A. Market View

I. Macro Liquidity

Monetary liquidity improved. The Federal Reserve remained on hold for five consecutive meetings, keeping the federal funds rate target range at 4.25% to 4.50%. Powell offered no clear guidance on a September rate cut, emphasizing inflation risks and stating that employment is solid, dampening expectations of a rate cut this year. The US dollar rose to a two-month high, and US stocks continued to rise to new highs. The crypto market underperformed US stocks.

2. Overall market conditions

Top 300 companies by market capitalization:

This week, BTC fluctuated at high levels, altcoins performed weakly, and cryptocurrency stocks plummeted. The main trend of the market revolved around the ETH system.

Top 5 gainers | Increase | Top 5 decliners | decline |

LOKA | 300% | TKX | 60% |

ZORA | 60% | FARTCOIN | 30% |

ZBCN | 50% | M | 30% |

KTA | 40% | VIRTUAL | 20% |

REKT | 40% | GRASS | 20% |

- ZORA: A socialfi project, partnering with the Base Chain app. Coinbase Foundation manipulated the market, causing a 10-fold increase in price from its low.

- ENA: The old stablecoin USDE and the new stablecoin USDTB continue to be profitable, and a micro-strategy platform for US stocks has been established to continuously buy. ENA has partnered with AAVE to release a revolving loan for the stablecoin USDE.

- CFX: It is a domestically produced compliant public chain. Hong Kong plans to issue a stablecoin license in September.

3. On-chain Data

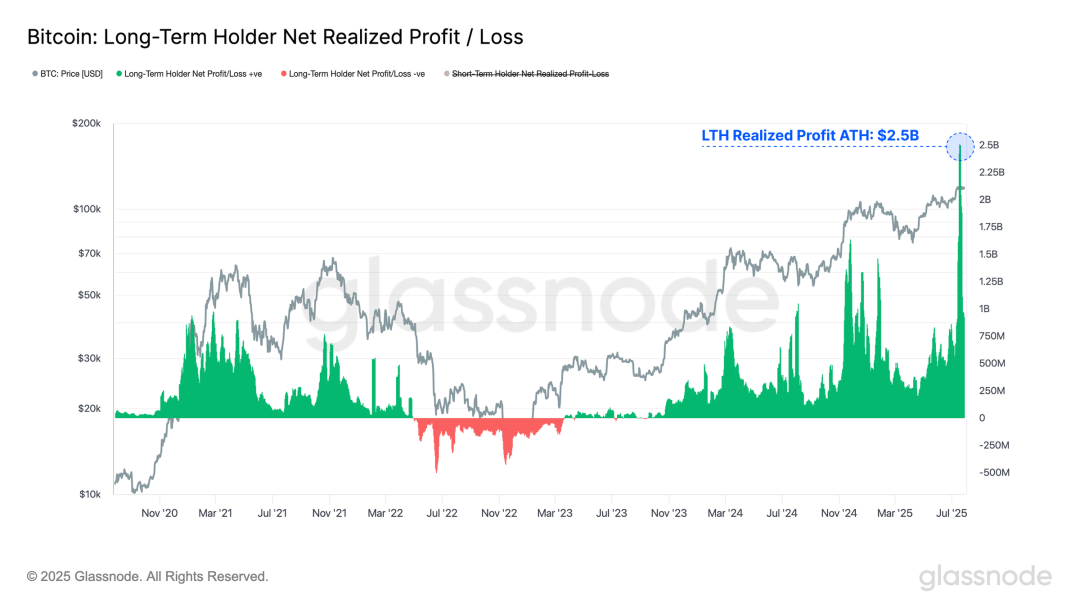

BTC liquidity faces a severe test. An early whale sold over 80,000 BTC in an over-the-counter (OTC) trade, generating nearly $10 billion in trading volume. However, the market effectively absorbed the seller pressure, with 97% of the circulating supply still profitable.

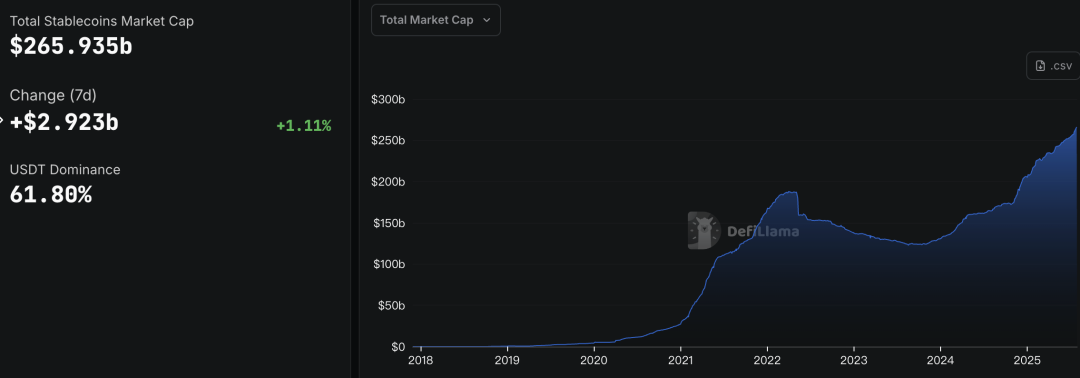

The supply of stablecoins continued to grow by 1%.

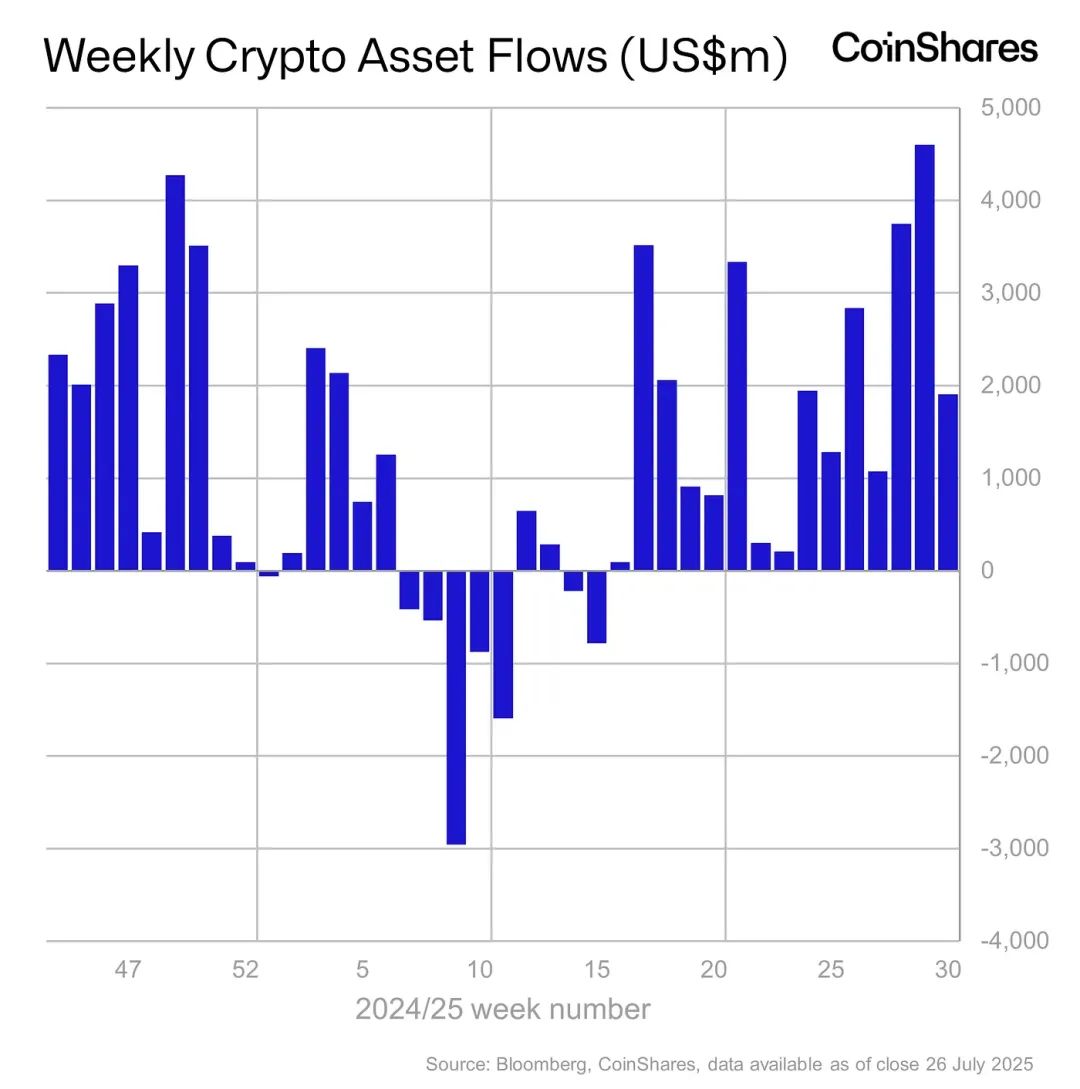

Institutional funds have continued to see net inflows. ETH has led to a surge in inflows, with year-to-date inflows exceeding the total for the past 24 years.

The long-term trend indicator, MVRV-ZScore, uses the market's total cost of ownership as a proxy for overall profitability. A reading above 6 indicates a top range, while a reading below 2 indicates a bottom range. When MVRV falls below the critical level of 1, holders are generally in a loss-making position. The current reading is 2.6, nearing the mid-range range.

IV. Futures Market

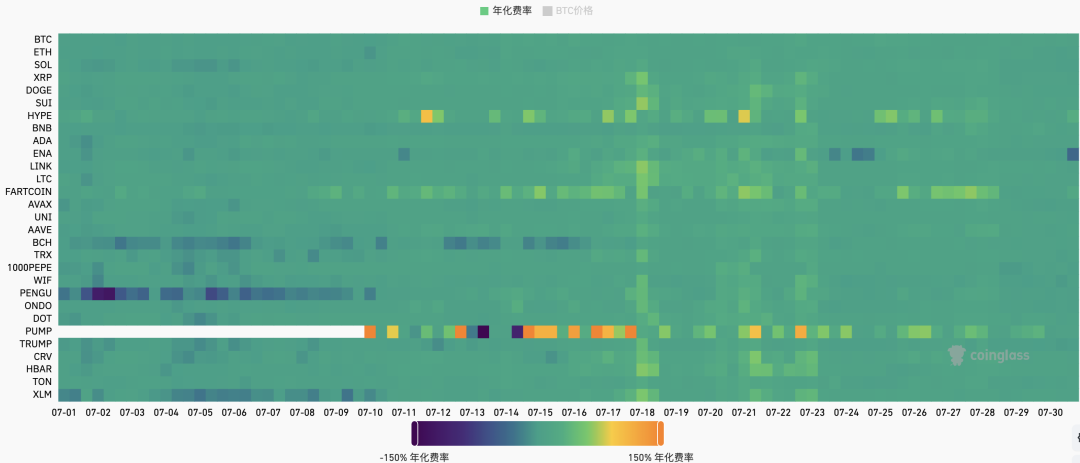

Futures Funding Rate: This week's rate is 0.01%, which is normal. Rates between 0.05-0.1% indicate higher leverage in long positions, signaling a short-term market top; rates between -0.1-0% indicate higher leverage in short positions, signaling a short-term market bottom.

Futures Open Interest: BTC open interest began to decline this week.

Futures long-short ratio: 1.1, indicating neutral market sentiment. Retail investor sentiment is often a contrarian indicator, with readings below 0.7 indicating fear and above 2.0 indicating greed. The long-short ratio fluctuates widely, making it less useful as a reference.

5. Spot Market

BTC fell this week, while the ETH/BTC exchange rate remained strong, with a handful of stablecoin-related altcoins leading the gains. The market is rotating from BTC to ETH and altcoins, and risks are expected to gradually accumulate in the future.

B. Stablecoins and RWA

1. Stablecoin sector

Hong Kong Monetary Authority: The first license may be issued early next year. Initially, Hong Kong compliant stablecoin holders must have real-name identities.

At a technical briefing on the regulatory regime for stablecoin issuers, Hong Kong Monetary Authority Deputy Chief Executive Chan Wai-min stated that the number of stablecoin issuer licenses to be issued in the first phase is uncertain and will depend on the quality of the application materials submitted by the applicants. The first stablecoin issuer license is expected to be issued early next year. He emphasized that the "barrier to passing" is very high, and that entering the "sandbox testing" does not guarantee a license. Chan also stated that the Hong Kong Monetary Authority maintains an open approach regarding fiat currencies. Stablecoin issuers can apply for licenses pegged to either a specific fiat currency or a basket of fiat currencies. The key is to specify the fiat currency in the application.

The Hong Kong Monetary Authority will open applications for the first batch of stablecoin issuer licenses from August 1 to September 30, 2025, marking the official implementation of Hong Kong's stablecoin regulation. The identities of all compliant stablecoin holders in Hong Kong must be verified, effectively implementing a real-name system to strengthen efforts to combat money laundering and financial crime risks. Hong Kong Monetary Authority Executive Director (Regulation and Anti-Money Laundering) Chan King-hung noted that this arrangement is stricter than the "whitelist" system previously outlined in the anti-money laundering consultation document, but that regulations could be relaxed in the future if the technology matures.

JD.com's JD Chain registered JCOIN and JOYCOIN, which may be the names of its stablecoins.

JD.com's JD Coin Chain has registered the names "JCOIN" and "JOYCOIN," which the market speculates are the names of its stablecoins. Registration instructions indicate that related services include electronic funds transfers and cryptocurrency financial transactions using blockchain technology. JD Coin Chain is a participant in the HKMA's Stablecoin Issuer Sandbox Program and previously collaborated with Airstar Bank to test a stablecoin-based cross-border payment solution for businesses in July of last year.

This move is closely tied to Hong Kong's upcoming Stablecoin Ordinance, which will take effect on August 1st. JD.com has participated in the Hong Kong Monetary Authority's (HKMA) stablecoin regulatory sandbox and is actively testing Hong Kong dollar-denominated stablecoin trading scenarios. Analysts believe that JD.com's issuance of a stablecoin could significantly reduce cross-border payment costs and increase settlement speed, helping it seize opportunities in the international supply chain and retail payment sectors.

JD.com's trademark registration demonstrates its commitment to blockchain finance and reflects Hong Kong's appeal as a digital asset financial hub. The future implementation and application of this stablecoin will further propel traditional e-commerce companies into the Web3 era.

PayPal allows US merchants to accept over 100 cryptocurrencies

On July 28, 2025, PayPal announced the launch of a new payment feature in the US market, allowing small merchants to accept payments in over 100 different cryptocurrencies, including mainstream currencies like Bitcoin and Ethereum. This move significantly expands PayPal's service offerings in the cryptocurrency payment space and encourages more merchants to participate in digital currency transactions.

PayPal's initiative, which focuses on small and medium-sized merchants, aims to lower the barrier to entry for merchants to use crypto assets and enhance their flexibility and operational innovation. As more merchants begin accepting cryptocurrency payments, this initiative is expected to boost the adoption and adoption of crypto assets in everyday business scenarios.

PayPal's open payment network is expected to serve as a bridge between traditional finance and the crypto ecosystem, providing merchants with new revenue channels and providing practical support for the practicality of cryptocurrencies. This strategy also strengthens PayPal's competitive advantage in the fintech transformation.

WLFI makes a strategic investment of US$10 million in Falcon Finance

WLFI will strategically invest $10 million in Falcon Finance, a synthetic dollar stablecoin project supported by DWF Labs.

Users use stablecoins (USDT, USDC, DAI, USDS, USD1, FDUSD) or mainstream cryptocurrencies (such as ETH, BTC, SOL, XRP and other top 100 altcoins by market capitalization, which usually require an excess collateral ratio higher than 100%) or Tokenized T-Bills (Superstate's USCC) as collateral to mint USDf. The current circulation of USDf has exceeded US$1 billion.

Several reasons for the rapid growth:

- Strong asset access capabilities: supports stablecoins, ETH/BTC, RWA (such as US Treasury bonds) and other types of assets as collateral

- Income mechanism: USDF holders can pledge sUSDF and participate in on-chain income distribution (sources include interest rate arbitrage, exchange funding rate, RWA income, etc.), attracting a large number of user conversions

- Points and Airdrop Expectations

2. RWA Sector

U.S. Crypto Policy Report Expected to Include Positions on Tokenization and Market-Defining Crypto Legislation

On July 30, 2025, the White House Digital Asset Task Force, established by the Trump administration, released a major policy report, its first public direction on cryptocurrency regulation since taking office. The task force, which includes key officials from the Treasury Department, the Office of Management and Budget, and SEC Chairman Paul Atkins, aims to implement the executive order signed by the president earlier this year and promote a unified, innovation-friendly crypto policy framework.

The report makes several core recommendations, including:

- Require the SEC and CFTC to use their existing authority to quickly clarify regulatory rules for crypto asset registration, custody, and trading;

- Pushing Congress to pass legislation such as the Clarity Act (which clarifies the responsibilities of the SEC and CFTC) and the Genius Stablecoin Act;

- Support blockchain tokenized securities, oppose the issuance of US central bank digital currency (CBDC), and promote the integration of encryption technology into traditional financial infrastructure.

Hong Kong Secretary for Financial Services and the Treasury: Hong Kong has regularized the issuance of tokenized bonds

In a draft response released by the Hong Kong government at the Legislative Council on July 30, 2025, the "2025 Digital Asset Policy Statement" (Policy Statement 2.0) was officially released, confirming Hong Kong's commitment to becoming a global digital asset innovation hub. This is an upgraded version of the initial policy statement from 2022, explicitly supporting the sustainable development of the virtual asset ecosystem.

Hong Kong launched a licensing system for virtual asset trading platforms in June 2023 and will implement stablecoin regulations on August 1, 2025. Furthermore, the government is advancing draft regulations for virtual asset trading and custody licenses, aiming to issue licenses to more institutions within three years. Regulators have also established a regulatory sandbox mechanism to encourage the testing of innovative technologies such as blockchain, AI, and tokenized assets in a controlled environment.

Hong Kong is actively strengthening cooperation with international anti-money laundering organizations (such as the FATF), mainland China, and other jurisdictions to jointly promote digital asset regulatory standards and the establishment of cross-border anti-money laundering mechanisms. Simultaneously, the Hong Kong Monetary Authority and the Securities and Futures Commission are implementing initiatives such as Project Ensemble to explore the tokenization of traditional assets and promote the implementation of tokenized bonds, funds, and other practical products.

Japan's MUFG Bank acquires Osaka high-rise building, plans to launch real estate tokenization product

MUFG Trust Bank acquired a high-rise office building in Osaka for over 100 billion yen (approximately US$680 million). The bank plans to tokenize the asset using blockchain technology and issue digital securities. Institutional investors will primarily participate through private REITs, while retail investors can also purchase tokenized shares through the Progmat platform for fractional ownership.

This initiative narrows the gap between retail investors and high-quality commercial real estate, significantly lowering the barrier to entry and enabling ordinary users to realize their investment potential. MUFG's token issuance caters to both institutional and retail investors, integrating the traditional REIT structure with new digital securities to significantly enhance asset liquidity and market transparency.

MUFG holds a 42% stake in the Progmat platform, which served as a key infrastructure for its token issuance, advised by its partner, Mitsui Digital. Despite establishing its own Alterna Trust, Mitsui has continued to utilize Progmat, demonstrating an ecosystem that coexists both competitively and collaboratively. This case marks a new phase in Japan's asset tokenization market, where institutional dominance and retail integration are key.