By Pima, Co-founder of ContinueCapital

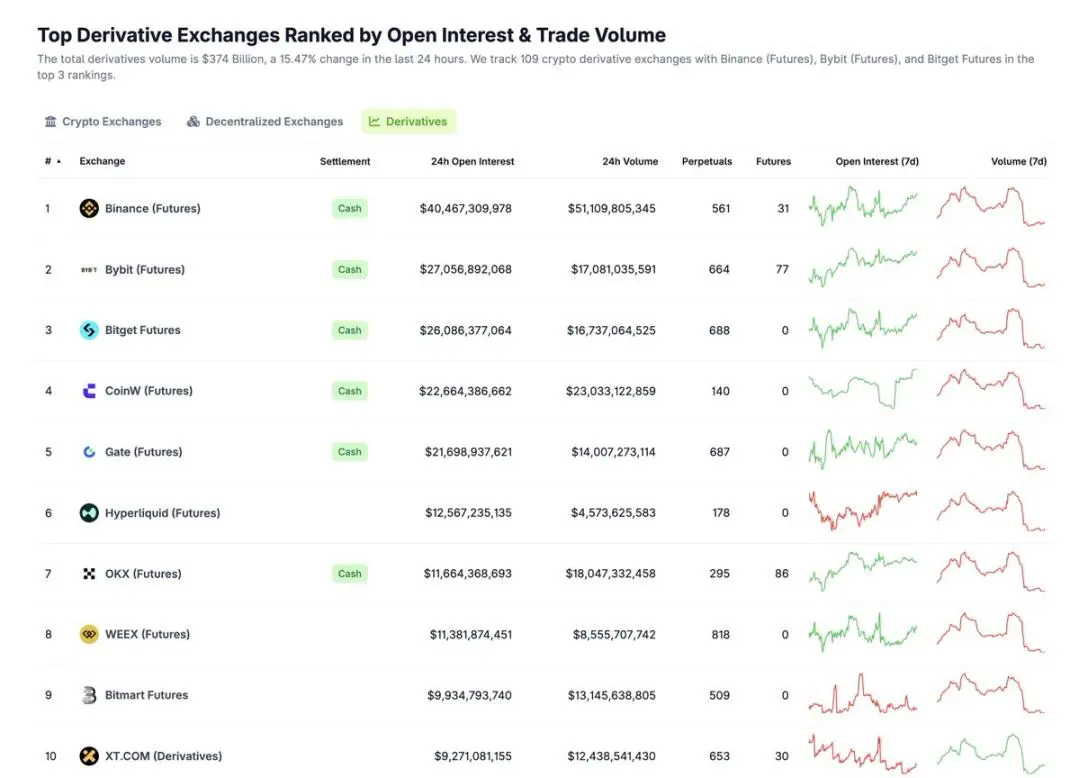

The most profitable business in the crypto field is the contract market, which currently generates approximately $20-30 billion in profits annually. This has grown rapidly at an annualized rate of approximately 100% over the past two years, while the spot market has been crushed. The profit distribution is approximately 3:1 for contracts: spot.

Based on a 25x PE ratio for US stocks, we can roughly predict that the futures market can support companies with market capitalizations of 500 billion to 750 billion yuan. If Binance alone takes 40% of the market, that translates to a market capitalization of 200 billion to 300 billion yuan. If Hyperliquid takes 30%, that translates to a market capitalization of 150 billion to 220 billion yuan. Why can't Binance achieve such a high PE ratio? I believe that this is due, firstly, to financial transparency issues (the Enron fraud had a devastating impact on the capital market). Second, there is the issue of access to more channels for capital market participation (DATs/ETFs/Robinhood, etc.). Third, there is the issue of revenue diversification (subscription models enjoy higher valuations than commission-based models). Over time, these obstacles are all improving.

How long will it take for $HYPE to reach 30% market share? Analyzing the future presupposes understanding the present. Your future performance can be dynamically estimated based on your current and past performance.

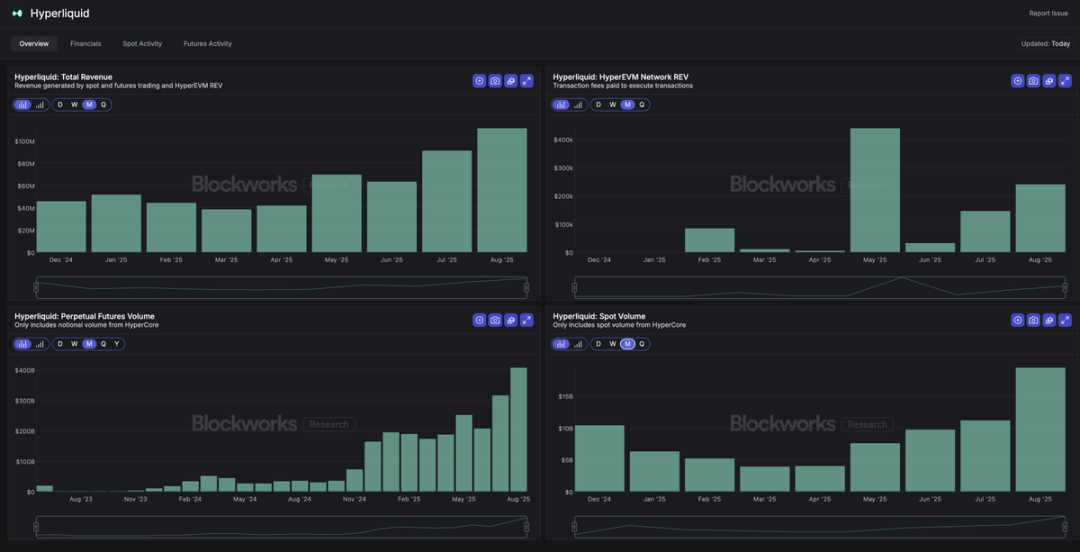

In December 2024, HYPE's monthly revenue will be 45 million, and in August 2025, it will be 110 million US dollars. The compound growth rate of monthly revenue is 11.8%. According to this growth rate, it will take about 19 months to achieve monthly revenue of 1 billion US dollars, which means annual revenue of 12 billion US dollars. The PE 25 corresponds to a fair market value of 300 billion; assuming that the marginal growth rate slows down (the scale increases/competition intensifies), the monthly revenue growth rate is 5%, and it will take a total of 64 months from 45 million to 1 billion, which is 55 months from now. The annualized growth rate is 80%, which means it will take about 4.5 years to achieve an annualized revenue of 12 billion US dollars.

With compliance supporting everything on the blockchain and the trend toward pan-financialization, the overall contract market continues to maintain rapid growth. Assuming a 30% annualized growth rate, the contract market's profits in five years will be between $74 billion and $111 billion. A profit of 100 billion yuan could easily support a market capitalization of $2 trillion. As long as you can capture 30% of the market share, a market capitalization of $600 billion is a completely fair valuation. It's important to understand that the US Mega 7 (except for TSLA) aren't driven by PE, but rather EPS. Every company with a market capitalization exceeding $2 trillion generates hundreds of billions of dollars in annual profits.

I have not predicted the stablecoin market revenue/spot market revenue/future ecosystem market revenue brought by HIP-3 on HYPE, etc., but only focused on the main contradictions and optimal solutions. (Of course, the payment market is also very large and needs to be separately listed.) The overall logic and ideas have built a framework, and you can extend it if you are interested.

The power of transparency and permissionlessness is infinite. Instead of lamenting why a project is stagnant, it is better to study how the company can earn more cash flow in the future.