Author: 1912212.eth, Foresight News

CoinList recently announced that it will start the Acurast (ACU) token sale at 1:00 am Beijing time on May 16, and the deadline is 1:00 am on May 23. 100% of the tokens will be unlocked at TGE. The public offering FDV is 90 million US dollars. The price of a single token is 0.09 US dollars, and the number of tokens that can be purchased is 60 million (6% of the total supply). The purchase limit is a minimum of 100 US dollars and a maximum of 2 million US dollars.

Although the wealth effect of CoinList in this cycle is not as good as before, it still has a certain influence. The returns of its open public offering projects Ondo Finance, Nillion, and WalletConnect are currently acceptable.

What exactly is Acurast and what are its characteristics?

1. Smartphone-enabled decentralized computing network

Acurast is a decentralized verifiable computing network that aims to build a secure, scalable, and data center-free computing infrastructure by leveraging the idle computing power of smartphones. Unlike traditional cloud computing giants (such as AWS and Google Cloud) that rely on centralized servers, Acurast provides decentralized computing resources through the Trusted Execution Environments (TEEs) of mobile phones, balancing privacy and efficiency.

Acurast liberates computing power from the hands of a few technology giants through mobile phones, giving ordinary users and developers more control. Its core features include:

- Decentralization and Verifiability: Acurast uses TEE technology on smartphones to ensure the security and verifiability of the computing process. TEE can verify the authenticity of the hardware and protect data privacy without trusting the device owner, thus achieving a highly secure computing environment.

- High scalability: The testnet has processed more than 240 million transactions, connected more than 65,000 computing units (smartphones), and covered more than 120 countries around the world.

- Cross-ecosystem compatibility: Acurast supports multiple development environments such as JavaScript, TypeScript, Node.js, and WASM, and is integrated with mainstream blockchain ecosystems such as Bitcoin, Ethereum, Polkadot, and TON.

- AI and Web3 application support: Acurast is particularly suitable for scenarios with high security and privacy requirements, such as decentralized AI model training, Web3 infrastructure, and high-security workloads.

By transforming smartphones into computing nodes, Acurast not only reduces computing costs, but also provides users with the opportunity to earn rewards by contributing idle computing power. This "everyone can participate" model makes it unique in the DePIN track.

2. Decentralized computing based on NPoS

Acurast's operating logic revolves around its core protocol architecture, combined with the Nominated Proof of Stake (NPoS) consensus mechanism and reputation engine to ensure the efficient operation and security of the network. Its ecosystem is mainly composed of the following roles and mechanisms:

- Developers: Deploy applications through Acurast's command line interface (CLI) to use the network's computing resources to run JavaScript, TypeScript, or WASM workloads. Developers pay fees (in $ACU or other tokens) for computing services.

- Processors: Smartphone users who contribute idle computing power by installing the Acurast Processor app and earn ACU token rewards. Each phone can get a fixed amount of 250 cACU (testnet points, which will be converted into ACU in the future) per month.

- Validators and nominators: Based on the NPoS consensus mechanism, validators are responsible for maintaining network security, and nominators support trusted validators by staking ACU to jointly ensure the decentralization and economic security of the network.

- End users: Use decentralized applications built on Acurast to enjoy low-cost, high-privacy computing services.

Acurast uses the NPoS algorithm, with the Orchestrator matching the developer's computing needs with the computing provider's resources. The reputation engine dynamically updates the reputation score based on the performance of the processor (smartphone), incentivizing honest behavior and punishing malicious nodes. Developers submit computing tasks to the Acurast network, and the coordinator assigns tasks to appropriate smartphones based on task requirements and processor reputation. The processor completes the computing task and returns the result, and the TEE ensures the privacy and verifiability of the result.

Developers pay fees, processors receive ACU rewards, and validators and nominators share network fees. This operating logic achieves the synergy of interests among developers, computing providers, and network maintainers through economic incentives and reputation mechanisms, and builds a sustainable decentralized computing ecosystem.

Token Economics

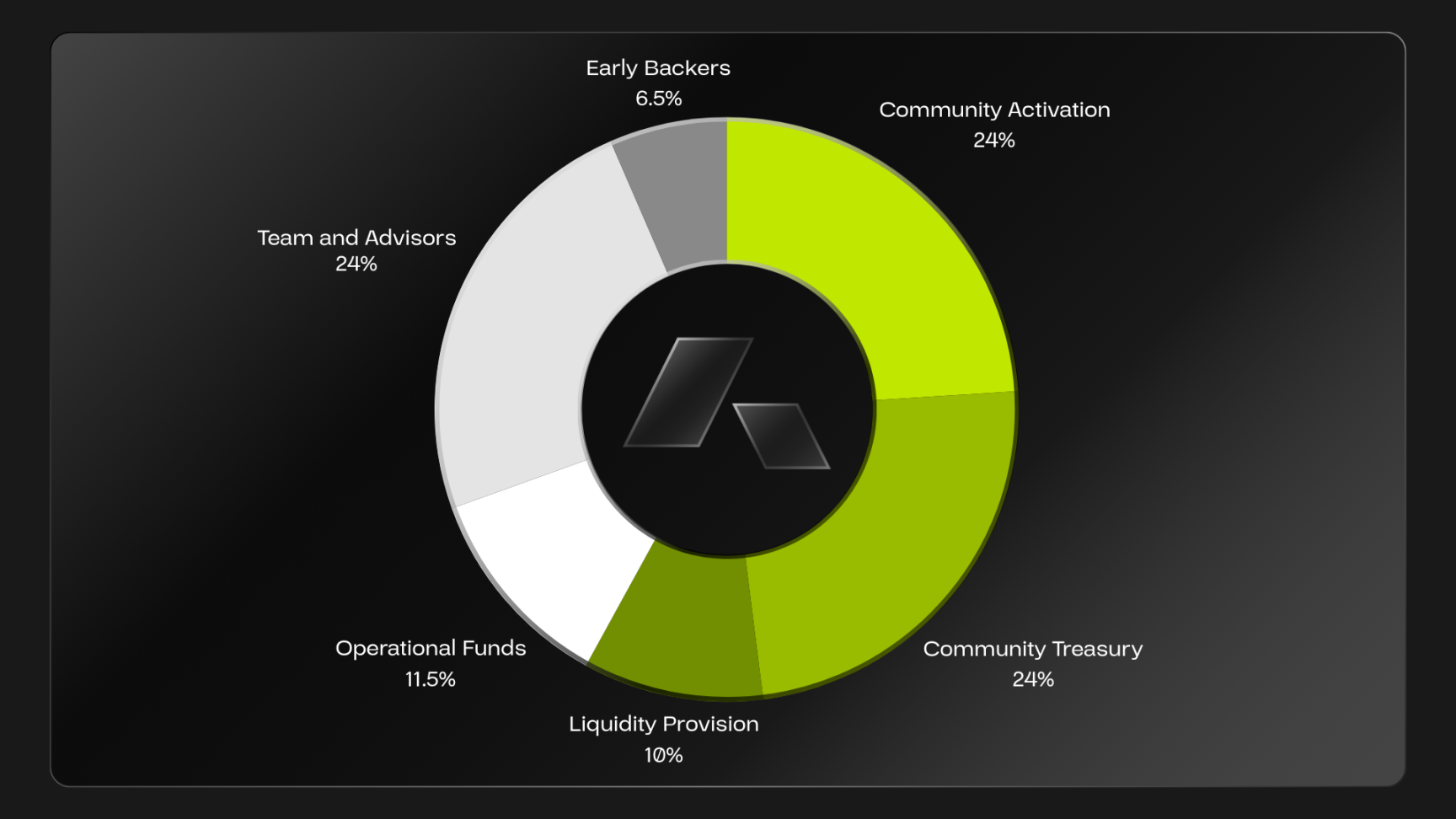

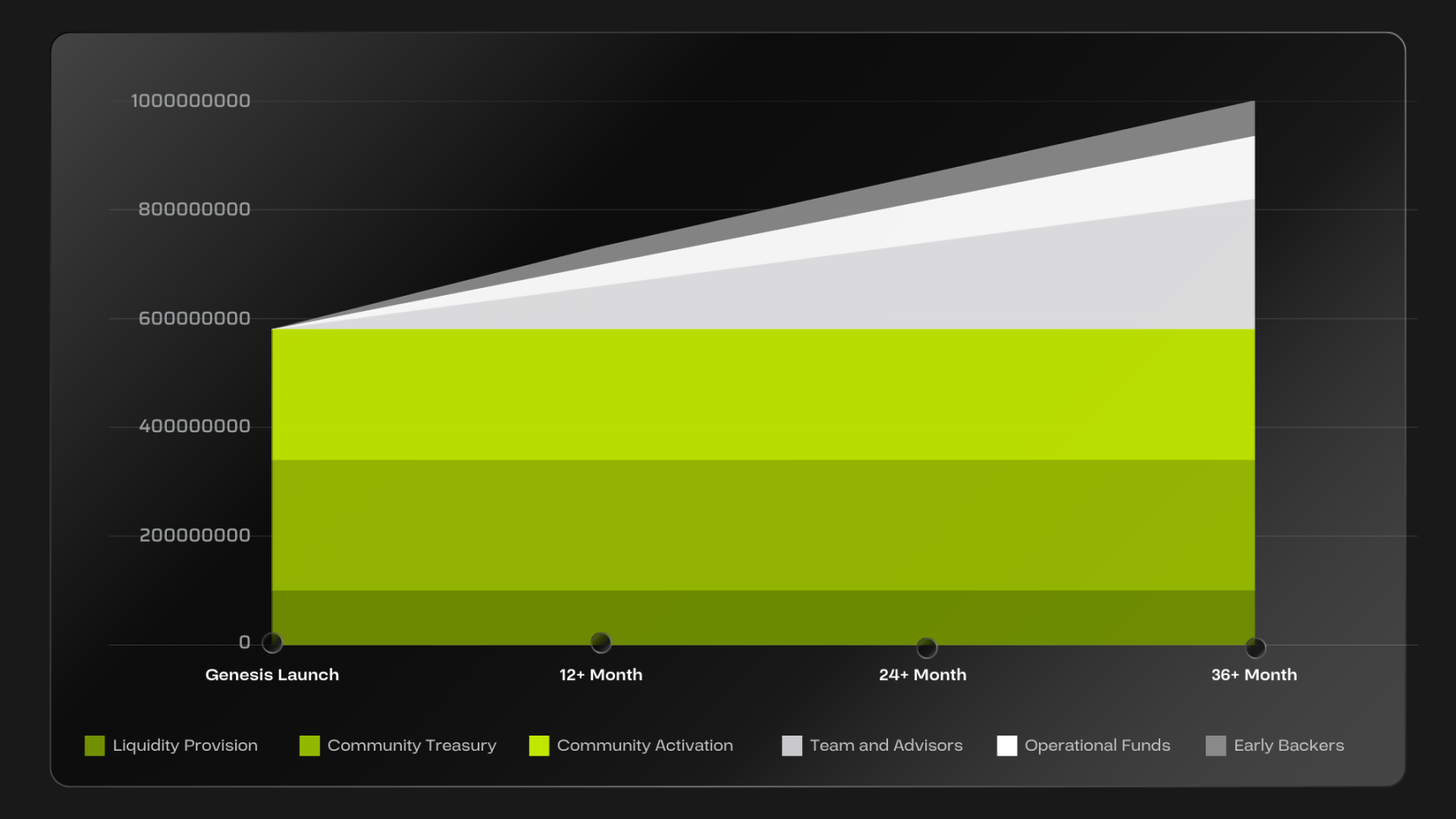

The total supply of Acurast tokens ACU is 1 billion, and TGE is expected to be completed in Q3 2025.

Community (69.5%): Includes Community Treasury, TGE community activations (such as airdrops, Launchpad participation), operating funds, and liquidity supply. These tokens will be unlocked at the TGE, giving priority to early users and contributors. Early Investors (6.5%): To support the funding needs of the project from testnet to mainnet, the allocation ratio is lower, and the lock-up period is at least 24 months, and it is gradually released to ensure fairness. Team and Advisors (24%): Tokens of core contributors, advisors, and future team members have the longest lock-up period (at least 24 months).

The ACU token has multiple uses in the Acurast ecosystem:

- Network fees: used to pay transaction fees. Fees will be destroyed to reduce circulation and enhance the scarcity of tokens.

- Staking: By staking ACU, participants provide economic security to the network and are rewarded with fees.

- Settlement: As a unified settlement token, it measures processor reputation and service quality and supports the abstraction of multi-token payments.

- Governance: Holders can participate in on-chain governance and vote on the direction of protocol development.

Although ACU's token economic model is well designed, it still faces potential risks. For example, the incentive balance mechanism, if the reward is too high or too low, may affect user participation or cause token price fluctuations. Market competition requires competing with traditional cloud computing giants such as AWS, Google Cloud and other DePIN projects. Smartphone hardware performance, network bandwidth and battery life may also cause computing resources to fluctuate.

4. Obtained millions of seed round strategic round financing

Acurast has not officially disclosed the names of its members, but their backgrounds and achievements can be inferred from the project progress and partners: the team has deep experience in decentralized computing, TEE technology, and NPoS consensus mechanism, and has successfully promoted the test network to process 240 million transactions and connect 65,000 devices. In terms of ecological cooperation, Acurast has established deep integration with Bitcoin, Ethereum, Polkadot, TON and other chain ecosystems.

In terms of financing, Acurast received a $1.5 million Grant in 2023, and subsequently received $2 million in seed and strategic rounds of financing, and received funding from multiple foundations (such as Polkadot ecosystem-related foundations), with participation from Dr. Gavin Wood (co-founder of Ethereum, founder of Polkadot), Leonard Dorlöchter (founder of PEQ), Michael van de Poppe (founder of MN Capital), Ogle (founder of GlueNet, CoinDesk influencer), Vineel Budki (CEO of Sigma Capital), and others.

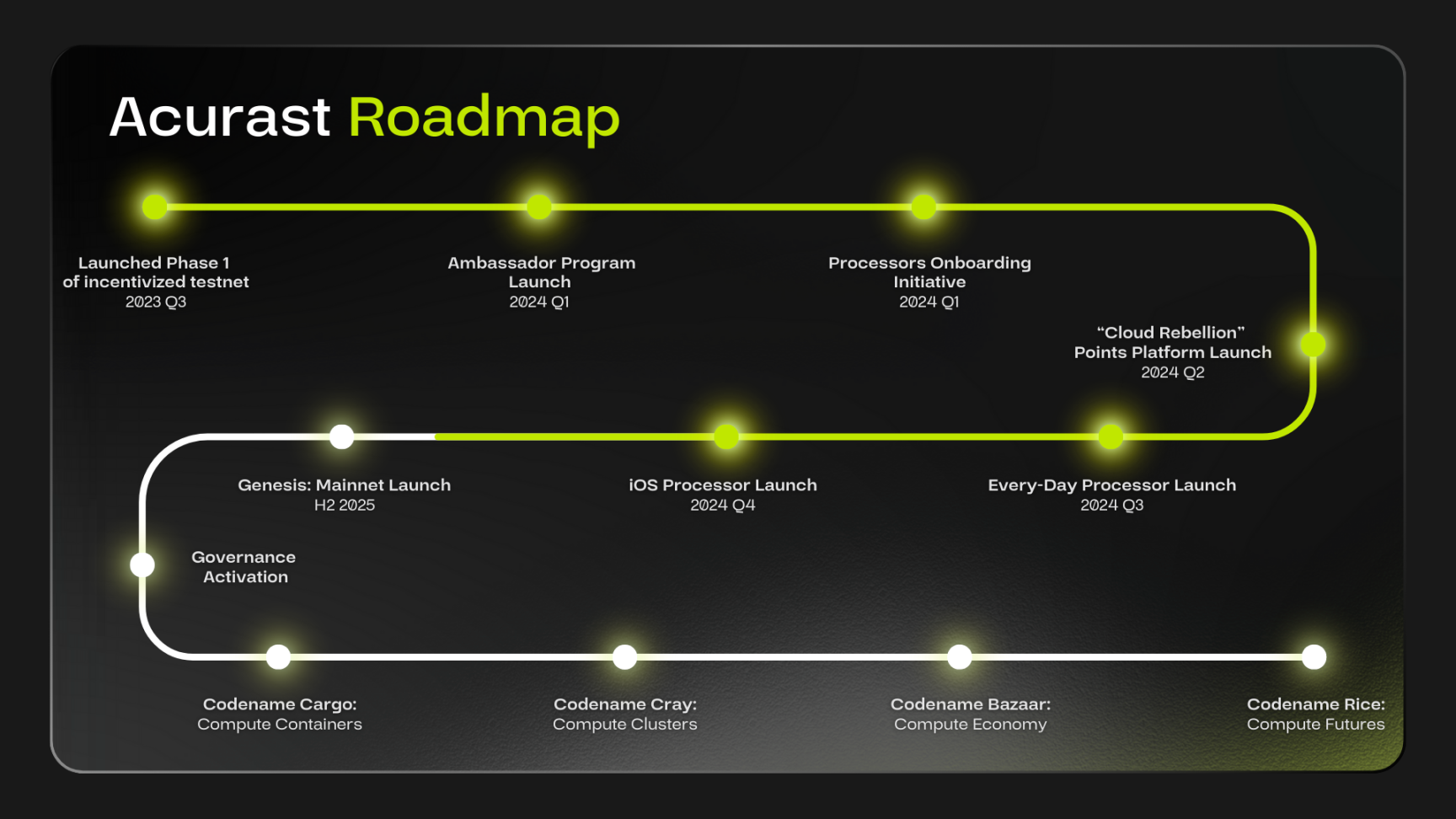

The official roadmap shows that its mainnet will be officially launched in the second half of this year.