1. Market observation

Keywords: BTC, ETH, AAVE

Jeffrey Ding, chief analyst at HashKey Group, predicts that Bitcoin is expected to break through its previous high in the near future, aiming for $108,000! At the data level, the new funding channel of $100 billion and the gradually stable market chips all indicate that this day will come soon.

First, the GENIUS Stablecoin Act has passed the Senate procedural motion. Now the bill will enter the Senate plenary vote stage. Its passage is inevitable, which will bring new funding channels to the digital currency market. Hundreds of billions of new funds will be injected into the digital currency market through stablecoins. Paul Atkins, chairman of the U.S. SEC, has instructed policy department staff to begin drafting rule proposals related to cryptocurrencies, which shows that they are already preparing for the passage of the bill. If this important bill is finally passed, it will become the first federal-level stablecoin legislation in the United States, which will have a significant and far-reaching impact on stablecoin regulation. Tokens related to the stablecoin track, such as Frax and AAVE, have seen significant gains recently.

Secondly, Glassnode data shows that illiquid supply has reached a historical peak. This shows that the current Bitcoin rally is not driven by retail investor enthusiasm, but by multiple structural forces, including institutional capital inflows, historic supply tightening, and improved macroeconomic environment. These factors indicate that Bitcoin will follow a more durable and mature path to hit new historical highs, which will lead to Bitcoin rising to the next platform of $150,000 to $180,000 this year.

Spot Bitcoin ETFs continue to attract capital inflows, showing strong fundamental support. Even against the backdrop of Moody's downgrading the US credit rating and risk-averse stock market sentiment, BTC was still able to rise over the weekend, further reinforcing its position as a store of value. This narrative is gaining more consensus and is expected to become a long-term positive catalyst.

At the same time, the narrative of the entire crypto market is also heating up. The volatility market also reflects the market's optimism. Despite the consolidation of spot prices and the continued macro uncertainty, the implied volatility of crypto assets remains relatively high. The skewed structure of Bitcoin call options remains stable in most maturities, suggesting that the market as a whole still maintains a structurally bullish expectation.

2. Key data (as of 12:00 HKT on May 19)

(Data sources: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

- Bitcoin: $106,826 (+13.9% YTD), daily spot volume $32.92 billion

- Ethereum: $2,546 (-23.7% YTD), with daily spot volume of $20.48 billion

- Fear of Greed Index: 70 (greed)

- Average GAS: BTC: 4 sats/vB ETH: 0.51 Gwei

- Market share: BTC 63%, ETH 9.1%

- Upbit 24-hour trading volume ranking: BTC, XRP, WCT, ETH, NXPC

- 24-hour BTC long-short ratio: 1.01

- Sector gainers and losers: AI (+2.15%), PayFi (-4.2%)

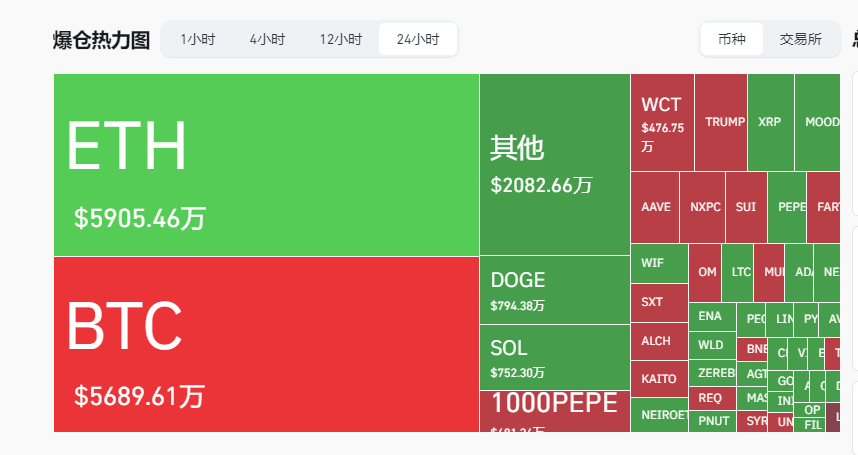

- 24-hour liquidation data: A total of 82,209 people were liquidated worldwide, with a total liquidation amount of US$214 million, including BTC liquidation of US$56 million, ETH liquidation of US$59 million, and SOL liquidation of US$7.52 million

- BTC medium and long-term trend channel: upper channel line ($103016.97), lower channel line ($100977.03)

- ETH medium and long-term trend channel: upper channel line ($2389.95), lower channel line ($2342.62)

*Note: When the price is higher than the upper and lower edges, it is a medium- to long-term bullish trend; otherwise, it is a bearish trend. When the price passes through the cost range repeatedly within the range or in the short term, it is a bottoming or topping state.

3. ETF flows (as of May 20)

- Bitcoin ETF: +$329 million

- Ethereum ETF: +$64.89 million

4. Today’s Outlook

Source: Societe Generale to launch world’s first bank-issued USD stablecoin on Ethereum

Upbit to List OM in KRW, BTC, USDT Markets

Bittensor (TAO) unlocked 210,000 tokens today, worth approximately $79.3 million

The biggest gains in the top 500 stocks by market value today: PI up 13.6%, TRUMP up 12.5%, FARTCOIN up 8.4%, UNI up 5.4%

5. Hot News

Texas Legislature passes Bitcoin Reserve Bill, awaiting Governor’s signature

SEC Delays Decision on XRP and Dogecoin ETFs and Seeks Public Comments

New SEC Inspector General Makes Fighting Crypto Fraud a Top Priority

Ethereum DEX active users surge 73%, Uniswap dominates 97% of the market

Strive plans to acquire Mt.Gox's claim rights to obtain 75,000 BTC to build a Bitcoin vault

Argentine President Closes Department Investigating Libra Crypto Scandal

This article is supported by HashKey , the largest licensed virtual asset exchange in Hong Kong and the most trusted crypto asset fiat currency portal in Asia. HashKey is committed to defining new benchmarks for virtual asset exchanges in terms of compliance, fund security, and platform security.