Source: Talking about Li and other things

At the beginning of this month (July), a friend left a message asking me: Is there still hope for ETH to break 3500 this year? As a result, less than two weeks later, we have seen Ethereum at 3600 US dollars.

Looking back at the bull market over the past two years, the process was actually quite painful for many ETH holders. Not only did they have to deal with the fact that the price of ETH could never break through its historical high, but they also had to deal with the impact of people’s FUD.

Frankly speaking, I was a little surprised by Ethereum’s breakthrough rise in the past two weeks, because according to my original expectations (guesses), I might have to wait until the end of the third quarter or the fourth quarter to see some new opportunities. However, the current results are still a very good thing for me (my position), and I am very happy to see ETH rise beyond my expectations.

In the past few days, I found that the mood in some groups seems to be better than before, and many E guards seem to be excited again. But at the same time, there is a new question in front of everyone, that is: what is driving the rise of ETH at this stage? How long can this upward momentum last?

Many people seem to find reasons to convince themselves when the stock price goes up, and they also like to find reasons to convince themselves when the stock price goes down. Some bloggers also like to catch such hot spots, such as turning bearish when the stock price goes down, and turning bullish when the stock price goes up, because this can well match people's reading preferences.

However, it is a bit of a hindsight to summarize the reasons after each rise, so let's discuss it in two parts:

First, let’s take a brief look at our views on Ethereum in our articles since the beginning of the year, which can be regarded as a testimony to everyone’s emotional fluctuations.

In the article on January 14, we talked about: From yesterday (January 13) to now, many partners are more FUDing Ethereum. Perhaps, ETH's performance so far has indeed disappointed many partners. But as for me, I am still optimistic about Ethereum, not to mention the long-term. After all, ETH is the only currency that has passed the spot ETF so far besides BTC. Perhaps, we still need to continue to have a little patience for Ethereum.

In the article on January 21, we talked about: ETH has been criticized badly by the whole network recently. Today, I also saw a friend in the group also shared a more interesting picture, comparing Ethereum with the A-share market, and teasing that it has broken through the 3,300 mark. However, despite all the talk and the noise, we still retain the views in the previous Ethereum series of articles, that is, we continue to be optimistic about the performance of Ethereum, and $4,000 is likely not the end of ETH's current bull market.

In the article on February 1, we talked about: For a period of time, many people have continued to FUD Ethereum, and "Ethereum" seems to have become an "Ethereum pit". You look down on ETH, but institutions such as WLFI and BlackRock are buying it. You think BTC is too expensive, but institutions such as MicroStrategy are buying it. The development of things always has a stage. We cannot only see the climax and ignore the mess that may appear after the climax. For those projects that hope to develop for a long time and pursue stable operation, ETH is still the best choice at present.

In the article on February 5, we talked about: the market is ruthless, it does not have any emotional color, only people are affected by emotional fluctuations. I am still optimistic because I still believe that the cycle law exists, and I also believe that the market can only usher in a new rise when most people have to lose money. If you don’t believe in this law, then choosing the time you personally think is right to exit is the most suitable option for you. It’s like Zhang San has always been optimistic about ETH, and Li Si has always been pessimistic about ETH, then it’s very simple, Zhang San stays, Li Si withdraws, and then each pays for their own choice.

In the article on February 10, we talked about: In the past week, the price of ETH does not seem to be recovering. When BTC rebounded, ETH continued to lie still, and when BTC fell, ETH followed suit. The patience of many people was worn away little by little. As of the time of writing this article, the price of ETH is still lying around 2600, and this position has fallen by about 46% compared to the peak of the last bull market. Maybe the institutions are playing a big game, or maybe the institutions have long been preparing for the decline (collapse). When they have not accumulated enough chips (voice), they will not follow the laws of history to carry the sedan chair for retail investors who like to cut the boat to seek the sword.

In the article on March 20, we talked about this: Many people think that the current price of Ethereum at $2,000 is low because they are pegged to $4,100, but if you are pegged to the lowest price of Ethereum at $800 in 2022, then the conclusion may be completely different. Selling at highs is actually a similar principle. If you are pegged to Ethereum reaching $10,000 sooner or later, then if you are holding $2,000 Ethereum or the Ethereum with a cost of $3,000, what is there to be pessimistic about?

In the article on April 24, we talked about: If I remember correctly, we haven’t talked about ETH specifically for more than a month, because some time ago, as long as we talked about ETH in the article (saying that we are optimistic about Ethereum), we would basically receive abusive messages, but this is understandable. However, with the changes in regulatory policies, the recovery of DeFi to a certain extent, the deep involvement of traditional financial institutions, and the continuous construction of the Ethereum network and ecology itself... We believe that Ethereum is still worthy of attention and attention in the future.

In the article on June 10, we talked about: I remember that in April, Ethereum fell to a low of around $1,300. At that time, the criticism of Ethereum on the Internet seemed to have never stopped. However, with the "rescue" of several big positive lines last month (early May), the price of ETH has doubled in less than a month. It seems that there are not as many voices criticizing Ethereum as before. Today (June 10), the price of ETH has returned to around $2,700, and the recent news about Ethereum seems to be constantly good.

In the article on June 15, we talked about: If we simply look back at the past, we can find that every time the market encounters some unexpected events, people are always swayed by panic. On the contrary, some institutions and whales often use these black swan events to do the opposite of retail investors. For example, we mentioned in the previous article that in the past 30 days alone, BlackRock has bought a total of about 220,000 ETH. On the one hand, retail investors are handing over their chips due to various news, and on the other hand, some institutions or whales are continuing to buy and accumulate in large quantities. Doesn’t this look interesting?

Secondly, let’s continue to think about the question above, that is, what is driving the rise of ETH at this stage? How long can this upward momentum last?

In terms of market price factors, the rigorous statement is that the price increase of ETH is caused by a surge in demand due to a combination of factors. However, this muddy statement may not sound meaningful to many people.

Therefore, we need to be more specific. As for the rise in this stage, the more direct statement can be summarized as follows: the current institutional interest in ETH is surging, because BTC's past performance has amazed many people (institutions) but missed it. Recently, with the passage of some cryptocurrency bills in the United States, ETH, as the only ETF other than Bitcoin, seems to be being sought after as a new one.

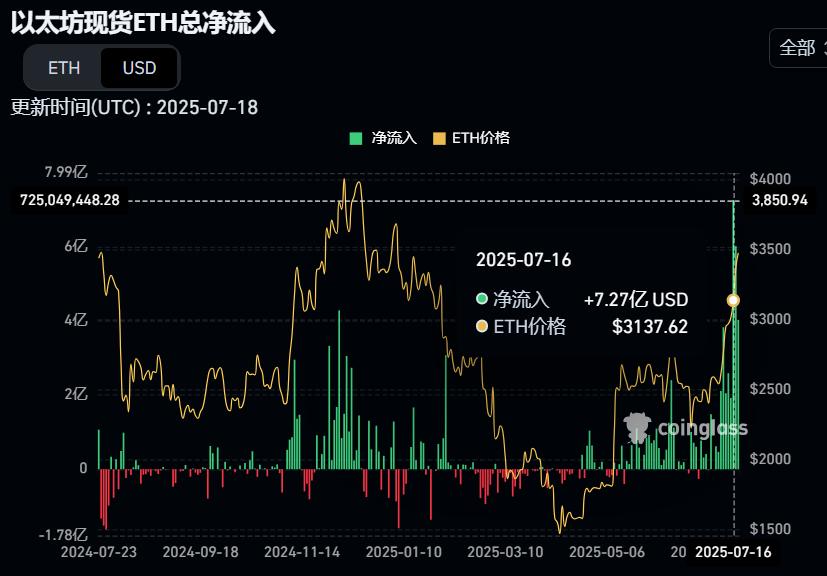

For example, in terms of ETH ETF inflows/outflows, the daily inflow a few days ago (7.16) set a new historical record, reaching US$727 million, as shown in the figure below.

For example, in terms of the ETH balance of exchanges, according to on-chain data, the ETH balance in exchanges has dropped sharply in the past 30 days and has reached a new low again. As shown in the figure below. A reduction in the supply of exchanges is usually seen as a bullish signal because it theoretically means a decrease in the number of tokens ready for sale.

In short, as some institutions have begun to actively buy ETH recently, the market's phased demand has changed, which seems to have become the main driving force for the rapid rise of ETH in this stage.

So, how long can ETH’s current upward momentum last?

We have mentioned above that prices are often determined by multiple factors. As for Ethereum, it is the only project other than Bitcoin that has passed the ETF, the largest crypto-based ecological project, the currency that is still the king of altcoins, and the best choice chain for the RWA narrative... These are all factors that affect the price changes of ETH.

Here we might as well exclude other price influencing factors and simply refer to the situation of MicroStrategy in Bitcoin:

In terms of imitating MicroStrategy's gameplay, Nasdaq-listed SharpLink Gaming has apparently become one of the most watched star institutions recently. Since they announced in May this year that ETH would be their main treasury reserve asset, their stock (SBET) has risen by more than 25 times, from US$3 to a maximum of US$79.

As of this writing, SharpLink Gaming has accumulated more than $990 million worth of ETH (the agency purchased about $213 million worth of ETH between July 7 and July 13 last week alone), not including ETH purchased by other TradFi investors through the spot ETH ETF. And according to the agency, they do not intend to stop this behavior soon and will continue to buy more ETH. As shown in the figure below.

It is foreseeable that as more and more institutions like SharpLink Gaming continue to buy ETH, this seems to continue to create more buying pressure.

As for whether there will be problems if institutions do this? What problems might occur? When might problems occur? We have already discussed specific methods for MicroStrategy in previous articles (such as the article on February 10 and the article on February 28). Interested partners can search and review historical articles and draw inferences from them.

To sum it up simply, as long as the stock trading price of companies like SharpLink Gaming can continue to be higher than the value of their ETH holdings, they can continue to play this strategy in a cycle.

As for the long-term, I can’t say for sure, but in the short to medium term, such as MicroStrategy for Bitcoin and SharpLink Gaming for Ethereum, their current gameplay (strategy) will generally benefit the prices of BTC and ETH, because the most advanced gameplay of prices is actually to form bubbles, and what a big bull market needs most is more bubbles. MicroStrategy has accumulated more than $71 billion worth of Bitcoin with this genius gameplay, and we have also witnessed the Bitcoin price breaking through historical highs. If there are no new black swan events in the macro environment, then ETH and some altcoins will most likely continue to rise.

Of course, since it is a bubble, it will eventually burst, and the process from the formation of the bubble to the final burst is often accompanied by repeated scripts. It does not mean that you can get rich tomorrow if you buy it today. Just as Bitcoin has risen from $15,000 to $120,000 in this cycle, but this rise process is not smooth sailing. Therefore, we also need to strictly follow our position management plan at all times, just as we talked about in the previous article (7.15): the bull market is a great retreat.

To sum up, investment/speculation is about grasping the bubble cycle, that is: embrace the bubble, enjoy the bubble, stay away from the bubble, and continue to look forward to the formation of the next new bubble.

According to our previous article, we may have another chance to enjoy the bubble before the end of this year. Before we officially stay away from the bubble, we need to focus on the following two major aspects:

1) Macroeconomic and economic aspects

In this regard, our main focus this year is the Federal Reserve's interest rate cuts and changes in the US Dollar Index (DXY), both of which will have a relatively large impact on risky assets.

According to current market expectations, the Fed may cut interest rates twice this year, and the timing of the rate cuts has become a key catalyst at present. If the Fed cuts interest rates in September, based on past experience, the market (smart money) usually starts to digest the expectation of rate cuts 3-6 months in advance, so in theory, the rise since April seems to be within a reasonable range, and the start of July may also mean that some altcoins will or are re-entering the acceleration mode.

2) Regulatory and institutional aspects

In this regard, we are mainly concerned about two things: one is the bill targeting cryptocurrencies/crypto markets, and the other is ETFs and institutional capital.

For example, we have mentioned the GENIUS Act in previous articles. In the long run, its passage will definitely promote the adoption of mainstream stablecoins. Not only will major institutions launch stablecoin-related businesses in the future, but more and more users (US dollars) will also be able to participate in DeFi and other services more conveniently.

Another example is ETF. With the approval of Bitcoin and Ethereum spot ETFs, the ETF routes of other leading altcoins seem to have become increasingly clear. Based on past experience, the fourth quarter of this year (around October) may become a new historical turning point for crypto ETFs, because as we mentioned in previous articles, more altcoin ETFs may be approved by then, which will inevitably bring more external liquidity. As shown in the figure below.

Although this round of crypto bull market has still been following some historical and cyclical laws so far, there have also been many different structural changes, such as the different speculative attributes of retail investors, different market driving forces (more and more institutions are deeply involved), different liquidity risk distribution (external liquidity brought by ETFs), different narrative sustainability (more and more narratives, shorter sector rotation)... and so on.

In the past, it seemed that getting rich in the crypto field was a very simple thing. Sometimes you could make money even with your eyes closed. But now it seems that making money is becoming more and more difficult. We not only need to study the various changes in the crypto field itself, but also need to pay attention to changes in the macro, economic, political, and US stock markets.

Although many crypto indicators are still of reference significance and value, we also need to start learning to change some existing concepts. For example, regarding the issue of "altcoin season", many people often use BTC.D (Bitcoin dominance) as an important reference indicator, but we also need to understand that the decline of BTC.D is only a result, not a cause.

In the future, the narrative of the crypto market will be driven more by external liquidity capital, such as institutional adoption, the development of stablecoins, the process of tokenization (such as RWA), etc. That is, the demand of the crypto market is already undergoing some fundamental changes, especially for those old crypto investors or crypto natives who always follow historical experience completely. Many of the so-called problems that appear at present seem to mean that crypto is moving towards new maturity, and we need to recognize this as soon as possible.

That’s all for today. The sources of the images/data cited in the text have been added to Notion. The above content is only personal opinion and analysis, and is only for learning records and communication purposes, and does not constitute any investment advice.