Source: Talking about Li and other things

Today is another rainy day, so the little friend didn't make a fuss about going out to play, but sat at the table to draw, and I could just write some articles at home. When I was writing, there was lightning and thunder outside, so I asked her: Do you know why there is lightning in the sky?

She looked up and looked at me as if I were a fool, and answered firmly: Because there is a power bank in the sky.

This answer was completely beyond my expectation, but I did not correct her immediately. After all, for a little kid in kindergarten, I felt that her answer was quite creative. I would give her some additional knowledge about thunder and lightning when I have time in the evening.

Back to the market. As Bitcoin hits a new all-time high, ETH has also seen a good rise in recent days, with the current price remaining around $3,000. I hope this momentum can continue. If ETH can continue to break through and rise, we may usher in a new mini-altcoin season again.

In fact, for quite a long time in the past, the topic of Altcoin Season has been discussed many times by many people, and even a bit like "crying wolf". Now, whenever the Altcoin Season is mentioned again, most people will sneer, because every time everyone is full of expectations for the Altcoin Season, but every time it makes people feel disappointed and disappointed. Therefore, now a relatively unified view has basically been formed (a view that most people will agree with), that is, the traditional Altcoin Season (roughly manifested as a comprehensive rotation of Altcoins and a general surge in prices) is difficult to reproduce.

Including some friends in the group who were discussing this topic a few days ago, someone also joked that it would be better to change the copycat season to copycat week, copycat day, copycat second...

Rather than saying that everyone is looking forward to the alt season, it is better to say that everyone is just looking forward to making money more easily during the bull market , but the market often does not go as most people expect. When most people start to go long, there is a high probability that it will fall, and vice versa. As we mentioned in an earlier article: The main logic or gameplay of the market is to make as many people lose money as possible.

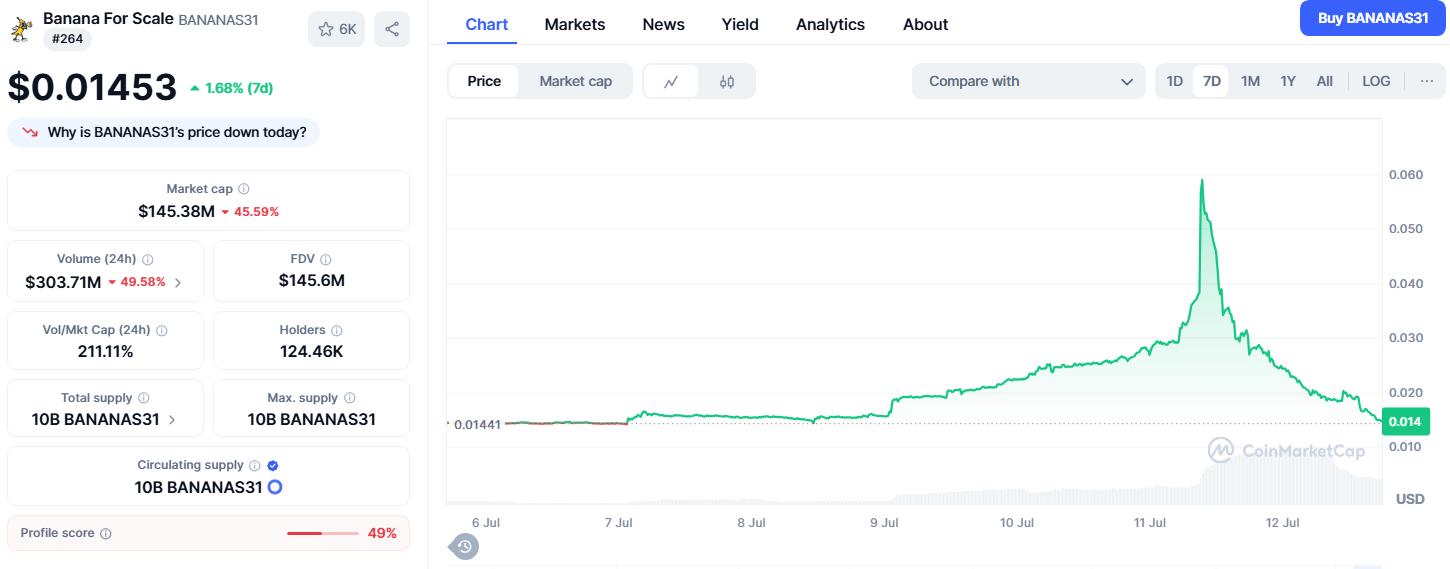

For example, BANANAS31, which appeared in the ranking of gains several times in the past few days, reached a peak yesterday (July 11) and when everyone was very excited, it began to plummet today, with a single-day drop of 77%, as shown in the figure below.

One cannot help but sigh that yesterday was still the "copycat season", but today has become the "copycat festival" . Many people hope to make money easily by taking advantage of the bull market, but the end result is often that they lose money easily in the bull market.

Originally, no one made money during the bear market. Everyone seemed equal and poor, but during the bull market, everyone lost money. Why is this so?

We have discussed this issue many times in previous articles. To sum it up briefly:

Many people will completely forget their trading discipline because they keep seeing someone making money or getting rich overnight. The impulse of FOMO emotions during the bull market will cause many people to constantly chase hot spots, chase high prices and increase leverage, and thus completely lose those plans and cautious mentality during the bear market. They always feel that the money they lost can be quickly earned back by taking advantage of the bull market. As a result, the original investment plans and goals gradually become a kind of gamble, and the result during the bull market is that they lose more and more.

Therefore, in this matter, the first thing we need to try to overcome is our FOMO mentality. As we mentioned in the previous article (July 10): As long as the market is still there, we will not lack trading opportunities. What we need to do is to continue to persevere and not be eliminated by the market. If your position management is not good enough or you are not self-disciplined enough, causing your investment portfolio to lose (or be trapped) most of the funds, then we will not have enough funds to seize new or even better opportunities.

Let’s go back to the topic of the alt season. Although the long-awaited “alt season” often turns into an “alt festival”, as we said at the beginning of the article, if the upward momentum of the past few days can continue, especially if ETH can continue to break through and rise, we may usher in a new mini alt season again.

The mini-altcoin season is just a definition we made in our previous article. The difference compared to the traditional altcoin season is that the overall altcoin rotation-style surge has turned into a structural market, that is, it has become a short-term outbreak of a certain sector (such as AI, RWA), or individual projects (such as PEPE, TRUMP) have seen huge increases in specific small cycles.

Remember in the article on July 1, we talked about the situation we might face in the third quarter, focusing on the following aspects:

- From a macro-cycle perspective, the third quarter of this year should be a relatively important market period. We might as well call it: the intersection season of crypto regulation and market change. Whether it is at the macro level, political level, policy level, market level... we may continue to witness some different changes.

- If the development trend based on various macro or policy factors fails to meet the market's expectations (new black swans appear), it is possible that the market will experience another round of corrections or relatively large fluctuations starting from the third quarter. However, if the scenario remains unchanged, we are likely to continue to see Bitcoin break new historical highs in the third quarter.

- If Bitcoin can continue to hit new highs in the second round similar to the previous bull market (compare the current market situation with the market situation in September 2021), then there is a high probability that Bitcoin's dominance will decline, and we will have the opportunity to see the fourth mini-altcoin season opportunity.

- In addition to Bitcoin, if altcoins want to allocate some positions again, it is best to focus on narrative areas such as Stablecoin, RWA, etc. Taking Stablecoin as an example, projects related to stablecoins such as AAVE and ENA will still have a certain performance space.

Judging from the actual market trends in the past two weeks, due to the overall optimism in macro and policy aspects (no new black swans have emerged), Bitcoin has broken through its historical high earlier than we originally expected. Ethereum has also begun to break through key short-term resistance levels, and the increase in many altcoins has exceeded 10%. For example, the highest increase in the past 7 days for AAVE we mentioned is about 18%, and the highest increase in the past 7 days for ENA is about 50%.

Although many people's emotions seem to have changed again due to the rise in the past few days, we will continue to maintain the views in the previous article: Overall, we will remain cautious about the market in the third quarter. If Bitcoin can really reach around $130,000 in Q3, there will be a high probability that some opportunities for altcoins will continue to appear, but then there may be a new round of periodic small corrections or shocks, which may last for 1-2 months, and it is not ruled out that Bitcoin may pull back to around $100,000, while altcoins may face a correction of at least 20-30% again.

As we mentioned in the previous article (July 10), when it comes to making money, some people focus on the current price, while others focus on the law of cycles. Whether it is long-term trading or medium-term trading, you must think clearly about how much money you can (target) make when you are right and how much loss you can (accept) when you are wrong. Opportunities and risks are often proportional. A surge is for a better plunge, and a plunge is for a better surge. In the later stage of a bull market, it is more important to keep the gains than to take higher risks to gamble.

When facing unexpected changes in the market, many people always habitually say this sentence: "It seems different this time", but in terms of human nature, it seems that nothing is different every time. It happened that when I was watching everyone's daily discussion in the group yesterday, a friend said something that was more appropriate: retail investors have their own logic. They buy when they see others making money and sell when they see themselves losing money.

I think the above sentence is quite vivid. I remember at the beginning of this year, when Bitcoin was at $100,000 and the market sentiment was relatively high, many people swore that they would buy Bitcoin as long as it fell to $70,000 because they missed out. As a result, Bitcoin really fell to around $70,000, but the voices of buying Bitcoin were basically inaudible. For another example, the same thing happened last year (2024) when Bitcoin fell from $70,000 to $50,000. When it really fell, many people would not buy it anymore.

The same question, if Bitcoin has the opportunity to continue to rise to $120,000 or $130,000, and then fall back to around $90,000 or $100,000, would you consider buying it?

I estimate that most people who missed the opportunity will still not buy, and the later the bull market goes, the higher the periodic risk of such buying will be, especially for those with short-term trading goals. They will continue to believe that Bitcoin has already risen so much, and the next increase will definitely be limited. It is better for them to directly buy some copycat or local dogs recommended by bloggers to try their luck.

However, we have discussed altcoins many times in our previous series of articles. In fact, it has been very difficult for most altcoins for a period of time. Under the influence of the macro environment, changes in market structure and market conditions where liquidity is severely diluted, it is difficult for us to accurately predict in advance what the next hot-selling project (token) will be. It seems that only those products (projects) with revenue-generating capabilities are worth looking forward to in the medium and long term.

Here we briefly give a few examples of projects:

For example, Hyperliquid (HYPE), which has performed relatively well in terms of price over a period of time, has now become one of the dApps with the highest fees, as shown in the figure below.

However, because the project's current market value has reached 15.5 billion US dollars (currently ranked 11th in market value and priced at 47 US dollars), and the Mcap/TVL ratio is 33.39, although there may still be some opportunities for growth, we believe that the room for growth in the short term is limited. If you still want to participate in such a project now, it seems that you should appropriately lower your profit plan goals.

For example, Pendle, AAVE and other projects are also projects we have mentioned several times in previous articles, including the article on March 28th where we talked about: Putting aside the price factor, I have always believed that projects such as Pendle and AAVE are good projects because they can generate sustainable income on their own. As shown in the figure below.

Currently, Pendle's market capitalization ranks 101st, with an Mcap/TVL ratio of 0.13, and AAVE's market capitalization ranks 29th, with an Mcap/TVL ratio of 0.16. Therefore, for the above projects, if you want to select projects based on revenue + market capitalization, then in theory, Pendle or AAVE seems to have a better chance.

Of course, the above is just a simple example, which is based on the two single dimensions of project revenue + market value. You may also need to combine other dimensions or indicators for more comprehensive considerations to improve your investment success rate, such as token unlocking, product roadmap, project investment/cooperation, etc.

The Hyperliquid, Pendle, and AAVE we mentioned above are all projects under the DeFi Yield track. At the same time, we also mentioned in the previous article (that is, the March 28 article we mentioned above): From a medium- and long-term narrative perspective, DeFi, Stablecoin (stablecoin) and RWA are narratives that are more worthy of anticipation and attention this year.

We have already talked a lot about the topic of Stablecoin in our articles a few days ago. Here we will continue to talk briefly about RWA. For a long time, many people (retail investors) seem to be pessimistic about the RWA field, but some large companies are continuing to make plans. For example, BlackRock has launched its own on-chain fund, JPMorgan Chase is launching a stablecoin on the Base platform, and Robinhood is introducing tokenized stocks on the chain...

We expect that as more and more companies begin to participate in tokenization this year (many companies are currently mainly speculating based on the stock market), this hype effect may eventually return to the encryption field and have some positive effects on some tokens related to the RWA track.

That is to say, the RWA narrative in the third quarter (or fourth quarter) of this year is theoretically worth your attention. Of course, I can’t tell you directly which RWA token to buy to make money. Here we are just providing a way of thinking or thinking. According to the Coingecko data platform, there are currently more than 500 projects under the RWA concept. If you are interested in such projects, you may wish to focus on two angles for research and attention:

The first is those RWA projects that already have relatively successful products.

The second is the RWA project that has the ability to continuously attract more on-chain funds.

However, in order to facilitate the research of some new partners, we might as well briefly list several related RWA projects here:

For example, Ondo Finance. A few days ago, I saw a report in Cointelegraph that they will acquire a compliant brokerage platform Oasis Pro and plan to launch a tokenized stock trading service for non-US users in the coming months, which also means that Ondo is stepping up its efforts to deploy tokenized business. At present, Ondo already has tokenized bond products such as OUSG (short-term treasury bonds) and USDY (income-earning US dollars). At the same time, they also plan to launch exclusive cross-chain bridging tools to strengthen asset transfers, and jointly launch a $250 million RWA investment fund with Pantera. Overall, Ondo's position as the current leader in on-chain US bonds seems to be stable.

For example, Backed Finance, the recently popular xStocks is a product launched by them. xStocks is a series of tokenized securities that are 1:1 collateralized by real stocks. The product was officially launched at the end of June. So far, more than 60 tokenized stocks have been launched, including Apple, Tesla, Nvidia, etc. It is expected that they will continue to expand to more DeFi platforms in the third and fourth quarters of this year. However, the project has not yet launched its own platform or governance tokens, only xAssets (tokenized real-world assets).

For example, Chintai Network (they plan to introduce RWA assets into the Bitcoin ecosystem), Robinhood (one of the main promoters of Tokenized Stocks), Lendr Fi (it is said that the mainnet will be launched soon, and a liquidity token called LsRWA will be introduced to participate in the protocol mortgage and income)... and so on. Interested friends can pay further attention to this.

That’s all for today. The sources of the images/data cited in the text have been added to Notion. The above content is only personal opinion and analysis, and is only for learning records and communication purposes, and does not constitute any investment advice.