Source: TopHash

Compiled and edited by Janna and ChainCatcher

Editor's Note

This article is based on the latest research report published in July 2025 by Tophash Digital, a digital asset consulting and investment firm. The report highlights the profound changes in the cryptocurrency exchange listing landscape from 2024 to the first half of 2025. Binance continues to lead with its Alpha airdrop and IDO program. Secondary listings are on the rise, outperforming primary listings. On-chain issuance and perpetual swap listings are emerging trends. Listing strategies, project performance, and paths vary significantly across exchanges. This article will provide a comprehensive overview of the listing dynamics across exchanges, encompassing multiple dimensions including activity, performance, and distribution.

ChainCatcher organized and compiled the content (with some deletions).

This study comprehensively analyzes the listing dynamics of crypto tokens on major centralized exchanges and in Binance's issuance plans from January 2024 to June 2025. The research targets several major exchanges, including Binance, Binance perpetual swaps, Coinbase, OKX, Upbit, Bithumb, and Bybit. The scope covers spot, perpetual swaps, and decentralized exchange (DEX)-based issuance channels, focusing on two types of listings: primary listings (new assets directly distributed through mechanisms such as airdrops, known as token generation events (TGEs) or initial exchange offerings) and secondary listings (the listing of tokens on new exchanges with existing trading history on other platforms). This study systematically analyzes listing trends, fully diluted valuation (FDV) distributions, post-listing performance, and cross-platform listing paths across different exchanges. The key objective is to provide insights into Binance's dominant role as a core listing channel and to compare and analyze the strategies and performance of other platforms, including Coinbase, OKX, Upbit, Bithumb, and Bybit. The ultimate goal is to reveal the diverse patterns and internal mechanisms of token issuance, price performance, and market expansion in different liquidity environments.

Exchange listing activities

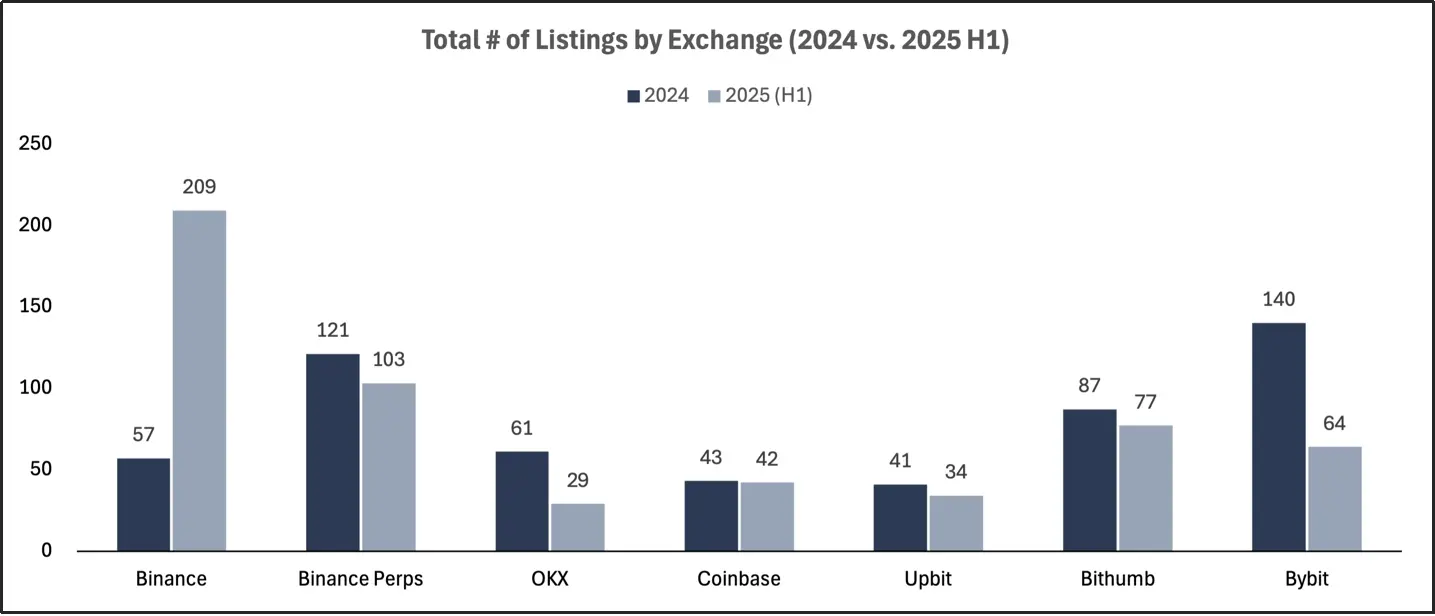

Total number of tokens listed on each exchange in 2024 and the first half of 2025

In the first half of 2025, cryptocurrency exchange listing activity increased significantly, but primary and secondary listings showed distinctly divergent development paths. Binance significantly expanded its token listing ecosystem through its DEX-based issuance business and continued expansion of its perpetual contract market. In contrast, the listing pace of many other major exchanges slowed or remained stable, indicating an overall trend of centralization.

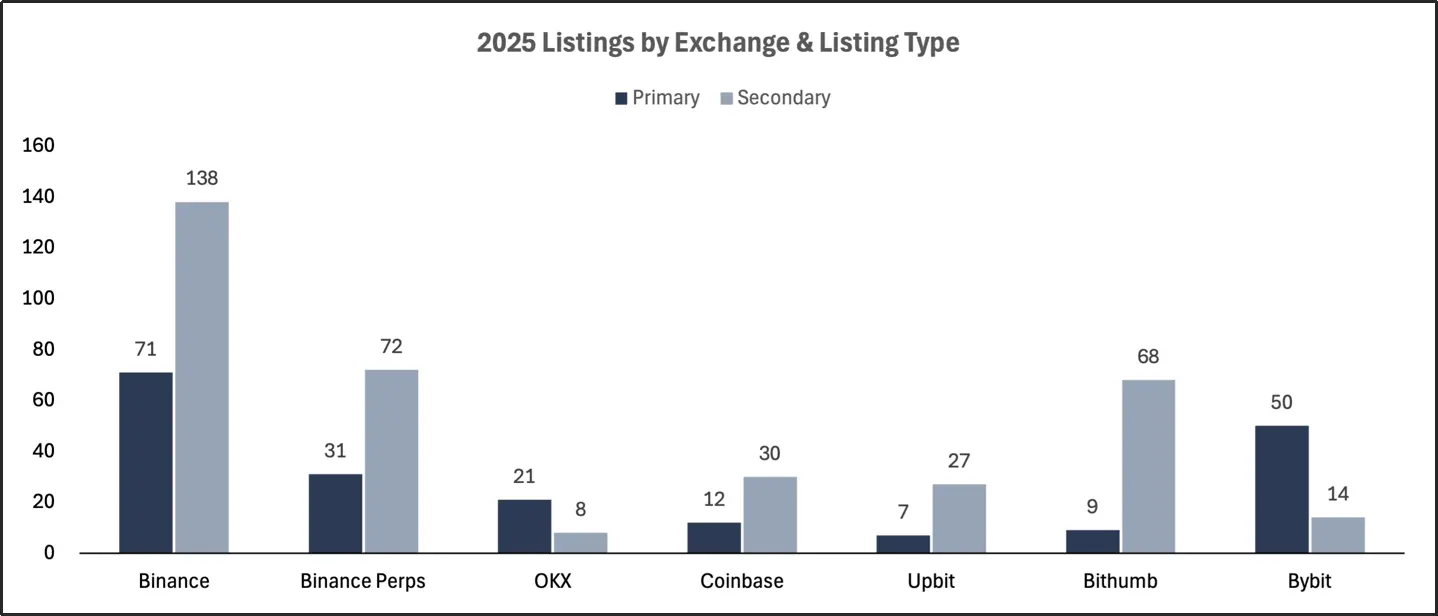

Number of first-time and second-time listed coins on each exchange in 2025

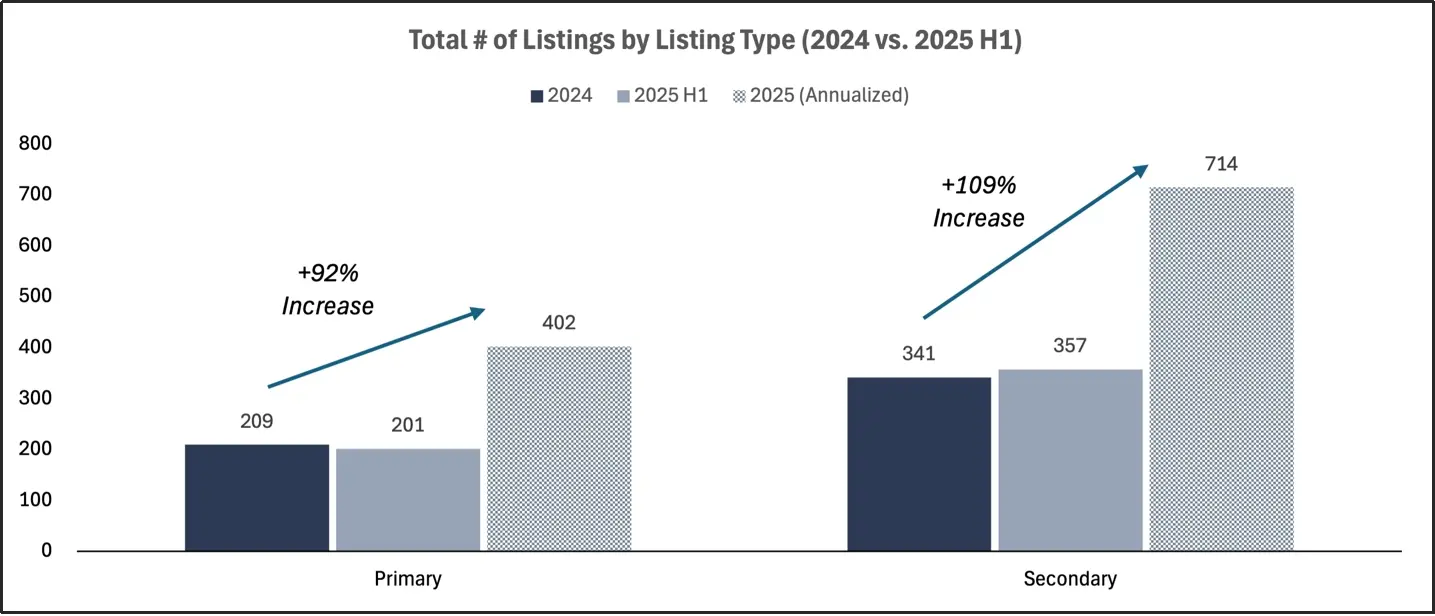

Total number of tokens listed on each exchange in 2024, the first half of 2025, and the estimated total number of tokens listed in 2025

In the first half of 2025, Binance remained the most active exchange globally for initial coin listings, hosting 71 projects, all driven by DEX issuance channels, including airdrops and initial decentralized offerings (IDOs) on its token discovery platform, Binance Alpha. Upbit and Coinbase maintained a relatively stable cadence of initial coin listings, each listing approximately 12 projects in the first half of the year, primarily focusing on major cryptocurrencies with large market capitalizations. In contrast, Bybit and OKX significantly reduced their initial coin listings, from double-digit numbers in 2024 to single-digit numbers in the first half of 2025. Overall, the industry's total initial coin listings are expected to increase significantly, from 209 in 2024 to 402 in 2025, a year-on-year increase of 92%. This growth is primarily driven by decentralized issuance methods such as Binance Alpha and IDOs.

In terms of secondary listings, Binance launched 138 projects during the same period, the vast majority of which were relistings of existing tokens through the Binance Alpha platform. Coinbase, Upbit, and Bithumb also placed a greater emphasis on secondary listings, with such projects accounting for approximately 80% of their total listings in 2025. Binance's perpetual swap market also showed a clear bias towards secondary listings, with nearly twice as many listings as primary listings. The number of secondary listings is projected to increase by 109% year-over-year, from 341 in 2024 to 714 in 2025. Led by Binance and its Alpha program, secondary listings are rapidly becoming the dominant form of exchange listing activity in 2025.

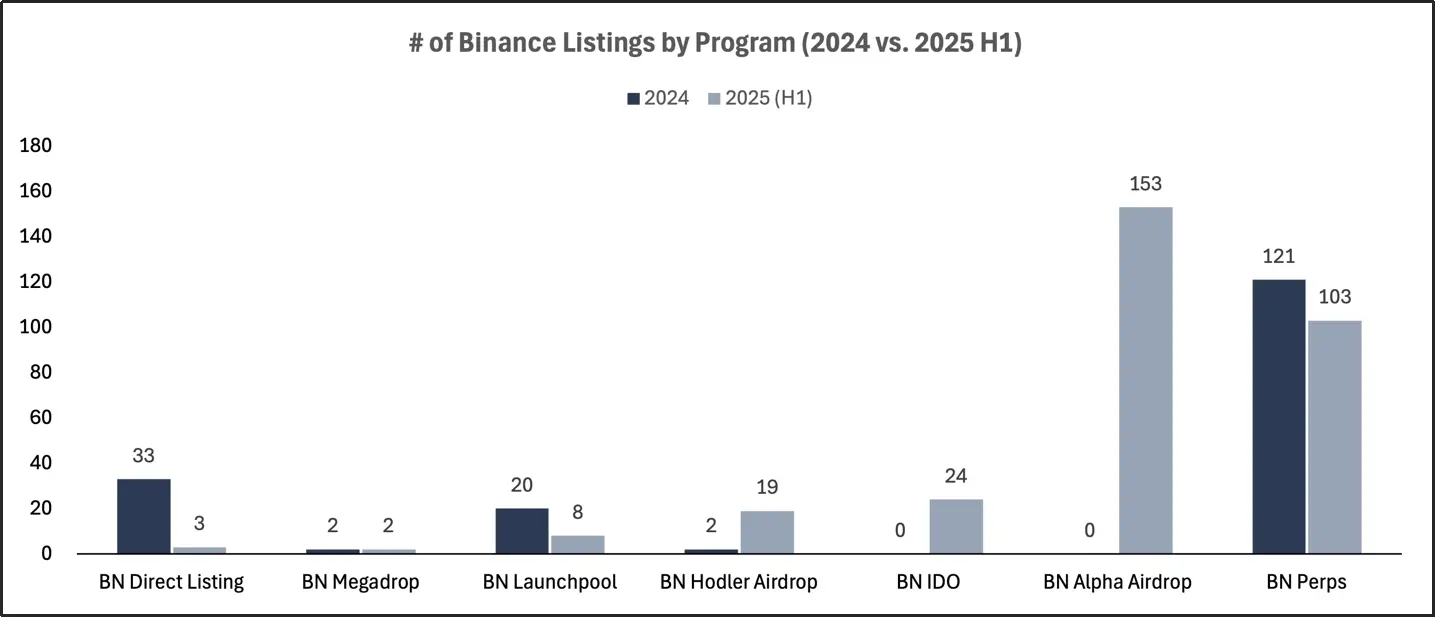

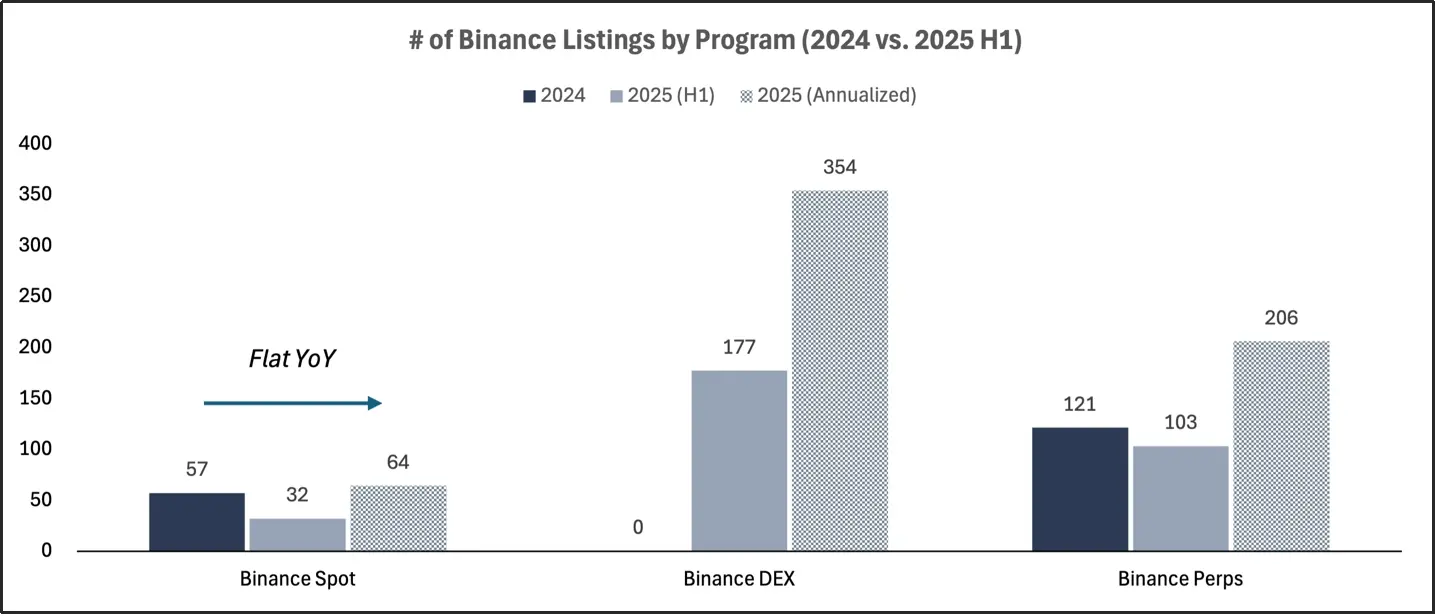

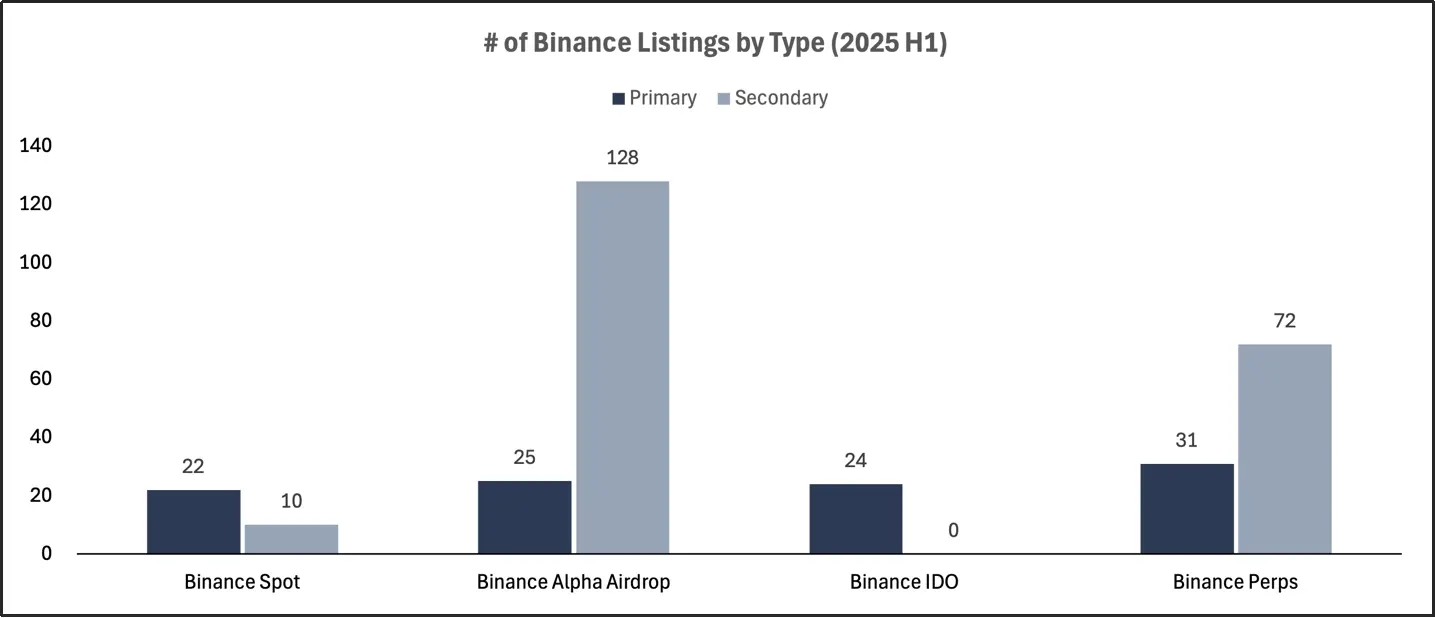

Number of Binance listings by project in 2024 and the first half of 2025

Alpha airdrops and IDOs dominated Binance's new Token Generation Events (TGEs), collectively contributing 84% of new asset issuance. Year-over-year, spot coin listings remain stable: 64 are projected in 2025, roughly the same as 57 in 2024. This includes various issuance methods, including direct listings, launchpools, megadrops, and holder airdrops.

Number of Binance spot, decentralized exchange, and perpetual swap listings in 2024, the first half of 2025, and the projected total for 2025

Secondary listings dominate Binance Futures' listings. Of the 103 projects launched in the first half of 2025, 72 were secondary listings. These projects continue to generate strong trading volume, but their impact on driving new token generation events (TGEs) has been limited. Currently, Binance's listing strategy has clearly shifted towards a focus on DEX issuance, while traditional spot listing mechanisms maintain strict review and control.

Number of first-time and secondary listings of various types on Binance in the first half of 2025

Coin listing performance on various exchanges

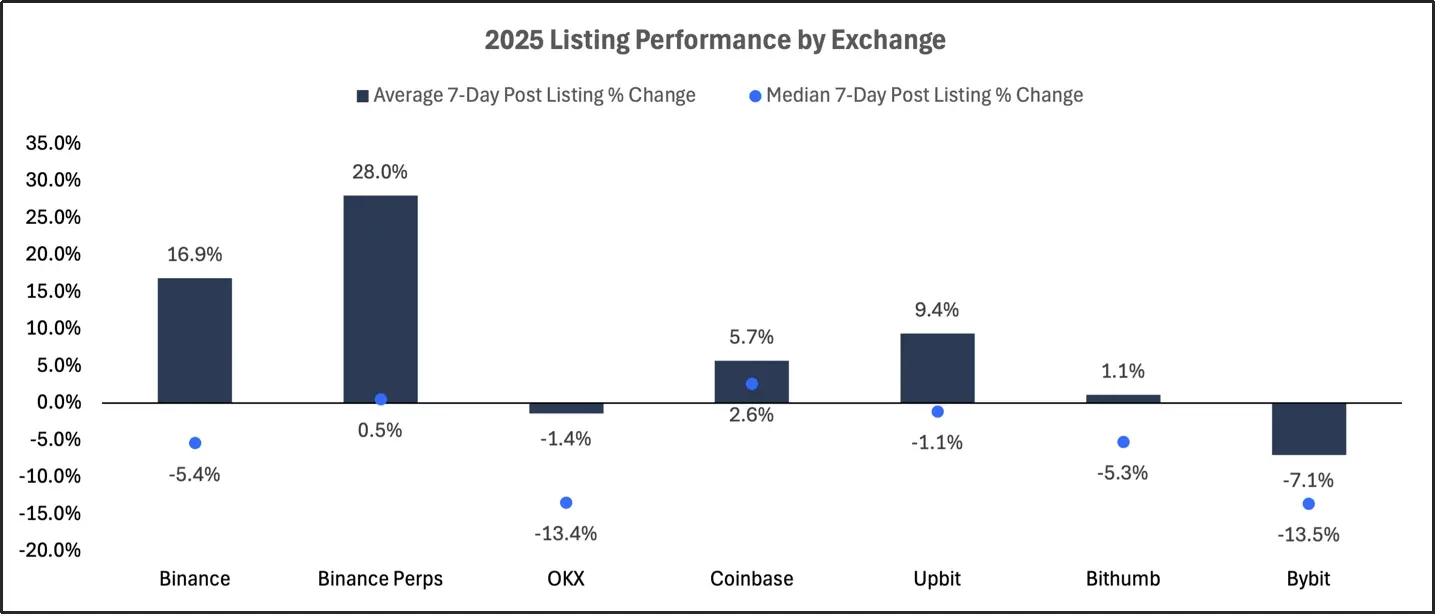

Token performance within 7 days of listing on various exchanges in 2025

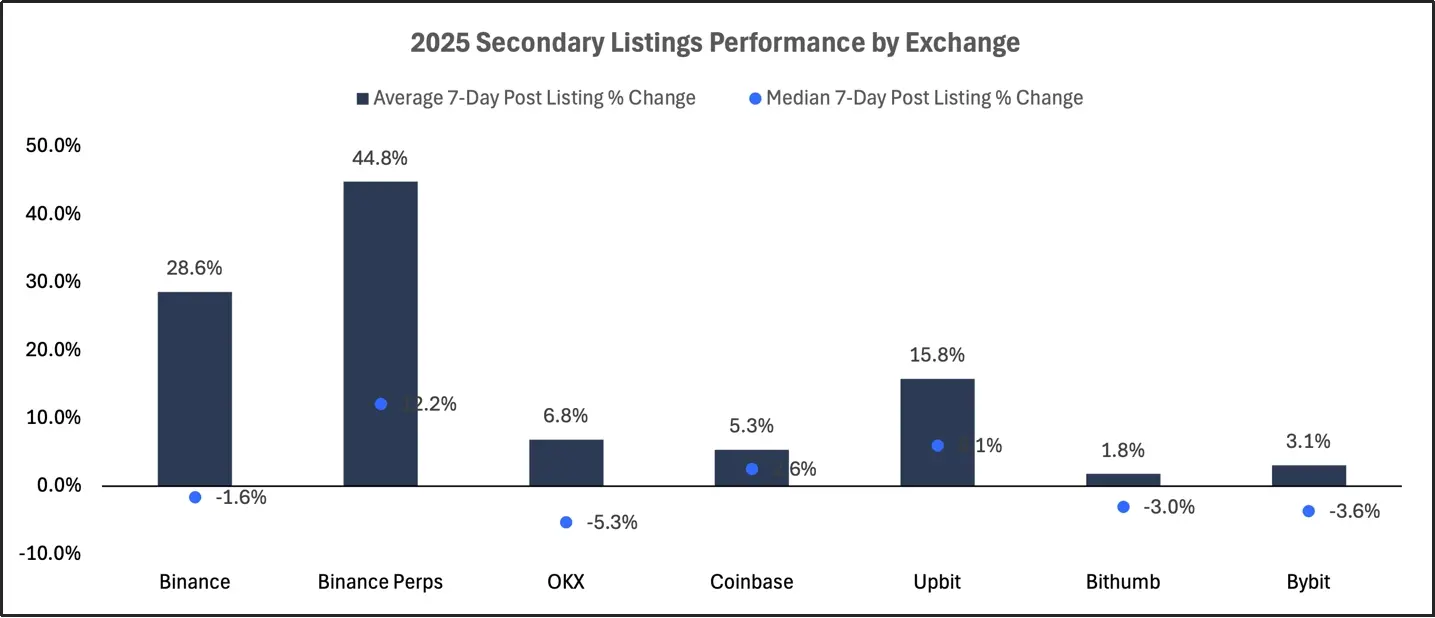

Seven-day performance data for exchange-listed projects reveals a significant divergence between first-time and secondary listings. Across nearly all platforms, first-time listings have underperformed, with both mean and median returns falling into negative territory since their token generation events (TGEs). In contrast, secondary listings have generally demonstrated stronger and more consistent positive returns, primarily due to their established market consensus and liquidity.

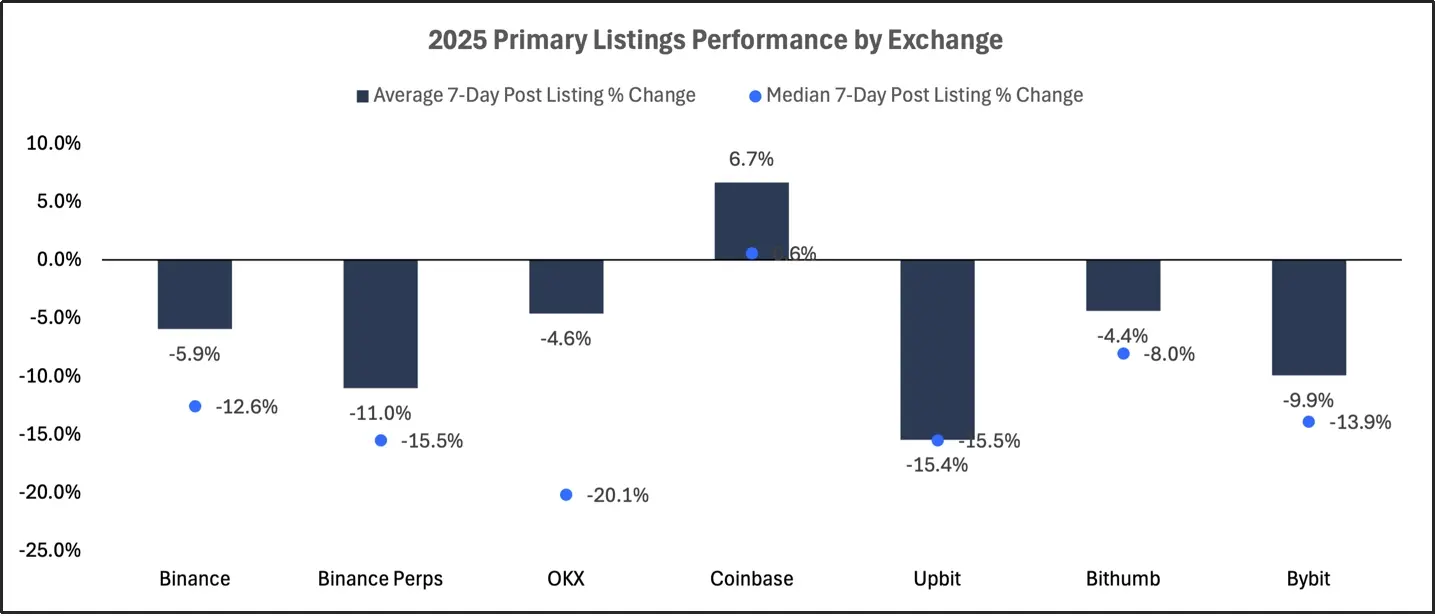

Token performance within 7 days of first listing on various exchanges in 2025

Newly listed coins on various exchanges' main boards have generally performed poorly, with negative returns across the board over the past seven days. While Coinbase saw a slight average positive return (+6.7%), its median return remained flat, suggesting a lack of upward momentum. Newly listed coins on Binance's spot, Alpha airdrop, and IDO channels all underperformed expectations, with median returns ranging from -5% to -19%. Exchanges such as OKX, Bithumb, and Upbit also experienced persistent losses, with average returns ranging from -4% to -15%. Overall, regardless of the exchange or project listing method, new coins appear to face immediate sell-off pressure.

Token performance within 7 days of secondary listing on various exchanges in 2025

Token performance within seven days of exchange listing reveals a stark difference between primary and secondary listings. Across nearly all exchanges, primary listings underperform, with both the mean and median returns after token generation events (TGEs) being negative. In contrast, secondary listings often deliver stronger and more stable returns, benefiting from their pre-existing market recognition and liquidity.

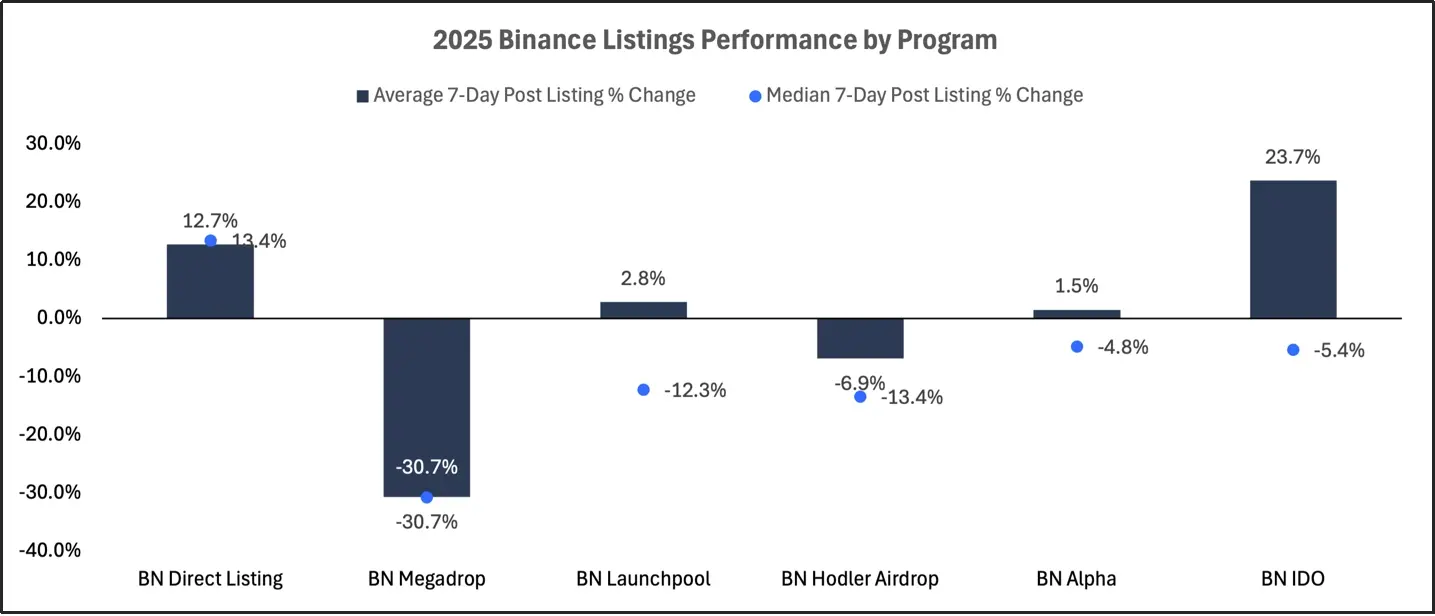

Token performance of various projects listed on Binance within 7 days of listing in 2025

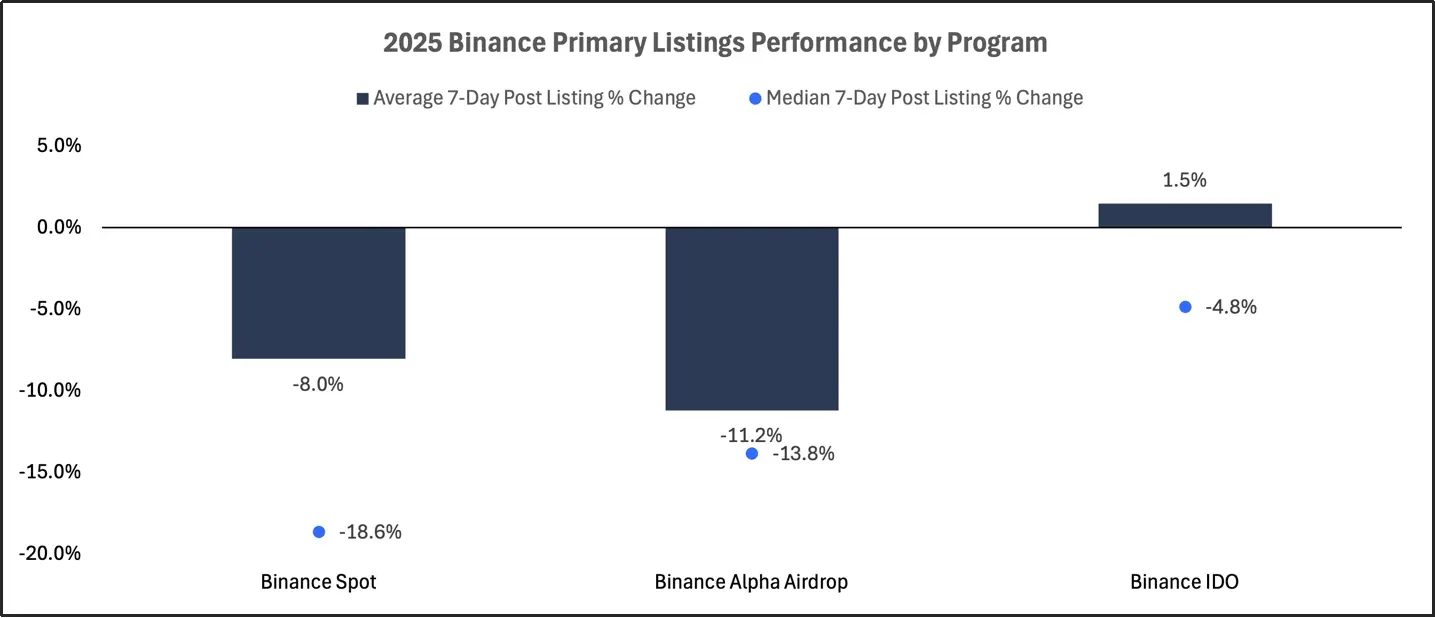

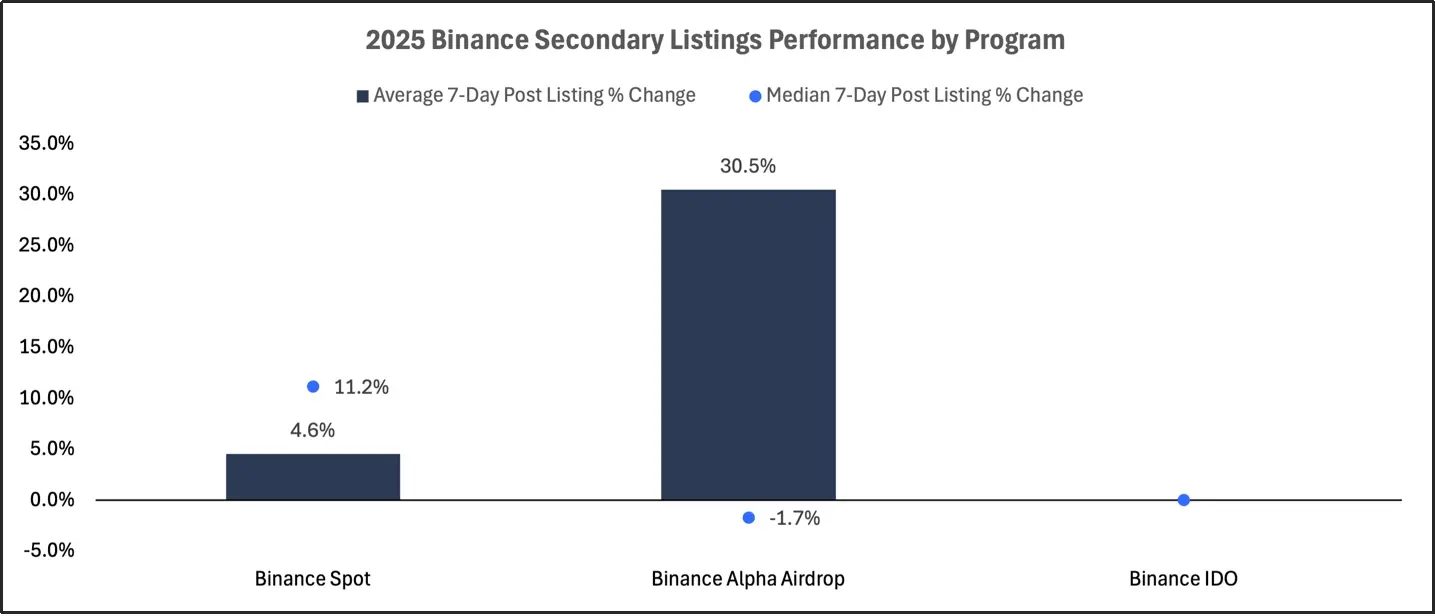

Initial decentralized exchange offerings (IDOs) saw an average return of +1.5% for first listings, but a median return of -4.8% highlights the limited reach of their success stories. Alpha airdrops had among the worst first listing performance, with an average return of -11.2% and a median return of -13.8%. Spot first listings had an average return of -8.0% and a median return of -19%, ranking last among all projects. Secondary listings for both spot and futures outperformed their respective first listings, further supporting the idea that existing tokens perform better when listed on new exchanges than when debuting through a token generation event (TGE). Secondary listings consistently performed the strongest after listing on Binance, while initial offerings, particularly through Alpha and spot channels, generally underperformed.

Token performance of various projects listed on Binance within 7 days of their first listing in 2025

Token performance of each Binance secondary listing within 7 days of listing in 2025

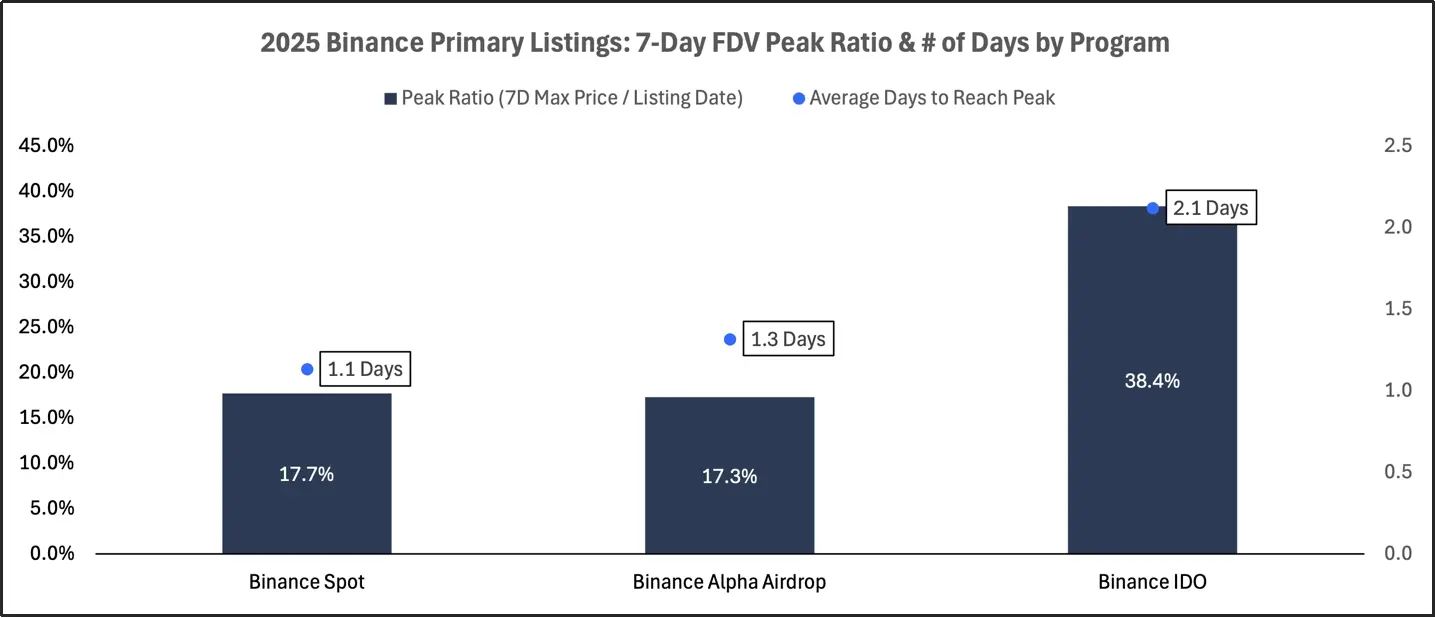

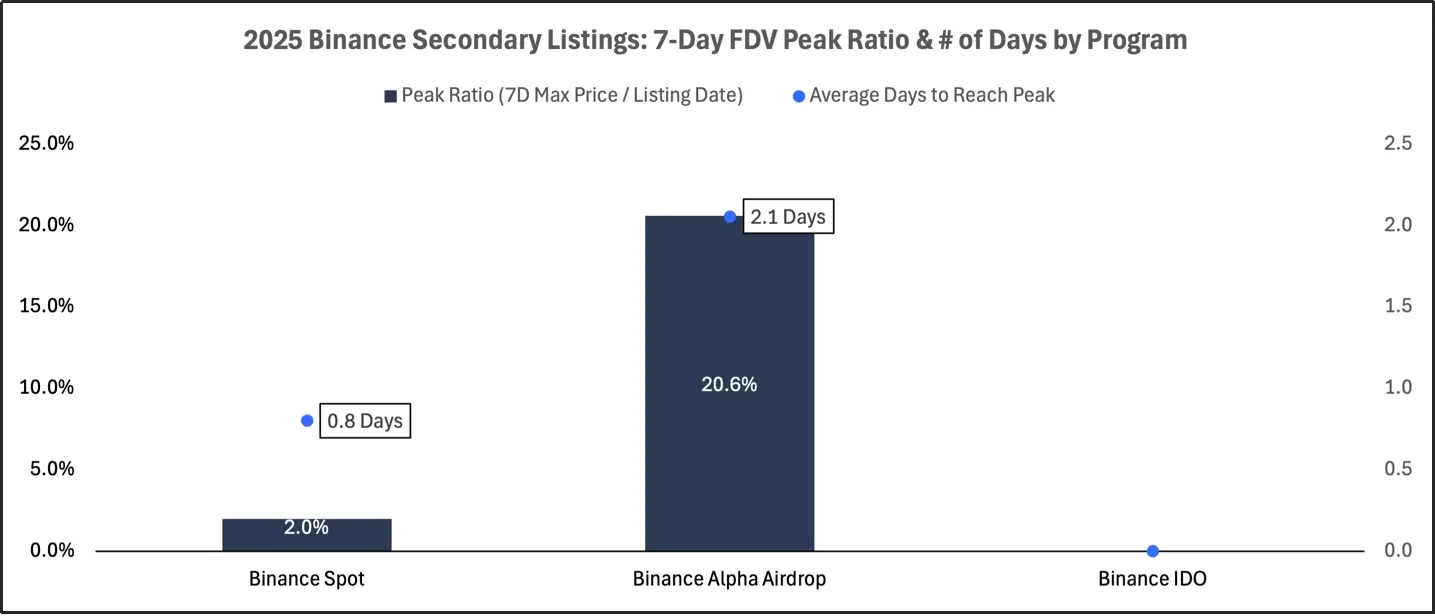

Peak fully diluted value (FDV) ratio and time analysis

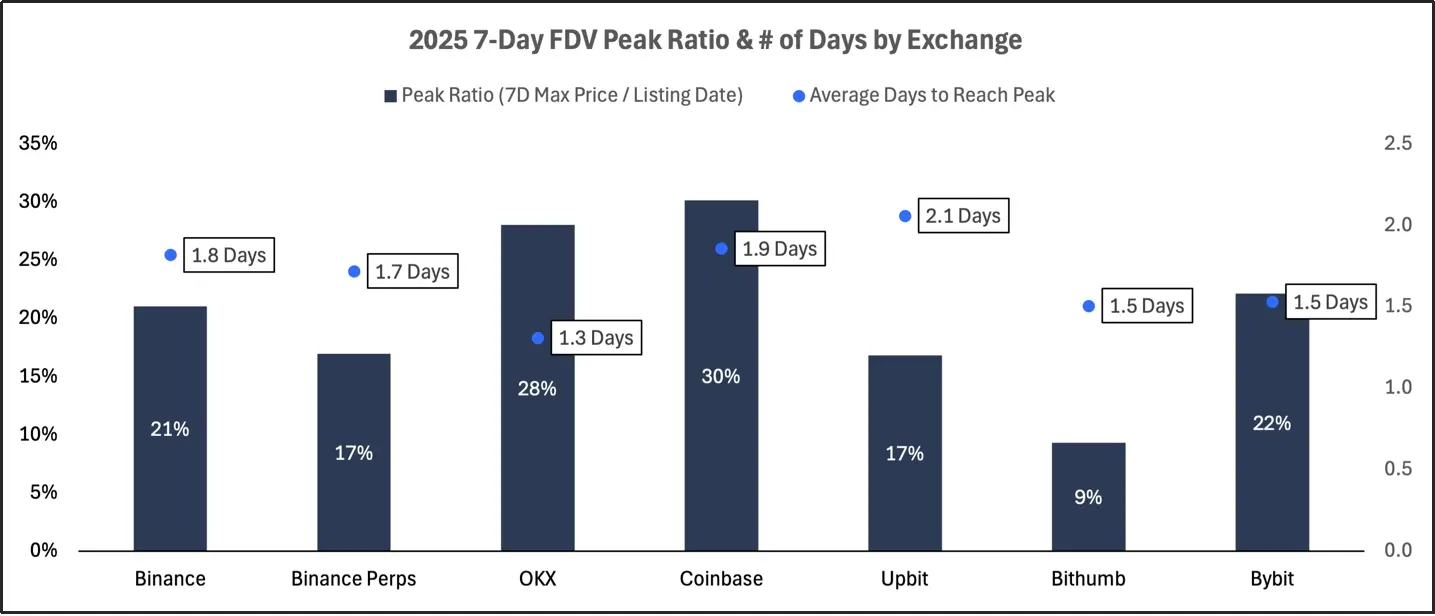

FDV peak ratio within 7 days and average number of days to reach the peak for each exchange in 2025

This section analyzes the peak fully diluted valuation (FDV) ratio and the average number of days to reach that peak. Together, these metrics reveal the dynamics of price discovery: a higher peak FDV ratio reflects stronger early demand and upward momentum, while a longer time to peak suggests sustained buying interest rather than early hype.

The peak FDV ratio in this article is calculated as follows: the highest price within 7 days after listing divided by the closing price on the day of listing.

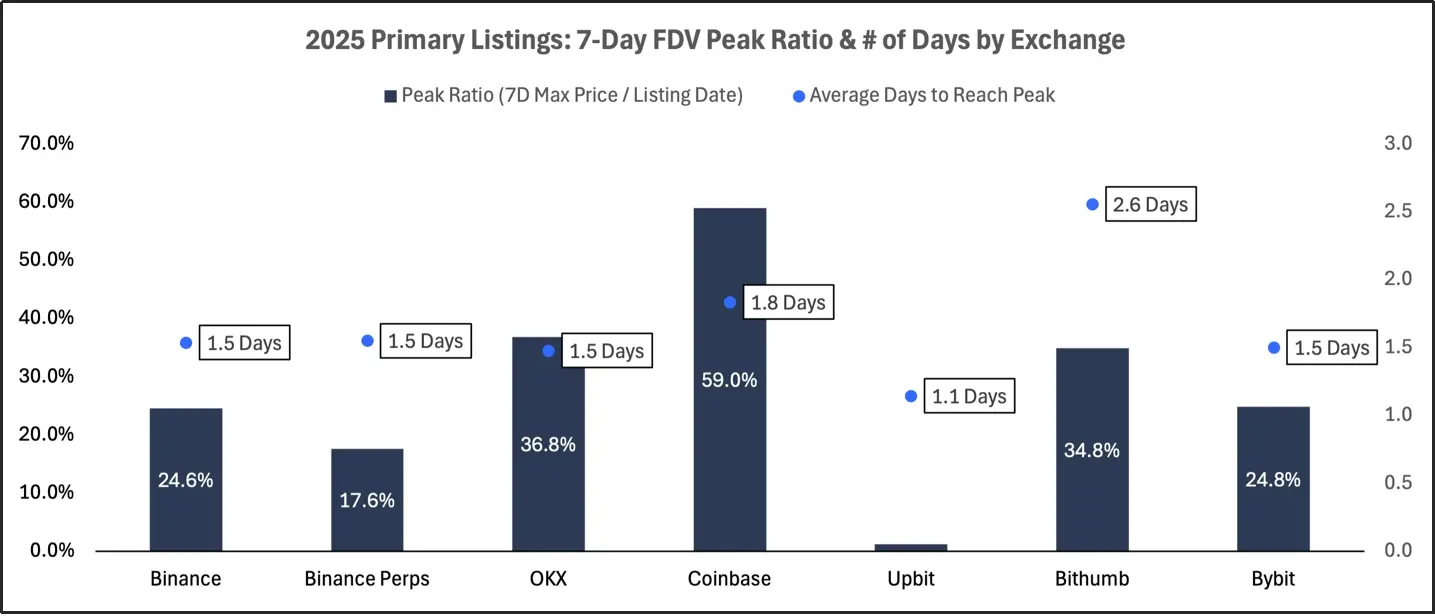

FDV peak ratio within 7 days of first listing on each exchange in 2025 and the average number of days required to reach the peak

Among first-time coin listings, Coinbase and OKX performed the best, with peak FDV ratios reaching 59% and 37%, respectively, both achieved within approximately 1.5 to 1.8 days. Binance IDO listings also performed strongly, with an average peak FDV ratio of 38% achieved within 2.1 days, reflecting sustained and stable market demand. In contrast, Alpha airdrops and direct spot listings peaked earlier and more modestly, with FDV ratios of only 17% to 18%, typically reaching their peak within 1.1 to 1.3 days. Listings on Upbit and Bithumb also saw rapid price increases, but subsequent momentum was noticeably lacking, indicating limited secondary market buying support. Overall, most first-time coin listings peaked quickly and early on, with relatively limited upside potential.

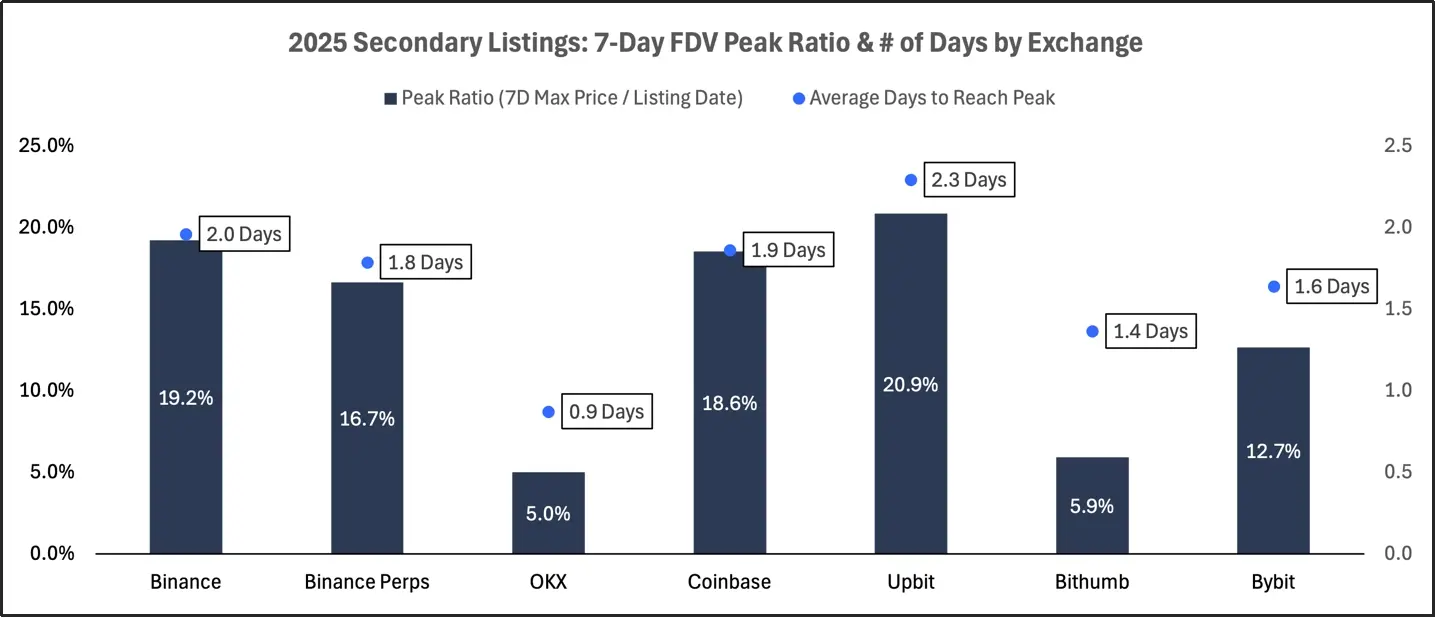

FDV peak ratio within 7 days of secondary listing on each exchange in 2025 and the average number of days required to reach the peak

Binance spot and Alpha secondary listings showed robust peak performance (approximately 20%-30%), though Alpha secondary listings took longer to reach their peak (2.1 days) and were more susceptible to extreme values. Upbit and Coinbase secondary listings exhibited similar trends, with peak FDV ratios of 18%-21% and peak times of approximately two days. OKX and Bybit secondary listings peaked quickly but performed weakly, with upside of less than 10% and peak times of less than 1.5 days. Overall, secondary listings exhibited healthier and more stable price discovery curves.

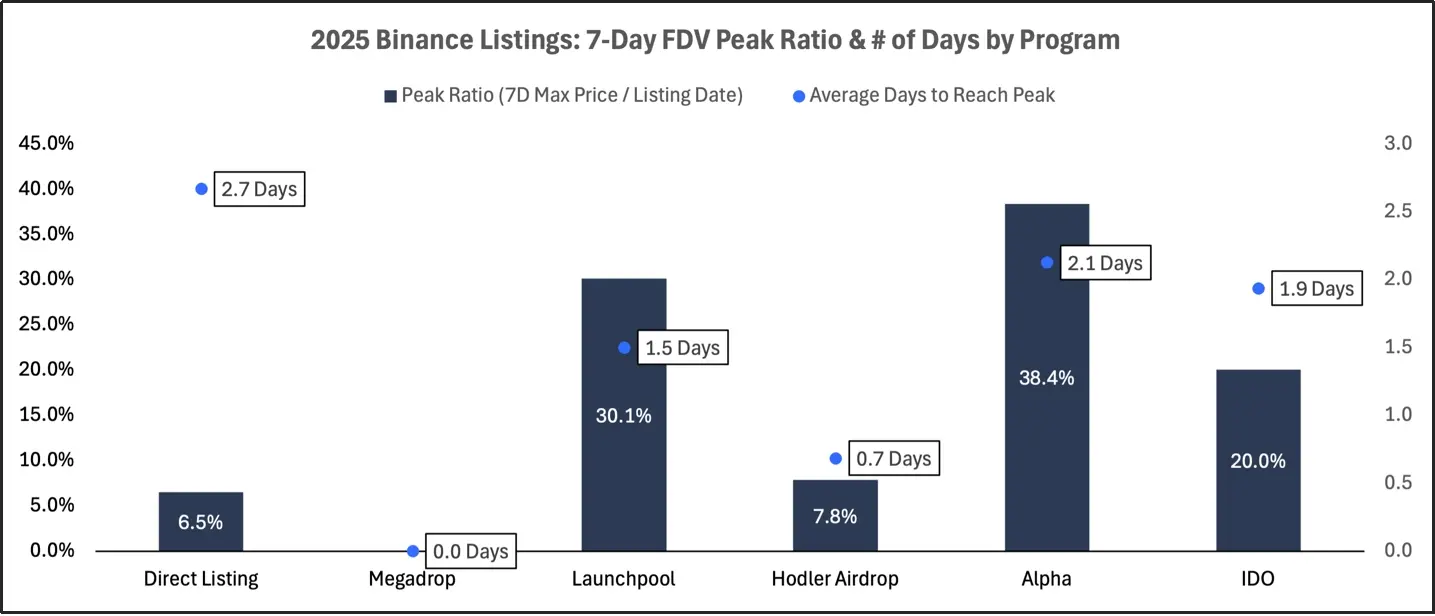

FDV peak ratio within 7 days of listing on Binance in 2025 and the average number of days to reach the peak

Binance IDO first-time listings achieved the highest peak ratio (38%) of all projects and took the longest to reach peak (2.1 days), indicating strong and sustained demand at launch. Alpha's airdrop first-time listings peaked earlier and at a lower level, with a FDV ratio of 17% within 1.3 days, indicating a stronger early momentum. Spot first-time listings performed similarly to Alpha, with an average peak ratio of 18%, often occurring on the first day of listing. Binance spot secondary listings experienced a rapid peak, but only 2%, with many projects reaching peak value on the day of listing. Overall, Binance spot listings have limited peak potential, and prices often fall quickly after peaking.

FDV peak ratio within 7 days of first listing on Binance in 2025 and average number of days to reach the peak

FDV peak ratio within 7 days of secondary listing of each project on Binance in 2025 and the average number of days required to reach the peak

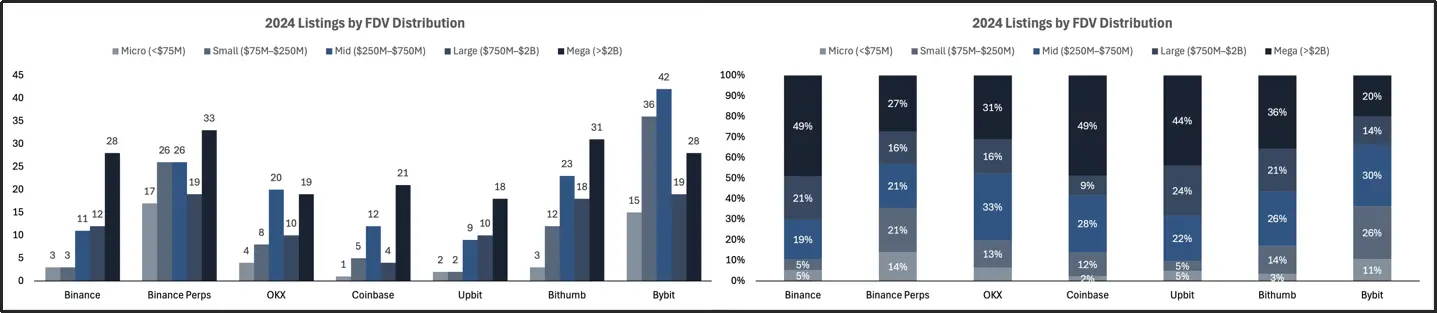

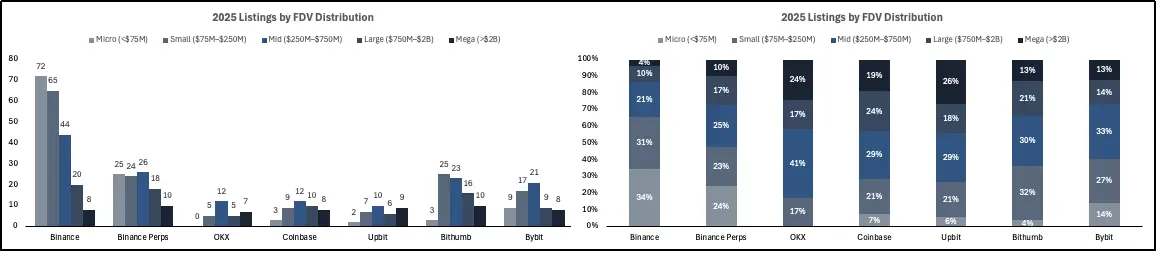

Listings by Fully Diluted Valuation (FDV)

Project valuation tiers by exchange in 2024 based on fully diluted valuation (FDV)

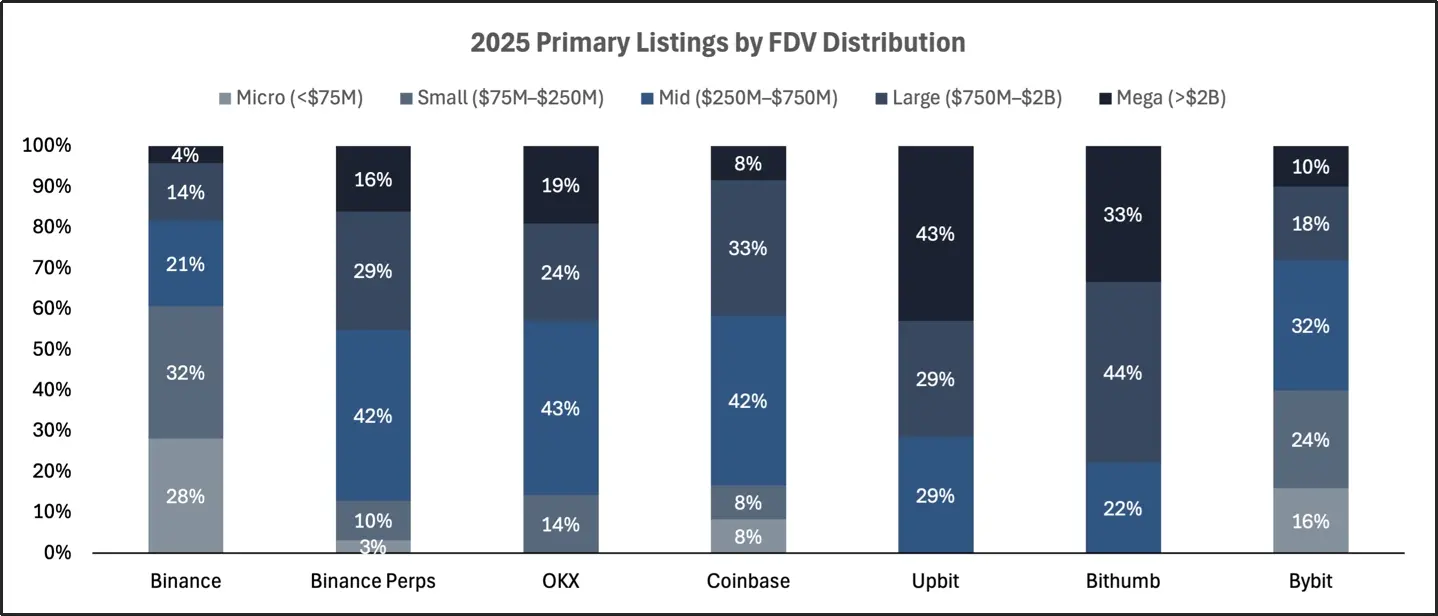

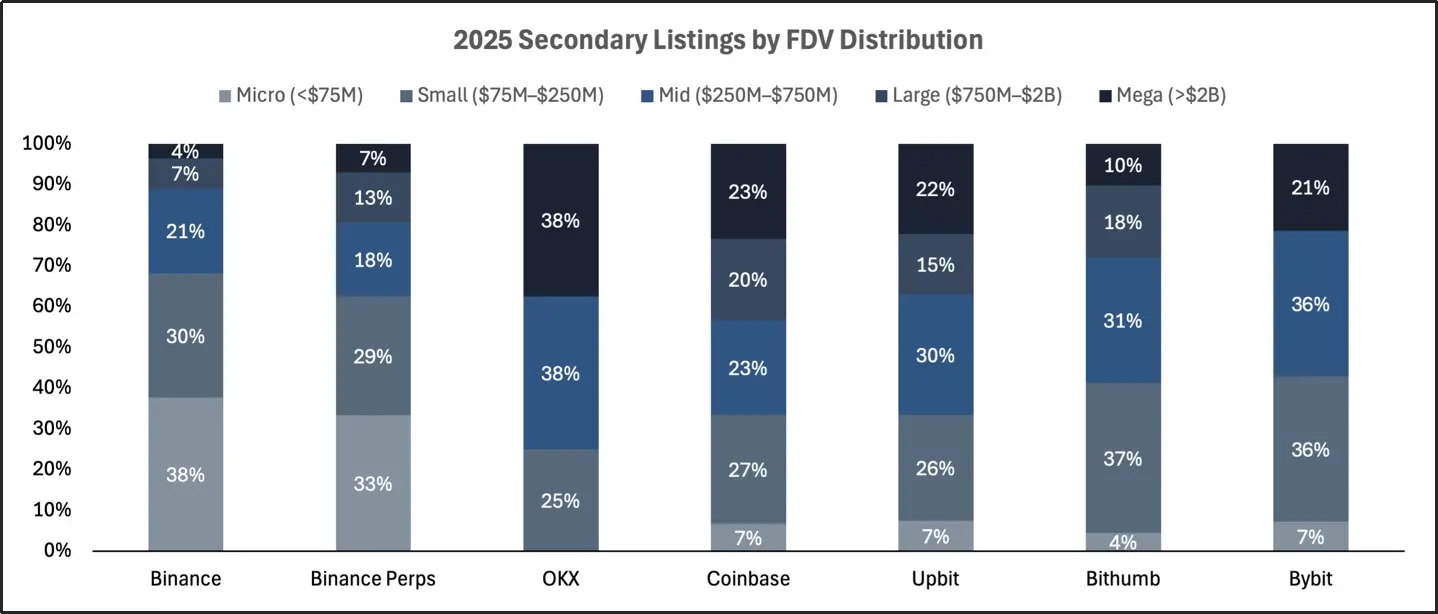

Project valuation tiers by exchange in 2025 based on fully diluted valuation (FDV)

This section analyzes the fully diluted valuation (FDV) of listed projects to assess how exchanges and listing plans divide trading flow by project size. For first-time listings, FDV is calculated based on the closing price on the day of listing; for secondary listings, FDV reflects pre-listing valuations. By comparing various exchanges and Binance's plans, we can identify patterns in how listing platforms select tokens within different valuation tiers and segment their offerings. These tiers are categorized as: Micro (<$75 million), Small ($75 million–$250 million), Medium ($250 million–$750 million), Large ($750 million–$2 billion), and Mega (>$2 billion).

Valuation tier ratios of various projects distributed by fully diluted valuation (FDV) across exchanges in 2024

Upbit and Bithumb's first coin listings were heavily skewed toward large- and mega-caps, with 72% and 77% of their projects, respectively, exceeding $750 million in fully diluted valuation (FDV). On Upbit alone, 43% of its projects were mega-caps. Coinbase and OKX's first coin listings were concentrated in the mid- and large-cap range, with 75% exceeding $250 million in FDV, and the majority falling between $250 million and $750 million. Binance Futures' first coin listings also tended toward high FDV, with 87% exceeding $250 million. Bybit's distribution was the most balanced, with micro-caps accounting for 16%, small-caps 24%, mid-caps 32%, and large- and mega-caps combined accounting for 28%. Overall, first coin listings tended to be dominated by high-FDV projects, but by 2025, driven by Binance DEX's planned launch, this trend shifted toward low-FDV projects.

The valuation tier ratios of various projects distributed by fully diluted valuation (FDV) across exchanges in 2025

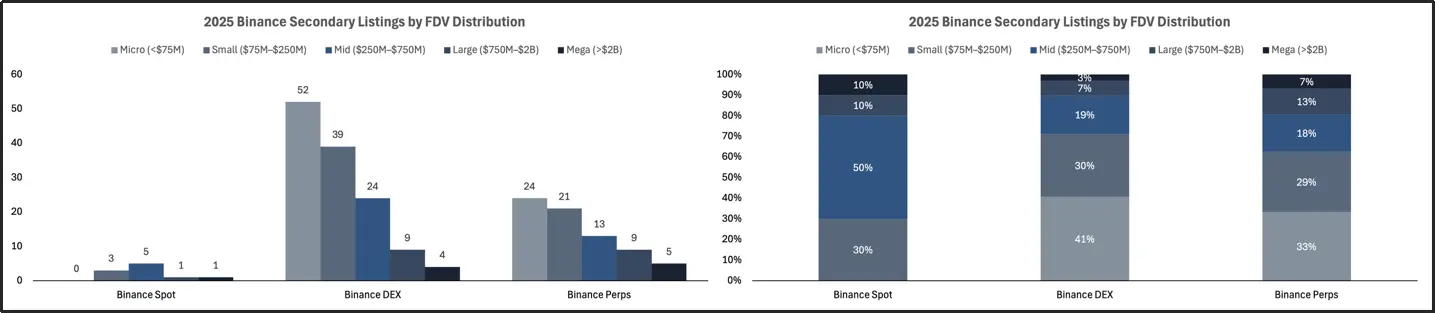

Driven by Binance Alpha, Binance's secondary listings tend to be smaller, with fully diluted valuations (FDVs) below $250 million. Secondary listings on Bybit and Coinbase have a wider distribution of FDVs. Secondary listings on South Korean exchanges, namely Upbit and Bithumb, are heavily skewed toward larger projects. These patterns suggest that secondary listings offer a more flexible and accessible channel for projects of varying maturity.

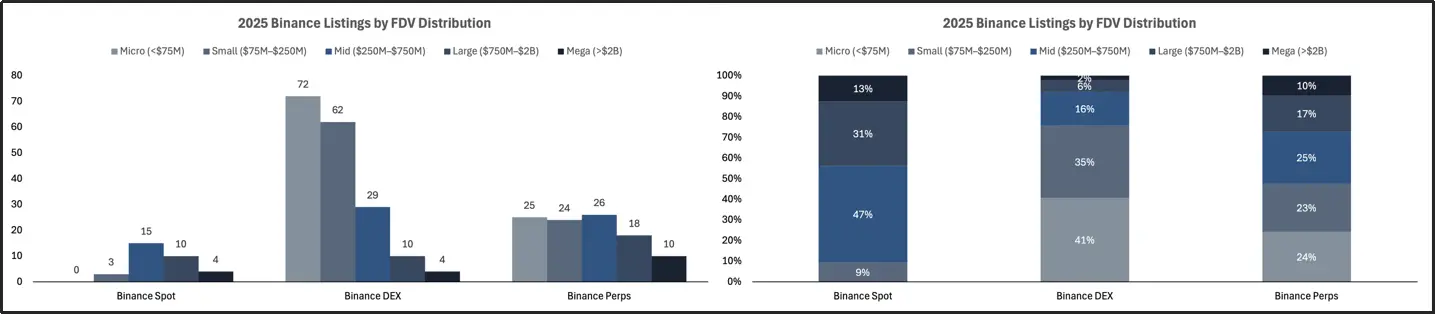

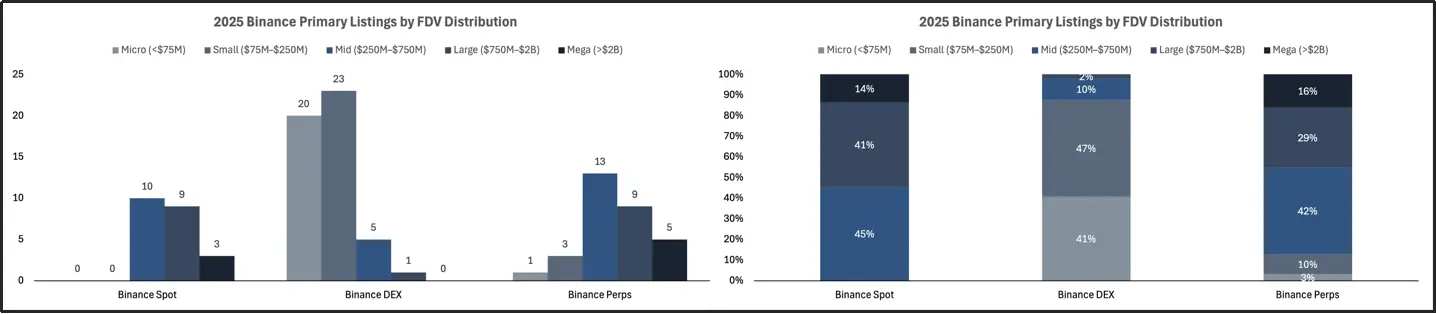

Binance project valuation tiers based on fully diluted valuation (FDV) in 2025

Binance's spot listings tend to favor large-cap projects, with no micro-cap projects. Most projects have a fully diluted valuation (FDV) above $250 million, with a high concentration above $750 million. The Alpha airdrop targets small-cap projects, with approximately 80% of listed projects having an FDV below $250 million, with a high proportion of micro-cap projects. Binance's IDO listings are concentrated, with nearly all projects having an FDV between $75 million and $250 million, and no projects exceeding $750 million. Each of Binance's listing programs targets a different market segment, with little overlap across FDV tiers. Clearly, Binance's strategy is clearly targeted: the spot segment targets scaled tokens, Alpha targets early-stage projects, and the IDO is dedicated to carefully selected growth-stage projects.

Project valuation tiers for Binance ICOs in 2025 based on fully diluted valuation (FDV)

Project valuation tiers for Binance secondary coin offerings in 2025 based on fully diluted valuation (FDV)

Binance’s Coin Listing Path

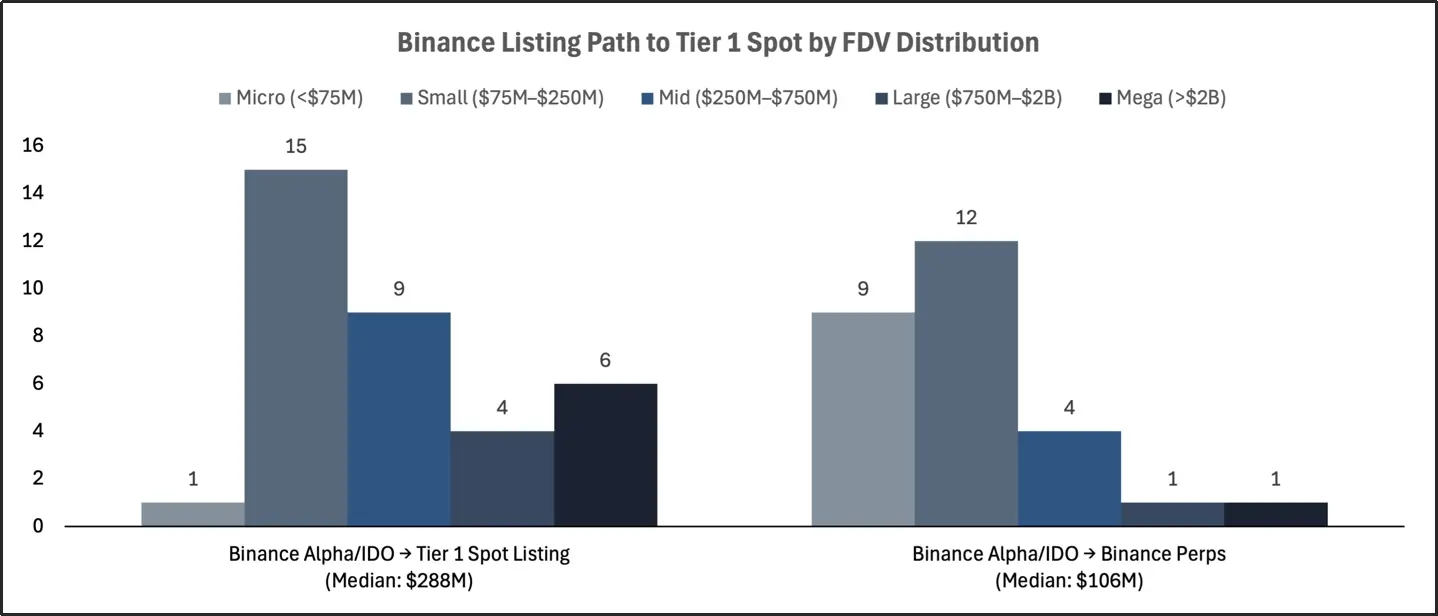

Listing paths for first-tier spot coins on Binance, divided by fully diluted valuation (FDV) distribution

This section will analyze the downstream listing paths of the Binance Alpha airdrop and Binance IDO, tracing how these tokens subsequently landed on Binance perpetual contracts, Binance spot, and the spot sections of other first-tier centralized exchanges (CEXs), such as OKX, Coinbase, Upbit, and Bithumb.

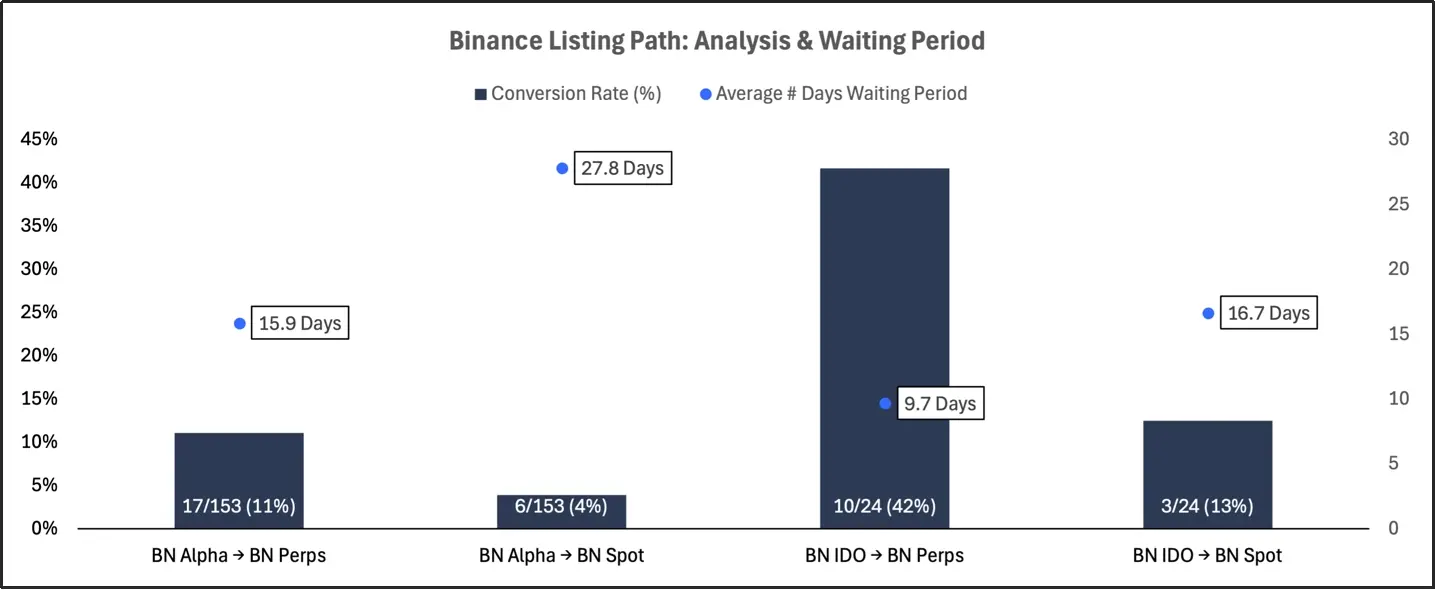

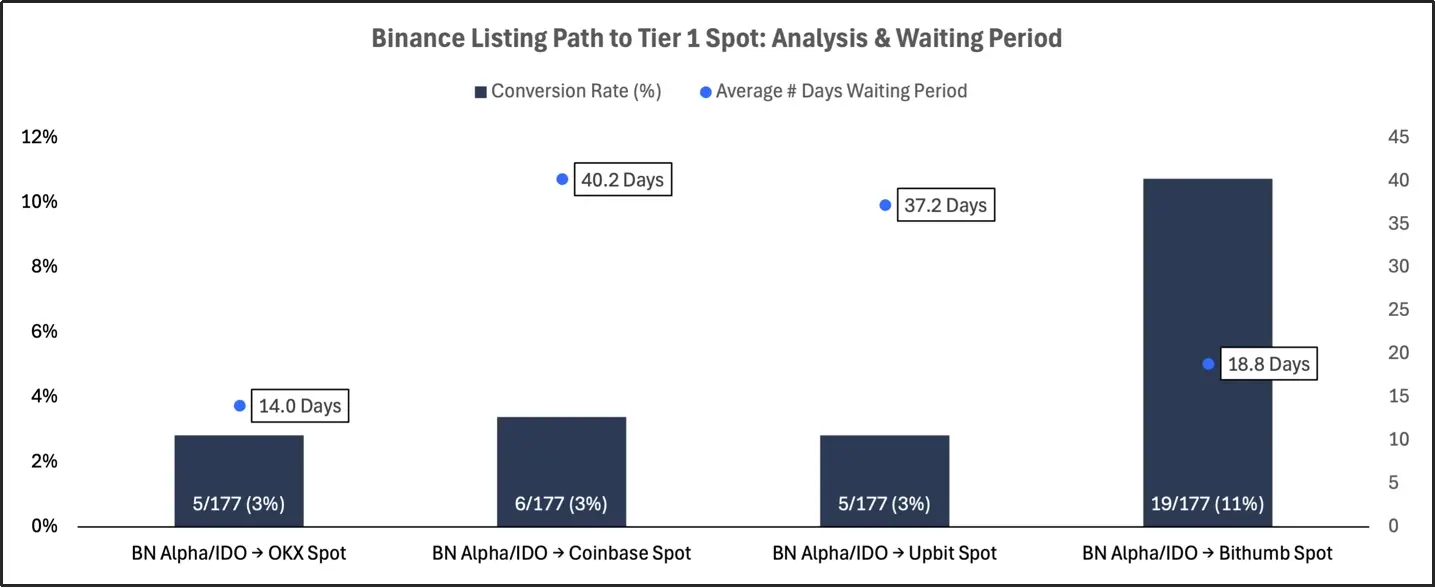

Binance’s Coin Listing Path: Conversion Rate and Average Waiting Time

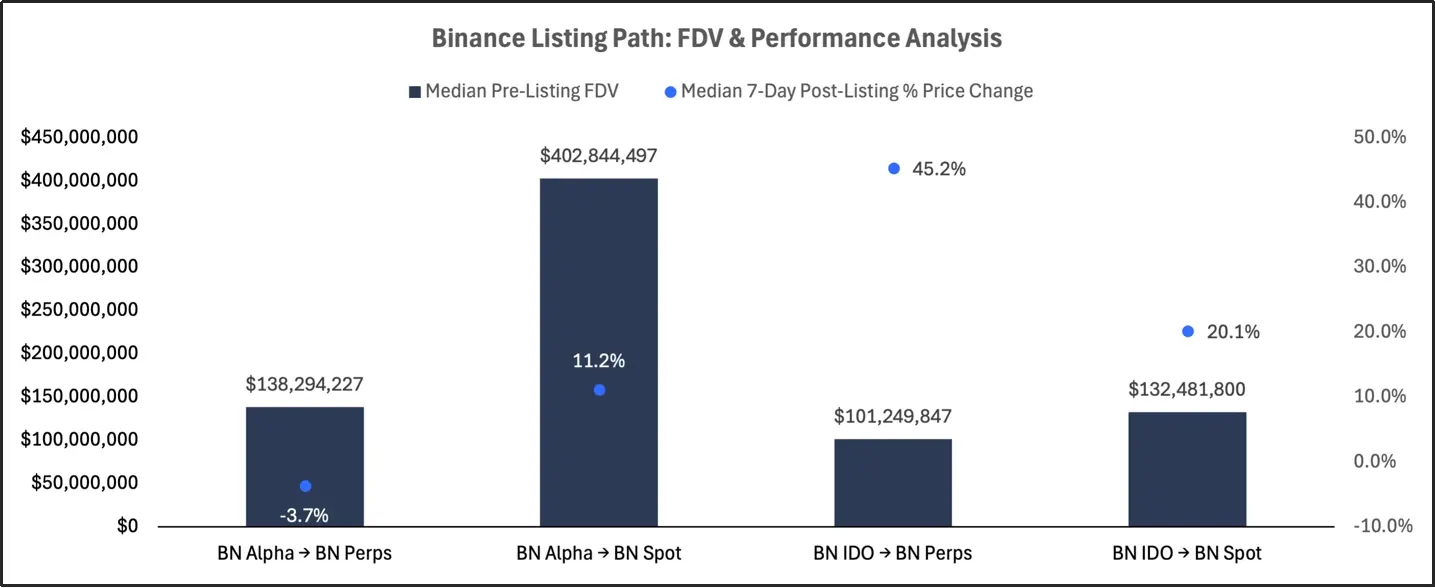

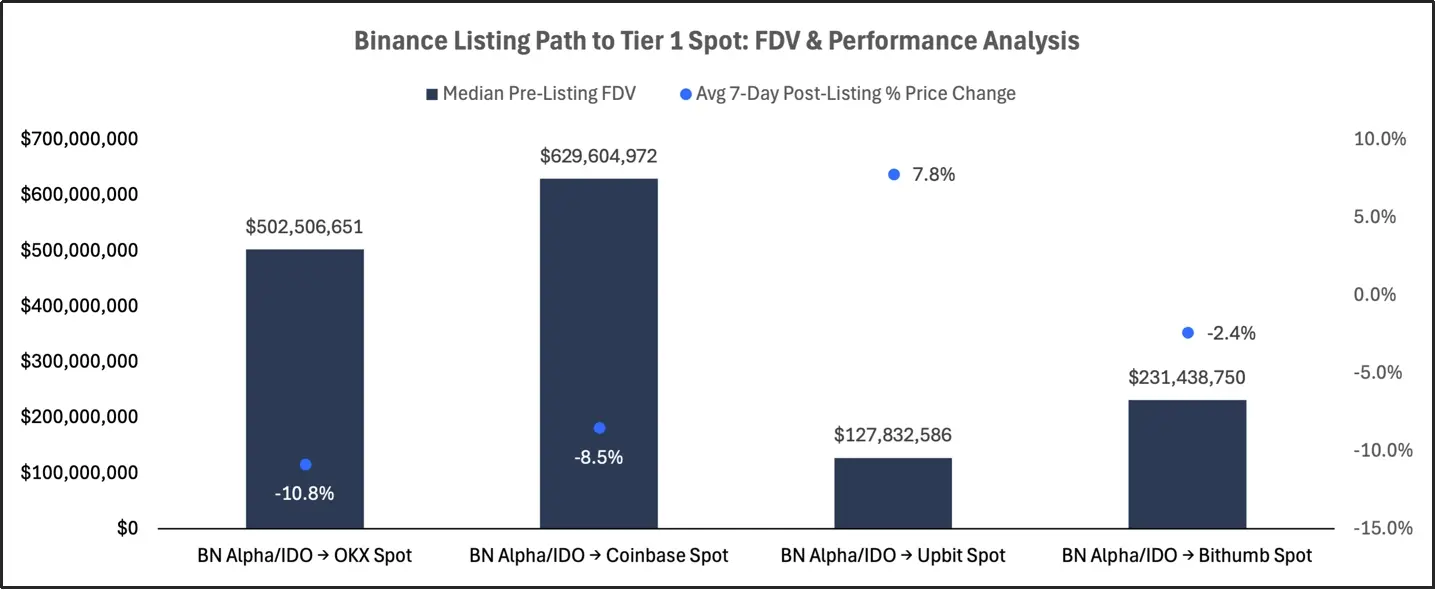

Binance’s Coin Listing Path: Fully Diluted Valuation (FDV) and Performance Analysis

Binance Alpha airdrops rarely lead to high-quality coin listings, resulting in a low conversion rate to perpetual swaps and spot trading, and generally weak post-listing performance. Tokens that have entered the spot market through Alpha are mostly high-fully diluted valuation (FDV) projects with some subsequent performance. Binance IDO, on the other hand, has significantly greater appeal in the downstream market, particularly in perpetual swaps, with rapid progress and impressive seven-day returns. While IDO-to-spot conversions are uncommon, their performance still outperforms Alpha. Overall, Binance Alpha's downstream conversion rate is low and performance is mixed, while IDOs offer a more robust path to downstream coin listings, particularly perpetual swaps.

Listing Path for First-Tier Spot Coins on Binance: Conversion Rate and Average Waiting Time

Binance’s Top-Tier Spot Coin Listing Path: Fully Diluted Valuation (FDV) and Performance Analysis

Tokens issued through Binance Alpha or IDOs are still rare for listing on the spot trading floors of first-tier exchanges. Conversion rates are low, and there are often long delays before listing on other major exchanges. These tokens generally underperform after listing on other exchanges, with most experiencing negative returns, with only a small increase on Upbit. This type of listing tends to favor large-cap tokens, further supporting the view that projects with higher fully diluted valuations (FDVs) are more likely to receive listings on first-tier exchanges. While listing on external exchanges can provide broader exposure, conversion rates are rare and performance is often disappointing, especially for high-FDV projects, whose liquidity events are more likely to be used for token distribution rather than project growth.

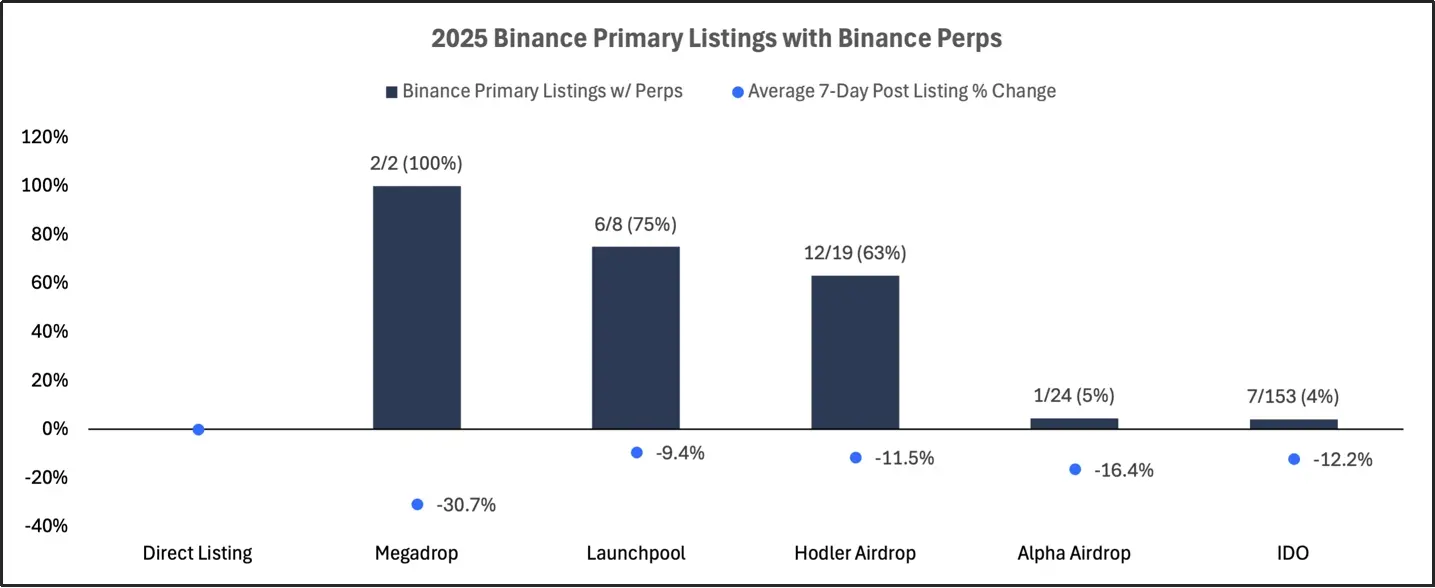

Projects that will simultaneously list their first coin and perpetual contract contracts on Binance in 2025

The chart above analyzes Binance's first coin listings in 2025 that also included perpetual swaps. The data shows that Binance significantly favors first-day spot trading over Alpha airdrops or IDOs when pairing perpetual swaps with token generation events (TGEs).

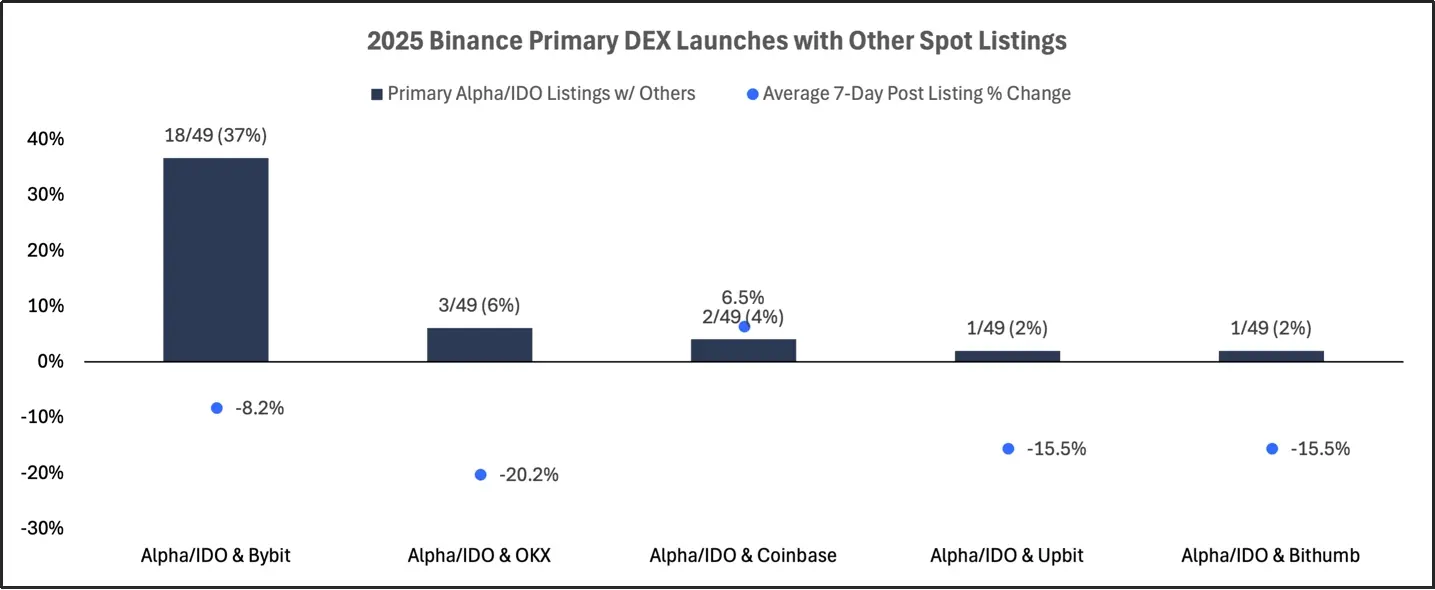

Frequency and performance of Binance’s first DEX launches in 2025, alongside spot listings on other exchanges

The chart above analyzes the frequency and performance of Binance's initial DEX offerings (including the Alpha airdrop and IDO) alongside spot listings on other major exchanges, such as Bybit, OKX, Coinbase, Upbit, and Bithumb. These co-listings generally underperformed, with negative 7-day average returns across all exchanges, with OKX, Upbit, and Bithumb experiencing particularly significant declines.

Summarize

In the first half of 2025, the cryptocurrency exchange listing landscape has changed significantly. This shift is driven by the rise of on-chain issuance projects, the increasing dominance of secondary listings, and a clearer segmentation of listing paths for different valuation tiers and platforms.

While Binance maintains a clear lead in total coin listings, its strategy has decisively shifted toward "on-chain-first" projects—particularly Alpha airdrops and IDOs, which now account for the majority of new token issuance. However, the success of these projects varies significantly: while Alpha airdrops achieved scalable issuance, subsequent performance and conversions were lackluster; IDOs, on the other hand, have become a more selective but higher-performing path, particularly for listing Binance perpetual swaps. Across all exchanges, secondary listings consistently outperform primary offerings in both 7-day returns and peak FDV ratios, a pattern that reflects the advantages of listing tokens after they have established initial liquidity and market presence. Notably, Binance, Coinbase, and Upbit experienced the strongest subsequent performance from secondary listings, while OKX and Bybit lagged behind.

Valuation segmentation is now deeply integrated into each exchange's project ecosystem: Binance's spot listings favor large-cap, high-FDV tokens, while its Alpha and IDO channels focus on early-stage and growth-stage projects, respectively. This reflects a more targeted screening approach to the token listing process and a clear hierarchy of access to high-quality trading channels. Cross-exchange liquidity remains rare and slow, with only a handful of projects originating on Binance successfully listing on the spot trading platforms of other first-tier exchanges. Even when this transition occurs, it is often concentrated among high-FDV projects, and post-listing performance is often lackluster.

Taken together, these trends highlight a maturing ecosystem where the type of project, stage of token development, and order of listings are more important than ever. Understanding these structural dynamics is key for projects, investors, and exchanges alike to navigate the increasingly tiered path from token generation to long-term exchange liquidity.

Click here to learn about ChainCatcher's current job openings

Recommended reading:

HTX DAO Officially Launches "Governance Mechanism for Recommended Listings and Delistings": Moving Towards a True Era of Community Consensus Decision-Making

What are the on-chain whales secretly buying? Bitget's public listing mechanism