stolen funds using Tornado Cash.

While this wasn't Balancer's fault, its success has made it more vulnerable to being targeted by brands using the agreement for phishing schemes.

June 2024: Velocone was hacked, resulting in a loss of approximately $6.8 million.

Although Veloccore is an independent project, its theft had nothing to do with Balancer. However, as a fork of Balancer, Veloccore uses the same CPMM (Constant Product Market Maker) pool design, so in a sense it is inherited from Balancer. It's more like the theft happened elsewhere, but the mechanism is in Balancer.

The whole incident likely stemmed from an attacker exploiting an overflow vulnerability in Veloccore's Balancer-style CPMM pool contract. By manipulating the fee multiplier to exceed 100%, the attacker caused a calculation error.

The attackers ultimately stole approximately $6.8 million through flash loans combined with a carefully crafted withdrawal operation.

November 2025: Latest attack, losses exceeding 100 million.

The technical principle behind this attack has been preliminarily identified. According to security researchers, the vulnerability lies in the access control check of the manageUserBalance function in the Balancer V2 protocol, which corresponds to the user permission check.

According to analysis by security monitoring agencies Defimon Alerts and Decurity, when verifying Balancer V2's withdrawal permissions, the system should have checked whether the caller was the true owner of the account, but the code incorrectly checked whether msg.sender (the actual caller) was equal to the op.sender parameter provided by the user.

Because op.sender is a user-controllable input parameter, attackers can arbitrarily forge identities, bypass authorization verification, and execute WITHDRAW_INTERNAL (internal withdrawal) operations.

In layman's terms, this vulnerability allows anyone to impersonate the owner of any account and directly withdraw internal balances. This basic access control error seems like a minor oversight, and its appearance in a mature protocol that has been running for five years is quite surprising.

Reflections on the History of Hacker Visits

What can we learn from this history of hacker visits?

My feeling is that DeFi protocols in the crypto world are more like "admirable from afar but not to be touched." From a distance, everything seems calm, but if you really want to study them in detail, there are many technical debts beyond the narrative that you probably need to pay.

For example, Balancer, a well-established DeFi protocol, has one of its innovations that naturally leads to the ability to create mixed pools by allowing up to eight tokens with custom weights.

Compared to Uniswap's minimalist design, Balancer's complexity increases exponentially.

Adding a new token dramatically expands the pool's state space. When you try to balance the prices, weights, and liquidity of eight different tokens in a single pool, the attack surface expands accordingly. The deflationary token attack of 2020 and the rounding error vulnerability of 2023 were essentially due to improper handling of boundary conditions caused by complexity.

Even more critically, Balancer chose a rapid iterative development path. From V1 to V2, and then to various Boosted Pools, each upgrade added new features to the old codebase. This accumulation of "technical debt" turned the codebase into a fragile tower of blocks;

For example, the recent attack caused by permission issues is a basic design flaw that shouldn't have occurred in a protocol that has been running for 5 years. It may also indicate that the project's code maintenance has gotten out of control.

Or perhaps, in a time when narrative, profit, and emotion outweigh technology, whether the underlying code has vulnerabilities is no longer important.

Balancer certainly won't be the last; you never know when the black swan events caused by the composability of DeFi will arrive. The complex dependency networks in the DeFi world make risk assessment almost impossible.

Even if you trust Balancer's code, can you trust all its integrations and partners?

For onlookers, DeFi is a novel social experiment; for participants, DeFi theft is a costly lesson; for the entire industry, DeFi becoming sound is a necessary tuition fee to reach maturity.

I just hope the tuition fee isn't too expensive.