A. Macro liquidity

Monetary liquidity is improving. The market expects the Federal Reserve to cut interest rates twice this year and four times next year. Once Trump secures a majority at the Fed, he will be able to push for more aggressive easing policies and circumvent Fed decisions through technical means. US stock valuations are already stretched and showing signs of an early bubble. The crypto market is leading the correction in US stocks.

B. Overall market conditions

Top 300 companies by market capitalization:

This week, BTC plummeted, and altcoins fell across the board. Every time Trump launches a new coin, it coincides with the peak of market liquidity. The market is focused on ETH.

Top 5 gainers | Increase | Top 5 decliners | decline |

ULTIMA | 90% | KTA | 20% |

CRO | 50% | QUBIC | 20% |

QTUM | 40% | CTC | 10% |

OKB | 40% | SAROS | 10% |

BIO | 30% | NNT | 10% |

WLFI: This is a stablecoin DeFi project developed by the Trump family. It will launch on September 1st, with 20% unlocked. The initial costs are 0.015 and 0.05, with 20% unlocked initially.

CRO: It is the crypto.com platform currency and the gas currency of the Crono public chain. Trump Media Technology will raise $6.4 billion for the CRO treasury.

HYPE: It is the leading contract platform on the chain. The funding rate will be significantly reduced by 80% in the next upgrade, the number of running nodes will be increased from 21 to 24, and the proportion of revenue used to repurchase tokens will be increased from 50% to 99%.

C. On-chain data

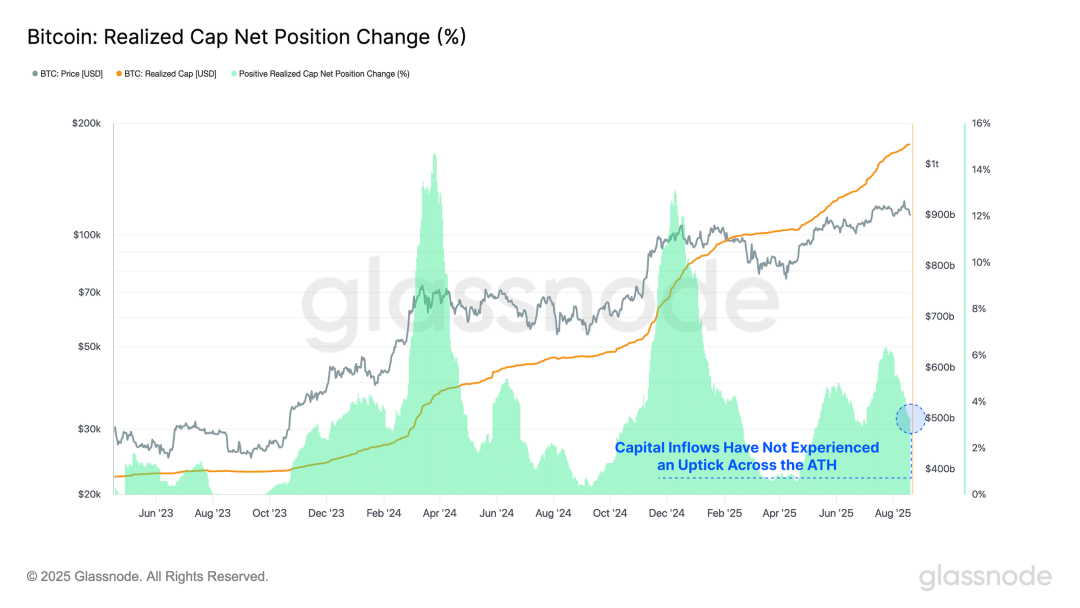

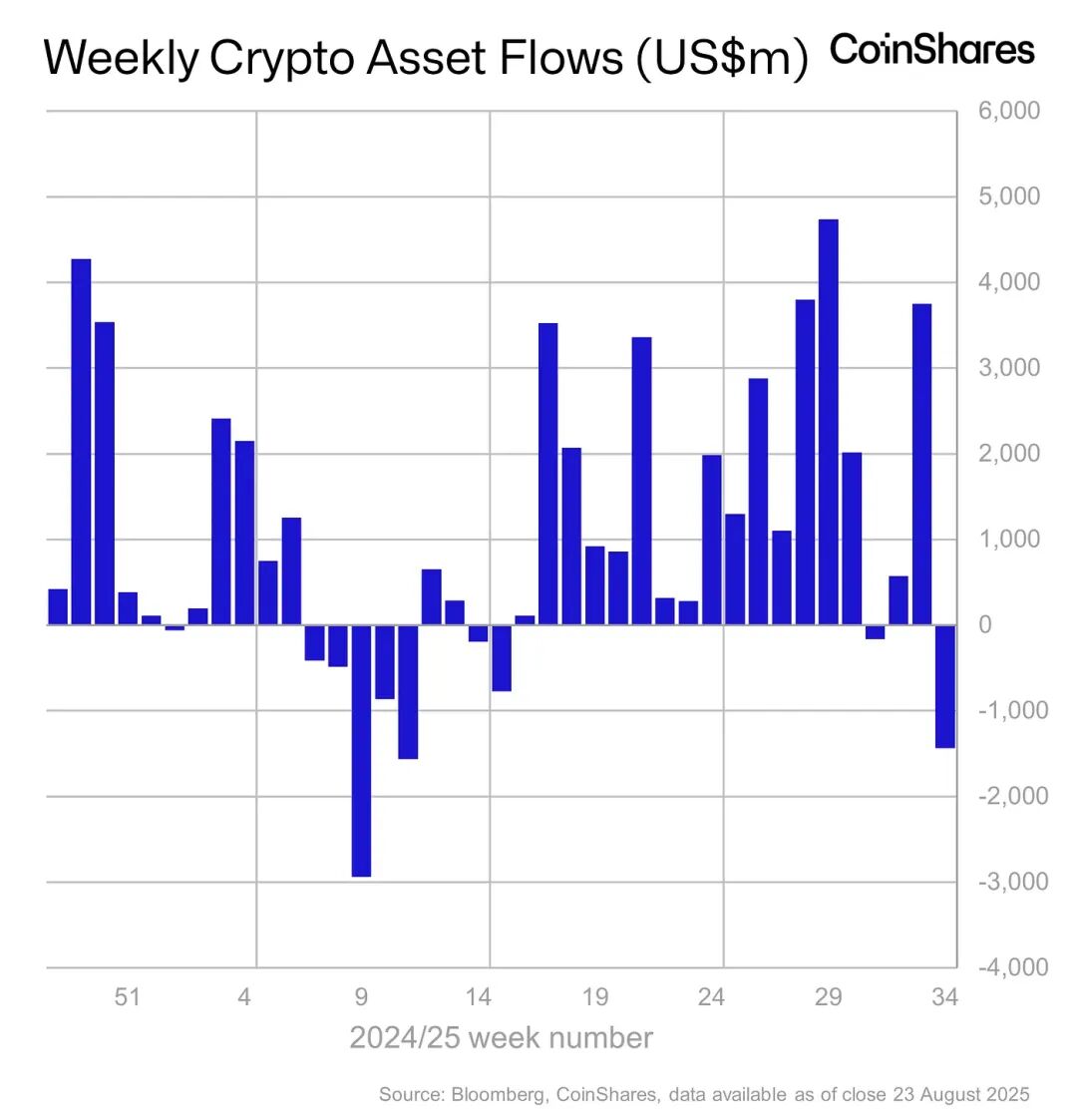

BTC is trending downward after hitting a local high. After weeks of massive inflows, ETFs are facing increasing profit pressure, suggesting that demand for traditional finance is cooling.

Institutional funds saw a net outflow of $1.4 billion last week, the most since March.

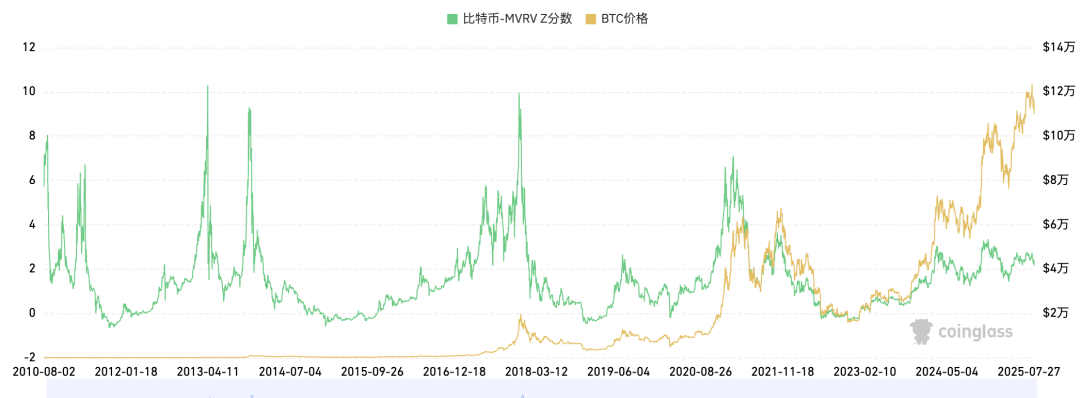

The long-term trend indicator, MVRV-ZScore, uses the market's total cost of ownership as a proxy for overall profitability. A reading above 6 indicates a top range, while a reading below 2 indicates a bottom range. When MVRV falls below the critical level of 1, holders are generally in a loss-making position. The current reading is 2.5, nearing the mid-range range.

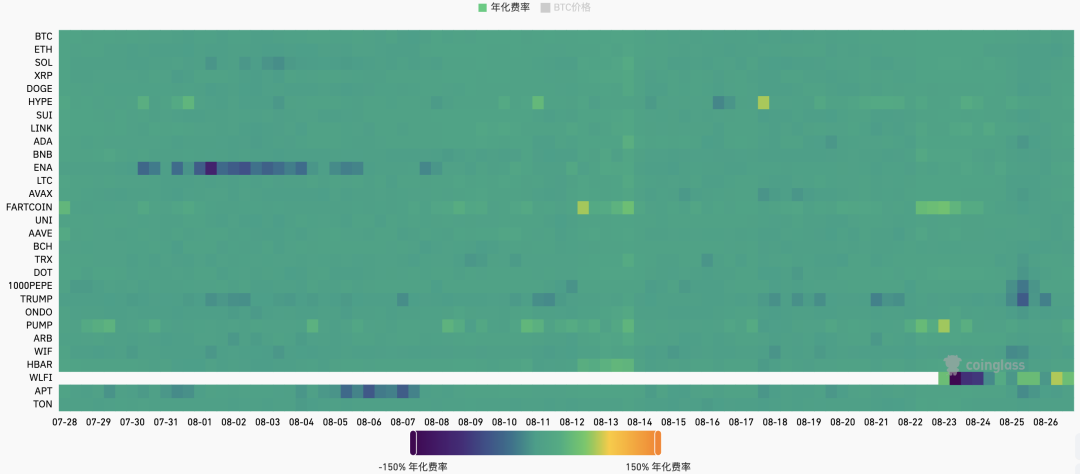

D. Futures market

Futures Funding Rate: This week's rate is 0.01%, which is normal. Rates between 0.05-0.1% indicate high leverage in long positions, signaling a short-term market top; rates between -0.1-0% indicate high leverage in short positions, signaling a short-term market bottom.

Futures open interest: BTC open interest decreased this week as major market funds withdrew.

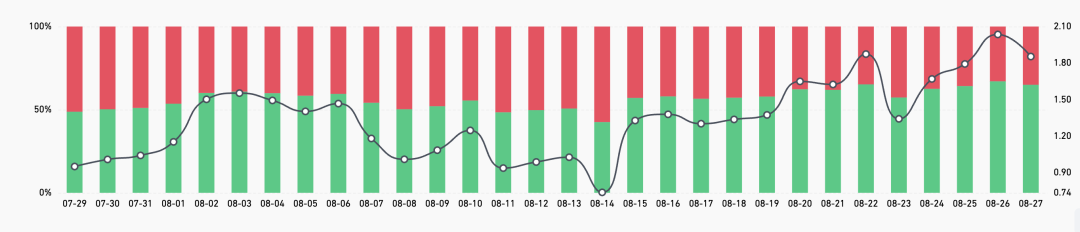

Futures long-short ratio: 1.8, indicating market sentiment leaning towards greed. Retail investor sentiment is often a contrarian indicator, with readings below 0.7 indicating fear and above 2.0 indicating greed. The long-short ratio fluctuates widely, making it less useful as a reference.

E. Spot Market

BTC saw a sharp decline this week. BTC dominance fell from a peak of 66% to 58%, marking its first significant and sustained decline since the post-US election rally, suggesting a potential market shift toward altcoins. The establishment of numerous altcoin treasuries in the US stock market has diverted funds from BTC buyers, increasing financing costs for companies like MicroStrategy.

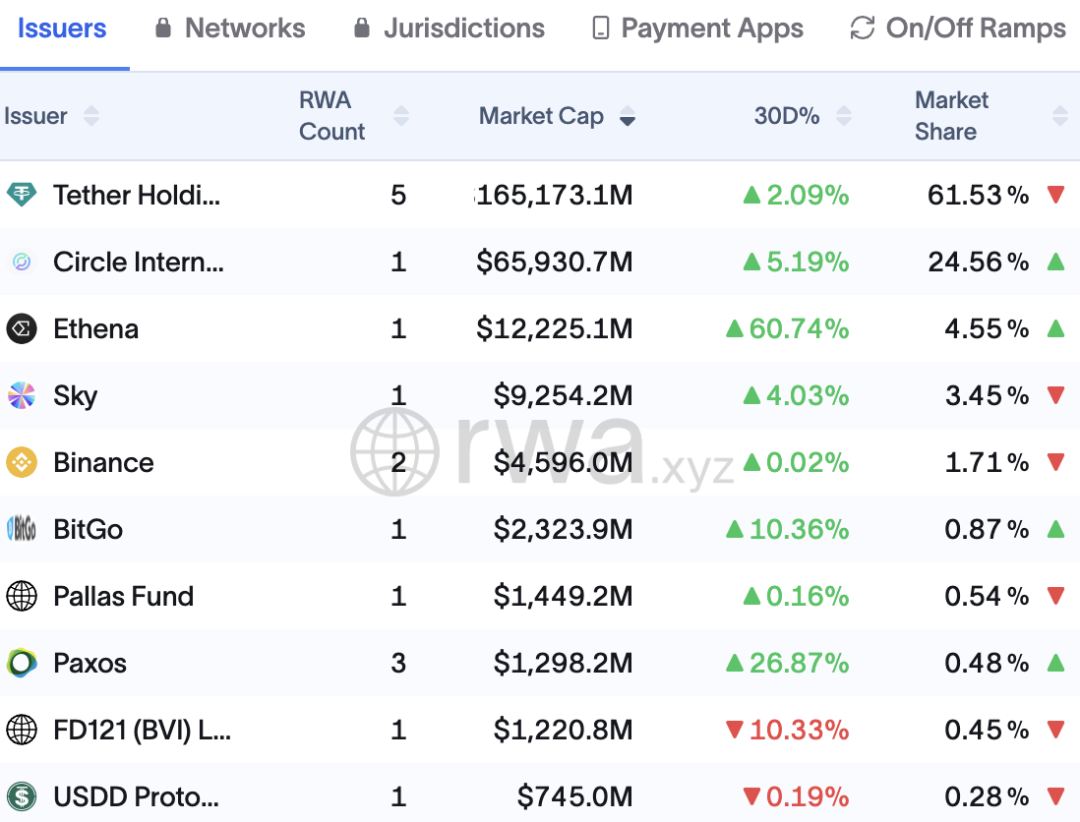

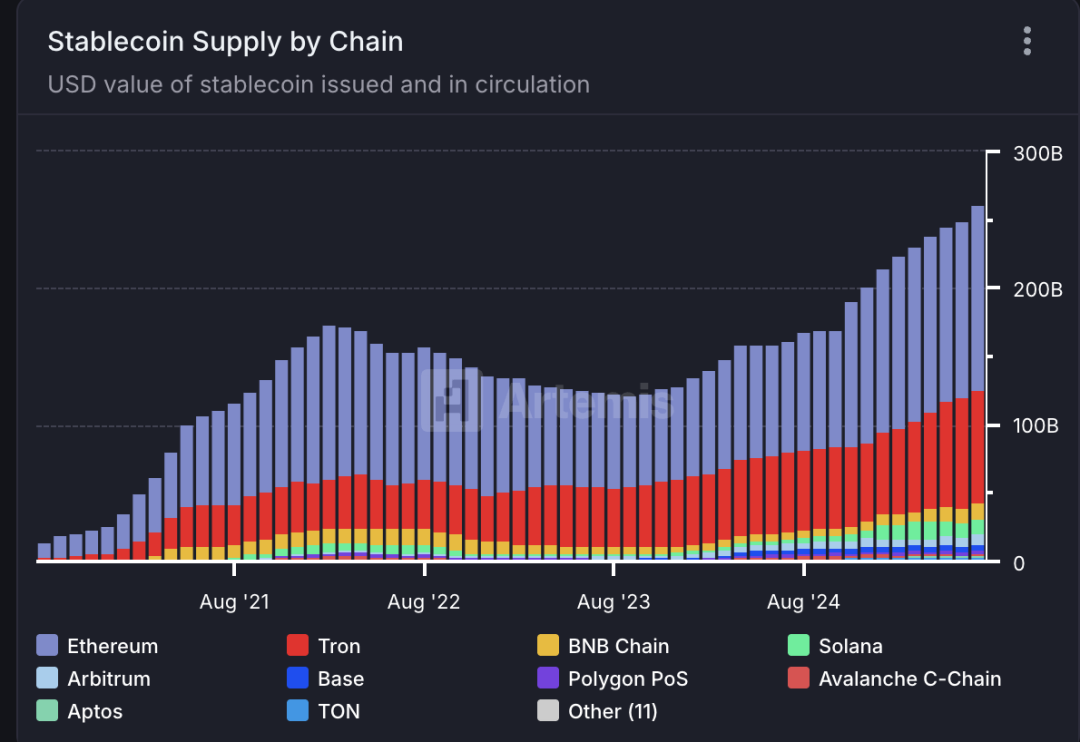

F. Stablecoin Market Global Mainstream Stablecoin Market Value

The total global stablecoin supply is $277.8B, up 0.1% week-over-week. USDT accounts for 62% of the market, while USDC accounts for 25%.

USD1, a rising stablecoin, saw its market capitalization grow by 10% this week. WLFI, the Trump family's DeFi project, will launch its stablecoin on September 1st. Its USD1 stablecoin had a supply of $3.5 million at launch in early March of this year. As of now, its market capitalization has exceeded $2.7 billion, ranking it seventh among stablecoins. USD1 is pegged 1:1 to the US dollar, with reserves comprised of cash, US Treasury bonds, and equivalents. BitGo is its custodian, and Crowe LLP issues monthly reserve verification reports. USD1 is widely regarded in the industry as highly transparent and trustworthy. USD1 is issued almost entirely on the BNB chain, accounting for over 90% of its total circulating supply.

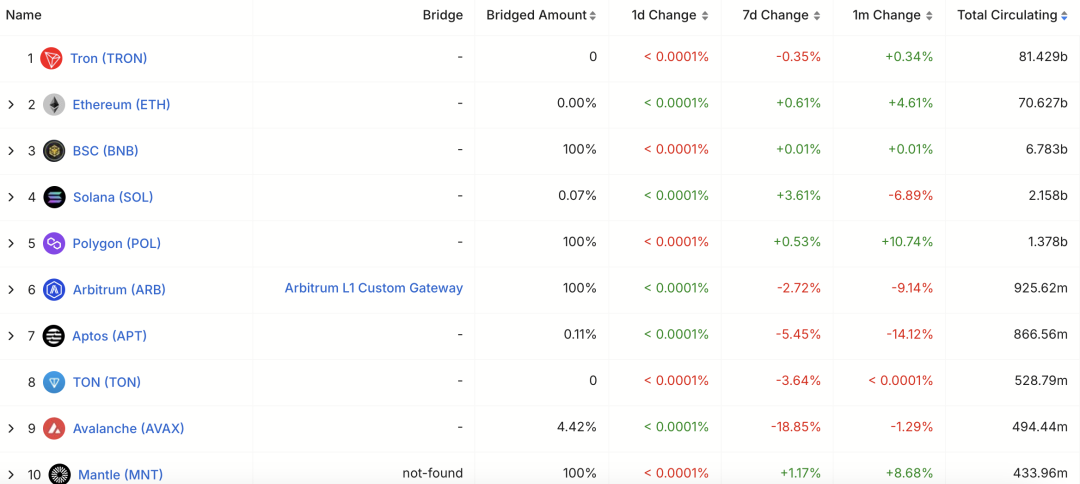

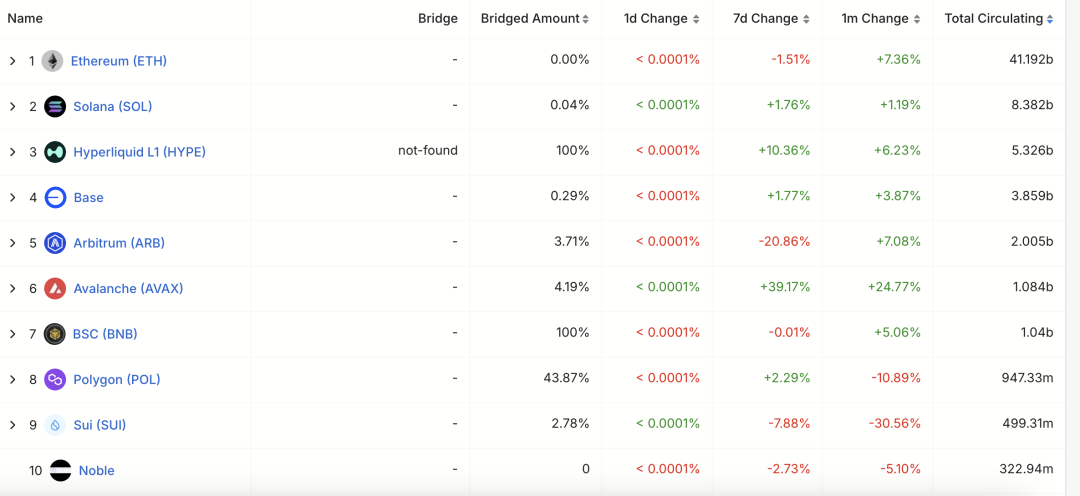

Stablecoins of various public chains

In the past 30 days, USDT has seen significant increases on the Polygon and MNT chains, at 11% and 9% respectively, mainly due to on-chain DeFi and exchange demand.

USDT's stablecoin public chain Plasma plans to issue coins next month and launch multiple deposit and investment activities on the Binance exchange, with a pre-market market value of US$5 billion.

In the past 30 days, USDC has seen a significant increase in AVAX chain and HYPE, by 25% and 6% respectively, mainly due to on-chain DeFI and exchange demand.

The next upgrade of the on-chain contract platform HYPE will see a significant 80% reduction in funding rates, an increase in the number of running nodes from 21 to 24, and a rise in the proportion of revenue used to repurchase tokens from 50% to 99%. HYPE primarily relies on USDC for deposits and withdrawals.

What applications are stablecoins mainly used for?

In the past 30 days, Ethena has seen a relatively significant amount of stablecoin deposits. The core reason is that USDe's high staking yield has attracted a large number of Defi players.

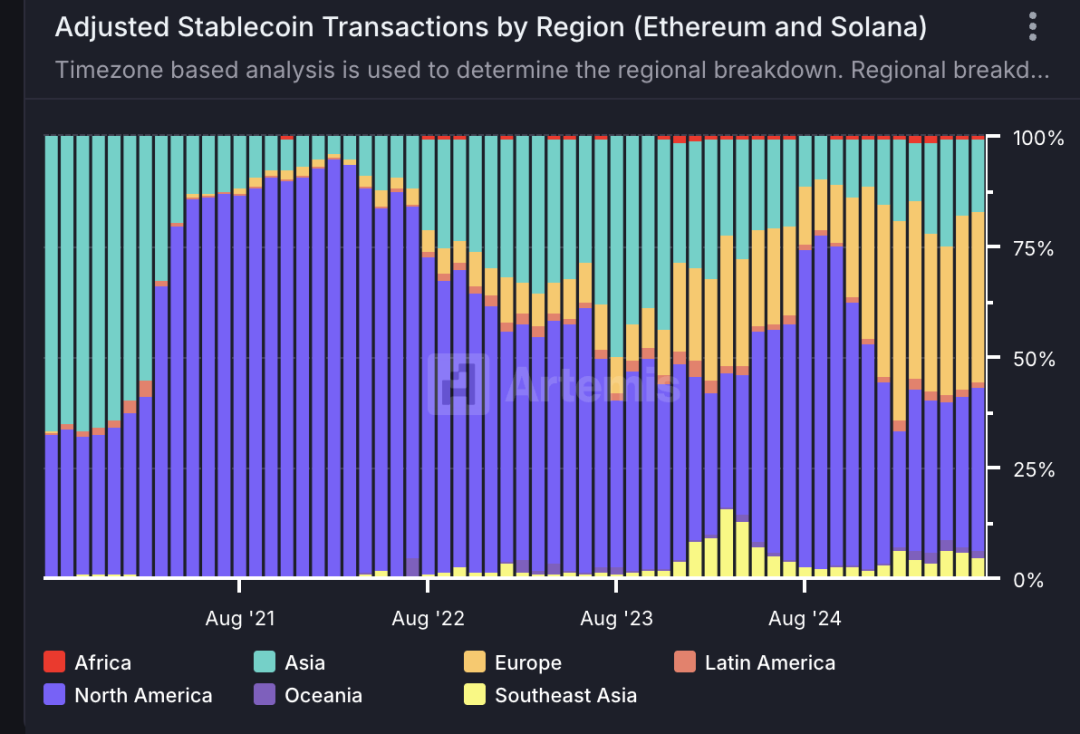

Geographical distribution of stablecoin usage

North America (38%), Europe (37%), and Asia (16%) remain the main markets, with no significant changes in other regions.