Original: The Round Trip

Compiled by: Yuliya, PANews

In an era where encryption and AI intersect, the truly important stories are often hidden outside the noise. In order to find these overlooked truths, PANONY and Web3.com Ventures jointly launched the English video program "The Round Trip". Co-hosted by John Scianna and Cassidy Huang, this episode will deeply analyze the key trends in the current global market, from the India-Pakistan conflict to the breakthrough of cryptocurrency, from the Sino-US trade negotiations to the divergence of global monetary policies, to provide readers with comprehensive market insights.

Token2049 Dubai Live: Heat Rekindles, Construction Mood Returns

The Token2049 Dubai event was crowded with people, the exchange made a high-profile appearance, and there were many high-quality projects. The rainstorm that plagued the event last year did not reappear, and the overall experience was greatly improved. Market sentiment has warmed up significantly, and the project team has returned to the "construction mode", showing their faith and vision.

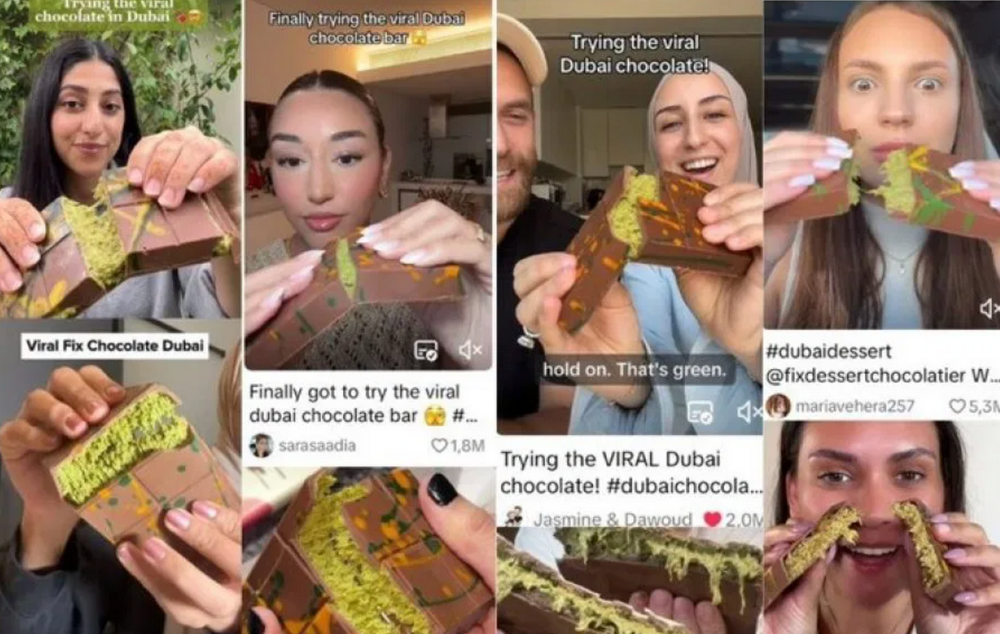

However, the sideline activities were too dense, and Dubai's traffic was congested, so it often took 30 to 40 minutes to shuttle between the activities. Despite this, the execution and long-term thinking of some founders were still impressive. In addition, there was an interesting episode: the global "pistachio shortage" was partly due to the popular pistachio chocolate in Dubai. It is reported that this chocolate is sold at Costco, and the price has risen from US$7 to US$10, while the original one in Dubai is as expensive as US$20 a piece.

Geopolitical situation: India-Pakistan conflict escalates

The most serious story of the week was the escalation of tensions between India and Pakistan. The conflict dates back to the partition of British India in 1947, and the two countries have fought four major wars since then: the Kashmir War of 1947-48, the Second Kashmir War of 1965, the Bangladesh Liberation War of 1971, and the Kargil War of 1999. Notably, both India and Pakistan have become nuclear-weapon states since 1998, making any conflict potentially more serious.

The current round of tensions stems from a terrorist attack in Indian-controlled Kashmir on April 22 that killed 26 tourists, mostly Hindus. The attack was claimed by the Resistance Front, a group linked to the Lashkar-e-Taiba (LeT), which was responsible for the 2001 Indian Parliament attack and the 2008 Mumbai attacks. India immediately accused Pakistan of harboring terrorists.

Earlier last week, India launched a military operation codenamed "Operation Sindoor" to hit nine targets in Pakistan-controlled Kashmir. India stressed that this was a precision strike against terrorist infrastructure, avoiding Pakistani military targets. However, Pakistan condemned this as an "act of war", reported civilian casualties including women and children, and claimed to have shot down Indian warplanes and carried out retaliatory strikes.

The conflict continued to escalate, with both sides exchanging fire near the Line of Actual Control (LOC), leading to the evacuation of a large number of civilians. China, as a close ally of Pakistan, expressed serious concern, and Western intelligence even reported that a Chinese J-10 fighter jet shot down an Indian French Rafale fighter jet. The international community, including UN Secretary-General Guterres and US President Trump, called on all parties to exercise restraint, but driven by populist leaders such as Modi, it is difficult for both sides to give in without a "victory".

Macroeconomic policy divergence: global liquidity and interest rate trends

Global macroeconomic policies are clearly diverging. The People's Bank of China lowered its reserve requirement ratio and injected $143 billion into the system, starting a liquidity release mode. It is unclear whether this is a liquidity injection in the context of the trade war or a quiet panic in the market. At the same time, despite lower oil prices, OPEC members agreed to increase production, a decision that may be aimed at stimulating global economic growth.

In the United States, Fed Chairman Powell kept interest rates unchanged at 4.25%-4.5% despite negative GDP in the first quarter. Whether inflation is under control or whether economic growth is sacrificed remains to be seen. In contrast, the United Kingdom chose to cut interest rates to 4.25%, demonstrating a different monetary policy path.

In addition, US President Trump reached a trade agreement with the UK, the first formal agreement since Trump launched a global tariff offensive. The two sides agreed to reduce trade barriers in automobiles, agriculture and steel, with US tariffs on British steel reduced from 25% to 0% and automobile tariffs reduced from 27.5% to 10%. In exchange, the UK will ease access to US cars, ethanol, agricultural products and industrial equipment. The agreement provides targeted tariff reductions, but it is still far from a comprehensive trade agreement and is more like the first step in a long negotiation process.

Chip diplomacy and AI strategic shift

Interestingly, the Trump administration last week hinted that it might revoke or not implement the Biden-era AI proliferation framework, which aims to control the global distribution of U.S. AI chips by classifying countries into three tiers, imposing export caps on even long-term allies, and is set to take effect on May 15.

This shift is very strategic and can be used as a bargaining chip in trade negotiations. For example, second-tier countries such as Israel, India and Switzerland are purchasing American F-35 fighter jets, but face restrictions on purchasing Nvidia chips. The contradiction is: you trust them to use your most advanced stealth fighter, but you don’t trust them to use GPUs? This strategic shift shows that the current administration plans to use AI chip exports as a trade negotiation tool rather than impose comprehensive restrictions. By giving allies greater access, American companies such as Nvidia and AMD can expand their markets, increase profits and reinvest them in the next generation of hardware, ensuring that the United States maintains a technological advantage.

This is not just about trade and economics, but also about strategic dynamics. Restrictive measures may be counterproductive and stimulate innovation. Take Tencent, for example, in response to chip restrictions, they developed Hunyuan Turbo S, a super-efficient AI model that can reply to queries in less than a second, combining elements of Mamba and Transformer. They also launched Hunyuan T1, which uses a hybrid system of experts for event reasoning and problem solving. As the saying goes: "Necessity is the mother of invention."

At last week’s ICLR conference, OpenAI, Google DeepMind, and universities from the U.S., China, and around the world were represented, presenting their research. There was a large presence of Chinese students and companies, who emphasized that their models use less memory. China is not waiting to gain access, but is innovating out of necessity. If the U.S. imposes excessive restrictions, it will only temporarily slow the development of these countries, and may inadvertently accelerate their progress. Therefore, changing this policy is not a sign of weakness, but a move toward strategic clarity.

Changes in Taiwan New Taiwan Dollar and Capital Flows

Markets have reacted, with the Taiwan dollar surging more than 10% in just two trading days, the most dramatic move since the 1980s. Foreign capital has poured into Taiwan's stock market, especially in the semiconductor sector. Taiwan chose not to intervene, signaling that it would allow the Taiwan dollar to appreciate. However, a stronger Taiwan dollar would hurt exports, on which Taiwan's economy is extremely dependent. Other Asian currencies also fluctuated, with traders anticipating similar moves by other central banks. Analysts are divided, with some believing the Taiwan dollar will continue to appreciate and others predicting an imminent pullback. The rise in the Taiwan dollar is due to the AI boom and the influx of foreign capital, but there are risks behind it. If export data is damaged, policy may be adjusted accordingly.

New progress in China-US trade negotiations

On May 12, China and the United States issued a joint statement after the economic and trade talks in Geneva, announcing adjustments to some tariffs. According to the statement, the United States will cancel 91% of the additional tariffs and suspend 24% of the "reciprocal tariffs" for 90 days. The current "reciprocal tariffs" on China have dropped to 10%. China has also canceled and suspended some countermeasures accordingly. This negotiation mainly focused on tariff reductions and did not involve the tariffs imposed by the United States on fentanyl and some of China's countermeasures. China and the United States also agreed to establish a mechanism to continue to negotiate on economic and trade relations in order to resolve differences through an institutionalized communication mechanism. The Ministry of Commerce said that the ultimate goal is to completely correct the mistakes of unilateral tariff increases, continue to strengthen mutually beneficial cooperation, and maintain the healthy, stable and sustainable development of China-US economic and trade relations.

The US-China trade war has had a substantial impact on the economies of both sides: rising costs for US companies, which have been passed on to consumers, leading to price increases and supply chain delays; China's factory activity has slowed down and exports have fallen. Beijing has responded with interest rate cuts, capital injections and a series of stimulus measures, but the chain reaction of the trade war has gone beyond the tariffs themselves and affected the stability of global trade.

The Bitcoin Enterprise Trend: From Strategy to MetaPlanet

Bitcoin recently broke through the $100,000 mark and is currently trading at around $101,000, reflecting the market's enthusiasm for crypto assets. The trend of corporate holdings of Bitcoin continues to strengthen:

Strategy (formerly MicroStrategy) held the fifth "Enterprise Bitcoin Conference" in Florida, and CEO Michael Saylor emphasized the importance of Bitcoin as a corporate reserve asset. At the conference, it was announced that it had purchased another 1,895 Bitcoins, bringing its cumulative holdings to 555,450 Bitcoins, continuing to maintain its position as the world's largest corporate Bitcoin holder.

Tokyo-listed MetaPlanet also bought 555 bitcoins last week, bringing its total holdings to 5,555. The number is symbolic in Japanese, as "5" is pronounced "Go," and 5-5-5-5 means "Go! Go! Go! Go!" The purchase was worth about $53 million, and the company's stock price subsequently rose 13%. MetaPlanet has become Asia's largest listed bitcoin holding company and ranks 11th in the world, with a goal of holding 10,000 bitcoins by the end of the year.

David Bailey, CEO of Bitcoin Magazine and consultant to MetaPlanet, announced the establishment of " Nakamoto Company", which focuses on Bitcoin media, mining and infrastructure construction. It aims to acquire troubled Bitcoin companies and restart their assets. It is backed by institutional and sovereign funds and can reportedly mobilize billions of dollars in capital.

Crypto Policy Observation: South Korea's ETF Shift and Different Reserve Attitudes of Various Countries

The 21st presidential election in South Korea will be held on June 3, 2025. The presidential election campaign officially kicked off on May 12, and seven candidates will launch a 22-day fierce campaign to canvass votes. Lee Jae-myung of the Democratic Party leads in the polls and is designated as the No. 1 candidate. His main opponent is Kim Moon-soo of the ruling People's Power Party, who is the No. 2 candidate.

Lee Jae-myung, a candidate for the left-wing Democratic Party, and Kim Moon-soo, a candidate for the right-wing party, both pledged to promote the legalization of Bitcoin ETFs, forming a rare cross-party consensus. This policy is aimed at promoting wealth accumulation among the middle class and providing more opportunities for the younger generation. Kim Byung-hwan, chairman of the Financial Services Commission (FSC), expressed his willingness to discuss implementation plans with the new government, marking a major shift in policy attitudes. The FSC has previously been clear in its opposition to spot crypto ETFs, believing that they are too volatile. The success of US spot crypto ETFs (net inflows of more than $43 billion) has become a key factor in South Korea's re-examination of such products.

At the same time, some states in the United States are gradually accepting Bitcoin: New Hampshire has approved legislation allowing the state to invest up to 5% of public funds in Bitcoin, and Arizona allows unclaimed digital assets to be used for staking or earn rewards and then transferred to a reserve fund.

However, Florida withdrew its Bitcoin strategic reserve bill, while Emma Reynolds, the UK Treasury's economic secretary, made it clear that Bitcoin's volatility makes it unsuitable as a public treasury reserve. Similarly, countries such as Japan, Switzerland, and Russia have also ruled out Bitcoin reserves, emphasizing the importance of stability in public financial management.