Key points

1. The global cryptocurrency market capitalization totaled $3.91 trillion, down 1.5% from $3.97 trillion last week. As of press time, the US Bitcoin spot ETF saw a cumulative net inflow of approximately $61.19 billion, with a net outflow of $607 million this week; the US Ethereum spot ETF saw a cumulative net inflow of approximately $14.37 billion, with a net inflow of $114 million this week. 2. The total stablecoin market capitalization was $304.8 billion, with USDT accounting for $183.5 billion (60.2%), followed by USDC at $75.8 billion (24.86%), and DAI at $5.37 billion (1.76%).

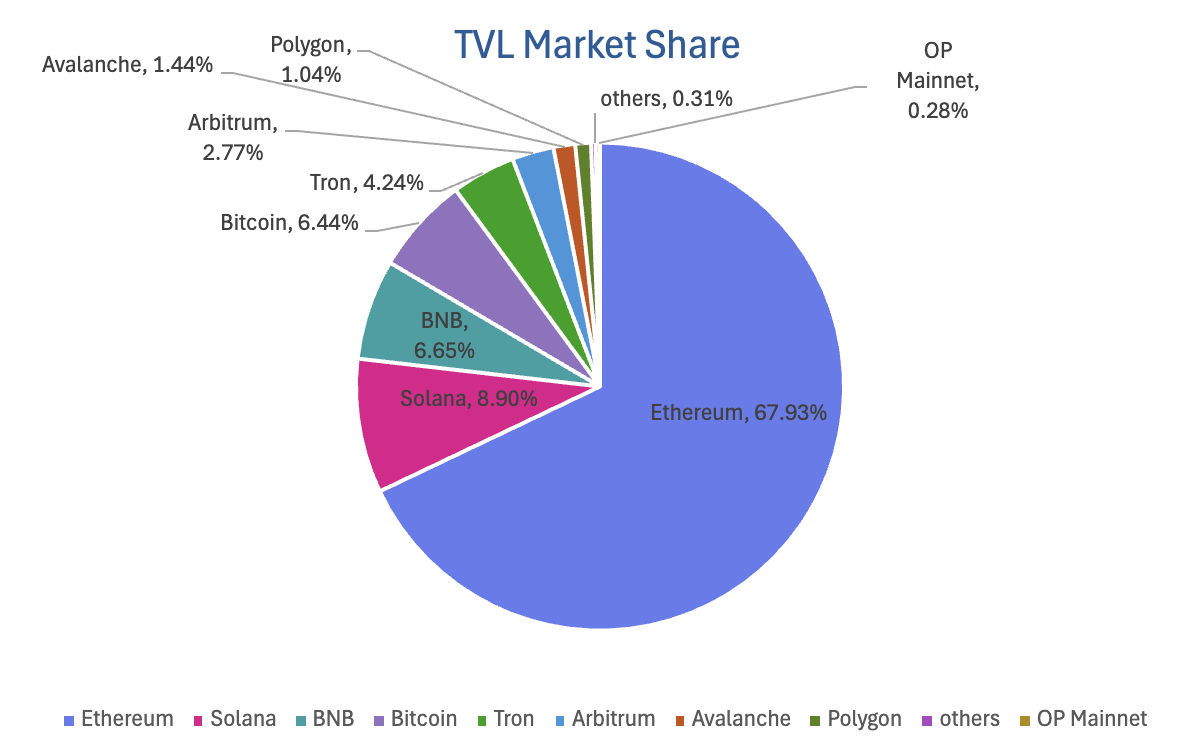

3. According to DeFiLlama data, the total TVL of DeFi this week was $149.6 billion, a decrease of approximately 5.01% from $157.5 billion last week. Breaking it down by public chain, the three public chains with the highest TVL are Ethereum (67.93%), Solana Chain (8.9%), and BNB Chain (6.65%).

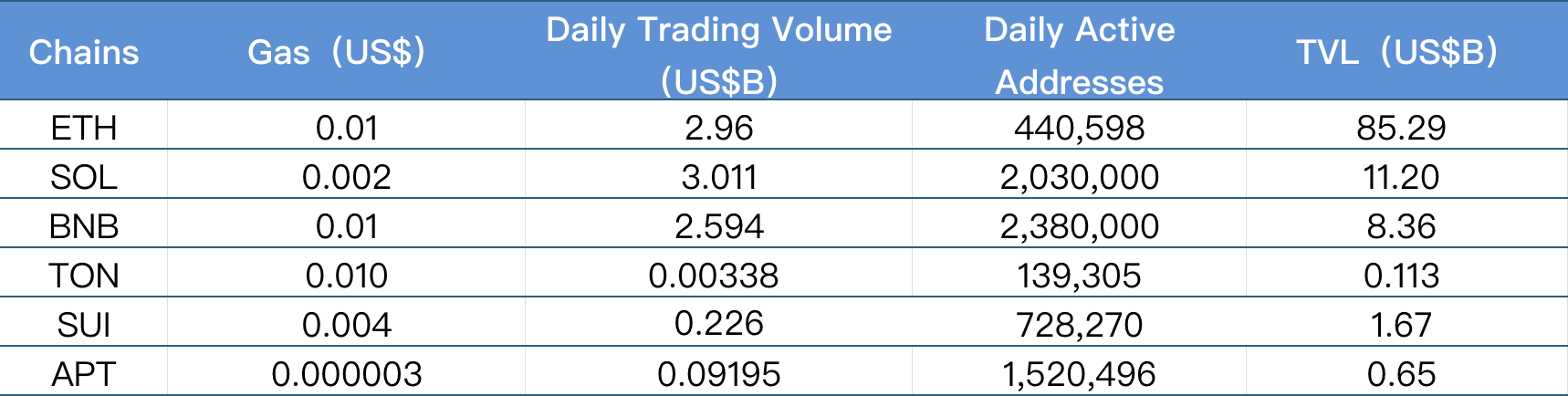

4. Overall public chain activity declined slightly this week. Ton was one of the few bright spots, with daily trading volume increasing by 11.24% and active addresses rising by 29.08%; while Sui performed the weakest, with trading volume declining by 50.44% and TVL decreasing by 22.23%. Ethereum, BNB Chain, Solana, and Aptos all experienced varying degrees of decline in daily trading volume, with BNB Chain seeing the smallest drop (-1.39%). Transaction fees remained relatively stable across chains, with Aptos rebounding by 13.71%, while Solana and Sui declined by 20.23% and 11.11%, respectively. Overall, both funding and activity levels showed a temporary pullback.

5. New Projects to Watch: Loon Finance, a company focused on stablecoins and payment solutions, launched CADC, a stablecoin pegged 1:1 to the Canadian dollar, also known as the "Canadian Digital Dollar." Standard Economics is a company focused on digital dollar wallet infrastructure, aiming to allow users to convert cash into "digital dollars" and conveniently spend them through wallets or linked Visa cards. Accountable is a digital finance platform designed to help businesses verify and share their asset-liability data in a privacy-preserving manner, while providing retail investors with verifiable yield opportunities.

Table of contents

I. Market Overview

1. Total market capitalization of cryptocurrencies / Bitcoin market capitalization ratio

2. Fear Index

3. ETF Inflow and Outflow Data

4. ETH/BTC and ETH/USD exchange rates

5.Decentralized Finance (DeFi)

6. On-chain data

7. Stablecoin Market Cap and Issuance Status

II. Hot Money Flows This Week

1. The top five gainers this week: VC coin and Meme coin

2. New Project Insights

III. New Industry Trends

1. Major Industry Events This Week

2. Major events that will happen next week

3. Key Investment and Financing Activities Last Week

IV. Reference Links

I. Market Overview

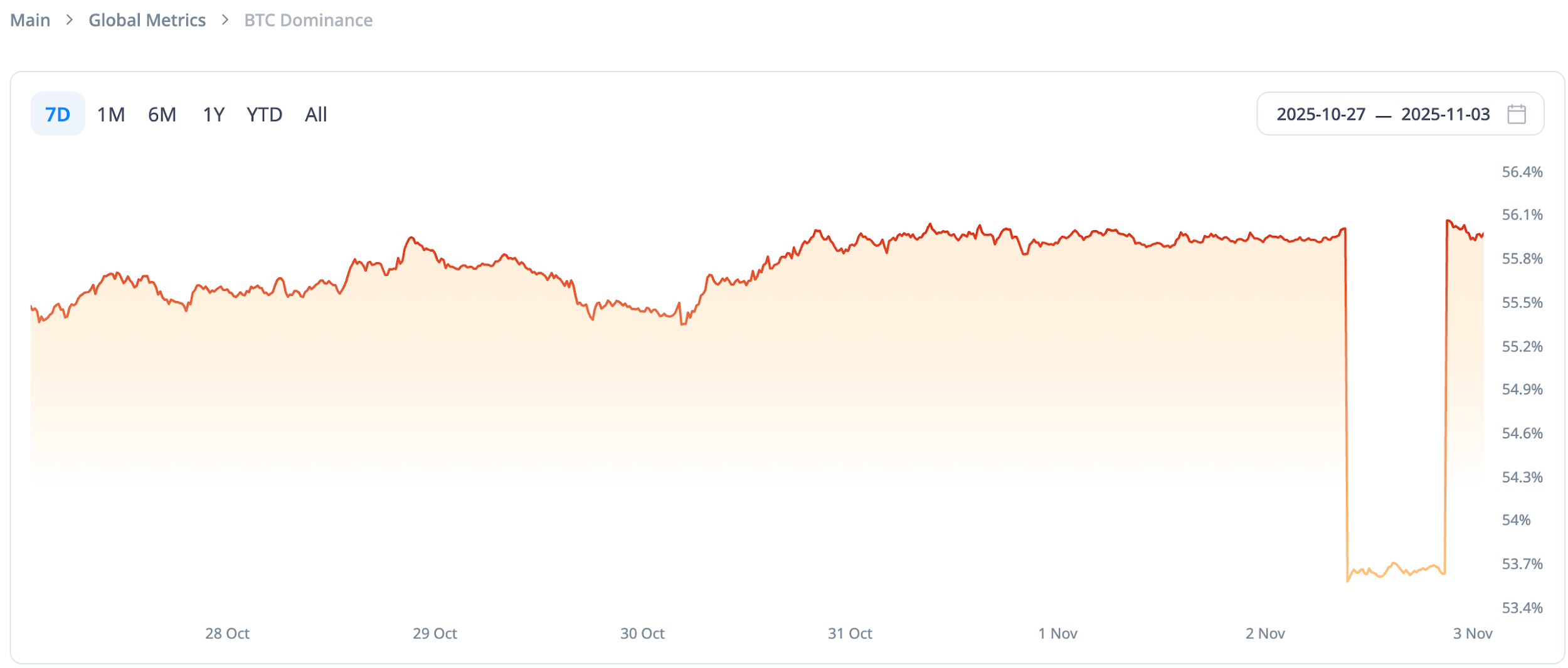

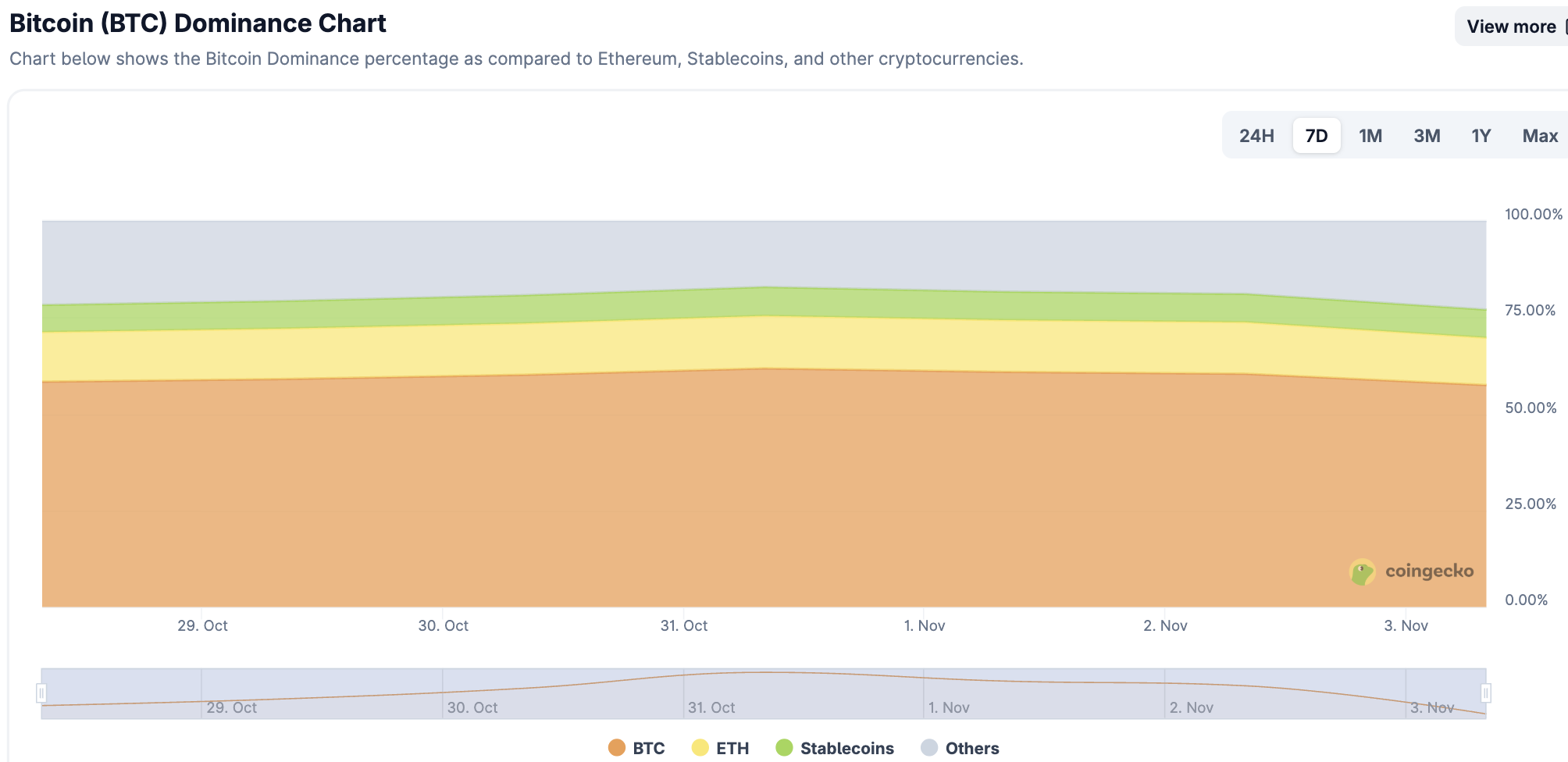

1. Total market capitalization of cryptocurrencies / Bitcoin market capitalization ratio

The global cryptocurrency market capitalization totaled $3.91 trillion, down 1.5% from $3.97 trillion last week.

Data source: cryptorank

Data as of November 2, 2025

As of press time, Bitcoin 's market capitalization is $2.19 trillion, accounting for 56% of the total cryptocurrency market capitalization. Meanwhile, stablecoins have a market capitalization of $304.8 billion, representing 7.79% of the total cryptocurrency market capitalization.

Data source: coingeck

Data as of November 2, 2025

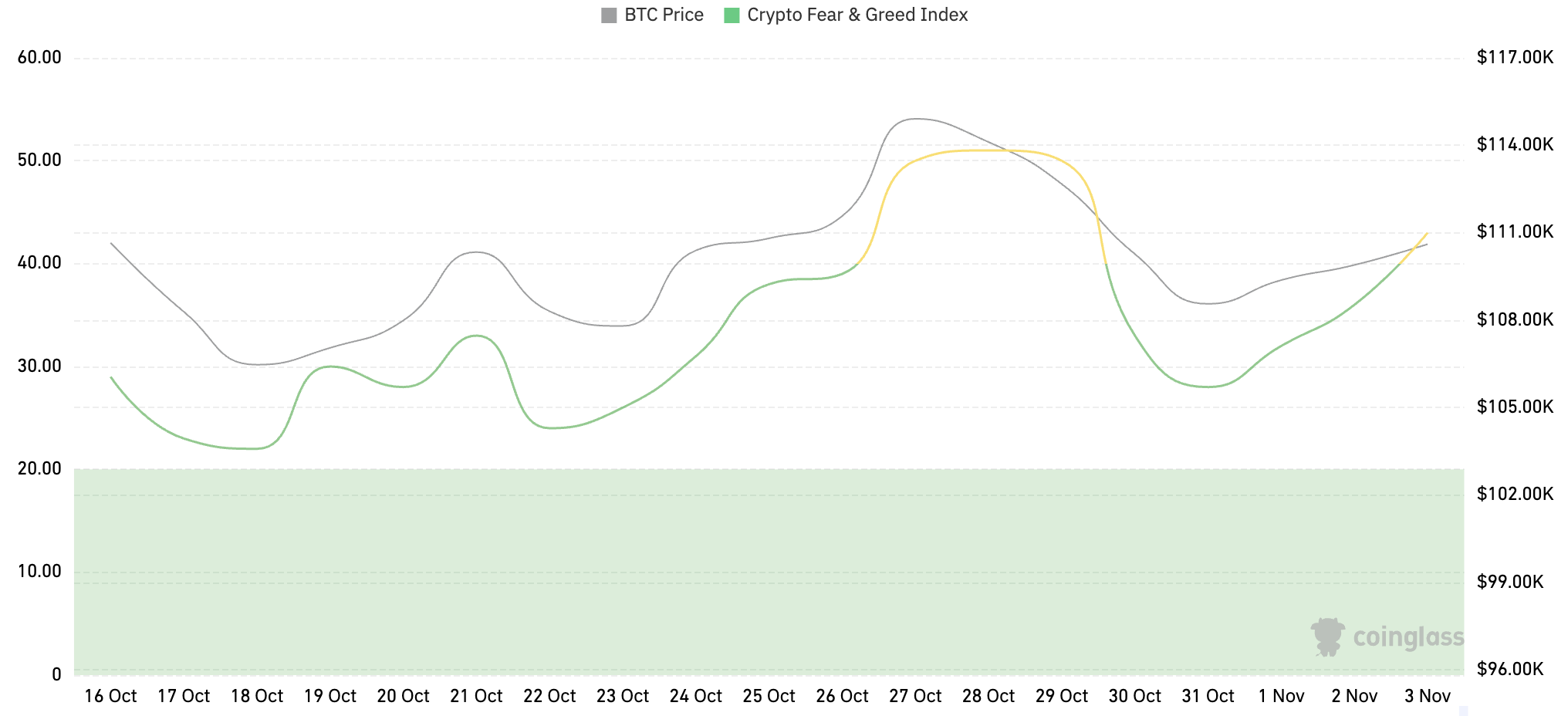

2. Fear Index

The cryptocurrency fear index is 43, indicating a neutral level.

Data source: coinglass

Data as of November 2, 2025

3. ETF inflow and outflow data

As of press time, the total net inflow into U.S. Bitcoin spot ETFs was approximately $61.19 billion, with a net outflow of $607 million this week; the total net inflow into U.S. Ethereum spot ETFs was approximately $14.37 billion, with a net inflow of $114 million this week.

Data source: sosovalue

Data as of November 2, 2025

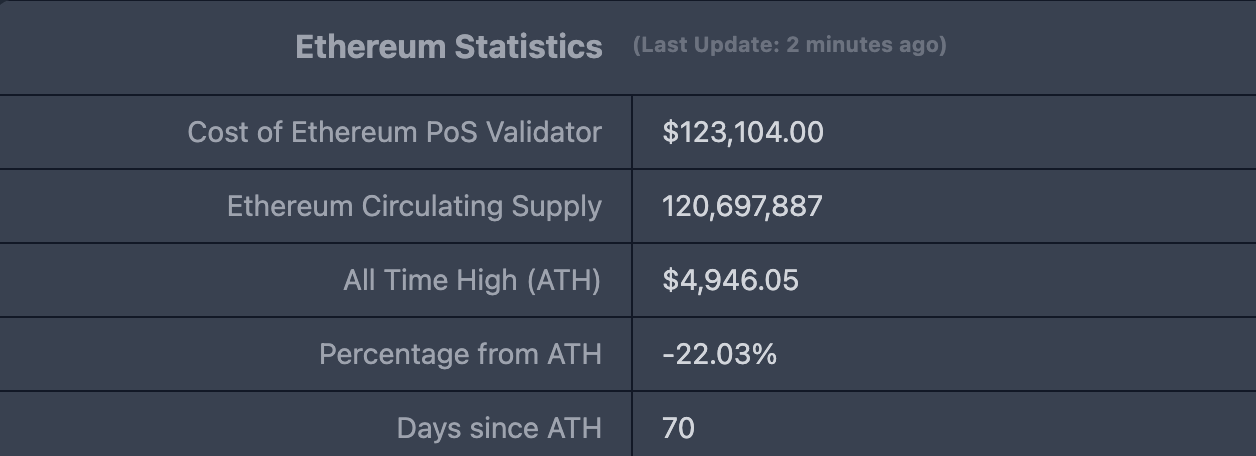

4. ETH/BTC and ETH/USD exchange rates

ETHUSD: Current price $3,850.54, all-time high $4,878.26, down approximately 22.03% from the high.

ETHBTC: Currently at 0.035111, historical high was 0.1238

Data source: ratiogang

Data as of November 2, 2025

5. Decentralized Finance (DeFi)

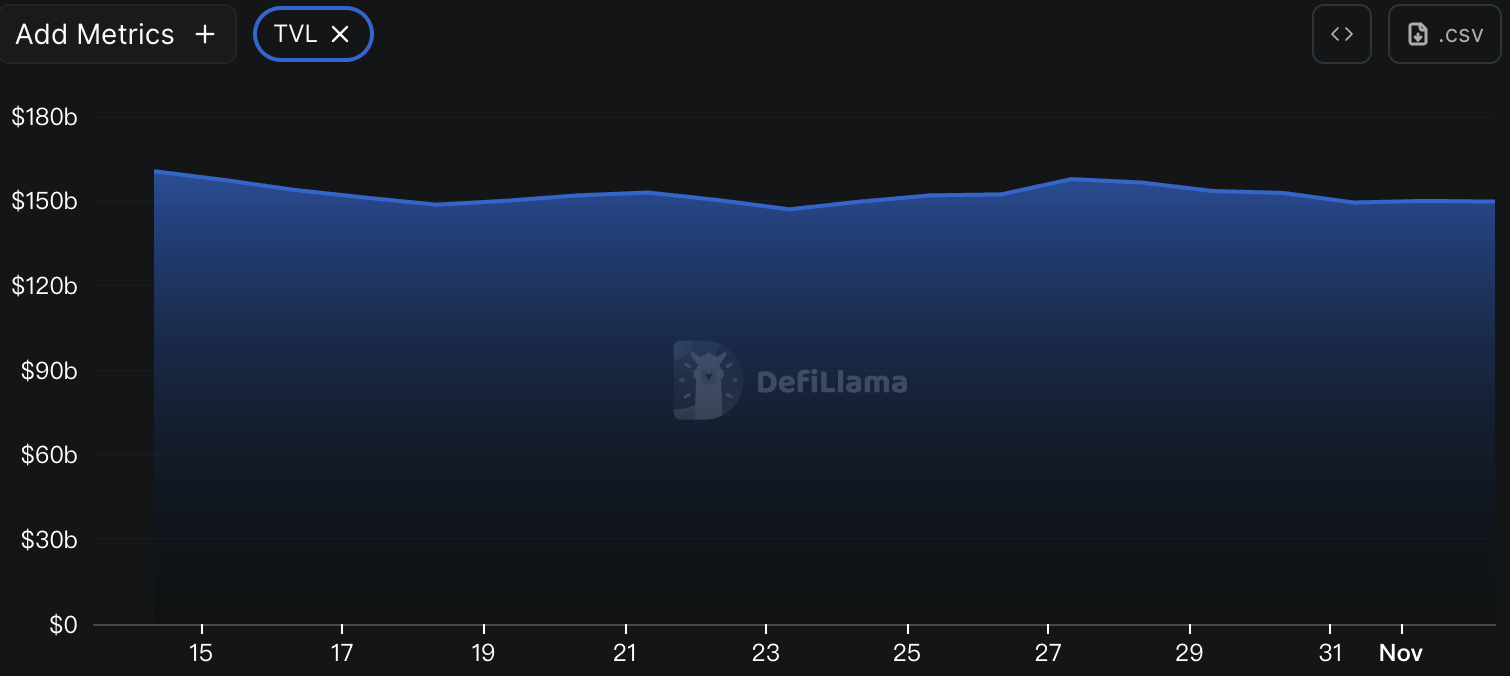

According to DeFiLlama data, the total TVL of DeFi this week was $149.6 billion, a decrease of approximately 5.01% from $157.5 billion last week.

Data source: defillama

Data as of November 2, 2025

Based on public blockchains, the three public blockchains with the highest TVL are Ethereum (67.93%), Solana (8.9%), and BNB Chain (6.65%).

Data source: CoinW Research Institute, defillama

Data as of November 2, 2025

6. On-chain data

Layer 1 related data

The analysis primarily focuses on daily transaction volume, daily active addresses, and transaction fees, currently covering Layer 1 data including ETH, SOL, BNB, TON, SUI, and APTOS.

Data source: CoinW Research Institute, defillama, Nansen

Data as of November 2, 2025

Daily trading volume and transaction fees: Daily trading volume and transaction fees are core indicators for measuring the activity and user experience of public chains. In terms of daily trading volume, only Ton saw an increase of 11.24% this week, while all other chains experienced varying degrees of decline. Sui chain saw the largest drop at 50.44%, while BNB Chain saw the smallest drop at 1.39%. The other chains with the largest drops were Ethereum (-20.61%), Aptos (-8.75%), and Solana (-2.96%). Regarding transaction fees, Ethereum, BNB, and Ton remained flat this week compared to last week; Solana and Sui saw declines of -20.23% and -11.11%, respectively; Aptos rebounded by 13.71%.

Daily Active Addresses and TVL: Daily active addresses reflect a public chain's ecosystem participation and user stickiness, while TVL reflects users' trust in the platform. Regarding daily active addresses, BNB Chain remained almost unchanged from last week, while Solana and Sui chains saw slight declines of -4.69% and -0.24% respectively. Ton, Ethereum, and Aptos saw increases of 29.08%, 15.86%, and 5.61% respectively; Solana and Sui chains declined by 4.68% and 0.24% respectively. In terms of TVL, all chains experienced declines this week, with Sui seeing the largest drop at -22.23%; Ton chain declined by 5.83%; the remaining chains saw relatively smaller declines: Solana (-4.7%), Ethereum (-4.49%), Aptos (-3.97%), and BNB Chain (-3.28%).

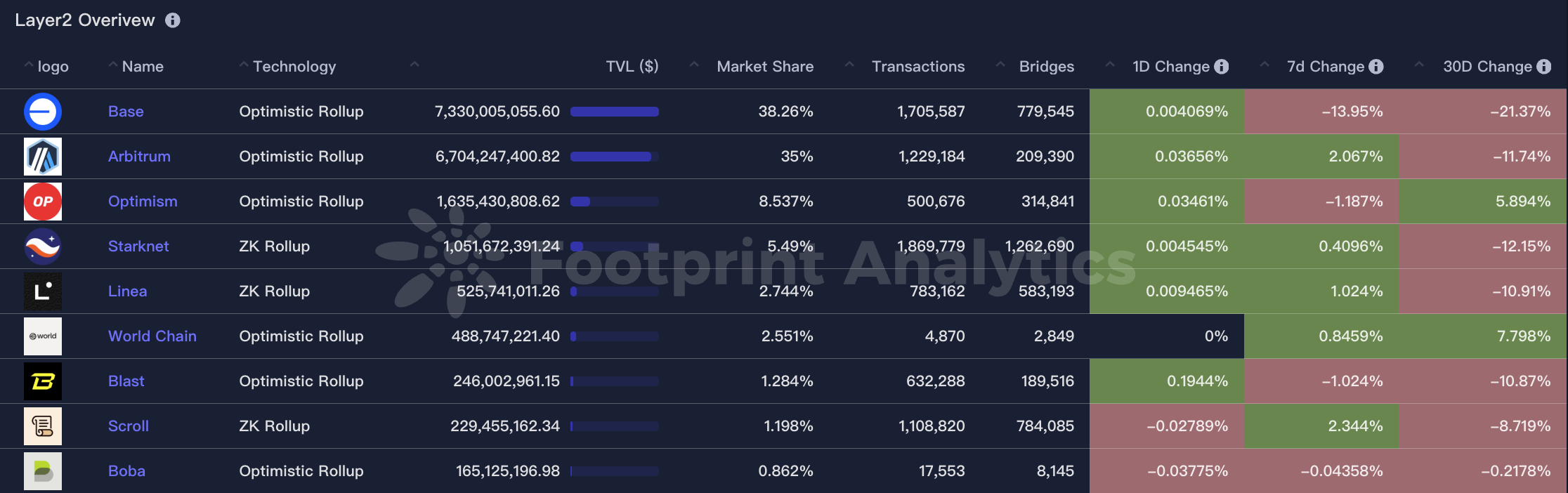

Layer 2 related data

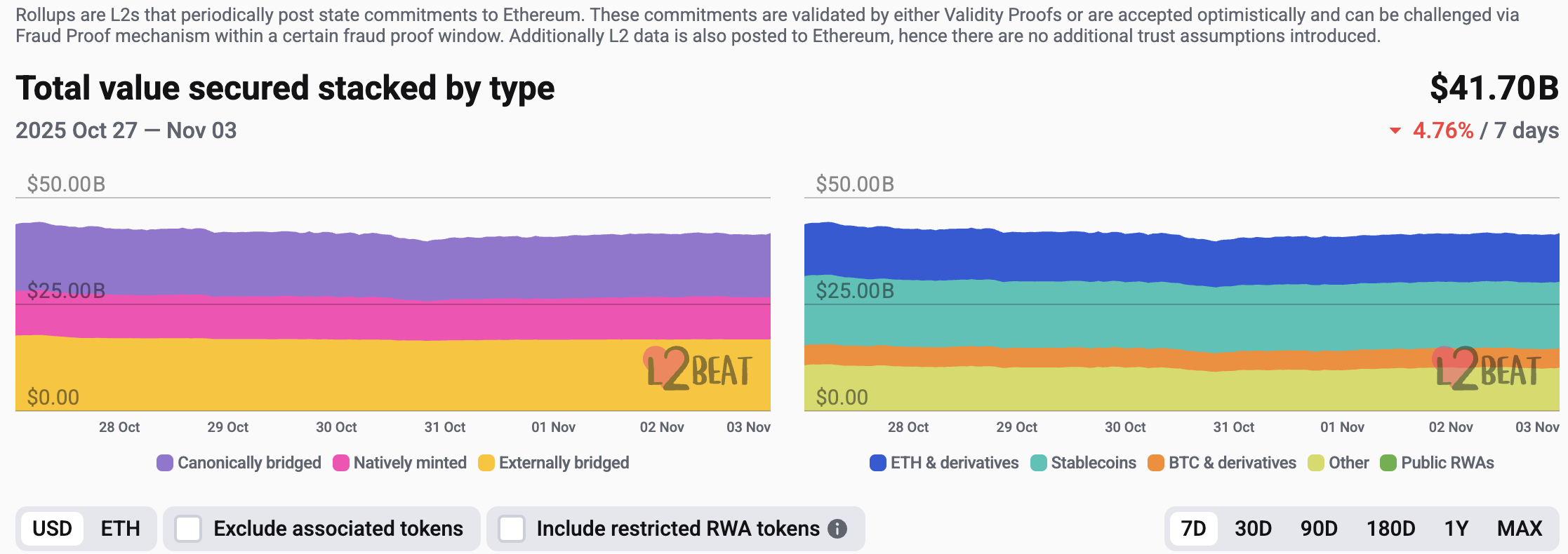

According to L2Beat data, the total TVL of Ethereum Layer 2 is $41.7 billion, a 4.6% decrease this week compared to last week ($43.73 billion).

Data source: L2Beat

Data as of November 2, 2025

Base and Arbitrum occupy the top positions with market shares of 38.26% and 35% respectively. Base's market share has slightly decreased over the past week, while Arbitrum's has slightly increased.

Data source: footprint

Data as of November 2, 2025

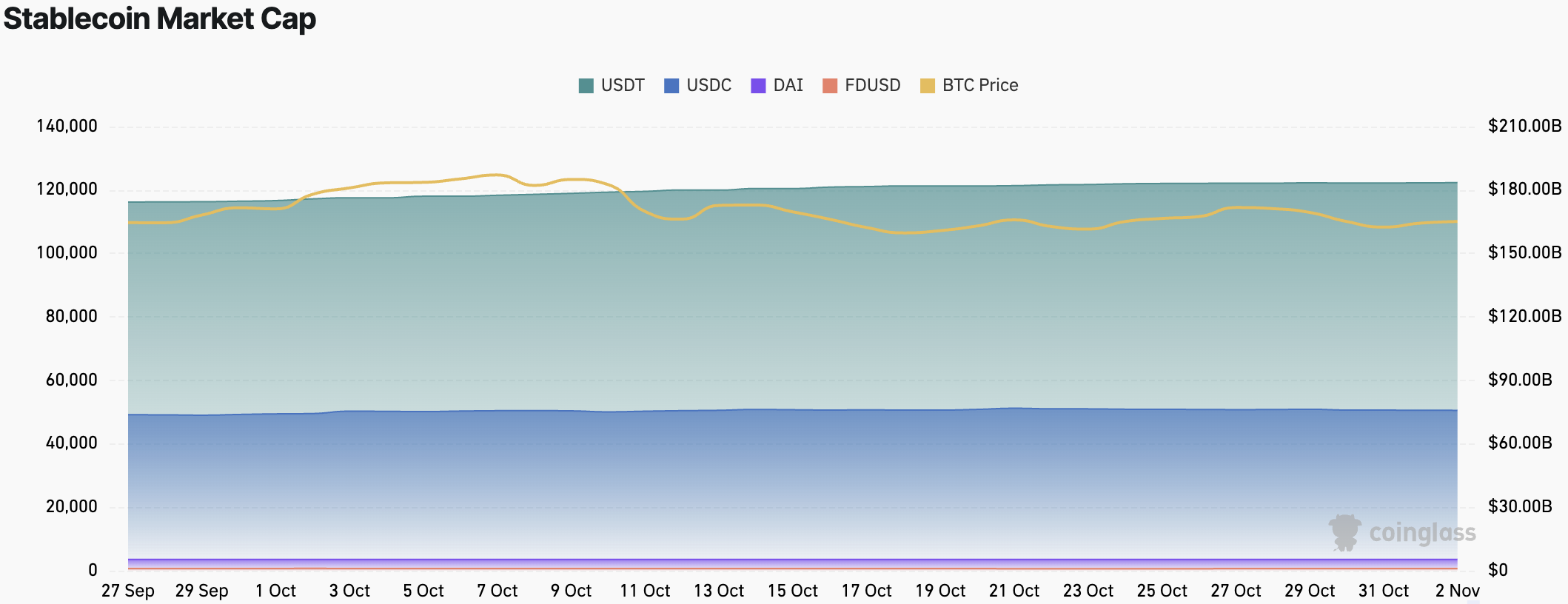

7. Stablecoin market capitalization and issuance

According to Coinglass data, the total market capitalization of stablecoins is $304.8 billion, of which USDT has a market capitalization of $183.5 billion, accounting for 60.2% of the total stablecoin market capitalization; followed by USDC with a market capitalization of $75.8 billion, accounting for 24.86% of the total stablecoin market capitalization; and DAI with a market capitalization of $5.37 billion, accounting for 1.76% of the total stablecoin market capitalization.

Data source: CoinW Research Institute, Coinglass

Data as of November 2, 2025

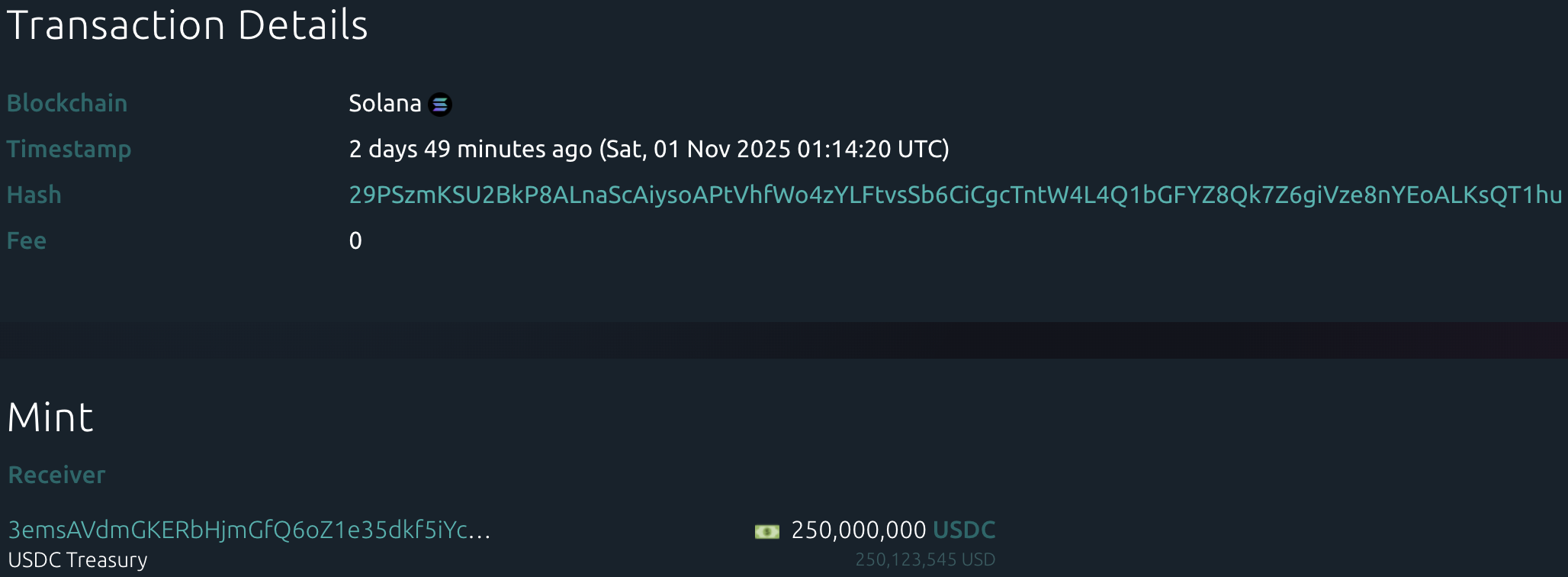

According to Whale Alert data, the USDC Treasury issued a total of 2.115 billion USDC this week, while the Tether Treasury issued no USDT. The total stablecoin issuance this week was 2.115 billion, an increase of 8.35% compared to last week's total stablecoin issuance (1.952 billion).

Data source: Whale Alert

Data as of November 2, 2025

II. Hot Money Flows This Week

1. The top five gainers this week: VC coin and Meme coin

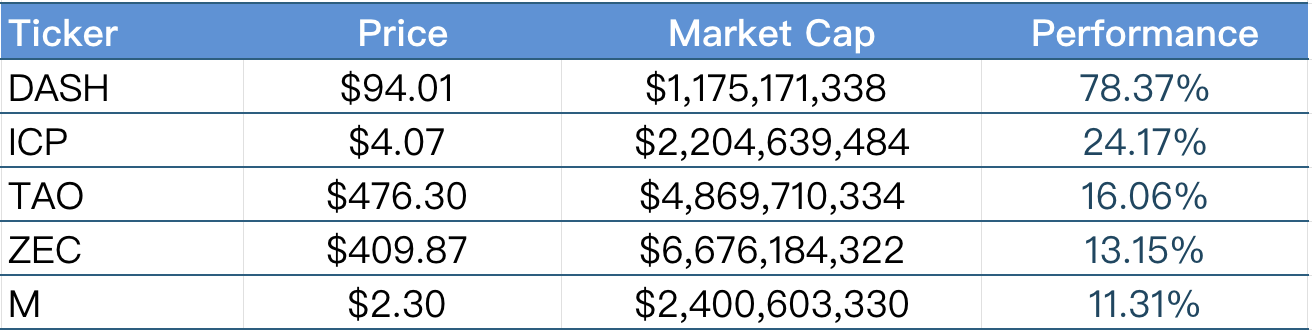

The top five performing VC coins in the past week

Data source: CoinW Research Institute, coinmarketcap

Data as of November 2, 2025

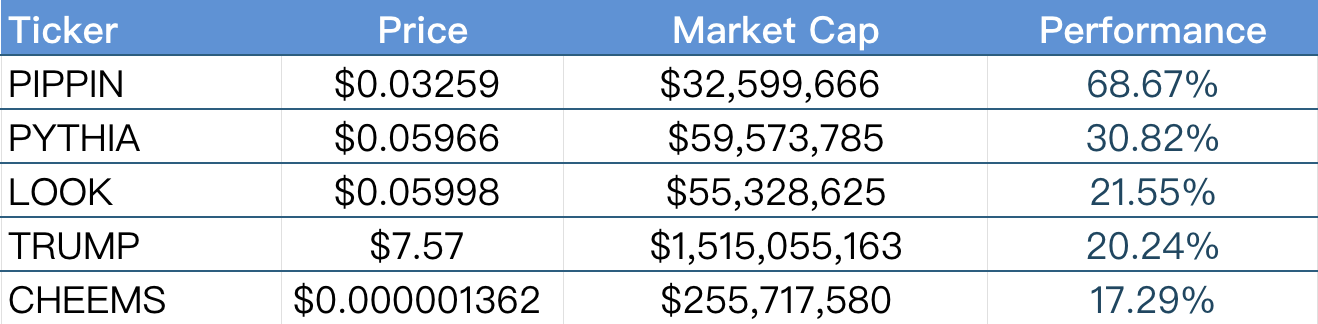

The top five gainers in the past week: Meme coins

Data source: CoinW Research Institute, coinmarketcap

Data as of November 2, 2025

2. New Project Insights

Loon Finance, a company specializing in stablecoins and payment solutions, has launched CADC, a stablecoin pegged 1:1 to the Canadian dollar, also known as the "Canadian digital dollar." Users can use CADC for transfers, payments, or cross-border transactions just like they would with regular Canadian dollars. This stablecoin is backed by 100% fiat currency reserves, and transactions are settled instantly on-chain, resulting in lower costs and faster speeds. Loon's goal is to make it easier for users in Canada and globally to use the Canadian dollar for digital payments and international settlements.

Standard Economics is a company focused on digital dollar wallet infrastructure, aiming to allow users to convert cash into "digital dollars" and conveniently spend them through the wallet or linked Visa card. Its goal is to improve payment convenience and financial inclusion, enabling unbanked individuals to participate in the digital economy.

Accountable is a digital financial platform designed to help businesses verify and share their asset-liability data in a privacy-preserving manner, while providing retail investors with verifiable return opportunities. The platform strives to pave a more efficient and secure path to financial growth by eliminating trust barriers and reducing fraud risk.

III. New Industry Trends

1. Major Industry Events This Week

On October 30th, MilkyWay (a liquidity staking protocol based on Celestia) announced that the third phase of its "Massdrop" airdrop is now open for claims. This phase covers 100 million MILK tokens, representing 10% of the total supply, and will be distributed to mPoint holders, Moolitia NFT holders, and milkINIT test users. The airdrop will be released in four phases.

On October 28th, Piggycell, a leading South Korean shared power bank project, officially launched its token PIGGY's TGE (Token Generation Event). The project centers on "sharing economy + Web3 incentives," combining offline power bank rental services with blockchain incentive mechanisms. By issuing PIGGY tokens, it rewards device users and partner merchants, promoting the digital upgrade of shared devices. The total supply of PIGGY tokens is 100 million, and the TGE marks the project's official entry into the tokenization and ecosystem incentive phase.

On October 29th, the metaverse gaming platform Pieverse officially completed its token generation event (TGE), which took place at 16:00 Beijing time on October 29th. The project had previously launched a Pre-TGE subscription event from 08:00–10:00 (UTC) on October 29th, and initiated the fourth phase of its Booster program on October 28th. Pieverse aims to build a virtual world ecosystem integrating games, social interaction, and digital assets, allowing users to earn token rewards through game interactions and task participation.

On November 1st, Aria, the RWA protocol for the Story ecosystem IPs, announced at an offline meetup in Seoul, South Korea, that it would increase the airdrop ratio for IPs from 2% to 10% to thank the Story community for their long-term support. The airdrop will be gradually unlocked to eligible IP holders after the token's listing. Currently, Aria has been launched as the first project on the BuiltLabs Vibe platform for community distribution, raising $600,000, with a project FDV of $60 million. KYC and subscription for this launch will end at 10 PM on November 2nd, and the contribution phase will begin at 10 AM on November 3rd.

On November 2, Momentum announced on the X platform that the first round of token airdrop subscriptions is now online. Users can complete the qualification verification and subscription within the next 48 hours to participate in the first round of MMT distribution.

2. Major events that will happen next week

The Monad airdrop claim period will end on November 3rd. Monad officially launched the "Airdrop Allocation Reveal" feature on October 28th, allowing eligible users to view their individual token allocation. This airdrop covered approximately 230,000 addresses. The snapshot was completed on September 30th, and the claim channel opened on October 14th and will continue until November 3rd. Monad officially confirmed on October 30th that there are no lock-up restrictions for this airdrop, and the tokens can be freely traded after claiming.

On November 3rd, the Capybobo airdrop query interface will officially launch, allowing users to view their individual $PYBOBO token allocation. Simultaneously, a special Capybobo airdrop season event will begin, with specific participation rules to be announced soon. Capybobo completed its TGE snapshot on November 2nd. As the first trendy toy project in the TON and KAIA ecosystems, Capybobo is preparing to launch "crypto doll clothes," creating its own trendy toy IP. Capybobo is the first project in the Catizen ecosystem to deeply integrate Web3 games with physical trendy toys, extending digital assets to tangible collectibles through a complete chain from "game skins—doll clothes design—physical products."

Polymarket recently announced that its return plan for US users is expected to launch by the end of November 2025. The platform was previously penalized by the Commodity Futures Trading Commission (CFTC) for not registering derivatives trading and subsequently shut down its US access in 2022. Following the resumption of operations in the US, the platform also confirmed it will issue its native token, POLY, and conduct an airdrop campaign, prioritizing rewards for active users.

On October 28th, the cross-chain infrastructure project edgeX launched a token name voting campaign on its official X (formerly Twitter) account and unveiled its project mascot, MARU, for the first time. The community generally believes this move suggests that edgeX is building momentum for the upcoming TGE (Token Generation Event), laying the groundwork for subsequent token issuance and brand building.

3. Key Investment and Financing Activities Last Week

Prenetics (Nasdaq: PRE), a US-listed health technology company, completed a $46.8 million oversubscribed equity financing round, with investors including Kraken and Exodus. If all warrants are exercised, the total financing amount could reach up to $212 million. This round of funding will be used to expand its health brand IM8 globally and accelerate its Bitcoin vault strategy. The company plans to purchase one Bitcoin daily, aiming to achieve $1 billion in revenue and a corresponding Bitcoin reserve within five years. Prenetics is a technology company focused on health and longevity innovation, and is driving the integration of health technology and digital assets through its "Bitcoin flywheel" model, combining cash flow operations with Bitcoin reserves. (October 27, 2025)

Stablecoin infrastructure company ZAR announced the completion of a $12.9 million funding round, led by a16z, with participation from Dragonfly, VanEck Ventures, Coinbase Ventures, and Endeavor Catalyst. ZAR plans to popularize stablecoin adoption through small shops in Pakistan, enabling users to exchange cash for digital dollars and make purchases via wallets and Visa cards, aiming to address the payment needs of the country's large unbanked population. If this model proves successful, ZAR plans to expand to the African market in 2026. ZAR provides a secure and convenient digital dollar wallet service, allowing users to exchange cash for cryptocurrency at nearby merchants. (October 28, 2025)

Nasdaq-listed Metalalpha Technology announced a strategic private placement agreement of approximately $12 million with Gortune International Investment Limited Partnership and Avenir Group, expected to close by November 30. The funds will be used to accelerate the development of its blockchain trading services, invest in innovative digital asset technologies, and replenish working capital. Headquartered in Asia, Metalalpha is a global crypto wealth management company with a core team from top Wall Street investment banks. It focuses on providing crypto derivatives services to institutional clients, including exchanges, mining companies, investment funds, and family offices, and is one of the largest crypto derivatives dealers in Asia. (October 30, 2025)

Bron Labs announced the completion of a $15 million funding round, with participation from approximately 140 investors, including prominent institutions such as LocalGlobe, Fasanara Digital, and GSR. The project is a platform focusing on "zero-custody" wallets and multi-chain DeFi access, aiming to combine institutional-grade asset security with a user-friendly experience: supporting multi-chain wallets, cross-chain swaps, hidden accounts, staking services, and advanced security features such as a "guardian recovery model." (October 30, 2025)

IV. Reference Links

1. Loon Finance: https://loon.finance/

2. Standard Economics: https://www.standardeconomics.com/

3. Accountable: https://www.accountable.capital/

4. Bron Labs: https://bron.org/

5. Metalpha: https://www.metalpha.finance/

6. Prenetics: https://www.prenetics.com/

7. ZAR: https://www.zar.app/